Tax Benefit On Education Loan In India Education loan interest is tax deductible under section 80E for individuals taking loans for higher studies limited to interest payments only Loan must be from recognized institutions No cap on deduction

Interest on loans taken for pursuing higher education including vocational studies is eligible for deduction u s 80E Understand Section 80E of the Income Tax Act which allows tax deductions for To encourage borrowers to take an education loan there is a tax benefit on repayment of the education loan Once you avail of an education loan the interest paid which is a component of your EMI on

Tax Benefit On Education Loan In India

Tax Benefit On Education Loan In India

https://i.ytimg.com/vi/L2Vv7NofRu4/maxresdefault.jpg?sqp=-oaymwEoCIAKENAF8quKqQMcGADwAQH4Ac4FgAKACooCDAgAEAEYfyA7KDswDw==&rs=AOn4CLCeJwcdxDKVjleLYvHxIhrxTaCH9Q

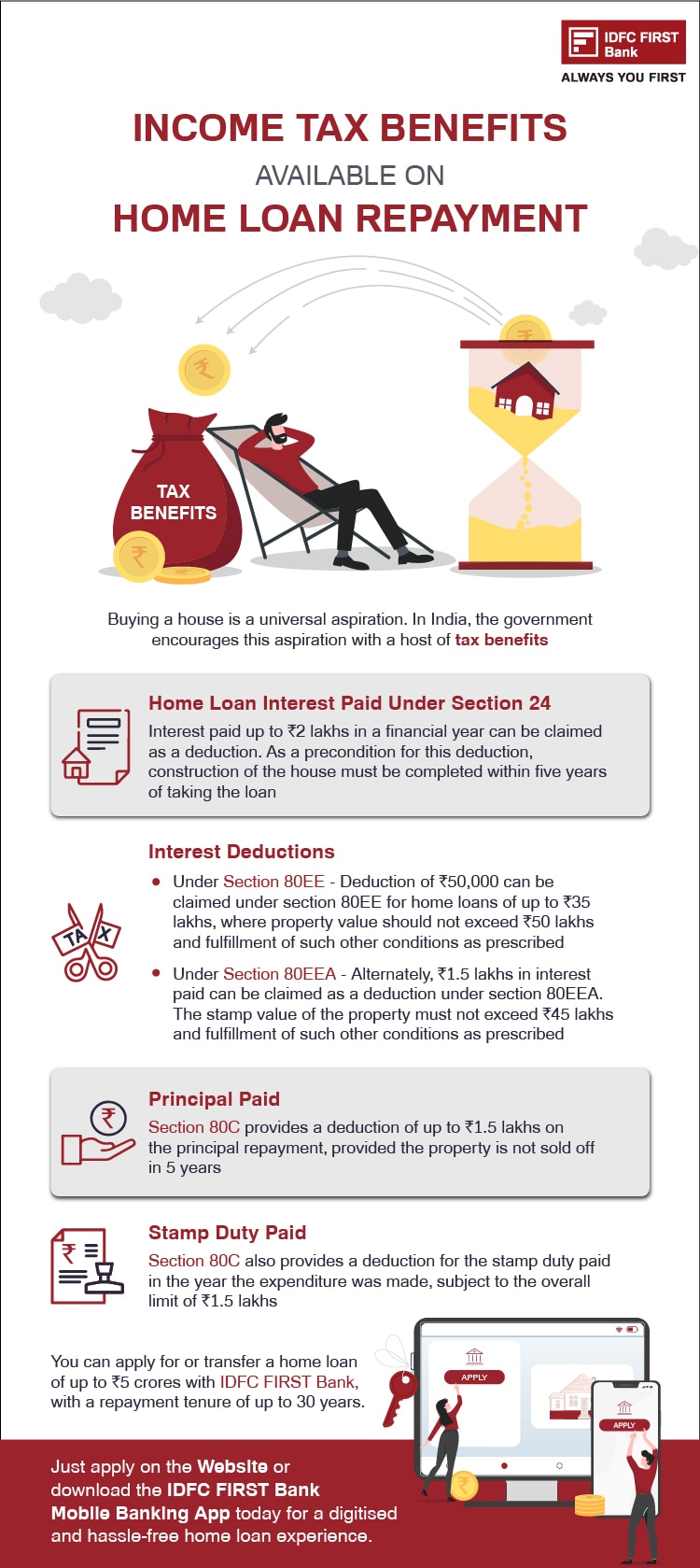

What Are The Tax Benefit On Home Loan Calculate Loan Tax Benefits

https://homefirstindia.com/app/uploads/2022/07/Untitled-design-14.png

Reasons To Get Personal Loan In India By Pratikshajadhav698 Issuu

https://image.isu.pub/181227073113-580287aeb88e0bf5c76cc963b52e85d3/jpg/page_1.jpg

Section 80E of the Income Tax Act allows a tax deduction on the interest paid on education loans for higher studies Section 80E deduction helps to reduce the Section 80E caters to tax deductions on educational loans Learn about the eligibility criteria period of deduction and associated tax benefits

Education loans are offered a tax deduction under Section 80e Income Tax Act on the interest of the loan There are other benefits to an education loan and they can be taken Learn how to maximize tax savings on your education loan with Section 80E This comprehensive guide explains eligibility deduction limits and step by step instructions

Download Tax Benefit On Education Loan In India

More picture related to Tax Benefit On Education Loan In India

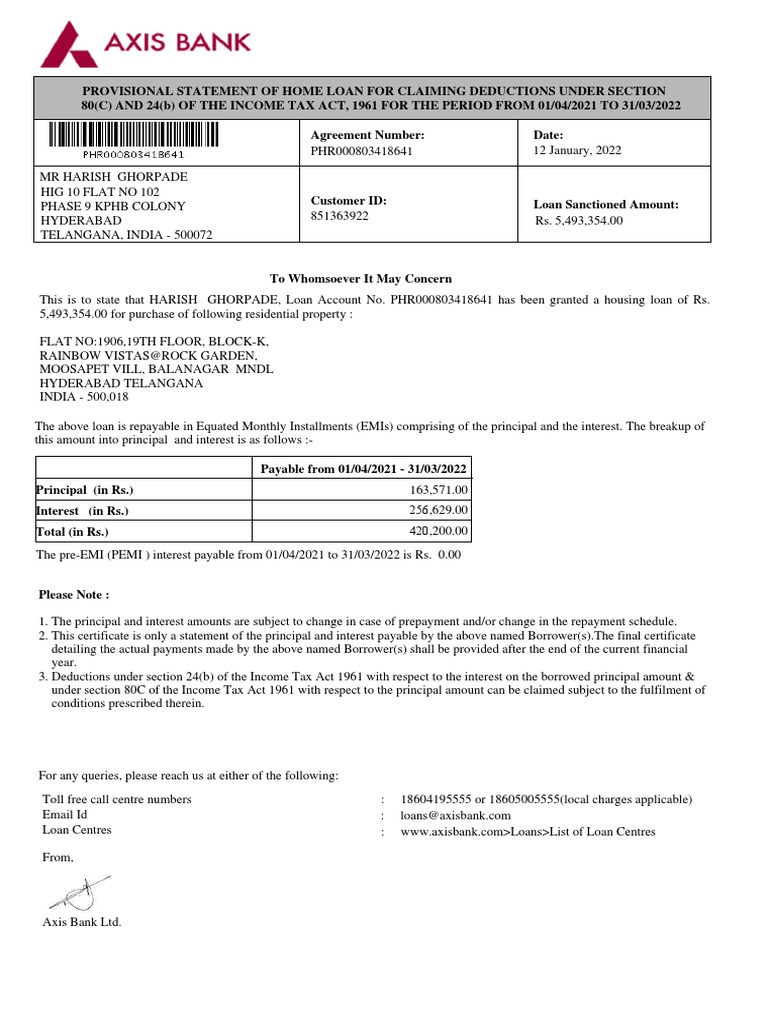

HOME LOAN INTEREST CERTIFICATE For FY 2021 22 PDF Loans Interest

https://imgv2-2-f.scribdassets.com/img/document/553973286/original/542bfb7a7c/1661356692?v=1

Income Tax Benefits On Housing Loan In India

https://blog.saginfotech.com/wp-content/uploads/2016/09/income-tax-benefit.jpg

Tax Benefits Of Paying Home Loan EMI HDFC Sales Blog

https://www.hdfcsales.com/blog/wp-content/uploads/2021/10/benefits-of-paying-home-loan-emi.png

In India tax benefits are available for educational loans under Section 80E of the Income Tax Act This section allows individuals to claim deductions on the interest paid on an The tax benefit on education loans is given under Section 80E of the Income Tax Act It allows taxpayers to claim deductions on the interest paid towards education loans for themselves their spouse their

Explore section 80E s tax benefits for education loans under the Income Tax Act Unveil eligibility deductions and document requisites for claiming deductions on loan interest Education Loan Tax Benefits under Section 80E of the Income Tax Act 1961 Aditya Birla Capital explains the top 5 things to know about claiming a tax

9 Types Of Loans In India Bank Loan In India 2023 Detailed

https://bank.caknowledge.com/wp-content/uploads/2021/04/9-Types-of-loans-in-India-Bank-Loan-In-India.png

Know Tax Benefit On Education Loans For Studies Abroad Future

https://i.ytimg.com/vi/ptRt0BBXgxY/maxresdefault.jpg

https://cleartax.in/s/section-80e-deduction...

Education loan interest is tax deductible under section 80E for individuals taking loans for higher studies limited to interest payments only Loan must be from recognized institutions No cap on deduction

https://tax2win.in/guide/sec-80e-deduction...

Interest on loans taken for pursuing higher education including vocational studies is eligible for deduction u s 80E Understand Section 80E of the Income Tax Act which allows tax deductions for

Education Loans 9 Common Education Loan Terms You Need To Know

9 Types Of Loans In India Bank Loan In India 2023 Detailed

Home Loan Tax Benefits Interest On Home Loan Section 24 And

Education Loan Process Education Holistic Education Loan

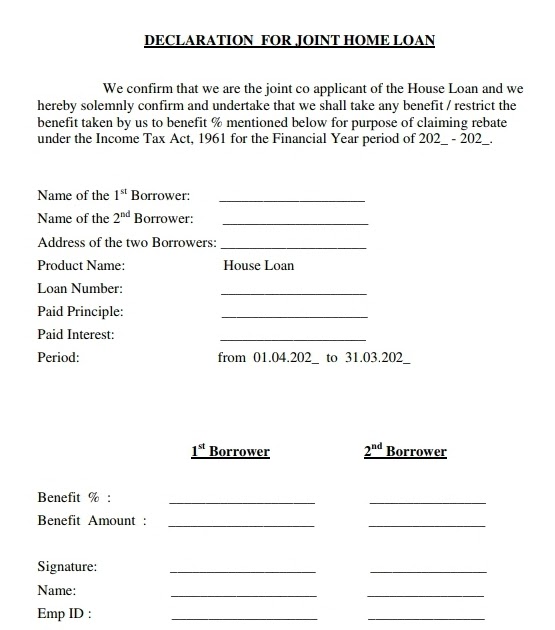

Joint Home Loan Declaration Form For Income Tax Savings And Non

Here Is The Tax Benefit On Personal Loans That You Can Avail

Here Is The Tax Benefit On Personal Loans That You Can Avail

Income Tax Benefits On Home Loan Loanfasttrack

What Is The Maximum Tax Benefit On Housing Loan Leia Aqui Is There A

Is A Plot Loan Eligible For Tax Exemption HDFC Sales Blog

Tax Benefit On Education Loan In India - Amount and period of deduction under section 80E of the Income Tax Act Entire interest amount paid during the Financial Year towards higher educational loan