Tax Benefit On Fd 80 C You can take advantage of the income tax deduction provision under Section 80C of the Income Tax Act by investing up to Rs 1 5 lakh in a tax saver fixed deposit account The scheme ensures

Tax Benefits As per Section 80C investment in tax saving FDs is deductible from your gross total income up to a limit of INR 1 5 lakh per annum which could reduce your taxable income and hence your 80 allows deduction for tax saving term deposits for a tenor of 5 years Every bank offers tax saving FDs which can be made for availing this deduction What is section 80c to 80u

Tax Benefit On Fd 80 C

Tax Benefit On Fd 80 C

https://akm-img-a-in.tosshub.com/indiatoday/images/story/202209/Tax_Benefits.jpg?VersionId=KA.W.Wl1CpsUjL4.dw1jXJ24fvBRYd1v

The Effects Of Changes In Foreign Exchange Rates Accounting Tax

https://ytkmgt.com.sg/wp-content/uploads/2021/05/Article-FB-post.png

Tax saving FDs And POTDs Provide Tax Benefits Under Section 80C Of The

https://media.faqinsurances.com/uploads/618x410/2023/03/11/tax-saving-fds-and-potds-provide-tax-benefits-under-section-80c-of-the-income-tax-act-of-1961-allowing-for-a-deduction-of-up-to-rs.jpg

Tax saver FD scheme is eligible for deduction under Section 80C of the Income Tax Act up to Rs 1 5 lakh The minimum deposit amount starts as low as Rs 1000 Who Should Invest in Tax Saving FD A tax saving FD is a fixed deposit under section 80 C and individuals can claim a tax exemption of up to Rs 1 5 lakh These deductions are available for

Section 80CCD allows deductions for contributions to the National Pension Scheme NPS or Atal Pension Yojana Understanding these 80C subsections can help taxpayers make informed Tax Saving FDs are fixed deposit schemes offered by both banks and post offices that allow tax deduction under Section 80C These FDs have a lock in period of 5 years and offer a

Download Tax Benefit On Fd 80 C

More picture related to Tax Benefit On Fd 80 C

TAX BENEFIT ON INVESTMENT IN STARTUPS U S 54GB CA Rajput

https://carajput.com/blog/wp-content/uploads/2022/04/INCOME-TAX-BENEFIT-ON-INVESTMENT-IN-STARTUPS-Section-54GB-1-885x1024.jpg

How You Can Benefit From Tax Experts And Tax Reform Nerdynaut

https://www.nerdynaut.com/wp-content/uploads/2019/08/How-You-Can-Benefit-from-Tax-Experts-and-Tax-Reform.png

Updates On International Tax Developments Global Financial Centres

https://www.at-mia.my/wp-content/uploads/2020/11/iStock-1182880534.jpg

Tax Saving Fixed Deposits FD are special saving schemes that help individuals save on taxes while earning interest Under Section 80C of the Income Tax Act 1961 investors These FDs allow you to save on income tax under section 80C of the Income Tax Act 1961 while offering competitive interest rates INDIE for example offers up to 7 50 per

In the case of joint deposits the Tax benefit under 80 c will be available only to the first holder of the deposit Tax Deductions For Re investment Fixed Deposits The following Check what is a Fixed Deposit under 80C How to Get Tax Deduction under Section 80C and Features and Benefits of Tax Saving Fixed Deposits

The 10 Top Tax Benefits For Businesses

https://blog.concannonmiller.com/hubfs/Tax Benefits - Businesses- gold sign copy.png#keepProtocol

Income Tax Benefits On Housing Loan In India

https://blog.saginfotech.com/wp-content/uploads/2016/09/income-tax-benefit.jpg

https://cleartax.in/s/fixed-deposit

You can take advantage of the income tax deduction provision under Section 80C of the Income Tax Act by investing up to Rs 1 5 lakh in a tax saver fixed deposit account The scheme ensures

https://www.taxbuddy.com/blog/fixed-de…

Tax Benefits As per Section 80C investment in tax saving FDs is deductible from your gross total income up to a limit of INR 1 5 lakh per annum which could reduce your taxable income and hence your

Here Is The Tax Benefit On Personal Loans That You Can Avail

The 10 Top Tax Benefits For Businesses

Income Tax Benefits On Home Loan Loanfasttrack

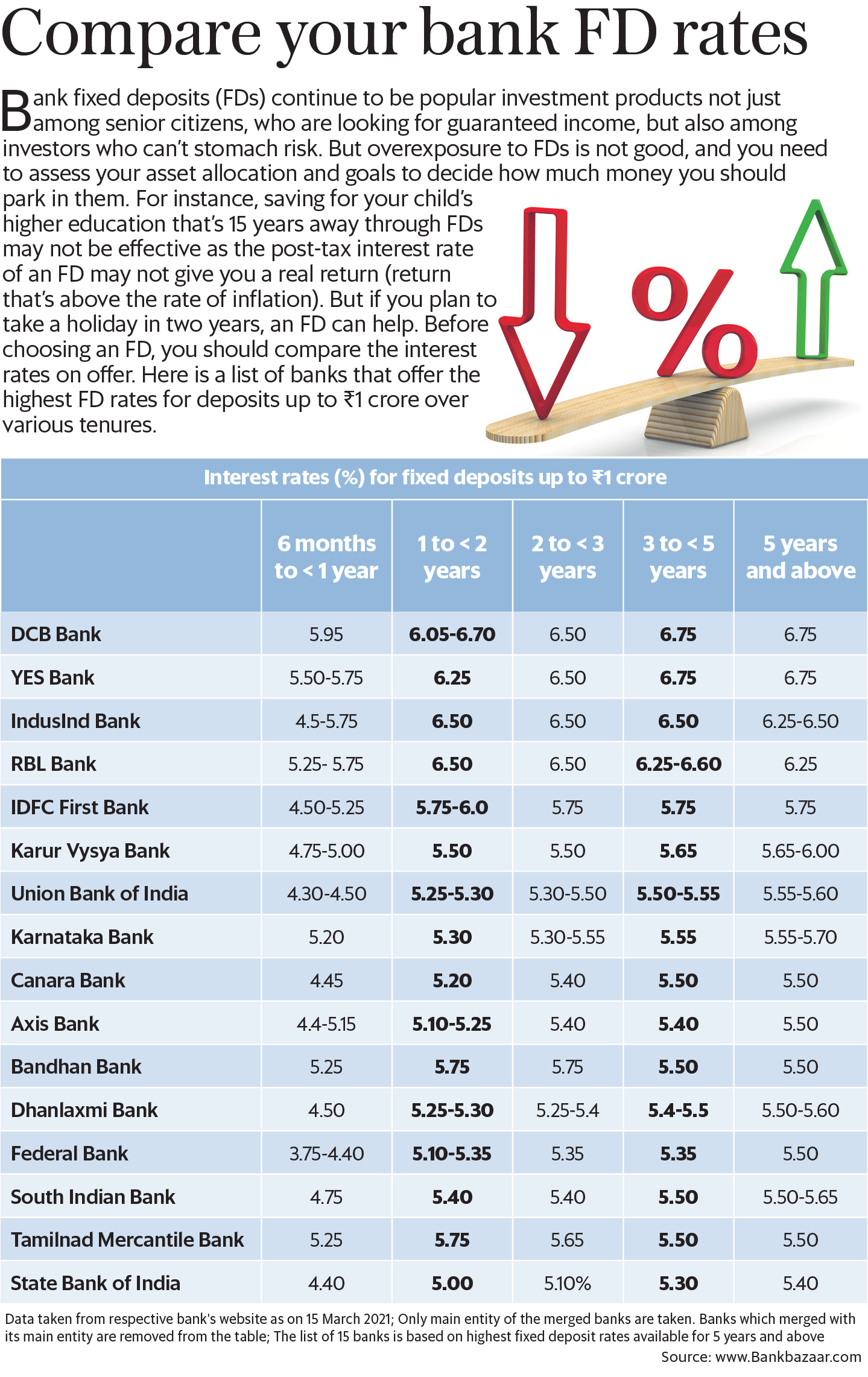

Compare Your Bank FD Rates Mint

Tax On FD TDS On Fixed Deposit Interest 2024

What Are The Tax Benefit On Home Loan FY 2020 2021

What Are The Tax Benefit On Home Loan FY 2020 2021

Income Tax Benefit On Home Loan Repayment IDFC FIRST Bank

Tax Benefit Investment Know About Section 80C Deductions

If You Choose The New Option Of Income Tax Then There Can Be A Big

Tax Benefit On Fd 80 C - Tax saver FD scheme is eligible for deduction under Section 80C of the Income Tax Act up to Rs 1 5 lakh The minimum deposit amount starts as low as Rs 1000 Who Should Invest in Tax Saving FD