Tax Benefit On Gift To Parents In India Taxpayers can transfer their surplus to their parents under a gift deed and invest money in their name In the case of senior citizens the tax exemption limit is Rs 3 lakh

Know about gift tax how are gifts taxed and when are gifts exempted from income tax Find out how tax is treated on different types of gifts received Cash gifts You do not have to pay gift tax on gifts or cash up to Rs 50 000 in a financial year Gift received from family If you receive presents from your parents spouse siblings or other close relatives such as your in

Tax Benefit On Gift To Parents In India

Tax Benefit On Gift To Parents In India

https://akm-img-a-in.tosshub.com/indiatoday/images/story/202209/Tax_Benefits.jpg?VersionId=KA.W.Wl1CpsUjL4.dw1jXJ24fvBRYd1v

Taxability Of Foreign Remittances Additional Cost To Parents In India

https://tharunraj.files.wordpress.com/2015/03/picture1.png

The Effects Of Changes In Foreign Exchange Rates Accounting Tax

https://ytkmgt.com.sg/wp-content/uploads/2021/05/Article-FB-post.png

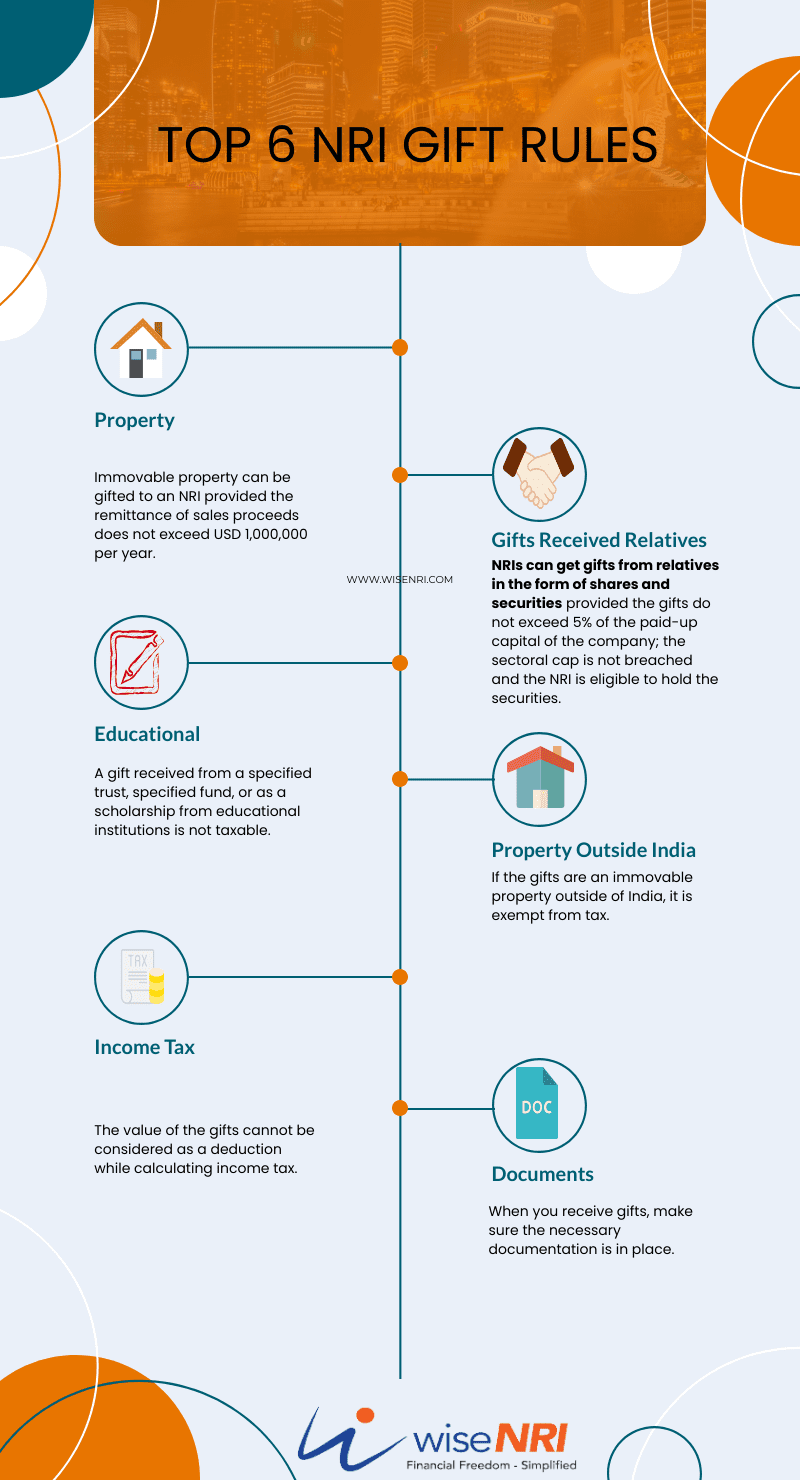

Gifts received from specified relatives including parents siblings spouse and lineal descendants are exempt from tax without any monetary limit How much money can you gift to a family member tax free in india 11 rowsCan I save tax by gifting money to parents India Yes you can save more by investing money in the names of your parents in the form of a gift which will be more beneficial if they

Making investments in your parents or children s name and reducing your tax liability is one way of saving money The income tax provisions exempt gift income from relatives Cash or gifts received upto Rs 50 000 during a financial year are exempt from tax however in case of gifts of a value higher than this threshold the entire amount is taxable in

Download Tax Benefit On Gift To Parents In India

More picture related to Tax Benefit On Gift To Parents In India

Avail Tax benefit On Personal Loan MY Wicked Armor

https://www.mywickedarmor.com/wp-content/uploads/2021/02/Is-there-any-Tax-Benefit-on-Personal-Loan.jpg

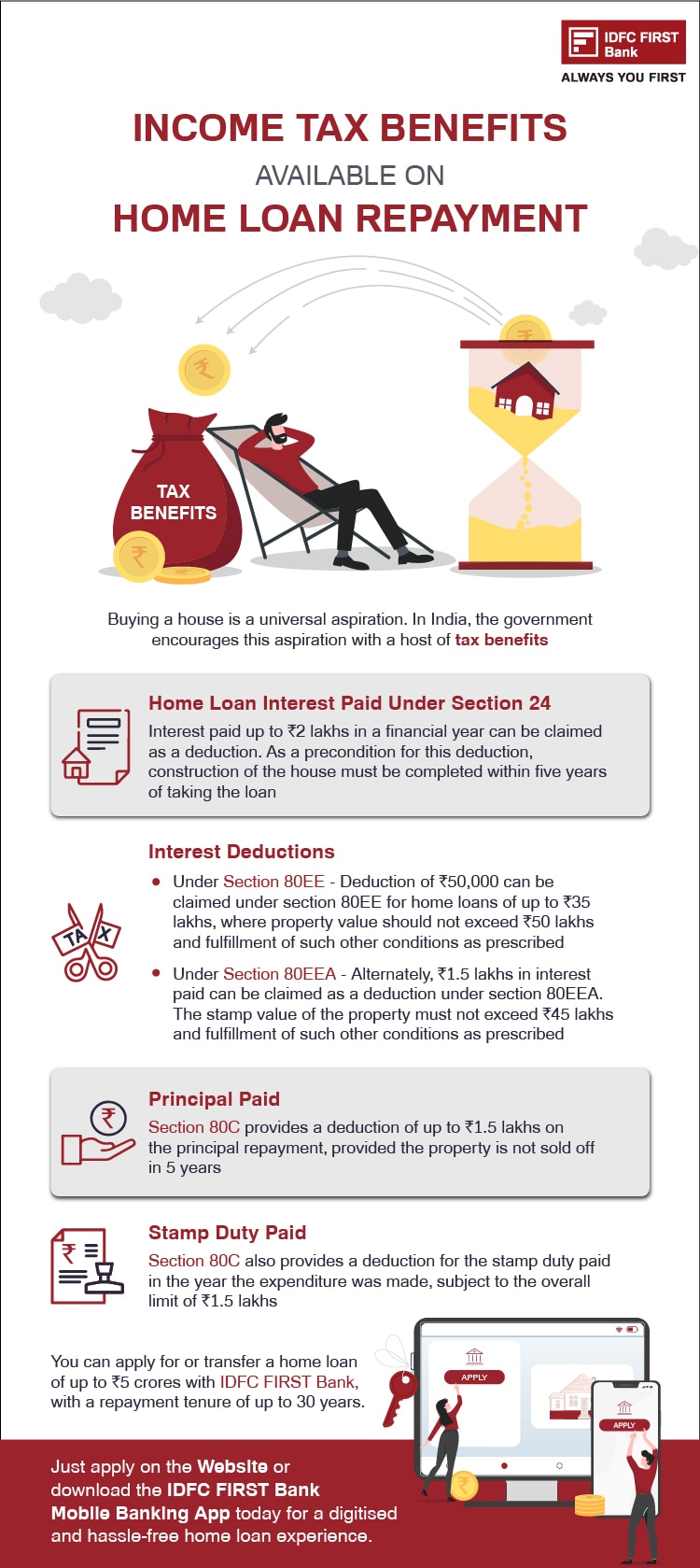

Income Tax Benefits On Housing Loan In India

https://blog.saginfotech.com/wp-content/uploads/2016/09/income-tax-benefit.jpg

Here Is The Tax Benefit On Personal Loans That You Can Avail

https://taxguru.in/wp-content/uploads/2019/06/Tax-Benefits.jpg

Gifts from non relatives valued over 50 000 are taxable in India The tax rate depends on your income tax slab 5 30 However gifts from close relatives like parents spouses or siblings are tax exempt When Section 56 2 x is introduced in Income Tax Act 1961 to tax the gifts Any sum of money or value of property received without consideration or for inadequate consideration will be subject to tax in the hands of recipient

However gifts of any amount received from or given to any relatives parents spouse your and your spouse s brothers and sisters brothers and sisters of your parents and How to Save Tax on Gifts In India you can save tax on gifts by utilizing specific exemptions Gifts from relatives on occasions like marriage or through inheritance are tax free

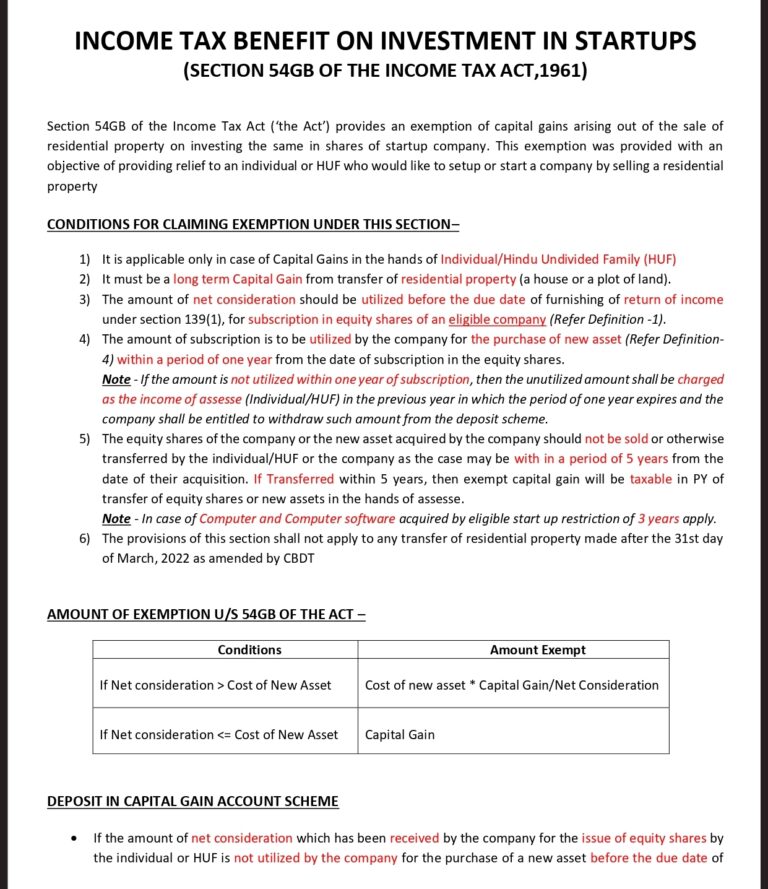

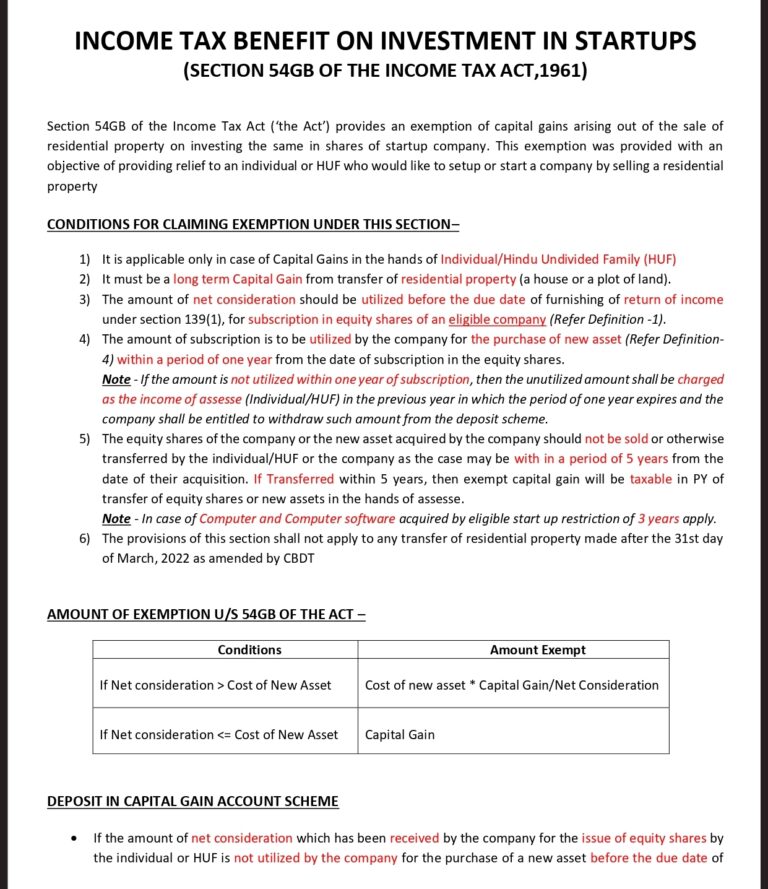

TAX BENEFIT ON INVESTMENT IN STARTUPS U S 54GB CA Rajput

https://carajput.com/blog/wp-content/uploads/2022/04/INCOME-TAX-BENEFIT-ON-INVESTMENT-IN-STARTUPS-Section-54GB-1-768x889.jpg

Home Loan Comparison Chart Of Leading Banks Loanfasttrack

https://www.loanfasttrack.com/blog/wp-content/uploads/2020/12/Home-Loan-Comparison-768x513.png

https://www.bankbazaar.com › tax › gifting-to-your...

Taxpayers can transfer their surplus to their parents under a gift deed and invest money in their name In the case of senior citizens the tax exemption limit is Rs 3 lakh

https://cleartax.in › how-are-gifts-taxed

Know about gift tax how are gifts taxed and when are gifts exempted from income tax Find out how tax is treated on different types of gifts received

What Is The Advancing Support For Working Families Act And Why Doesn t

TAX BENEFIT ON INVESTMENT IN STARTUPS U S 54GB CA Rajput

All About Tax Benefit On Tuition Fees Under Section 80C The Inbuilt

What Are The Tax Benefit On Home Loan FY 2020 2021

What Is The Maximum Tax Benefit On Housing Loan Leia Aqui Is There A

Gift Tax In India Save Tax On Gift Income Tax On Property Gift

Gift Tax In India Save Tax On Gift Income Tax On Property Gift

How To Claim Tax Benefit On Home Loan For Under Construction Property

Good It Webzine Photographic Exhibit

Home Loan Tax Benefits

Tax Benefit On Gift To Parents In India - All you need to know about the Gift tax in India A gift of any form of cash cheque or property is taxable if it exceeds Rs 50 000 Learn about rules and exemptions