Tax Benefit On Higher Education Loan Verkko 27 kes 228 k 2023 nbsp 0183 32 There is no tax benefit for the principal part of the EMI What is 80E education loan deduction 80E education loan deduction is a tax incentive given to people who avail education loan for higher studies This deduction is available only on the interest amount paid on the loan and not on the principal amount

Verkko It can mean a reduction of more than 6 000 euros and if you have taken a higher education degree in a foreign country you may save up to 12 000 euros You are eligible for student loan compensation Opens in a new window if you have started higher education studies in autumn Verkko To encourage borrowers to take an education loan there is a tax benefit on repayment of the education loan Once you avail of an education loan the interest paid which is a component of your EMI on the education loan is allowed as a deduction under Section 80E of the Income Tax Act 1961

Tax Benefit On Higher Education Loan

Tax Benefit On Higher Education Loan

https://www.ashar.in/wp-content/uploads/2021/03/Tax-benefits-of-home-loans-image.jpg

Tax Benefits On Home Loan Know More At Taxhelpdesk

https://www.taxhelpdesk.in/wp-content/uploads/2021/11/Tax-Saving-Benefits-of-having-property-through-Home-Loan-1.png

What Are The Tax Benefit On Home Loan Calculate Loan Tax Benefits

https://homefirstindia.com/app/uploads/2022/07/Untitled-design-14.png

Verkko 6 p 228 iv 228 228 sitten nbsp 0183 32 The maximum amount for the tax exempt portion of the grants in 2023 is 25 548 52 The amount of earned income subject to tax is 4 452 48 40 000 00 10 000 00 25 548 52 More detailed information on the taxation of scholarships and grants can be found in Taxation of grants scholarships and awards for merit Verkko Deduct higher education expenses on your income tax return as for example a business expense and also claim an American opportunity credit based on those same expenses Claim an American opportunity credit for any student and use any of that student s expenses in figuring your lifetime learning credit

Verkko 22 syysk 2023 nbsp 0183 32 An education credit helps with the cost of higher education by reducing the amount of tax owed on your tax return If the credit reduces your tax to less than zero you may get a refund There are two education credits available the American Opportunity Tax Credit and the Lifetime Learning Credit Verkko Section 80E of the Income Tax Act 1961 relates to deduction for the repayment of Interest on Education Loan Customers of HDFC Credila can avail Income Tax Deduction on interest paid on Education Loan taken from HDFC Credila Either student or parent can claim this tax benefit

Download Tax Benefit On Higher Education Loan

More picture related to Tax Benefit On Higher Education Loan

Tax Benefits On Home Loan Know More At Taxhelpdesk

https://www.taxhelpdesk.in/wp-content/uploads/2022/07/Tax-benefits-on-Home-Loan-819x1024.jpeg

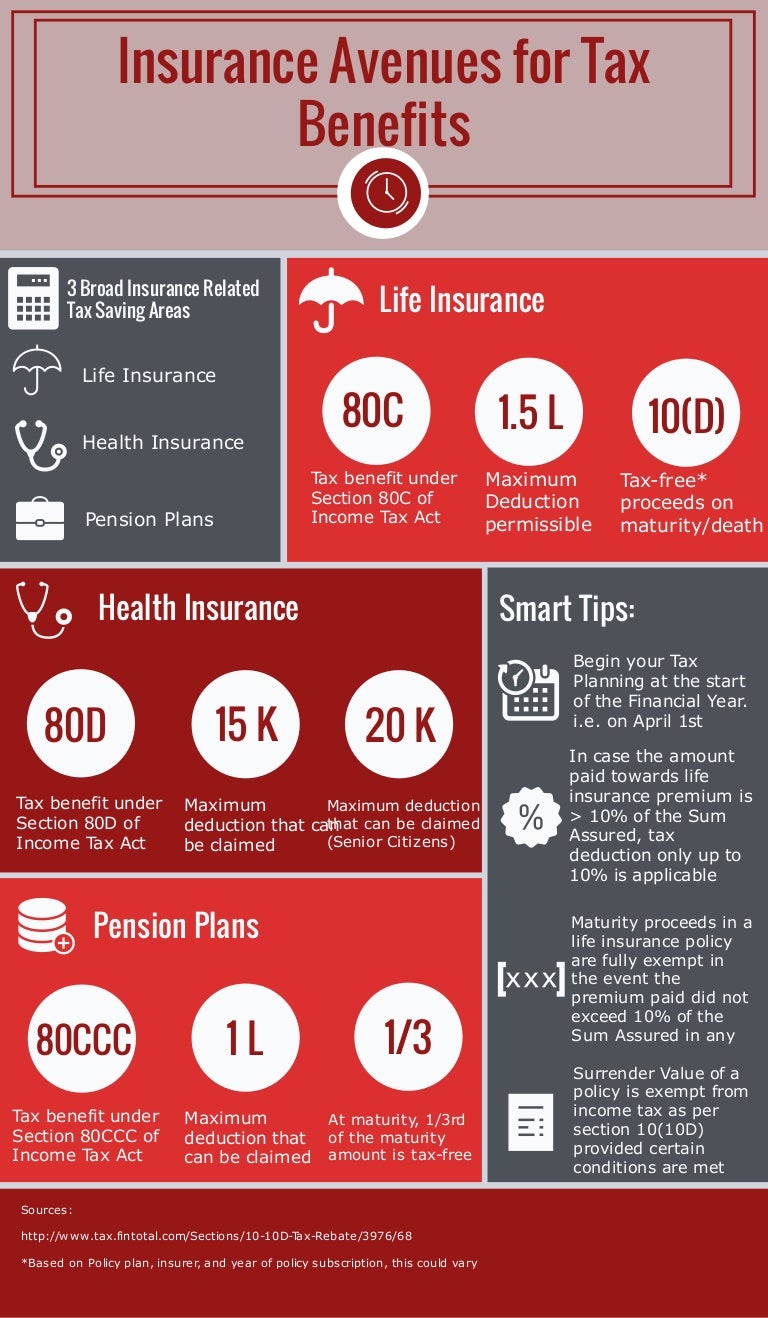

Insurance Avenues For Tax Benefits

https://cdn.slidesharecdn.com/ss_thumbnails/insurance-avenues-for-tax-benefits-160217134627-thumbnail-4.jpg?cb=1524812596

Tax Benefits Of Paying Home Loan EMI HDFC Sales Blog

https://www.hdfcsales.com/blog/wp-content/uploads/2021/10/benefits-of-paying-home-loan-emi.png

Verkko An education loan tax benefit is a provision that allows individuals to claim a tax deduction on the interest paid on a loan taken for higher education This tax benefit is available in many countries including India where it is provided under Section 80E of the Income Tax Act Verkko 12 jouluk 2023 nbsp 0183 32 The student loan interest tax deduction The tax benefits of your student loan don t end with the above credits A deduction is also available for the interest payments you make when you start repaying your loan As of 2023 the deduction is available to the following filers Single filers with MAGIs of 90 000 or less

Verkko 28 jouluk 2023 nbsp 0183 32 Section 80E provides a tax deduction on the interest component paid on a loan taken for higher education by an individual assessee or on behalf of their spouse or children Contents What is section 80E of income tax Who can claim tax benefits on interest paid on an education loan What is the deduction amount u s 80E Verkko 23 jouluk 2023 nbsp 0183 32 The tax benefit is only applicable if you take an education loan from financial institutions and not from friends family and relatives The education loan must be taken for higher studies to be eligible for deduction under Section 80E Calculating Tax Rebates on Education Loans

The Effects Of Changes In Foreign Exchange Rates Accounting Tax

https://ytkmgt.com.sg/wp-content/uploads/2021/05/Article-FB-post.png

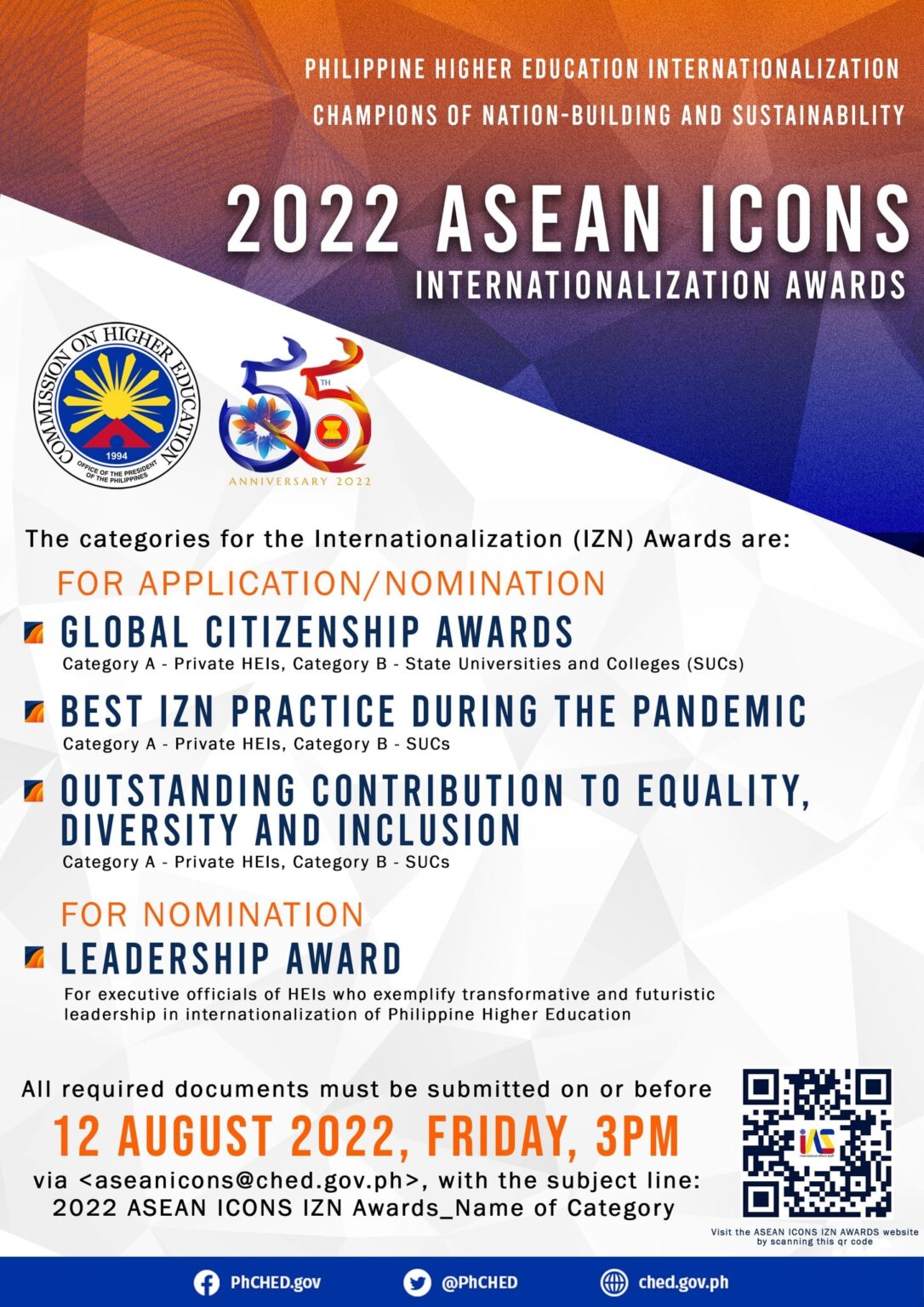

Call For Nominations 2022 ASEAN Philippine Higher Education

https://mimaropa.ched.gov.ph/wp-content/uploads/2022/08/Call-for-Nominations-2022-ASEAN-Philippine-Higher-Education-Internationalization-Champions-of-Nation-Building-and-Sustainability-Internationalization-Awards-min-1086x1536.jpg

https://cleartax.in/s/section-80e-deduction-interest-education-loan

Verkko 27 kes 228 k 2023 nbsp 0183 32 There is no tax benefit for the principal part of the EMI What is 80E education loan deduction 80E education loan deduction is a tax incentive given to people who avail education loan for higher studies This deduction is available only on the interest amount paid on the loan and not on the principal amount

https://www.suomi.fi/.../income-of-higher-education-students

Verkko It can mean a reduction of more than 6 000 euros and if you have taken a higher education degree in a foreign country you may save up to 12 000 euros You are eligible for student loan compensation Opens in a new window if you have started higher education studies in autumn

HOME LOAN INTEREST CERTIFICATE For FY 2021 22 PDF Loans Interest

The Effects Of Changes In Foreign Exchange Rates Accounting Tax

What Are The Tax Benefit On Home Loan Calculate Loan Tax Benefits

How To Avail Tax Benefits On Personal Loan Tata Capital Blog

Broad base Student Loan Debt Forgiveness Is Bad Idea

What Are The Tax Benefits On Top Up Loan HomeFirst

What Are The Tax Benefits On Top Up Loan HomeFirst

How Can Better Federal Data On Higher Education Outcomes Reduce Student

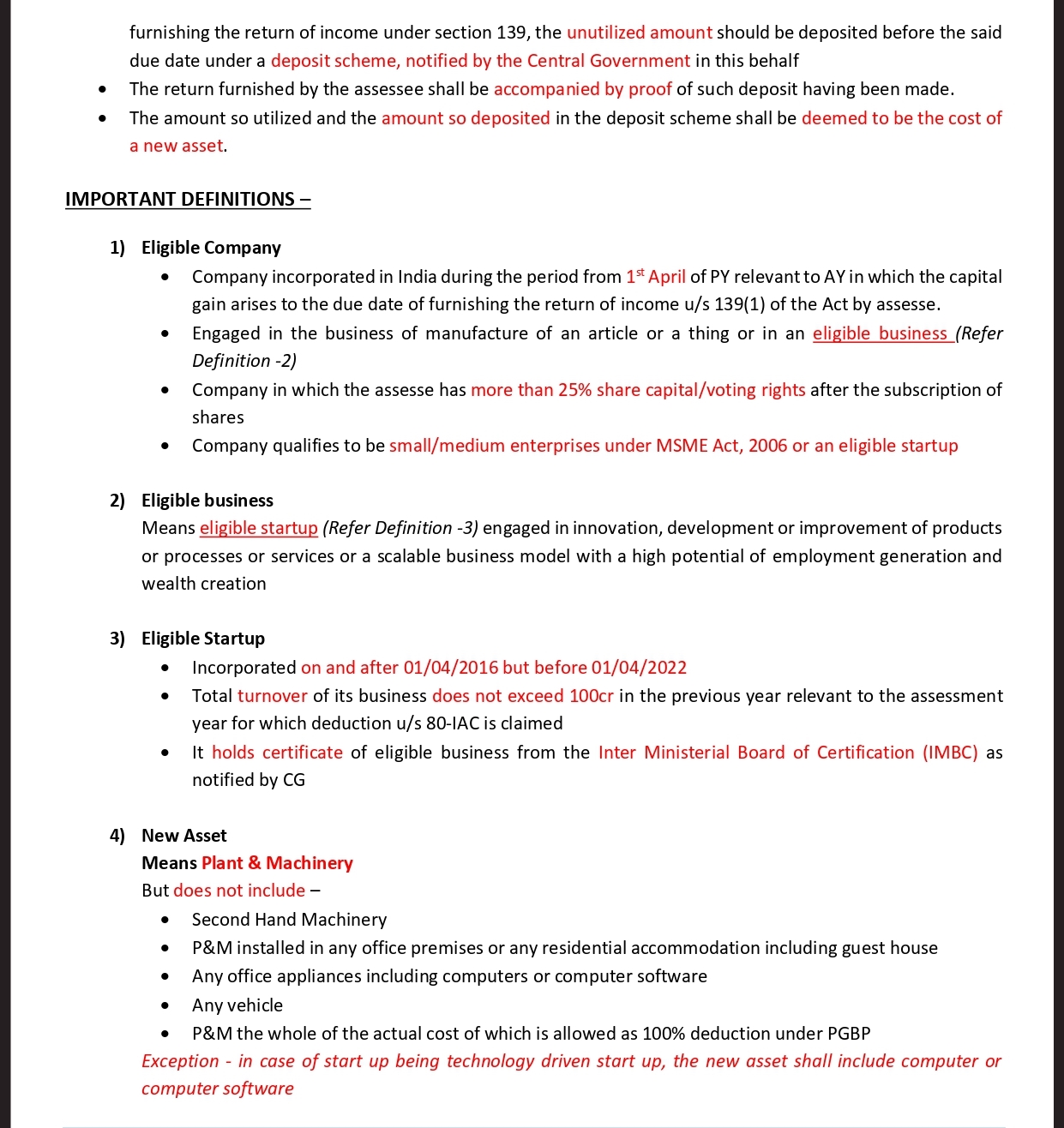

TAX BENEFIT ON INVESTMENT IN STARTUPS U S 54GB CA Rajput

Here Is The Tax Benefit On Personal Loans That You Can Avail

Tax Benefit On Higher Education Loan - Verkko Deduct higher education expenses on your income tax return as for example a business expense and also claim an American opportunity credit based on those same expenses Claim an American opportunity credit for any student and use any of that student s expenses in figuring your lifetime learning credit