Tax Benefit On Home Loan For Rented Property If you have rented out the property the entire interest on the home loan is allowed as a deduction Your deduction on interest is limited to Rs 30 000 if you fail to meet any of the conditions given below The home loan must be for the purchase and construction of a property The loan must be taken on or after 1 April 1999

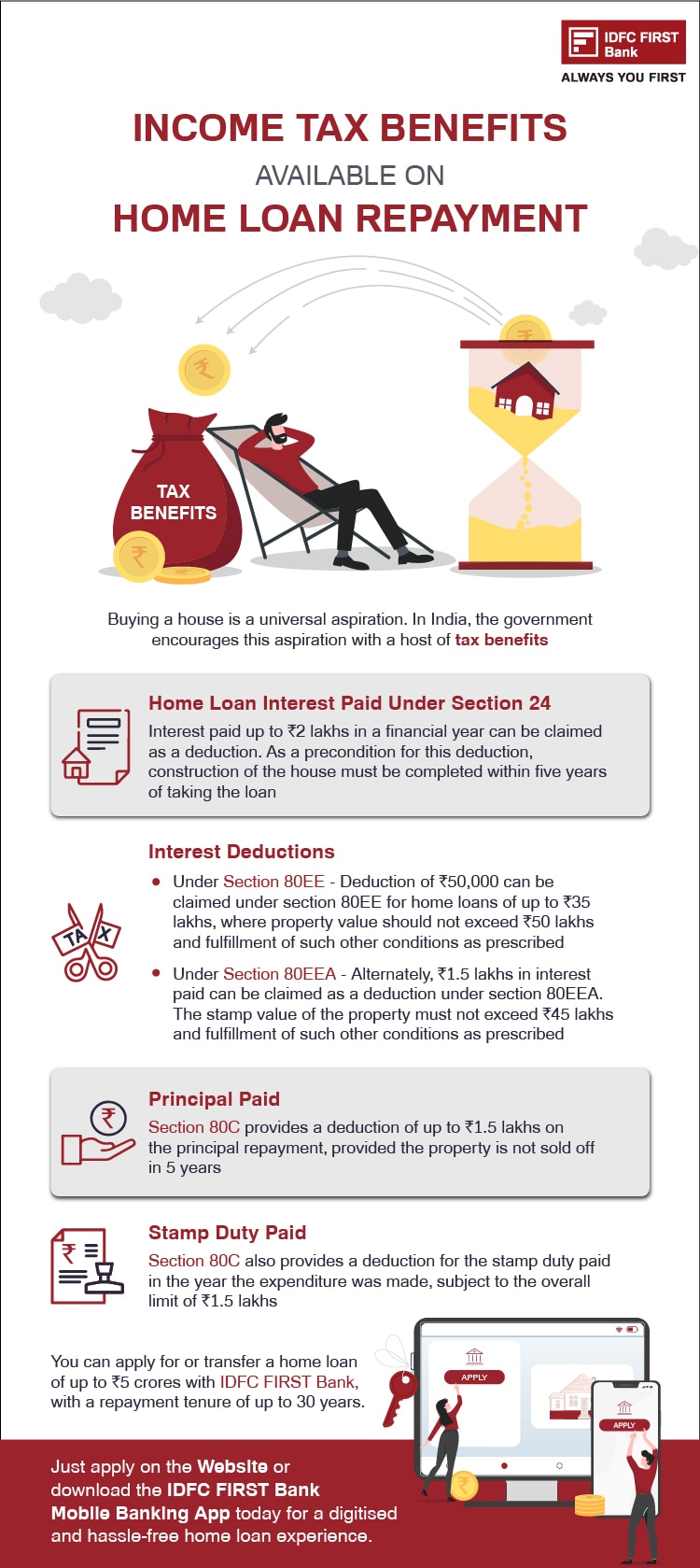

Tax Deduction on Home Loans a Tax Deduction on Home Loan Interest Section 24 Homeowners can claim a deduction of up to Rs 2 lakh on their home loan interest if the owner or his family resides in the house property The same treatment applies when the house is vacant A tax payer can claim home loan tax benefits along with house rent allowance in two scenarios A he is paying EMI for an under construction project B he is living in a rented accommodation while his own property is also let out

Tax Benefit On Home Loan For Rented Property

Tax Benefit On Home Loan For Rented Property

https://www.raunaqfoundations.com/wp-content/uploads/shutterstock_1383141659-min-scaled.jpg

Income Tax Benefit On Second Home Loan Complete Guide

https://assetyogi.b-cdn.net/wp-content/uploads/2017/06/income-tax-benefit-on-second-home-loan-889x500.jpg

Home Loan Tax Benefits

https://www.ashar.in/wp-content/uploads/2021/03/Tax-benefits-of-home-loans-image.jpg

Yes you can claim an income tax exemption on both the house rent allowance HRA and repayment of the home loan If you are living in a house on rent and servicing a home loan on another property even if both the properties are located in the same city you can claim tax benefits for both The government is supporting first time and main home buyers by increasing the Higher Rates for Additional Dwellings in Stamp Duty Land Tax on the purchases of second homes buy to let residential

As per Section 24 b of the Income Tax Act You can claim a tax deduction of up to Rs 2 lakh on home loan interest paid This deduction is applicable in case of self occupied as well as vacant residential properties In case of let out or rented residential properties there no cap on tax deduction Tim says With the rate at which no stamp duty is charged for home movers due to fall from 250 000 to 125 000 anyone purchasing a property over this amount could face paying up to 2 500 more in stamp duty land tax Meanwhile the threshold rate at which first time buyers do not pay stamp duty is likely to fall from 425 000 to 300 000

Download Tax Benefit On Home Loan For Rented Property

More picture related to Tax Benefit On Home Loan For Rented Property

Tax Benefits On Home Loan Know More At Taxhelpdesk

https://www.taxhelpdesk.in/wp-content/uploads/2021/11/Tax-Saving-Benefits-of-having-property-through-Home-Loan-1.png

Home Loan Tax Benefit Home Loan Income Tax Benefit Income Tax

https://i.ytimg.com/vi/0ExGuGq5C0Q/maxresdefault.jpg

Tax Benefits On Home Loan Know More At Taxhelpdesk

https://www.taxhelpdesk.in/wp-content/uploads/2022/07/Tax-benefits-on-Home-Loan-819x1024.jpeg

Homeowners can claim a deduction on their home loan interest on self occupied property under Section 24 of the Income Tax Act The deduction amount is up to Rs 2 lakhs or Rs 1 50 000 for the previous financial year if the owner or their family occupies the house property Tax Benefits under Section 80EEA The rule foregoes tax benefit on a home loan on a self occupied property The tax rules still allow deduction on interest paid towards loan on a rented property under section 24

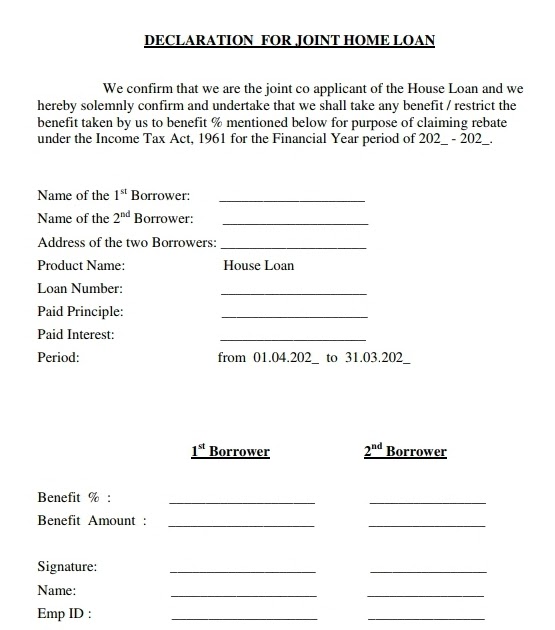

If you took a home loan and are still living in a rented place you will be entitled to 1 Tax benefit on principal repayment under Section 80C 2 Tax benefit on interest payment under Section 24 3 House Rent Allowance HRA benefit Of course you can claim tax benefits on the home loan only if your home is ready to live in during that All joint owners can individually avail of tax benefits on a joint home loan provided certain conditions are met Let s examine them It s pertinent to note that ownership of the property is a prerequisite to availing any tax benefits against the property

Home Loan Tax Benefit saving In 2019 20 In Hindi tax Benefit saving On

https://i.ytimg.com/vi/TqmeyW7QUDY/maxresdefault.jpg

What Are The Tax Benefit On Home Loan Calculate Loan Tax Benefits

https://homefirstindia.com/app/uploads/2022/07/Untitled-design-14.png

https://cleartax.in/s/deductions-under-section24...

If you have rented out the property the entire interest on the home loan is allowed as a deduction Your deduction on interest is limited to Rs 30 000 if you fail to meet any of the conditions given below The home loan must be for the purchase and construction of a property The loan must be taken on or after 1 April 1999

https://cleartax.in/s/house-property

Tax Deduction on Home Loans a Tax Deduction on Home Loan Interest Section 24 Homeowners can claim a deduction of up to Rs 2 lakh on their home loan interest if the owner or his family resides in the house property The same treatment applies when the house is vacant

Joint Home Loan Declaration Form For Income Tax Savings And Non

Home Loan Tax Benefit saving In 2019 20 In Hindi tax Benefit saving On

Home Loan Tax Exemption Check Tax Benefits On Home Loan

Income Tax Benefit On Home Loan 2022 I Home Loan Deductions And Tax

What Is The Maximum Tax Benefit On Housing Loan Leia Aqui Is There A

RBI Guidelines For Home Loan Interest Rates 2024 LoanPaye

RBI Guidelines For Home Loan Interest Rates 2024 LoanPaye

Housing Loan Tax Benefit Provident Housing

What Is The Apr On A Home Loan

Can I Get Tax Benefit On Home Loan During Pre construction Period Mint

Tax Benefit On Home Loan For Rented Property - In case of a let out house you can only claim tax deduction on the interest payment of a home loan On the other hand a self occupied house gives you two avenues of saving taxes which are the payment of interest and repayment of principal