Tax Benefit On Insurance Learn about the tax implications of life insurance premiums including when they might be taxable and whether they are tax deductible

The term tax benefit refers to any tax law that helps you reduce your tax liability Benefits range from deductions and tax credits to exclusions and exemptions They cover Life insurance offers desirable tax advantages though it is not exactly tax free Here are ways your life insurance benefits could be taxed Withdrawing too much

Tax Benefit On Insurance

Tax Benefit On Insurance

https://www.washingtonpost.com/wp-apps/imrs.php?src=https://arc-anglerfish-washpost-prod-washpost.s3.amazonaws.com/public/4MTTNAQNDUI6RCEQG4XCAR6JGU.jpg&w=1440

Tax Benefit Thetaxtalk Avail Tax Benefit If Living In A Rented Premises

https://thetaxtalk.com/wp-content/uploads/2018/02/56-1-1024x800.png

5 Situations When You Lose Tax Benefit On Your Health Insurance

https://www.medicalisland.net/wp-content/uploads/2018/02/Tax-Benefit-on-Insurance.png

A life insurance payout can be taxable in the following situations The insurer issues the death benefit in installments The death benefit is typically paid out in a lump sum but the life The primary advantage of buying a life insurance policy is that upon death your heirs or beneficiaries can receive a substantial lump sum payment without federal taxation Although death benefits are

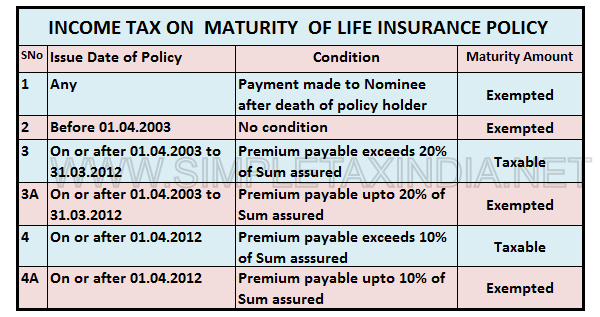

Updated May 20 2024 Reviewed By Mark Friedlander Edited By Susan Meyer Are life insurance proceeds taxable In general death benefits paid out to Tax benefit on policy benefits The death benefit and maturity benefit received under life insurance plans is tax free in your hands under the provisions of Section 10 10D There is no limit on the

Download Tax Benefit On Insurance

More picture related to Tax Benefit On Insurance

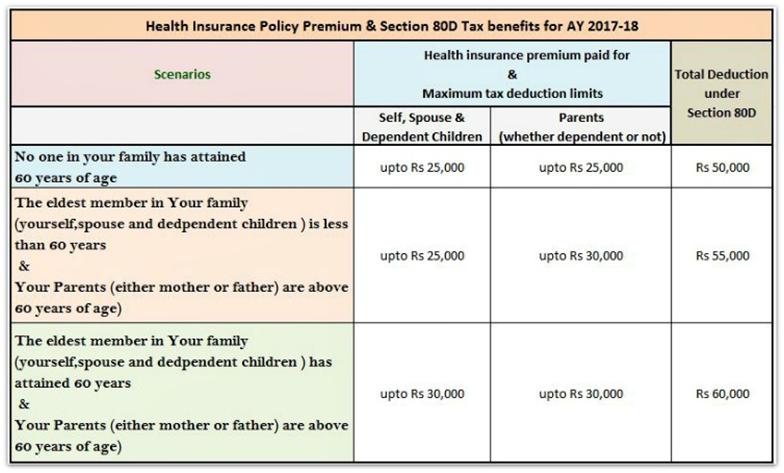

Health Insurance Deduction U S 80D Income Tax Deductions Exemptions

https://cms.careinsurance.com/cms/public/assets/media/tax-benefit.jpg

Tax Benefit PDF

https://imgv2-1-f.scribdassets.com/img/document/68860484/original/4d847262fc/1689543742?v=1

Income Tax Benefits On Housing Loan In India

https://blog.saginfotech.com/wp-content/uploads/2016/09/income-tax-benefit.jpg

Updated Mon Apr 1 2024 Liz Knueven If you are the beneficiary of a life insurance policy the payout known as a death benefit is typically tax free There are some You can get some tax free health benefits from your employer including medical insurance when you re working abroad annual check ups Check and report changes to medical

In most cases money paid out from a life insurance policy is not taxable Life insurance payouts can sometimes be subject to taxation such as when the contract changes Tax benefits on life insurance policy Life insurance policies offer maturity death benefits and tax deductions under Section 80C and Section 10 10D of the Income Tax Act of

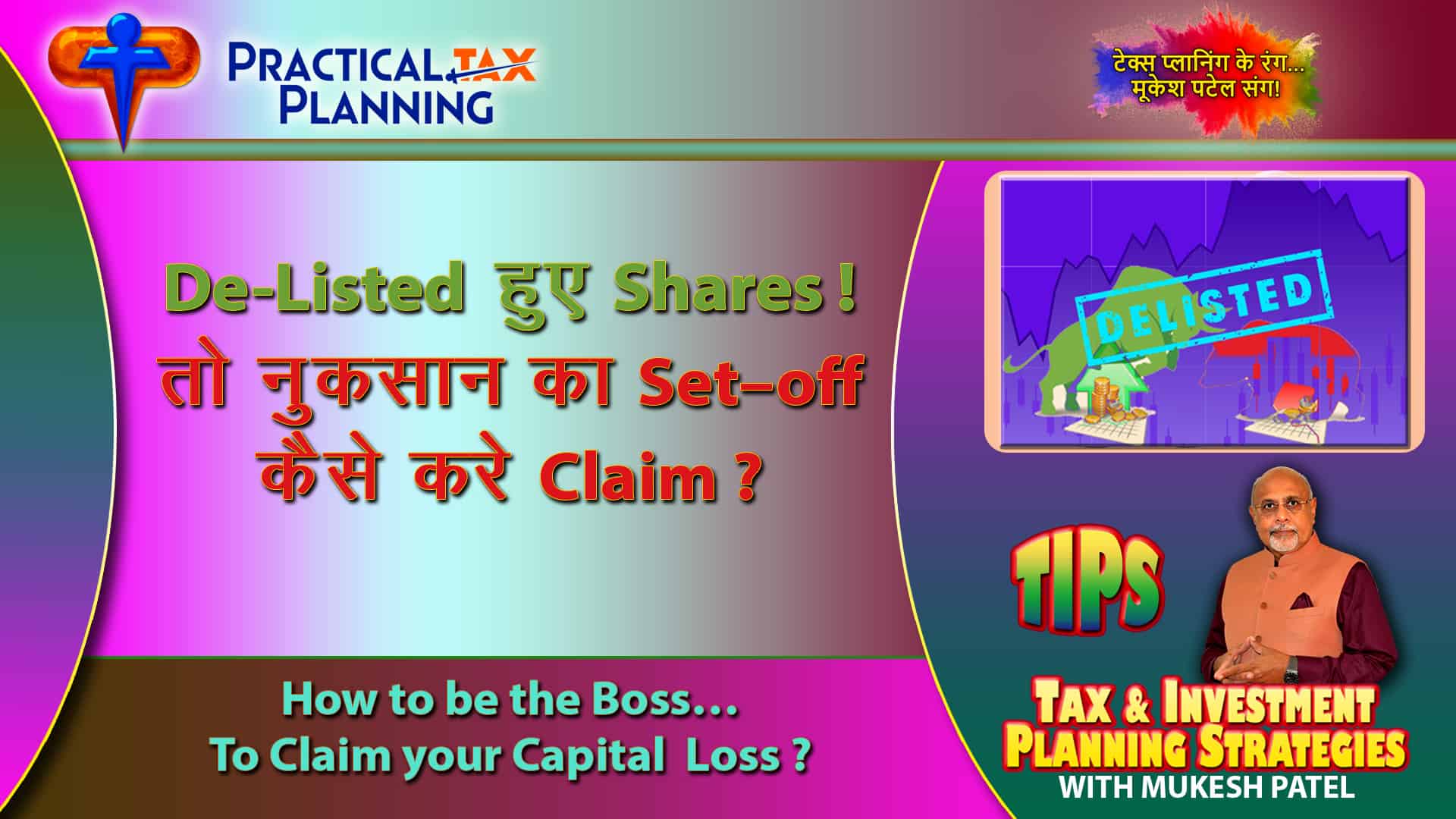

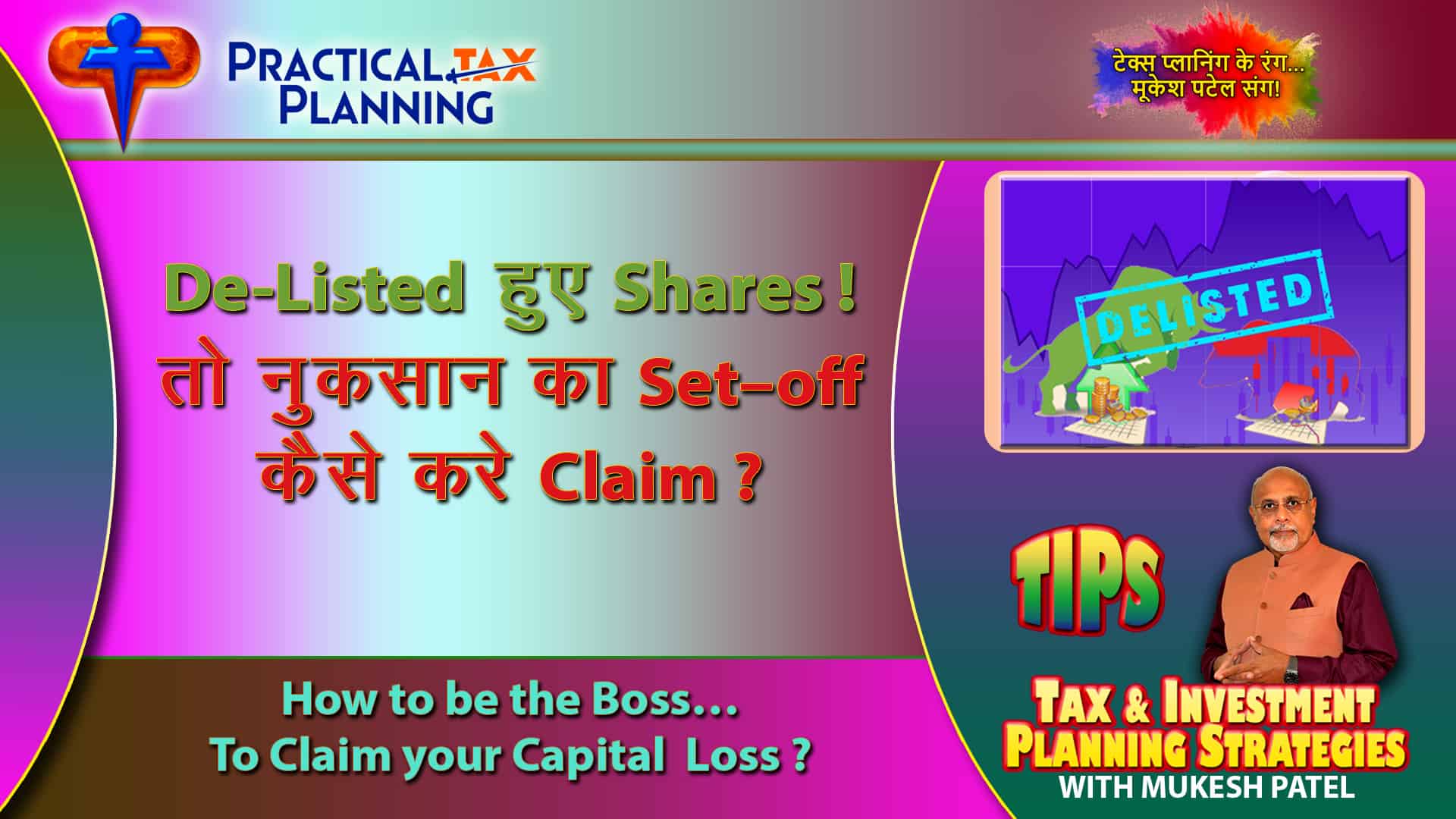

DELISTED SHARES How To Claim Tax Benefit Through Set Off Capital Loss

https://www.practicaltaxplanning.com/ptp/wp-content/uploads/2022/11/17-copy.jpg

Life Insurance And Income Tax Benefit With BIMTech In Hindi YouTube

https://i.ytimg.com/vi/fMU_UHKWlns/maxresdefault.jpg

https://www.investopedia.com/articles/perso…

Learn about the tax implications of life insurance premiums including when they might be taxable and whether they are tax deductible

https://www.investopedia.com/terms/t/tax-b…

The term tax benefit refers to any tax law that helps you reduce your tax liability Benefits range from deductions and tax credits to exclusions and exemptions They cover

INCOME TAX BENEFIT ON LIFE INSURANCE SIMPLE TAX INDIA

DELISTED SHARES How To Claim Tax Benefit Through Set Off Capital Loss

Freelance Accounting Personal Tax Services

Govt To Scrap Long term Tax Benefit For Debt Mutual Funds Investing

Credit Insurance Concept On Craiyon

Income Tax Benefits On Home Loan Loanfasttrack

Income Tax Benefits On Home Loan Loanfasttrack

Tax Benefit

How Health Insurance Tax Benefits 2016 Can Ease Your Pain

Impacts Of Commerical Office Meltdown And Unaffordable Housing Combined

Tax Benefit On Insurance - The primary advantage of buying a life insurance policy is that upon death your heirs or beneficiaries can receive a substantial lump sum payment without federal taxation Although death benefits are