Tax Benefit On Loan For Plot Verkko 13 jouluk 2022 nbsp 0183 32 Deduction for home loan interest other pages Deductions for first time homebuyers Page last updated 12 13 2022 If you have a home loan and pay interest on it you are normally entitled to deductions from your taxes However the rules are different depending on how the dwelling is used

Verkko 30 syysk 2022 nbsp 0183 32 Remember that tax benefits on plot loans can only be claimed once a building has been completed on the subject plot Benefit from taxes under section 80C You may be allowed for a deduction under this section for the portion of your home and plot loans that relates to the principal payments and ignores the plot loan interest rate Verkko Deductions under Section 24 Under Section 24 of the IT Act you can claim tax benefits of up to Rs 2 lakh However you must covert the plot loan to a regular home loan to avail the benefits The process to covert a plot loan to a regular home loan is simple and can be done once the construction has been completed

Tax Benefit On Loan For Plot

Tax Benefit On Loan For Plot

https://akm-img-a-in.tosshub.com/indiatoday/images/story/202209/Tax_Benefits.jpg?VersionId=KA.W.Wl1CpsUjL4.dw1jXJ24fvBRYd1v

Income Tax Benefit On Second Home Loan Complete Guide

https://assetyogi.b-cdn.net/wp-content/uploads/2017/06/income-tax-benefit-on-second-home-loan-889x500-768x432.jpg

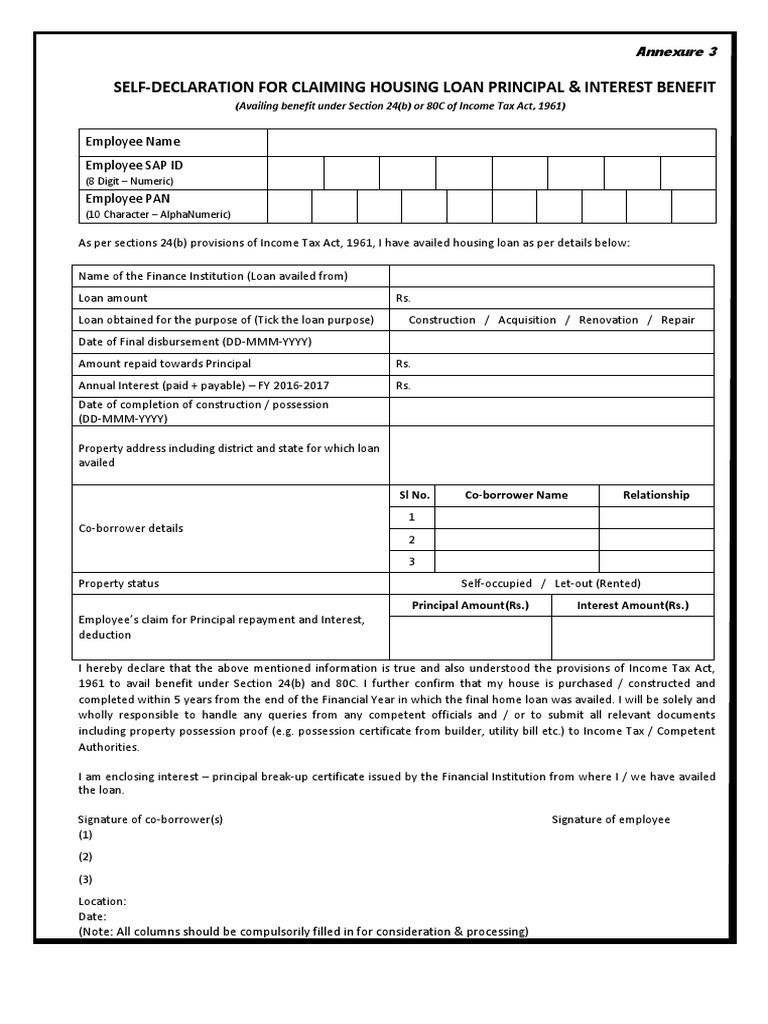

Self Declaration For Claiming Housing Loan Principal Interest Benefit

https://imgv2-2-f.scribdassets.com/img/document/558860084/original/8382a4f494/1672898190?v=1

Verkko Differences and advantages of plot ownership When a housing company is on a lease plot you can buy an apartment with less capital and pay rent for the plot as part of the monthly maintenance fee If the housing company owns its plot you need more capital to purchase an apartment but your monthly housing costs are lower Verkko Plot Loan Tax Benefits Know How It Works Tax benefits come in handy when availing of home loans So borrowers expect an income tax rebate on plot loans also The question of whether plot loan tax exemption is available is dependent on what purpose the plot purchased is meant to be used for

Verkko 24 elok 2023 nbsp 0183 32 Understanding MCLR in Banking and Loans Home Loan Rejection Reasons for Declined Applications Explore income tax benefits on plot loans exemptions rebates and deductions Learn about tax advantages for plot purchase and construction loans Verkko 19 huhtik 2022 nbsp 0183 32 In fact you can get tax benefits on both the plot loan and the home loan taken to build a home on that plot How to Avail the Tax Benefits on a Plot Loan You can avail of plot loan tax benefits only if you construct a building on the plot for which you took the loan

Download Tax Benefit On Loan For Plot

More picture related to Tax Benefit On Loan For Plot

IPPB Tie up With PNB Punjab National Bank To Offer Retail Loans viz

https://blogger.googleusercontent.com/img/a/AVvXsEgrBdLcqSY48ppZlBxWTsaw6lEv3qk3BkZxrGozxcmDA-gyWwoYPXi-mVcnfvCCIxdhm3lLRWPMoFX9jyH1jHy9QmTAcwSIbjOWA8EJYcHtN8jfwFcgxnRfmkLqqMEskOONisXpJSKsFybJNFUz6ma8FKkvBYxiF0yxRDsdZCjrA0aAHd6m50iDv1ZG5A=s16000

What Are The Tax Benefit On Home Loan Calculate Loan Tax Benefits

https://homefirstindia.com/app/uploads/2022/07/Untitled-design-14.png

The Effects Of Changes In Foreign Exchange Rates Accounting Tax

https://ytkmgt.com.sg/wp-content/uploads/2021/05/Article-FB-post.png

Verkko 28 helmik 2023 nbsp 0183 32 The tax benefit applies to both loans the plot loan used to purchase the plot and the home loan used to build a house on the plot Also Read All You Need to Know About Tax on Rental Income from House Property in India timesproperty Verkko Beyond the obvious advantages of owning a piece of real estate plot loans also come with certain tax benefits that borrowers can leverage In this guide we will delve into the tax benefits associated with plot loans and explore how to make the most of them Understanding Plot Loan Tax Benefits 1 Tax Deduction on Interest Paid

Verkko 12 toukok 2021 nbsp 0183 32 Explained How plot loans differ from home loans on interest rates and income tax benefits Interest rates on plot loans are a few basis points higher compared to those on home loans Verkko 18 jouluk 2023 nbsp 0183 32 how much tax benefit on home loan The tax benefit for a home loan as per different sections in Income Tax Acts is listed below Up to Rs 2 lakh under Section 24 b for self occupied home Up to Rs 1 5 lakh under Section 80C Who is eligible to claim tax deductions on home loans

Tax Benefits Of Paying Home Loan EMI HDFC Sales Blog

https://www.hdfcsales.com/blog/wp-content/uploads/2021/10/benefits-of-paying-home-loan-emi.png

Home Loan Tax Benefits

https://www.ashar.in/wp-content/uploads/2021/03/Tax-benefits-of-home-loans-image.jpg

https://www.vero.fi/en/individuals/tax-cards-and-tax-returns/...

Verkko 13 jouluk 2022 nbsp 0183 32 Deduction for home loan interest other pages Deductions for first time homebuyers Page last updated 12 13 2022 If you have a home loan and pay interest on it you are normally entitled to deductions from your taxes However the rules are different depending on how the dwelling is used

https://www.hdfcsales.com/blog/is-a-plot-loan-eligible-for-tax-exemption

Verkko 30 syysk 2022 nbsp 0183 32 Remember that tax benefits on plot loans can only be claimed once a building has been completed on the subject plot Benefit from taxes under section 80C You may be allowed for a deduction under this section for the portion of your home and plot loans that relates to the principal payments and ignores the plot loan interest rate

Home Loan Comparison Chart Of Leading Banks Loanfasttrack

Tax Benefits Of Paying Home Loan EMI HDFC Sales Blog

Is A Plot Loan Eligible For Tax Exemption HDFC Sales Blog

Income Tax Benefits On Housing Loan In India

Income Tax Benefit On Home Loan Repayment IDFC FIRST Bank

Debt Consolidation Loans 5 Tips To Get Approved For One

Debt Consolidation Loans 5 Tips To Get Approved For One

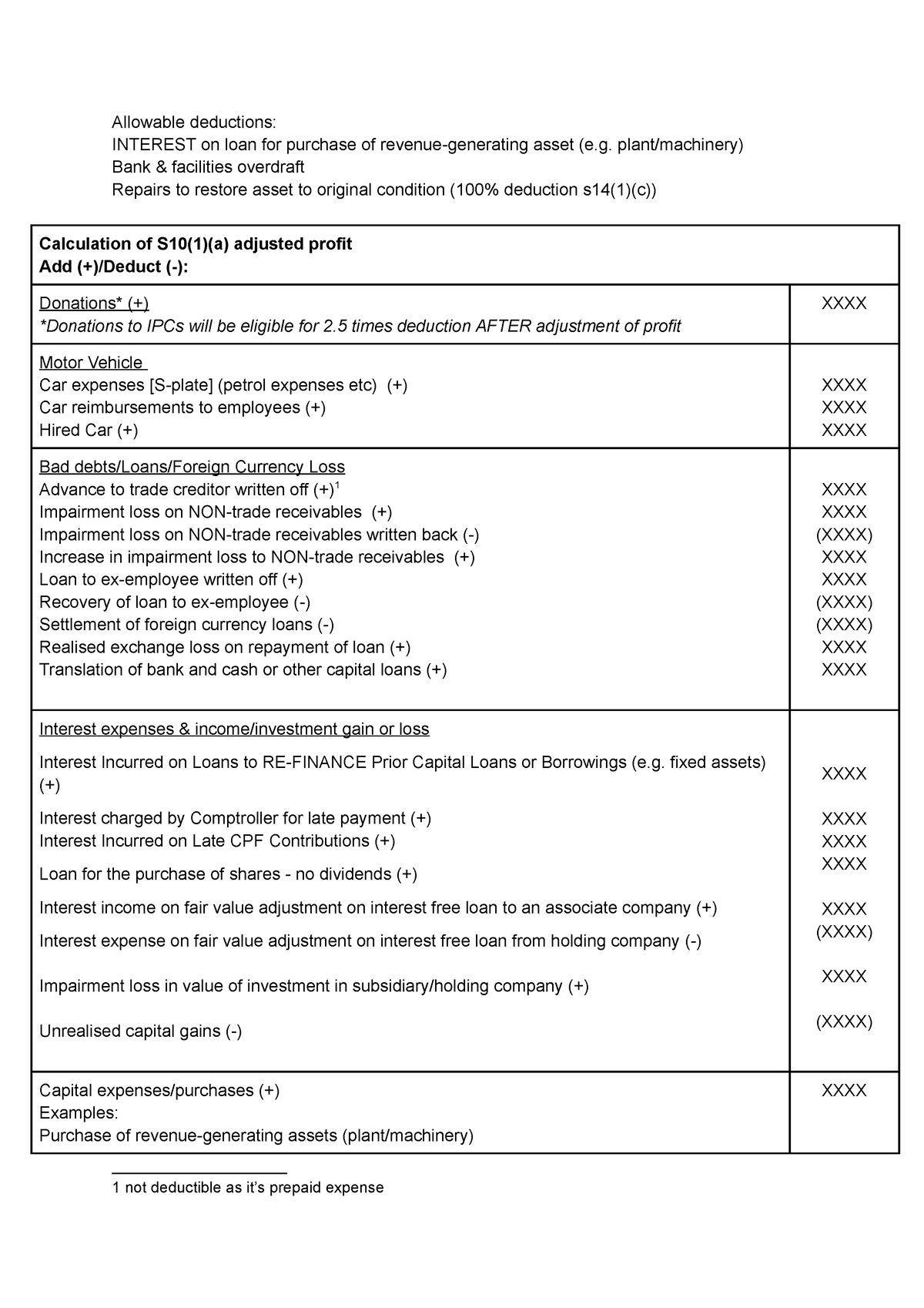

Notes Summary Allowable Deductions INTEREST On Loan For Purchase

Loan For Plot Purchase At Best Price In Pune ID 2849118224962

What Are The Tax Benefits On Top Up Loan HomeFirst

Tax Benefit On Loan For Plot - Verkko 19 huhtik 2022 nbsp 0183 32 In fact you can get tax benefits on both the plot loan and the home loan taken to build a home on that plot How to Avail the Tax Benefits on a Plot Loan You can avail of plot loan tax benefits only if you construct a building on the plot for which you took the loan