Tax Benefit Retirement Plan Key Takeaways You can deduct your traditional 401 k contributions from your tax return in the year that you make them A 401 k employer match can help you grow your nest egg even faster In

A defined benefit plan guarantees a specific benefit or payout upon retirement The employer may opt for a fixed benefit or one The IRS considers a defined benefit plan to be a qualified employer sponsored retirement plan That makes them eligible for

Tax Benefit Retirement Plan

Tax Benefit Retirement Plan

https://sdgaccountant.com/wp-content/uploads/2021/08/The-Benefits-of-a-403b-Plan.jpg

IRS Announces 401 k And Other Retirement Plan Adjustments For Tax Year

https://www.bravocpa.com/wp-content/uploads/2020/11/Retirement-Plan-Adjustments-Chart.jpg

Pension Plan Type Of Pension Plans And Their Tax Benefits

https://www.canarahsbclife.com/content/dam/choice/blog-inner/images/things-to-consider-while-planning.jpg

Tax advantaged plans include IRAs and qualified retirement plans such as 401 k s Key Takeaways Tax advantaged refers to favorable tax status held by certain Your contributions to a 401 k may lower your tax bill and help you build financial security

Defined benefit plans offer employees a contractually assured annuity at retirement In contrast under a defined contribution plan an employee owns an account in which balances depend on the size of past Business benefits Employer contributions are tax deductible Assets in the plan grow tax free Plan options are flexible Tax credits and other benefits for starting a

Download Tax Benefit Retirement Plan

More picture related to Tax Benefit Retirement Plan

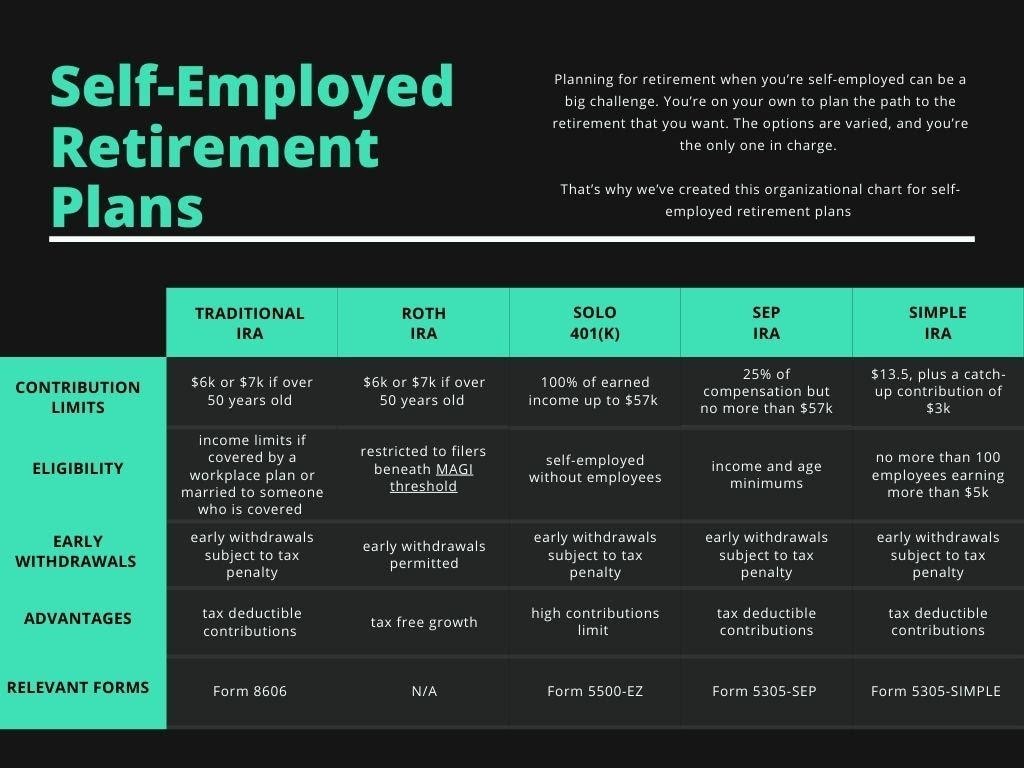

What IRA Retirement Plan Is The Best For Your Small Business Benefits

https://i.pinimg.com/originals/05/b4/99/05b499902ee0110560d73f32aeaafd7a.jpg

Qualified Retirement Plan How It Works Investing Taxes

https://www.carboncollective.co/hs-fs/hubfs/Types_of_Qualified_Retirement_Plan.png?width=4800&name=Types_of_Qualified_Retirement_Plan.png

Tax Tip To Get Tax Benefits On Retirement Plan AOTAX COM

https://www.aotax.com/wp-content/uploads/2018/11/Tax-tip-to-get-tax-benefits-on-retirement-plan-1.jpg

Traditional IRA Anyone who earns taxable income can open a traditional IRA If you don t have a retirement plan through work the contributions you make to a traditional IRA are usually Defined Benefit Plans are a powerful retirement and tax planning tool In this article we will explain how Defined Benefit Plans are taxed We will start by describing how Defined Benefit Plans are funded

Defined benefit plans provide a fixed pre established benefit for employees at retirement Employees often value the fixed benefit provided by this type of plan On the employer The retirement benefits received by an employee in accordance with the BIR registered retirement plan is exempt from income tax even though the employee

Tax Deal Gives Boost To SIMPLE Retirement Plans

https://blogs-images.forbes.com/ashleaebeling/files/2016/01/rollover_chart-1200x806.jpg

![]()

A Quick Guide To Retirement Plans For Small Business Owners Lifetime

https://lifetimeparadigm.com/wp-content/uploads/2021/04/Retirement-Plans-Depositphotos_372913290_xl-2015.jpg-small-web-2500-pixels.jpg

https://www.investopedia.com/articles/i…

Key Takeaways You can deduct your traditional 401 k contributions from your tax return in the year that you make them A 401 k employer match can help you grow your nest egg even faster In

https://www.investopedia.com/terms/d/…

A defined benefit plan guarantees a specific benefit or payout upon retirement The employer may opt for a fixed benefit or one

IRS Limits On Retirement Benefits And Compensation EisnerAmper Wealth

Tax Deal Gives Boost To SIMPLE Retirement Plans

How To Adjust Your Retirement Planning As You Age

Retirement Savings Plans For Expats Smash Your Goals

What Is A Defined Benefit Plan New York Retirement News

Tax Free Retirement Plan YouTube

Tax Free Retirement Plan YouTube

The 3 Important Parts Of A Fulfilling Retirement Part 1 By Terry S

Best Retirement Plans For The Self Employed 3 Financial Group

:max_bytes(150000):strip_icc()/401kplan.asp-4103bbcbcf0943068955a6c47d6eca0c.png)

What Is A 401 k And How Does It Work 2022

Tax Benefit Retirement Plan - Your contributions to a 401 k may lower your tax bill and help you build financial security