Tax Benefit Under 10 10d Tax Benefits of Section 10 of Income Tax Act When considering tax benefits of insurance we commonly consider the

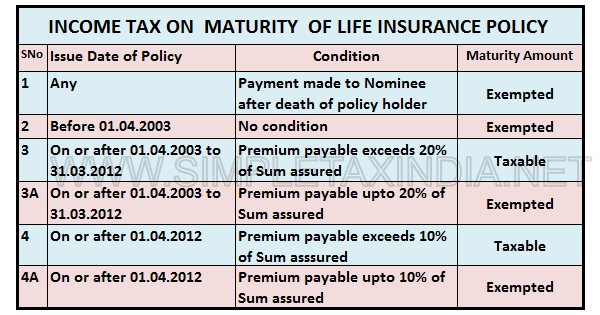

Tax benefits can be claimed under Section 10 10D on the amount you receive when your policy matures Maturity Benefit if the following requirements are Under Section 10 10D of the Income Tax Act individuals may qualify for a tax exemption on the sum assured and accrued bonus they receive due to a life insurance

Tax Benefit Under 10 10d

Tax Benefit Under 10 10d

https://www.maxlifeinsurance.com/content/dam/corporate/images/10-10d_1.jpg

EPS Pension Form 10D How To Fill The Form 10D For Claiming EPS

https://gstguntur.com/wp-content/uploads/2021/04/EPS-Pension-Form-10D-1024x576.png

Exemption Under Section 10 10d

https://img1.wsimg.com/isteam/ip/1cf65adc-a5ac-4711-8d93-9b4a2d36cbd4/section-10-under-income-tax-act.jpg

Section 10 10D is an essential provision in the Income Tax Act 1961 that deals with the taxation of life insurance policies in India It allows sum assured or Under Section 10 10D of the Income Tax Act 1961 residents can claim tax exemptions on life insurance payouts including the sum assured and accrued bonus

Life insurance policies offer maturity death benefits and tax deductions under Section 80C and Section 10 10D of the Income Tax Act of 1961 The tax deductions What is Section 10 10D of the Income Tax Act Individuals can claim tax exemption on the sum assured and accrued bonus if any received through their life

Download Tax Benefit Under 10 10d

More picture related to Tax Benefit Under 10 10d

Section 10 10D Income Tax Tax On LIC Policy CA TARIQUE KHICHI

https://i.ytimg.com/vi/zWbC_5_K82U/maxresdefault.jpg?sqp=-oaymwEmCIAKENAF8quKqQMa8AEB-AH-CYACsgWKAgwIABABGGUgZShlMA8=&rs=AOn4CLCP2H8dPFUx6uyGDLUm8dMWwz8q8w

Unlock The Term Insurance Tax Benefit Under Section 80C 80D Loan Papa

https://i0.wp.com/loanpapa.in/wp-content/uploads/2023/07/Term-Insurance-Tax-Benefit.png?w=840&ssl=1

Section 10 10D Of Income Tax Act Exemptions Payouts

https://navi.com/blog/wp-content/uploads/2022/03/115-BAC-1.jpg

Tax benefits under Section 10 10D of the Income Tax Act 1961 can be claimed only on the following terms and conditions Tax deductions under Section 10 10D of the Income Some of the important points of section 10 10D of tax deductions are Any amount payable to the insured under life insurance policies is applicable for tax

What is the maximum exemption available under Section 10 10D The total payment under a life insurance policy is eligible for tax exemption under Section 4 Plan options to choose from Return of Total Premiums Paid at Maturity Variety of Premium Payment Term Income Period Policy Term options Check

.webp)

SuperCA

https://superca.in/storage/app/public/blogs/10(10d).webp

Income Tax Benefit On Life Insurance Section 80C And 10D

https://img1.wsimg.com/isteam/ip/1cf65adc-a5ac-4711-8d93-9b4a2d36cbd4/save-tax.jpg

https://www.maxlifeinsurance.com/.../se…

Tax Benefits of Section 10 of Income Tax Act When considering tax benefits of insurance we commonly consider the

https://lifeinsurance.adityabirlacapital.com/life...

Tax benefits can be claimed under Section 10 10D on the amount you receive when your policy matures Maturity Benefit if the following requirements are

Standard Deduction For Salary Ay 2021 22 Standard Deduction 2021

.webp)

SuperCA

CBDT Notifies New Guidelines For Tax Exemptions Under Section 10 10D

MONEY BACK POLICY SAVINGS PLAN TAX FREE RETURN INCOME APPLICABLE TAX

INCOME TAX ON MATURITY OF LIFE INSURANCE POLICY SIMPLE TAX INDIA

Union Bank Of India Star Dai Ichi 2023 2024 EduVark

Union Bank Of India Star Dai Ichi 2023 2024 EduVark

One Of The Most Important And Necessary Elements Of Guaranteeing A

How Life Insurance Policies Are Taxed Mint

Bharat Bank

Tax Benefit Under 10 10d - Section 10 10D tax benefits from the Income Tax Act can be obtained only if the conditions listed below are met The tax deduction under this Section is applicable on any returns