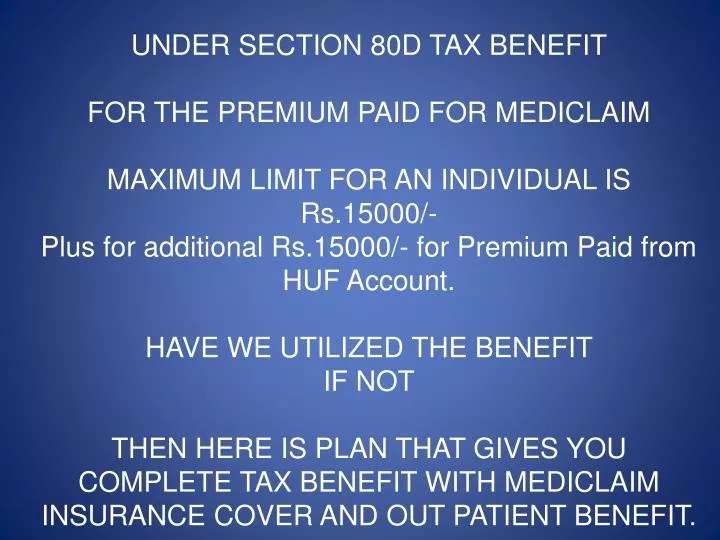

Tax Benefit Under Mediclaim Policy Verkko 5 marrask 2019 nbsp 0183 32 Having a good mediclaim policy in India not only helps you deal with the huge hospitalization costs but also brings you many tax benefits under section

Verkko 4 kes 228 k 2022 nbsp 0183 32 TAX BENEFITS DUE TO LIFE INSURANCE POLICY HEALTH INSURANCE POLICY AND EXPENDITURE ON MEDICAL TREATMENT Verkko 1 helmik 2023 nbsp 0183 32 Tax Rebate on Mediclaim Policy If you want to reduce the tax liability on your annual income the best way to do so is to buy a health insurance policy and claim the 80D deduction on the premium

Tax Benefit Under Mediclaim Policy

Tax Benefit Under Mediclaim Policy

https://i.ytimg.com/vi/b8u5anGb288/maxresdefault.jpg

Varistha Mediclaim Policy National Insurance Premium

https://velocitymart.com/uploads/pages/Varistha Mediclaim Policy.jpg

Preventive Check Up 80d Wkcn

https://emailer.tax2win.in/assets/guides/all_images/Section-80D-Summary.jpg

Verkko 27 marrask 2019 nbsp 0183 32 1 The first thing to note about deductions on the premium is the age and number of persons insured in a policy For instance as an individual assessee Verkko 22 syysk 2022 nbsp 0183 32 Under this section you can claim deductions for the premium paid on health insurance policies for yourself and your dependents Furthermore deductions are possible for expenses

Verkko The premium you pay towards a mediclaim or health insurance policy qualifies for tax deduction under Section 80D of the Income Tax Act 1961 That is it reduces your tax Verkko 21 jouluk 2016 nbsp 0183 32 Section 80D allows a tax deduction of up to Rs 25 000 per financial year on medical insurance premiums Section 80D also includes a Rs 5 000 deduction

Download Tax Benefit Under Mediclaim Policy

More picture related to Tax Benefit Under Mediclaim Policy

PPT UNDER SECTION 80D TAX BENEFIT FOR THE PREMIUM PAID FOR MEDICLAIM

https://image1.slideserve.com/3028516/slide1-n.jpg

Medical Insurance Premium Receipt 2019 20 PDF Deductible Insurance

https://imgv2-2-f.scribdassets.com/img/document/442594448/original/090873fdc7/1704447541?v=1

Mediclaim Receipt PDF Insurance Taxes

https://imgv2-1-f.scribdassets.com/img/document/621617355/original/6847dd0a3f/1687582685?v=1

Verkko 16 lokak 2023 nbsp 0183 32 Tax benefits Premiums paid towards Mediclaim qualify for tax deductions under Section 80D of the Income Tax Act For individuals over 60 years a Verkko 18 jouluk 2023 nbsp 0183 32 Tax benefit under Section 80D Mediclaim policy typically has low premiums but limited benefits They serve as an affordable way to hedge against large

Verkko 29 maalisk 2021 nbsp 0183 32 There is no limit on the number of policies or providers HUF HUF can claim a deduction under section 80D for a Mediclaim taken for any of the Verkko 23 huhtik 2020 nbsp 0183 32 Speaking about medical reimbursement it is an option available to employees wherein their employers reimburse their medical treatment costs Under

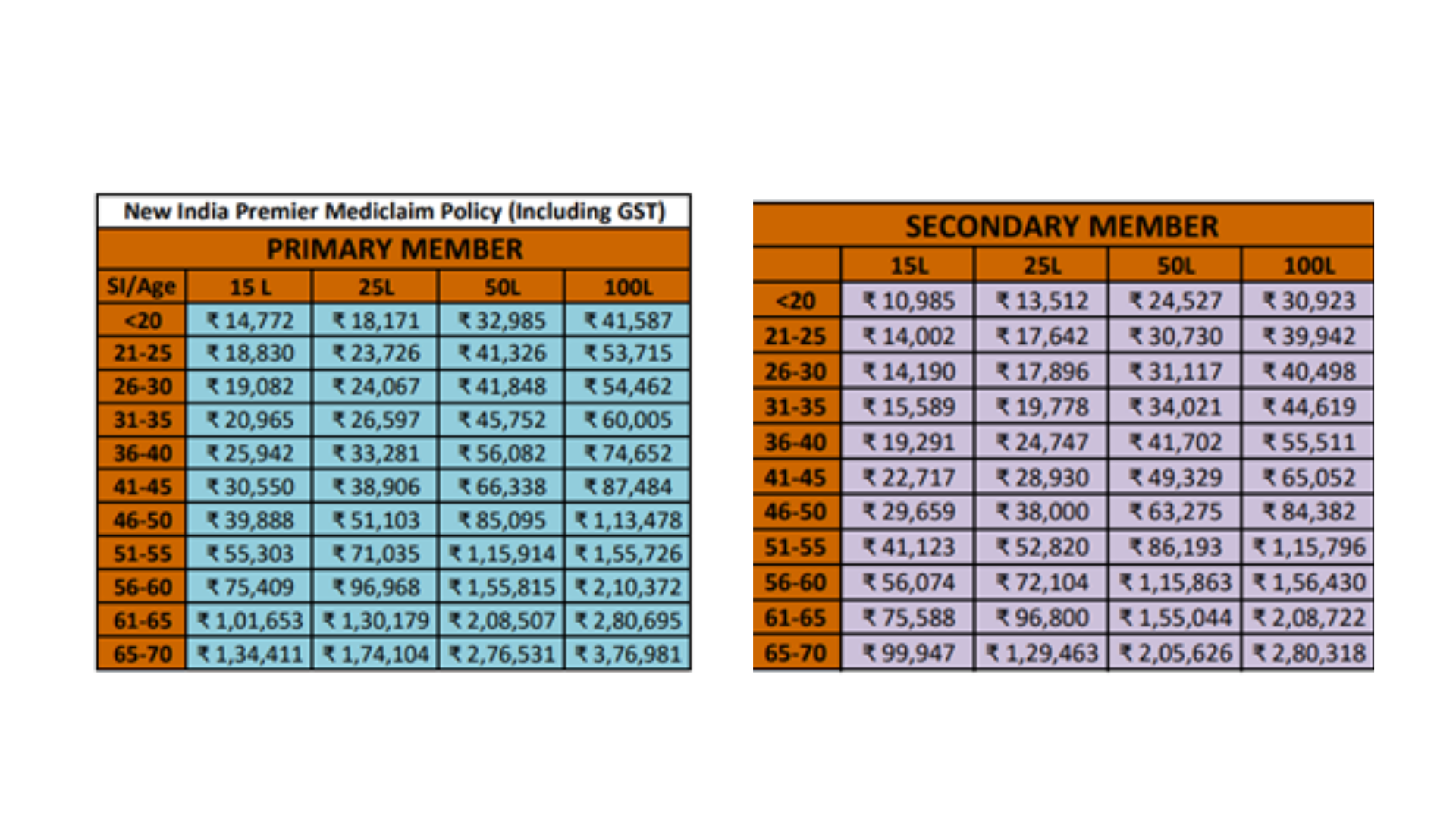

How To Calculate Group Mediclaim Policy Premium PlanCover Small

https://www.plancover.com/insurance/wp-content/uploads/2021/12/How-to-calculate-group-Mediclaim-policy-premium.png

Choosing Health Insurance Plan From New India Assurance

https://moneymonc.com/wp-content/uploads/2021/04/image-6.png

https://www.careinsurance.com/blog/health-insurance-articles/what-are...

Verkko 5 marrask 2019 nbsp 0183 32 Having a good mediclaim policy in India not only helps you deal with the huge hospitalization costs but also brings you many tax benefits under section

https://taxguru.in/income-tax/tax-benefit-insurance-premium-mediclaim...

Verkko 4 kes 228 k 2022 nbsp 0183 32 TAX BENEFITS DUE TO LIFE INSURANCE POLICY HEALTH INSURANCE POLICY AND EXPENDITURE ON MEDICAL TREATMENT

Advantages Of Group Mediclaim Policy By GreenLife Insurance Issuu

How To Calculate Group Mediclaim Policy Premium PlanCover Small

Expense Management Software Expense Reimbursements

Tax Saving On Health Insurance Section 80D Detailed Guide For FY

NTA Blog EITC Awareness Day Is January 27 The Earned Income Tax

Know Every Detail About The National Mediclaim Policy Your Guide To

Know Every Detail About The National Mediclaim Policy Your Guide To

Section 80D Mediclaim Income Tax Deduction For Individual

The New Tax Regime FY 2020 21 VS The Old Tax Regime Quick Tax Help

Standard Deduction Income Tax Ay 2021 22 Standard Deduction 2021

Tax Benefit Under Mediclaim Policy - Verkko 25 maalisk 2018 nbsp 0183 32 Section 80D offers income tax deduction towards payment of medical insurance or mediclaim premium Under the current rules an individual can claim a