Tax Brackets In Canada Your tax bracket is based on taxable income which is your gross income from all sources minus any tax deductions you may qualify for In other words it s your net income after you ve claimed all your eligible deductions

Canada 2024 and 2023 Tax Rates Tax Brackets The Federal tax brackets and personal tax credit amounts are increased for 2024 by an indexation factor of 1 047 a 4 7 increase See Indexation of the Personal Income Tax System for how the indexation factors are calculated Tax brackets outline the proportion of income tax that we need to pay based on annual earnings Canada follows a progressive tax system in contrast to a flat system where uniform tax rates

Tax Brackets In Canada

Tax Brackets In Canada

https://cardinalpointwealth.com/wp-content/uploads/2021/12/Winter_2021_Canadian_Income_Tax_Table.jpg

2024 Canadian Tax Brackets What You Need To Know

https://maplemoney.com/wp-content/uploads/canadian-tax-brackets-pin.jpg

Are You Ready Greater Fool Authored By Garth Turner The Troubled

http://www.greaterfool.ca/wp-content/uploads/2017/08/RYAN-2.png?x64811

Information for individuals and businesses on rates such as federal and provincial territorial tax rates prescribed interest rates EI rates corporation tax rates excise tax rates and more Canada has five federal tax brackets with different tax rates and because we also pay taxes to the provincial or territorial government where we live they each have their own tax brackets

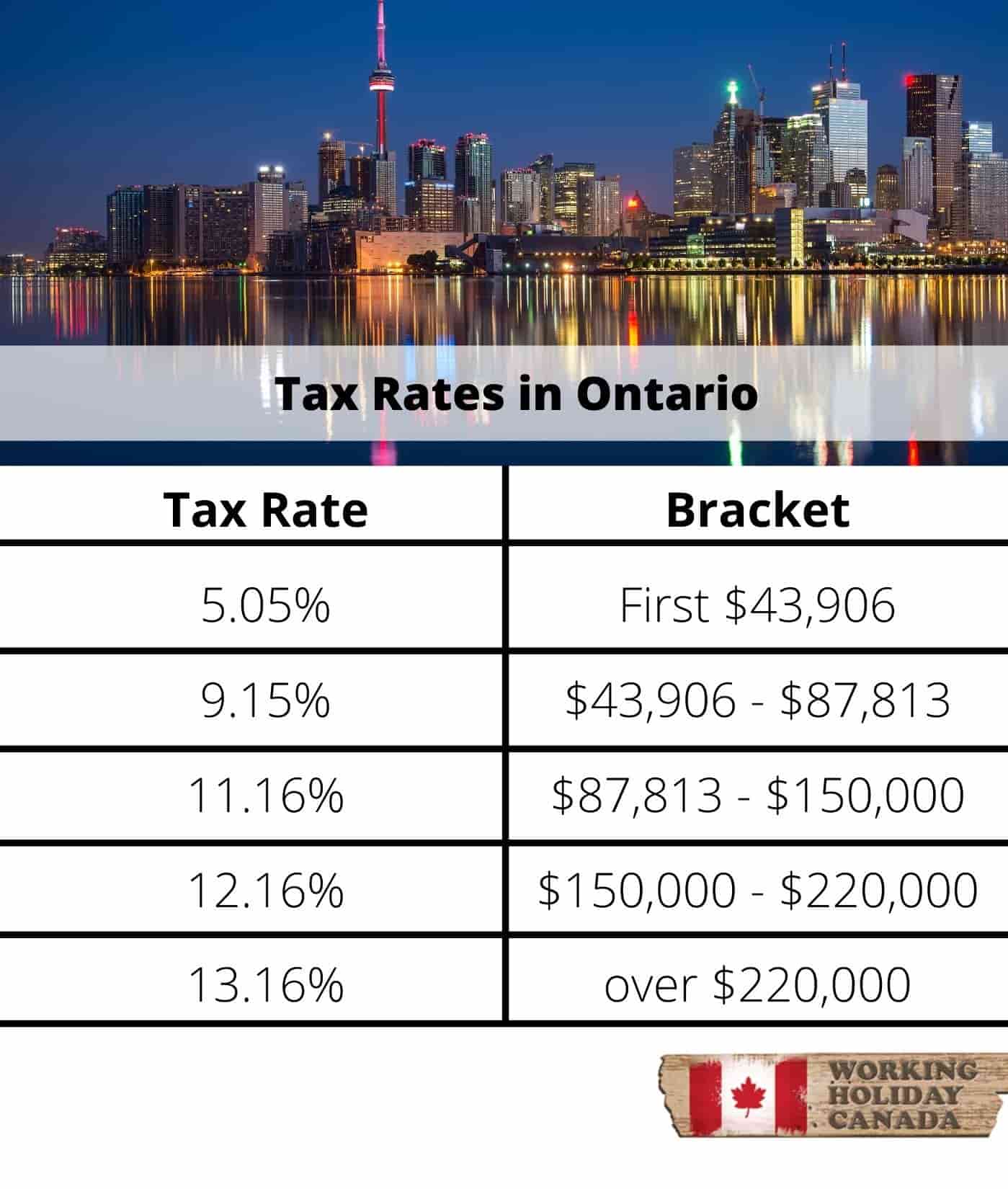

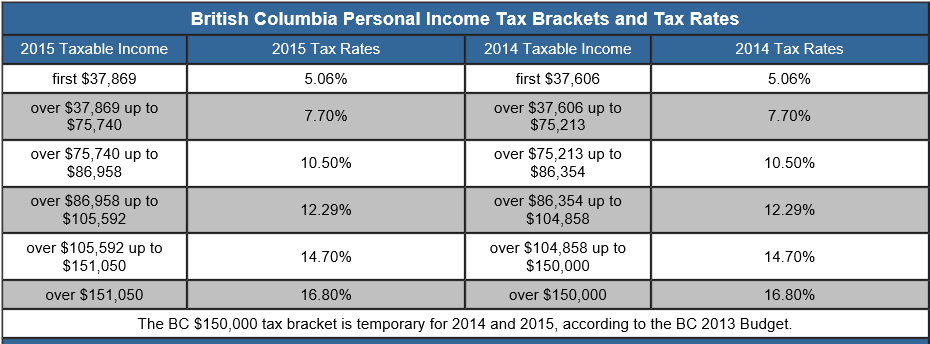

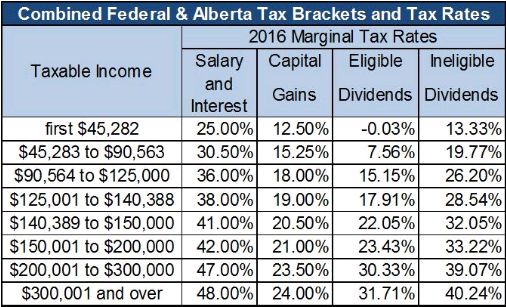

What are the tax brackets in Canada How do tax brackets work Find out where you stand and how much of your salary you ll pay in taxes 2024 2023 Tax Rates Tax Brackets Canada Provinces Territories Choose your province or territory below to see the combined Federal Provincial Territorial marginal tax rates for each tax bracket Canada tax rates Federal Alberta British Columbia Manitoba New Brunswick Newfoundland Labrador Nova Scotia Ontario

Download Tax Brackets In Canada

More picture related to Tax Brackets In Canada

Personal Income Tax Brackets Ontario 2019 MD Tax Physician

http://www.mdtax.ca/wp-content/uploads/2020/03/PERSONAL-INCOME-TAX-BRACKETS-2019-1.png

Marginal Tax Rates For Each Canadian Province Kalfa Law Firm

https://kalfalaw.com/wp-content/uploads/2020/04/Marginal-Tax-Rates-2020_Ontario.png

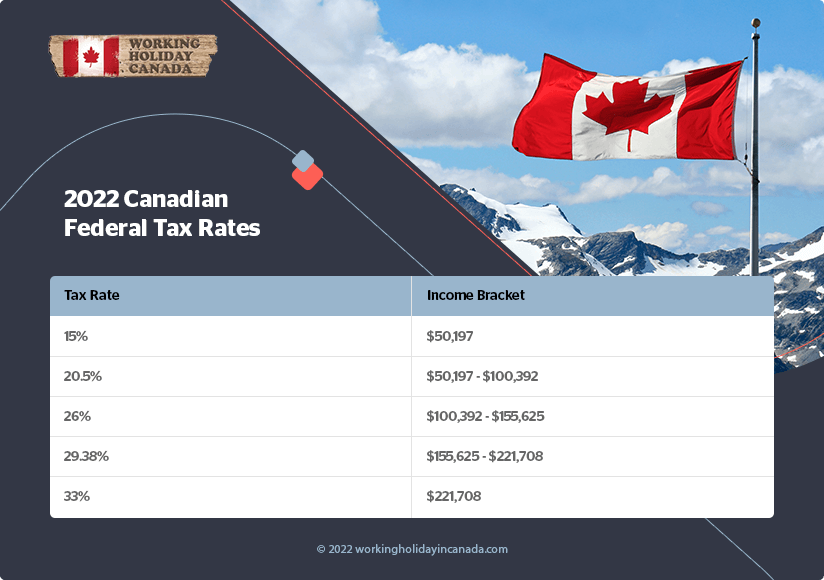

The Basics Of Tax In Canada Updated For 2022

https://workingholidayincanada.com/wp-content/uploads/2022/04/Canada-Federal-Tax-Rates-2022.png

3 minutes What are Canada s Tax Brackets Tax brackets exist at both the federal and provincial or territorial level in Canada Your income determines your tax bracket and The 2022 edition of Individual Tax Statistics by Tax Bracket presents basic counts and amounts of individual tax filer information by tax bracket These statistics are based on the 2020 tax year initial assessment data up to January 28 2022 Table of Contents Explanatory notes Confidentiality procedures Data source Classification variables

[desc-10] [desc-11]

Tax Brackets For Ontario Individuals 2017 And Subsequent Years MD

http://www.mdtax.ca/wp-content/uploads/2016/02/Picture4-1.png

Gross Income Calculator Manitoba Trito Salary

https://www.birchwoodcredit.com/wp-content/uploads/2021/01/BCI022-Internal-TaxBracketsInManitoba.png

https://www.wealthsimple.com/en-ca/learn/tax-brackets-canada

Your tax bracket is based on taxable income which is your gross income from all sources minus any tax deductions you may qualify for In other words it s your net income after you ve claimed all your eligible deductions

https://www.taxtips.ca/taxrates/canada.htm

Canada 2024 and 2023 Tax Rates Tax Brackets The Federal tax brackets and personal tax credit amounts are increased for 2024 by an indexation factor of 1 047 a 4 7 increase See Indexation of the Personal Income Tax System for how the indexation factors are calculated

The Basics Of Tax In Canada WorkingHolidayinCanada

Tax Brackets For Ontario Individuals 2017 And Subsequent Years MD

Tax Brackets Canada 2020 How Tax Brackets Work In Canada

Year 2015 BC Personal Income Tax Bracket And Tax Rate Royal Oak

Federal Income Tax Brackets 2022 Canada Aboutthese

2022 Tax Brackets Canada Alberta

2022 Tax Brackets Canada Alberta

2017 Tax Tables Canada Cabinets Matttroy

The 2022 tax Brackets In Canada Based On Annual Income And Broken Down

The tax Brackets In Canada For 2020 Broken Down By Province Too

Tax Brackets In Canada - [desc-12]