Tax Break From Donations Tax deductible donations must meet certain guidelines to get a tax break for your good deed Here s how to make your charitable donations a little sweeter

The 2023 and 2024 rules require donors to itemize their deductions to claim any charitable contribution deductions and are limited to the AGI limit of 60 for cash donations for qualified Send Renu an email If you ve shopped recently at your supermarket there s a good chance you faced a choice at the checkout

Tax Break From Donations

Tax Break From Donations

https://elpasoansfightinghunger.org/images/page/make-charitable-donation-get-tax-break-21549-Make-your-charitable-tax-break-count.png

Tax Breaks That Are Going Away So Use These Deductions Now

https://www.gannett-cdn.com/-mm-/49c6537cb43149c7ceb87f2c7ddf77c6efd24fd2/c=0-50-580-376/local/-/media/2018/02/25/USATODAY/usatsports/tax-breaks-for-retirees-retirement-taxes-irs-money-deduction-credit_large.jpg?width=3200&height=1680&fit=crop

Donations

https://res-4.cloudinary.com/deo07tbou/image/upload/q_auto/v1/woodswavewonder/D9483FB0-32E2-4D60-B303-CA61FFDE84E0.jpg

Here s how it works You give 10 000 on Jan 1 and another 10 000 on Dec 31 This strategy allows you to claim the 20 000 gift as an itemized deduction on The standard deductions for all types of filers went up a bit in 2024 meaning there is a higher threshold to reach to be eligible for a charitable donation tax break

You can obtain these publications free of charge by calling 800 829 3676 You may deduct charitable contributions of money or property made to qualified 4 ways to get a tax break from your charitable giving Last Updated Dec 31 2022 at 4 29 p m ET First Published Dec 27 2022 at 5 00 a m ET By Liz Weston If you re charitably minded

Download Tax Break From Donations

More picture related to Tax Break From Donations

DONATIONS

https://www.msd.gov.lk/images/slide/30.jpg

A Lucrative Tax Break For Manufacturers The Domestic Production

https://blog.concannonmiller.com/hubfs/mfg emblem-TAX BENEFITS copy.png#keepProtocol

Tax Accounting Services Lee s Tax Service

https://leestaxservicellc.com/files/IMG_1348.png

Specifically you can deduct charitable contributions of 20 to 60 of your adjusted gross income AGI The percentage of your deduction depends on the Key Takeaways To get the charitable deduction you usually have to itemize your taxes You must make contributions to a qualified tax exempt organization You

A tax break for retirees is back Here s how to use it and what to avoid Qualified Charitable Distributions which allow Individual Retirement Account holders in Special 300 Tax Deduction The Internal Revenue Service has a special new provision that will allow more people to easily deduct up to 300 in donations to qualifying

Can Your Donations To Abortion Funds Be Protected As A Constitutional

https://images.fastcompany.net/image/upload/w_1280,f_auto,q_auto,fl_lossy/wp-cms/uploads/2022/07/p-1-can-your-donations-to-abortion-funds-be-protected-as-a-constitutional-right.jpg

10 Things To Know About 1 Million Tax Break On Center Software

https://www.oncenter.com/wp-content/uploads/2020/12/social_taxbreak_-scaled.jpg

https://www. nerdwallet.com /article/taxes/tax...

Tax deductible donations must meet certain guidelines to get a tax break for your good deed Here s how to make your charitable donations a little sweeter

https://www. investopedia.com /articles/…

The 2023 and 2024 rules require donors to itemize their deductions to claim any charitable contribution deductions and are limited to the AGI limit of 60 for cash donations for qualified

There s A Tax Break Waiting For Owners Who Renovated This Year

Can Your Donations To Abortion Funds Be Protected As A Constitutional

WHICH IS BETTER TAX CREDITS OR TAX DEDUCTIONS Tax Professionals

The Local Tax Break Many Retirees Don t Know About but Should

The Retirement Tax Break That Will Pay You An Annual Income WSJ

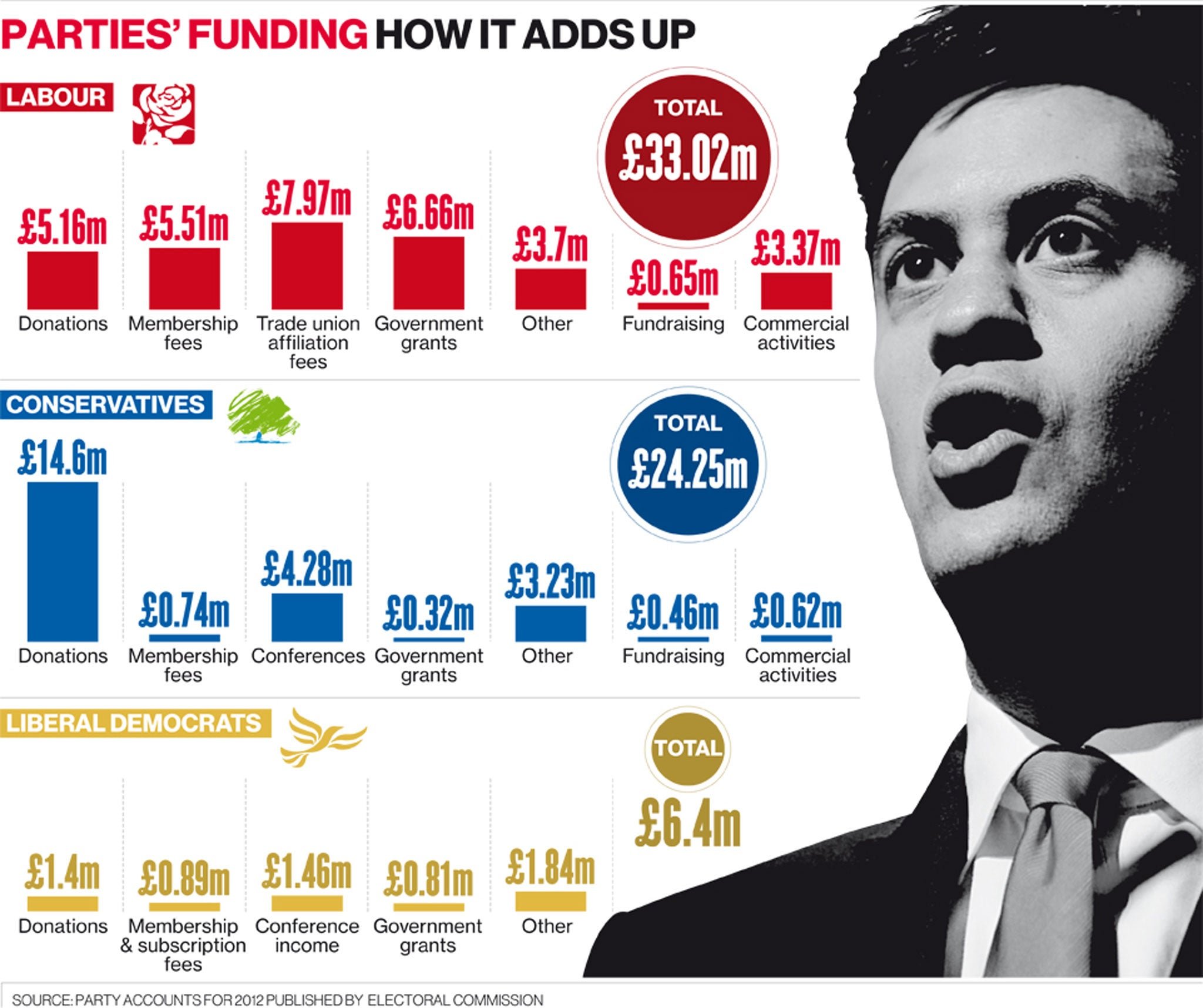

Political Donations Are Missing The Mark

Political Donations Are Missing The Mark

How Do I Donate To The Republican Party

Incredible 5000 Tax Breaks When Donating A Car To A Charity

How To Write A Tax exempt Donation Letter Leah Beachum s Template

Tax Break From Donations - You can obtain these publications free of charge by calling 800 829 3676 You may deduct charitable contributions of money or property made to qualified