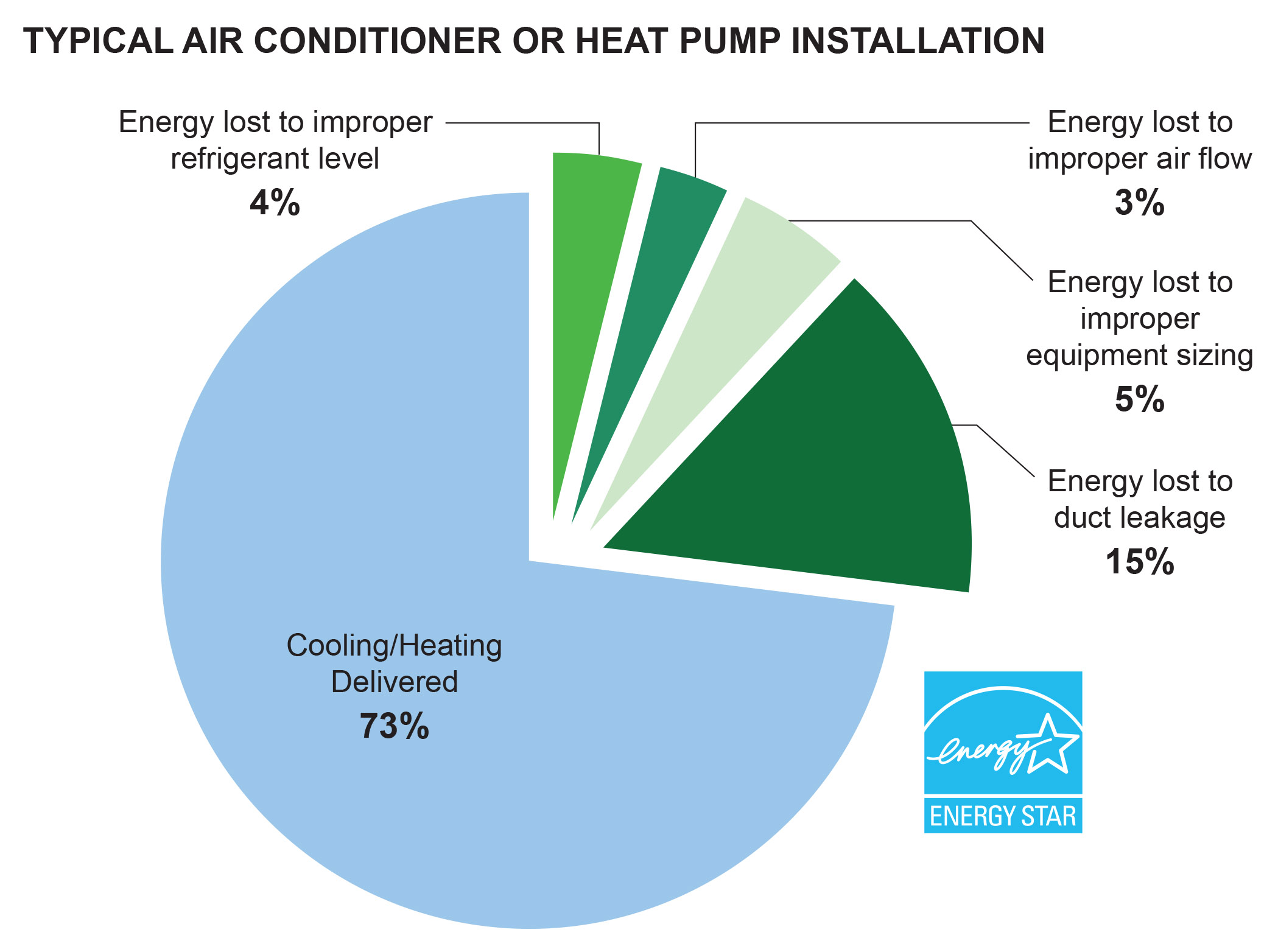

Tax Breaks For Energy Efficient Air Conditioners You can receive up to 3 200 in federal tax credits for installing qualifying HVAC equipment into an existing home split between ACs furnaces or boilers 1 200 and air source heat pumps and biomass stoves 2 000 Your HVAC system must fulfill high energy efficiency requirements to qualify for tax credits

The overall total limit for an efficiency tax credit in one year is 3 200 This breaks down to a total limit of 1 200 for any combination of home envelope improvements windows doors skylights insulation electrical plus furnaces boilers and How To Qualify For and Claim HVAC Tax Rebates You can claim your residential energy tax incentive when you file your federal income taxes For federal tax returns filed between 2023 and 2032 you are eligible to claim a credit equal to 30 of the cost of your installation

Tax Breaks For Energy Efficient Air Conditioners

Tax Breaks For Energy Efficient Air Conditioners

https://cdn.homedit.com/wp-content/uploads/2020/06/Guide-for-the-Most-Energy-Efficient-Air-Conditioners.jpg

Energy Efficient Features To Look For In Air Conditioners Total

http://www.totalelectricsandac.com.au/wp-content/uploads/2020/08/totalelectricsandac_Energy-efficient-air-conditioner.jpg

Energy Efficient Features For New Air Conditioners

https://www.hhaircon.com.au/wp-content/uploads/2015/01/shutterstock_217204051.jpg

If you make energy improvements to your home tax credits are available for a portion of qualifying expenses The credit amounts and types of qualifying expenses were expanded by the Inflation Reduction Act of 2022 The inflation Reduction Act of 2022 IRA amended the credits for energy efficient home improvements and residential energy property These FAQs provide details on the IRA s changes to these tax credits information on eligible expenditures and provides examples of how the credit limitations work

The federal tax credits for energy efficiency were extended as part of the Inflation Reduction Act IRA of 2022 So if you made any qualifying home improvements to your primary residence after December 31 2021 you may be eligible to claim them on your taxes when you file for 2022 Through 2032 federal income tax credits are available to homeowners that will allow up to 3 200 annually to lower the cost of energy efficient home upgrades by up to 30 percent

Download Tax Breaks For Energy Efficient Air Conditioners

More picture related to Tax Breaks For Energy Efficient Air Conditioners

How To Reduce Your Air conditioner Costs

https://www.originenergy.com.au/blog/wp-content/uploads/GettyImages-1259269839-2048x1365.jpg

Top 3 Most Energy Efficient Air Conditioners For Summer 2019

https://electricityrates.com/wp-content/uploads/2019/03/TraneACUnit-1076x675.jpg

Energy Efficiency Upgrades Air Conditioning Systems

https://www.ny-engineers.com/hs-fs/hubfs/airconditioners-1.jpg?width=899&name=airconditioners-1.jpg

Does the IRS offer tax breaks for energy efficient appliances The IRS offers several ways for taxpayers to cut their tax bills through investing in certain energy efficient appliances and home improvements The renewed Energy Efficient Home Improvement Tax Credit 25C program increases the HVAC tax credit limit for installing CEE Top Tier high efficiency equipment it is retroactive to January 1 2022 and approved until 2032

Effective Jan 1 2023 Provides a tax credit to homeowners equal to 30 of installation costs for the highest efficiency tier products up to a maximum of 600 for qualified air conditioners and furnaces and a maximum of 2 000 for qualified heat pumps The amended Energy Efficient Home Improvement Credit which begins in 2023 and extends through 2032 increases the tax credits as high as 600 for qualified air conditioner or gas furnace and up to 2000 for qualified heat pump heat pump water heater or boiler

Most Efficient Central Air Conditioners For 2015

https://serviceplusnow.com/wp-content/uploads/2015/05/Most-Efficient-Central-Air-Conditioners-for-2015.jpg

Home Ownership Matters Living In A Hot Zone Here Are 9 Of The Most

https://homeownershipmatters.realtor/wp-content/uploads/2020/08/Air-Conditioner-1200.png

https://airconditionerlab.com › what-hvac-systems...

You can receive up to 3 200 in federal tax credits for installing qualifying HVAC equipment into an existing home split between ACs furnaces or boilers 1 200 and air source heat pumps and biomass stoves 2 000 Your HVAC system must fulfill high energy efficiency requirements to qualify for tax credits

https://www.energystar.gov › about › federal-tax...

The overall total limit for an efficiency tax credit in one year is 3 200 This breaks down to a total limit of 1 200 for any combination of home envelope improvements windows doors skylights insulation electrical plus furnaces boilers and

Are More Efficient Air Conditioners On The Horizon

Most Efficient Central Air Conditioners For 2015

Inverter Type Air Conditioners Are More Energy Efficient Fixed Capacity

12 Best Energy Efficient Air Conditioners 2022

New Air Conditioners Lake County FL AC Guys

Energy Efficient Central Air Conditioners Energy Choices

Energy Efficient Central Air Conditioners Energy Choices

About The Smart Tools For Efficient HVAC Performance Campaign

Best 6000 BTU Air Conditioners 2021 Guide HVAC Beginners

Energy Efficient Air Conditioning Tips That Help Reduce Cooling Costs

Tax Breaks For Energy Efficient Air Conditioners - The total limit for an efficiency tax credit in one year is 3 200 The restriction includes a maximum credit of 1 200 for any combination of home energy improvements windows doors skylights insulation electrical plus furnaces boilers and