Tax Breaks For Low Income Earners 2023 Tax Tip 2024 19 March 21 2024 The Earned Income Tax Credit is the federal government s largest refundable tax credit for low to moderate income workers

A number of federal tax credits exist to help taxpayers primarily those in middle income and low income There are seven federal income tax rates in 2023 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent The top marginal

Tax Breaks For Low Income Earners 2023

Tax Breaks For Low Income Earners 2023

https://www.badcredit.org/wp-content/uploads/2019/06/Best-Personal-Loans-for-Low-Income-Earners-Feat.jpg

Five Tax Breaks For Paying Your Student Loan

https://img-s-msn-com.akamaized.net/tenant/amp/entityid/AA1iEIZT.img?w=1920&h=1303&m=4&q=79

Top Ten Real Estate Tax Breaks Advisors To The Ultra Affluent

https://groco.com/wp-content/uploads/2019/08/Tax-breaks-1024x649.jpg

The earned income tax credit EITC sometimes shortened to earned income credit is a tax break for low and moderate income workers To qualify you have to have worked in the The earned income credit which ranges from 600 to 7 430 2023 depending on your situation is a refundable tax credit for low to moderate income workers By Stephen

For tax year 2023 the top marginal tax rate will remain at 37 for individual single taxpayers with incomes greater than 578 125 693 750 for married couples 2023 tax rates for a single taxpayer For a single taxpayer the rates are Here s how that works for a single person earning 58 000 per year 2023 tax rates for

Download Tax Breaks For Low Income Earners 2023

More picture related to Tax Breaks For Low Income Earners 2023

6 Hidden Tax Breaks For Retirees GOBankingRates

https://cdn.gobankingrates.com/wp-content/uploads/2018/05/02-shutterstock_121065067.jpg

Who Benefits More From Tax Breaks High Or Low Income Earners

https://www.pgpf.org/sites/default/files/Who-benefits-from-tax-breaks-hero.jpg

Tax Breaks For Seniors And Low fixed Income Taxpayers In California

https://danielsgonzales.com/wp-content/uploads/2015/09/AdobeStock_74911462-1024x683.jpg

NCA NewsWire A tax break for millions of Australians will expire this year as planned amid claims Treasurer Jim Chalmers used the Easter long weekend to bury the How would low and middle income workers get a tax break Biden wants to expand the Earned Income Tax Credit or EITC a tax credit that is aimed at workers

MoneyWatch Millions of low income Americans eligible for tax refund boost this year By Irina Ivanova February 23 2022 3 52 PM EST MoneyWatch This The 2024 tax season is underway and unless you are granted a tax extension by the IRS 2023 federal income tax returns are due on April 15 this year Don t miss out on these

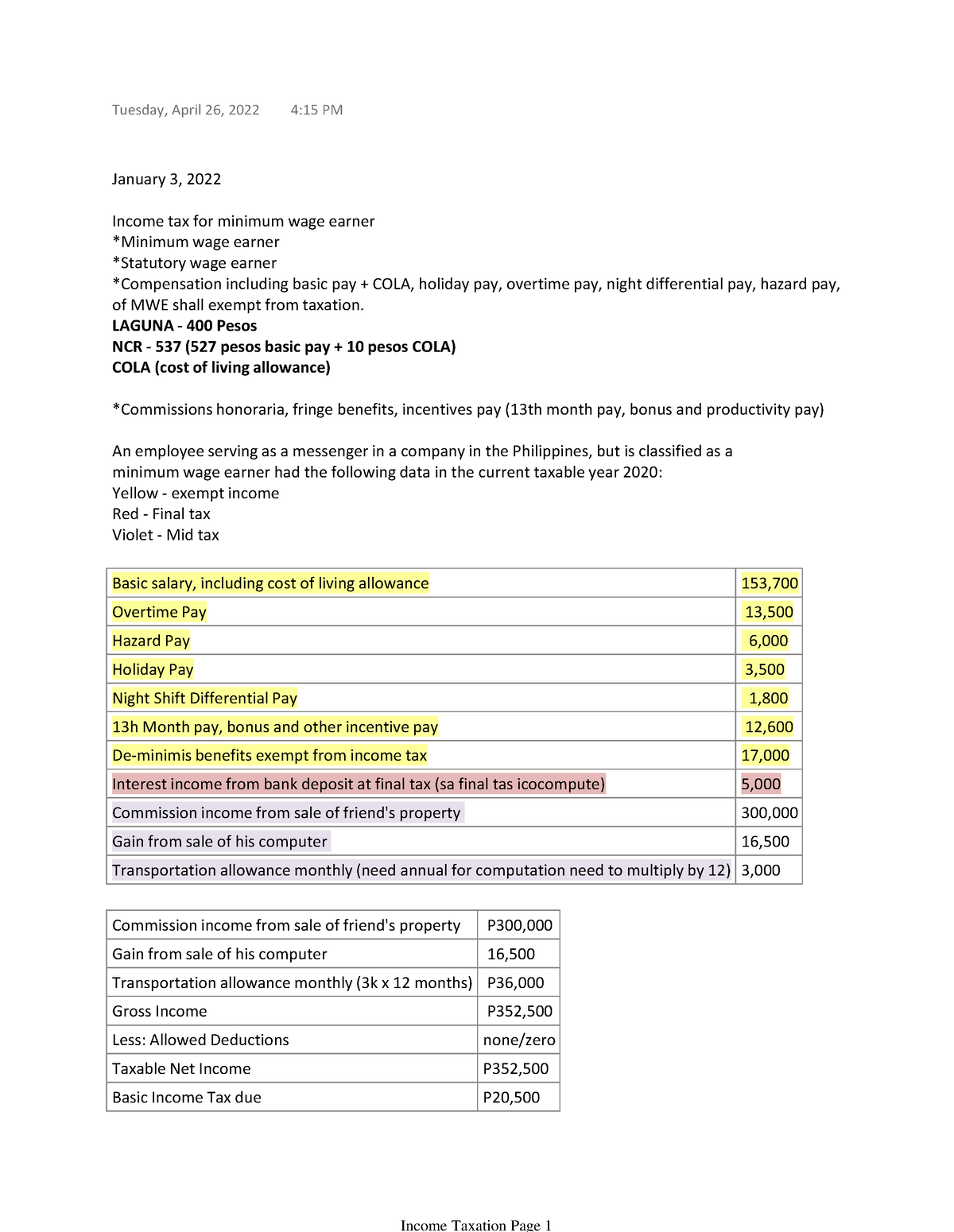

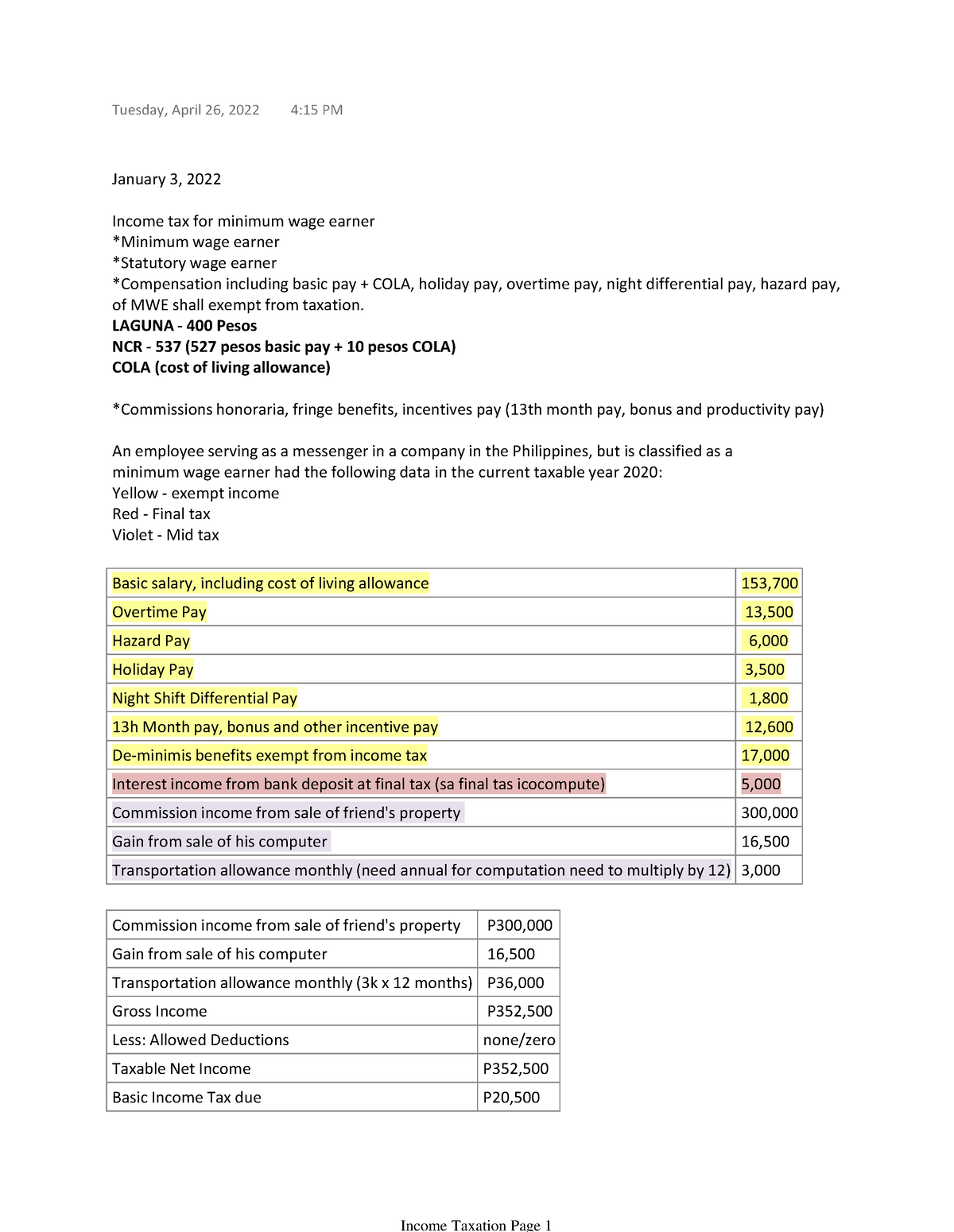

Income Tax For Minimum Wage Earners In The Philippines January 3

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/733a671b0c19efb45d19d2d85823aa1d/thumb_1200_1550.png

State Income Tax Breaks To Provide Needed Relief For Many 11alive

https://media.11alive.com/assets/WXIA/images/1b6e9e9a-7c5e-4ab4-bb86-aedae8e1b792/1b6e9e9a-7c5e-4ab4-bb86-aedae8e1b792_1920x1080.jpg

https://www. irs.gov /newsroom/low-to-moderate...

Tax Tip 2024 19 March 21 2024 The Earned Income Tax Credit is the federal government s largest refundable tax credit for low to moderate income workers

https:// turbotax.intuit.com /tax-tips/tax...

A number of federal tax credits exist to help taxpayers primarily those in middle income and low income

Tax Breaks For Caregivers Of Elderly Parents SeniorResource

Income Tax For Minimum Wage Earners In The Philippines January 3

Figure 1 From Income Tax Breaks For The Elderly How Did We Get Here

China Extends Income Tax Breaks For Low And Mid Income Earners

Tax Breaks For 529 College Savings Plans To Get More Generous

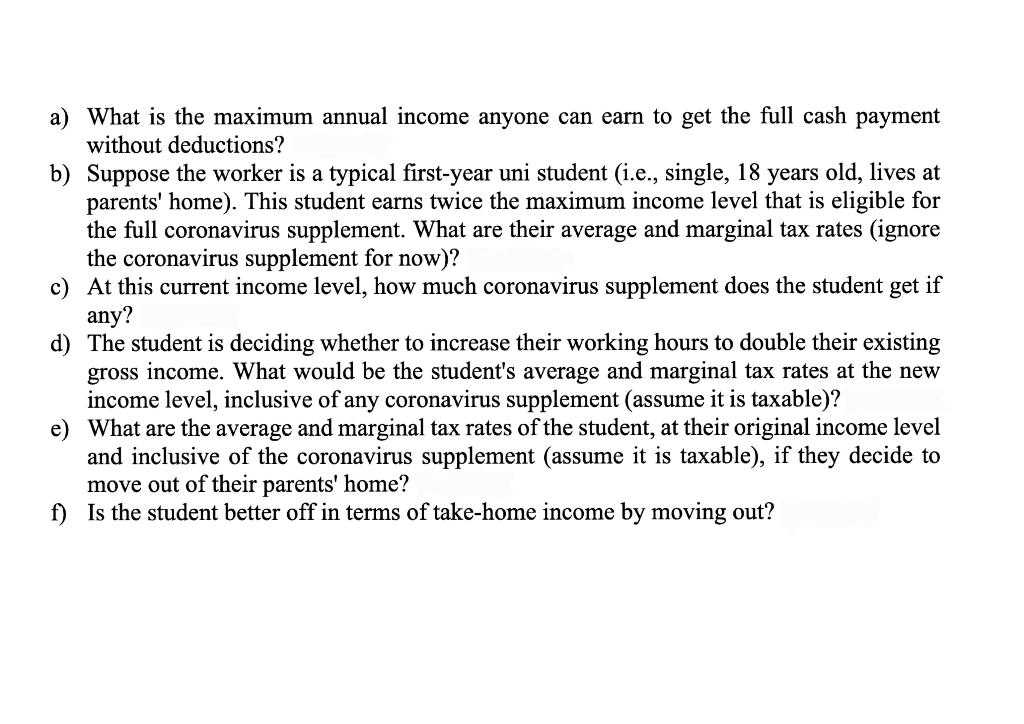

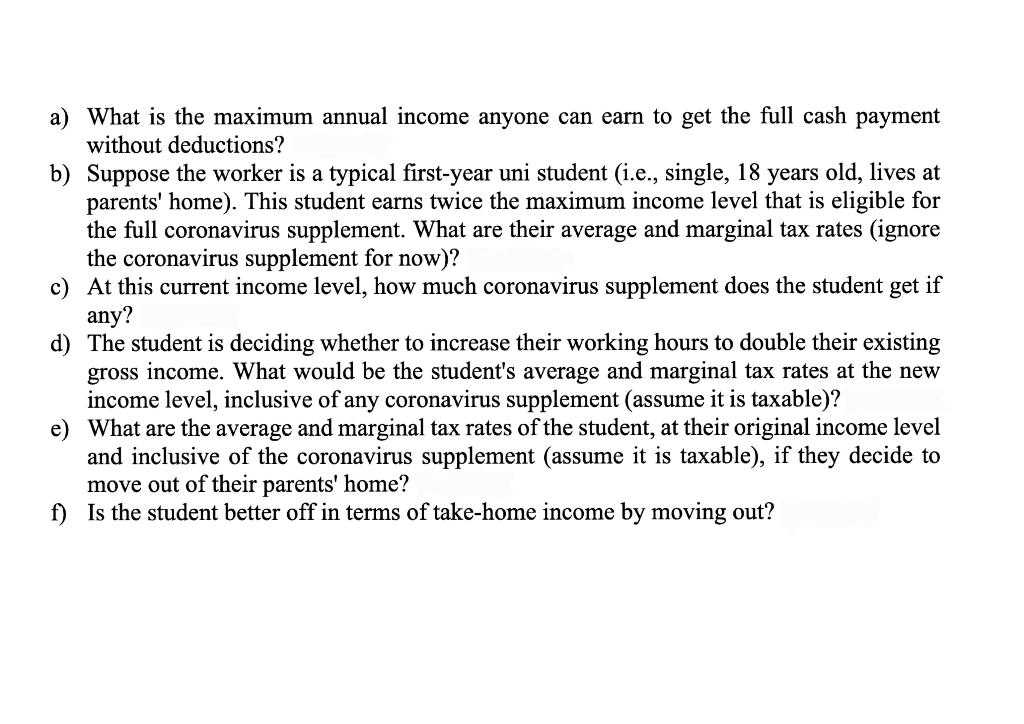

Solved Because Of The Pandemic Low income Earners Are Chegg

Solved Because Of The Pandemic Low income Earners Are Chegg

These Tax Breaks Are Back For 2020 And It Could Mean A Bigger Refund

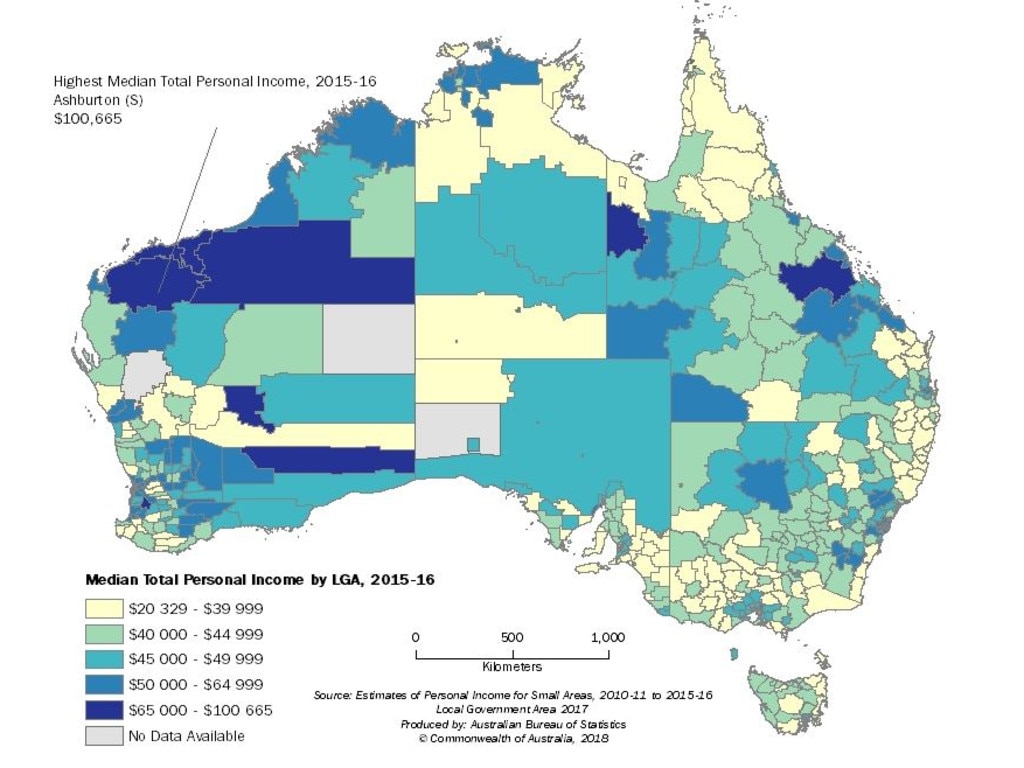

How The Average Townsville Income Compares To Rest Of Australia

Why Govt Offer Free Cars For Low Income Families Low Income Families

Tax Breaks For Low Income Earners 2023 - Personal Finance Here s how much you can earn and still pay 0 capital gains taxes in 2023 Published Thu Oct 20 20222 52 PM EDT Updated Fri Oct 21