Tax Breaks For School Fees You must pay the expenses for an academic period that starts during the tax year or the first three months of the next tax year Eligible expenses also include student activity fees you are required to pay to enroll or attend the school

Several tax breaks can help you cover the high costs of education future college expenses and interest you pay on student loans Currently private schools are eligible for tax breaks like charitable business rate relief and they don t have to charge VAT on tuition or boarding fees Final details of these changes

Tax Breaks For School Fees

Tax Breaks For School Fees

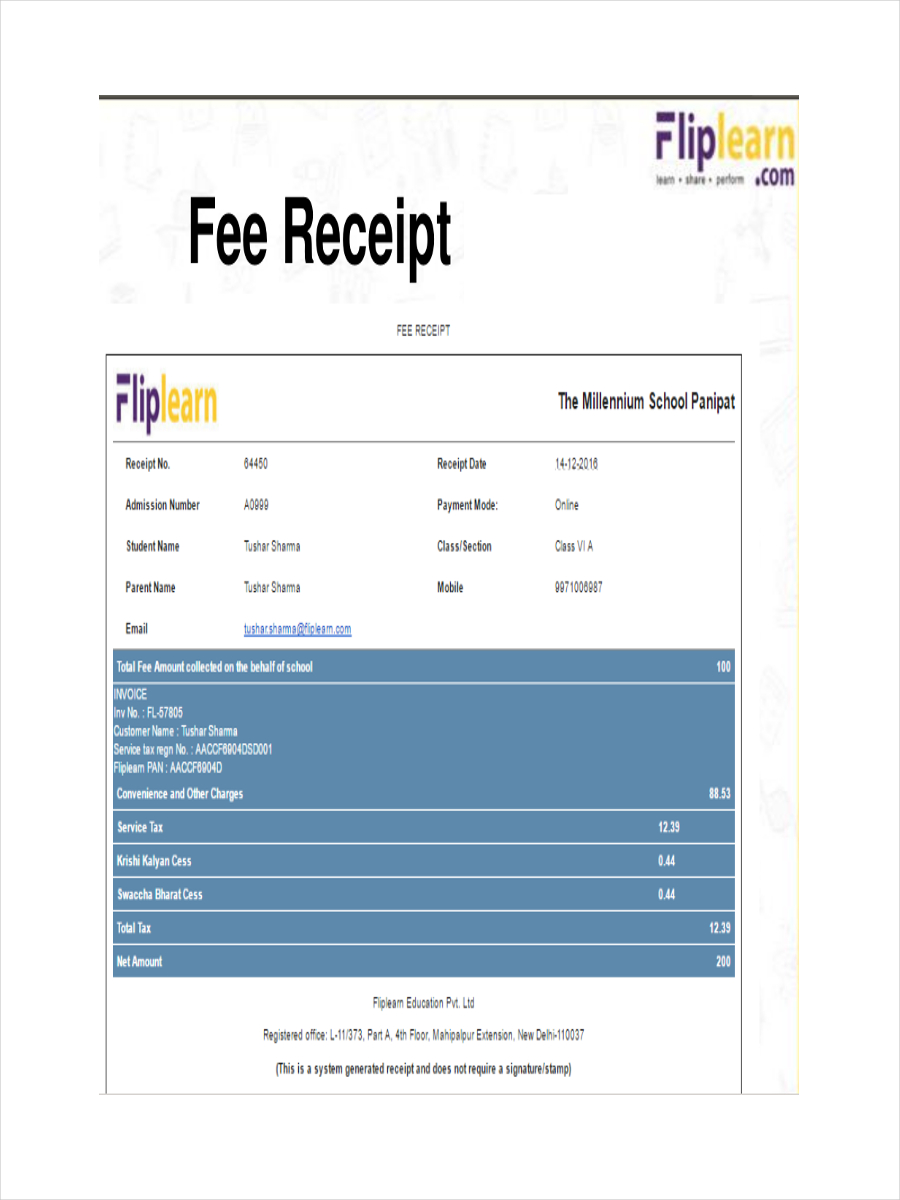

https://images.examples.com/wp-content/uploads/2017/06/Play-School-Receipt-Example.jpg

Sending Kids To School Tax Breaks For Parents Paying For College

https://www.templateroller.com/img/blog_post_img/17acfc59af0c79d09e902ac65de1d57c.jpg

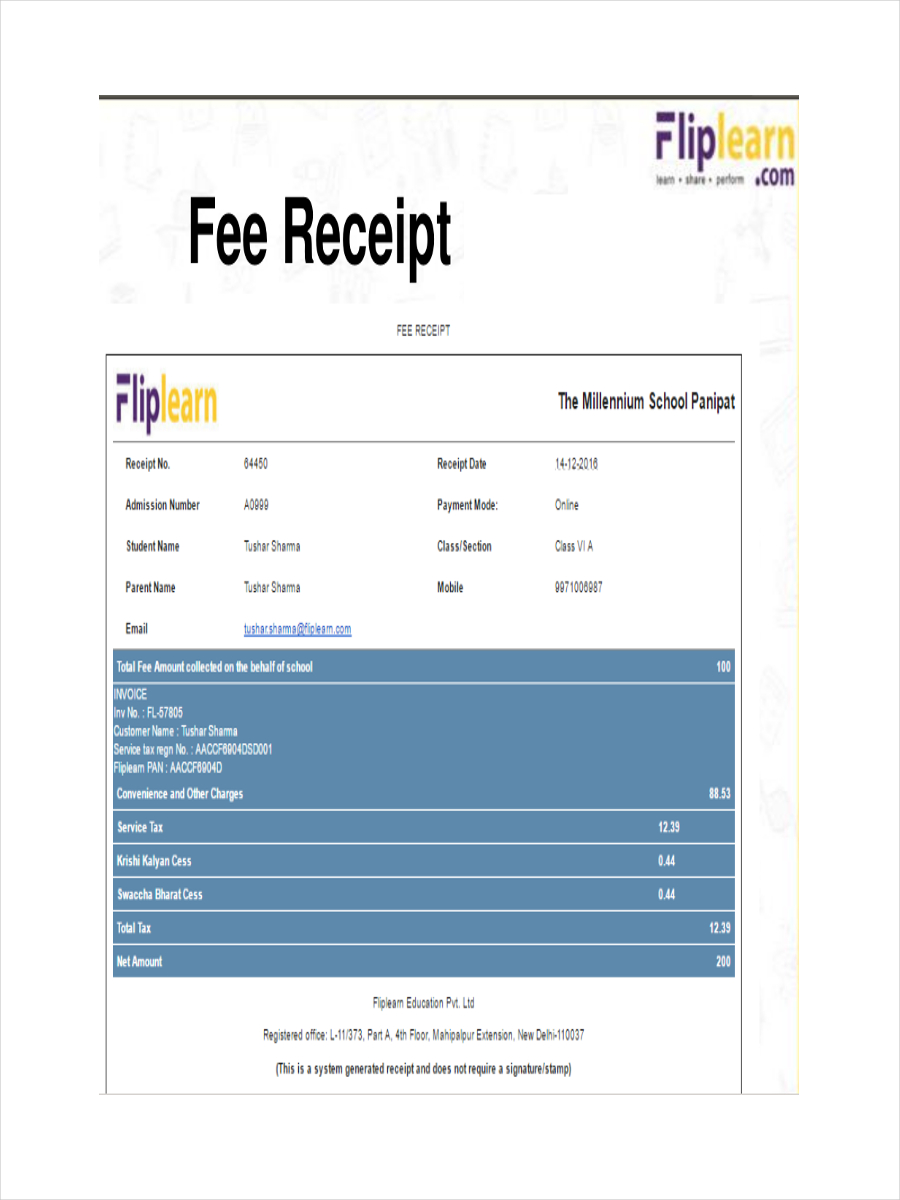

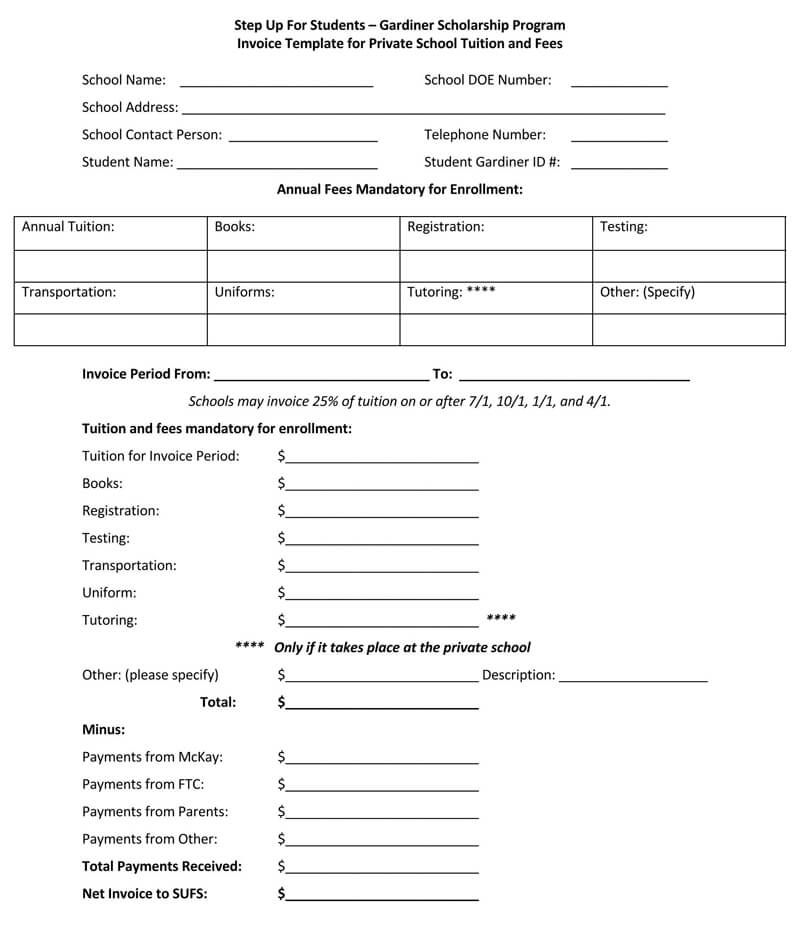

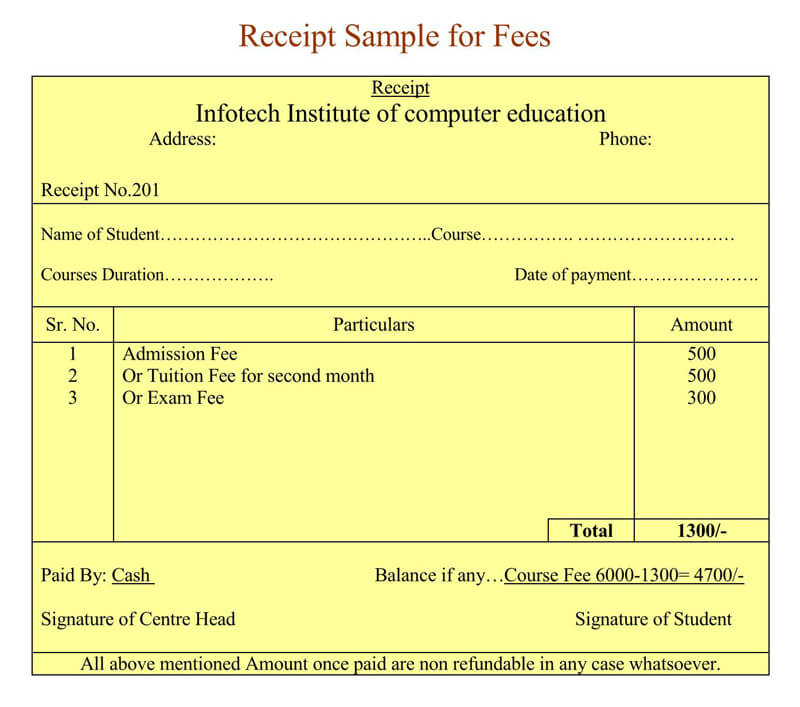

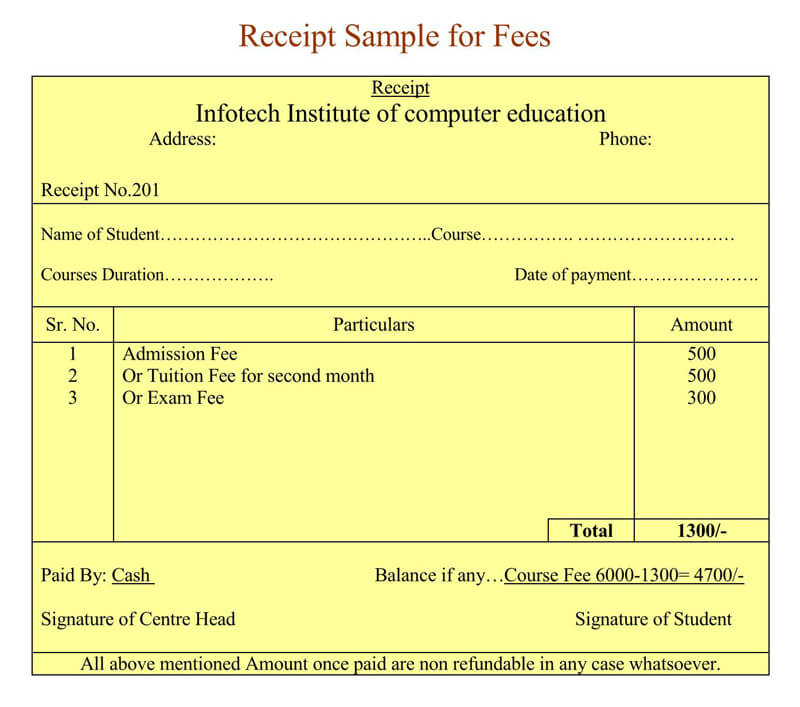

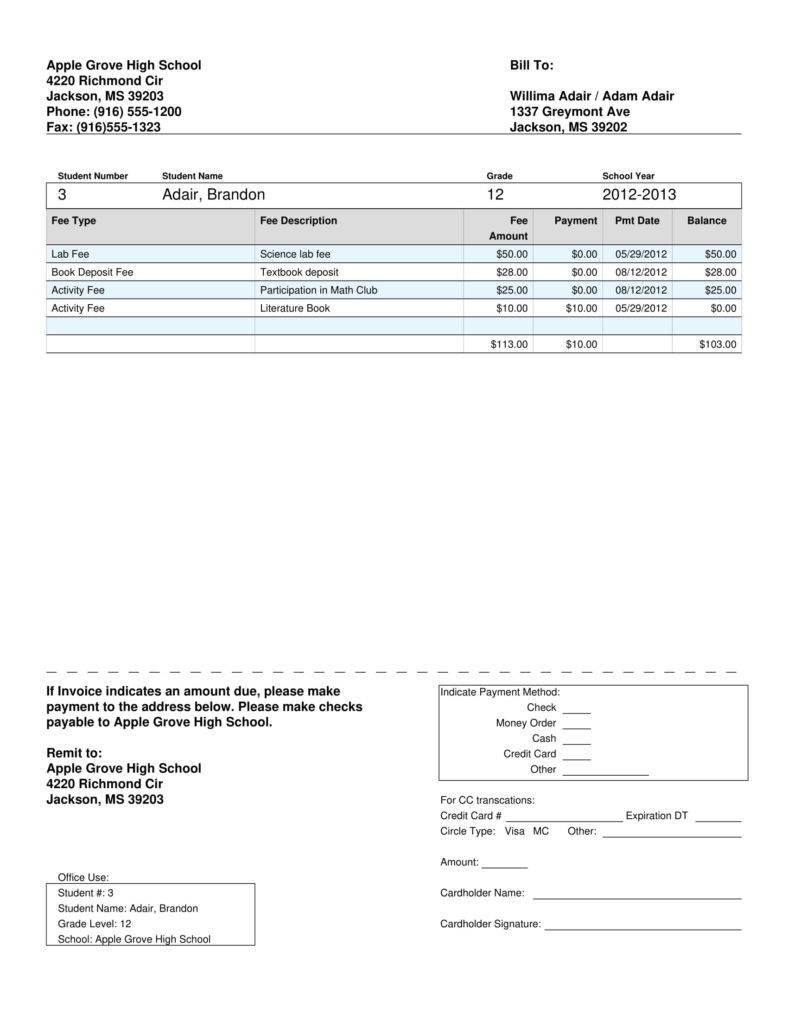

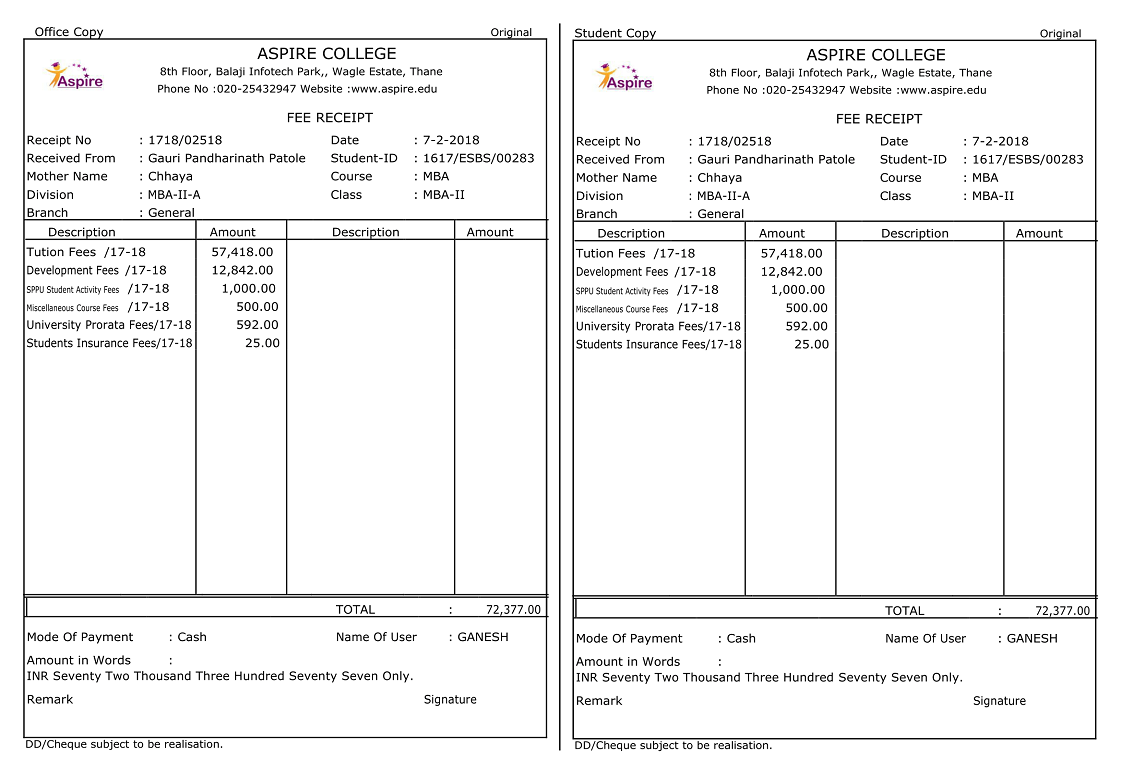

Explore Our Sample Of School Tuition Receipt Template Receipt

https://i.pinimg.com/originals/a8/fd/7e/a8fd7e9e940981e659ccec9164474692.jpg

An education tax credit allows you to reduce your taxes owed and may in some cases generate a tax refund The IRS offers two types of education tax credits to offset tuition and fees you have Close The government has confirmed it will end tax breaks for private schools in a controversial new policy Labour will remove the VAT exemption from January and business rates relief for

VAT at the standard rate of 20 will be added to private school fees from 1 January 2025 external The government said the tax would apply to all payments for the January term made from 29 Details This measure confirms that from 1 January 2025 all education services and vocational training provided by a private school in the UK for a charge will be subject to VAT at the standard

Download Tax Breaks For School Fees

More picture related to Tax Breaks For School Fees

Request Letter For Tax Certificate For Income Tax SemiOffice Com

https://semioffice.com/wp-content/uploads/2021/09/Letter-Asking-for-Payment-Details-for-Tax-Payments.png

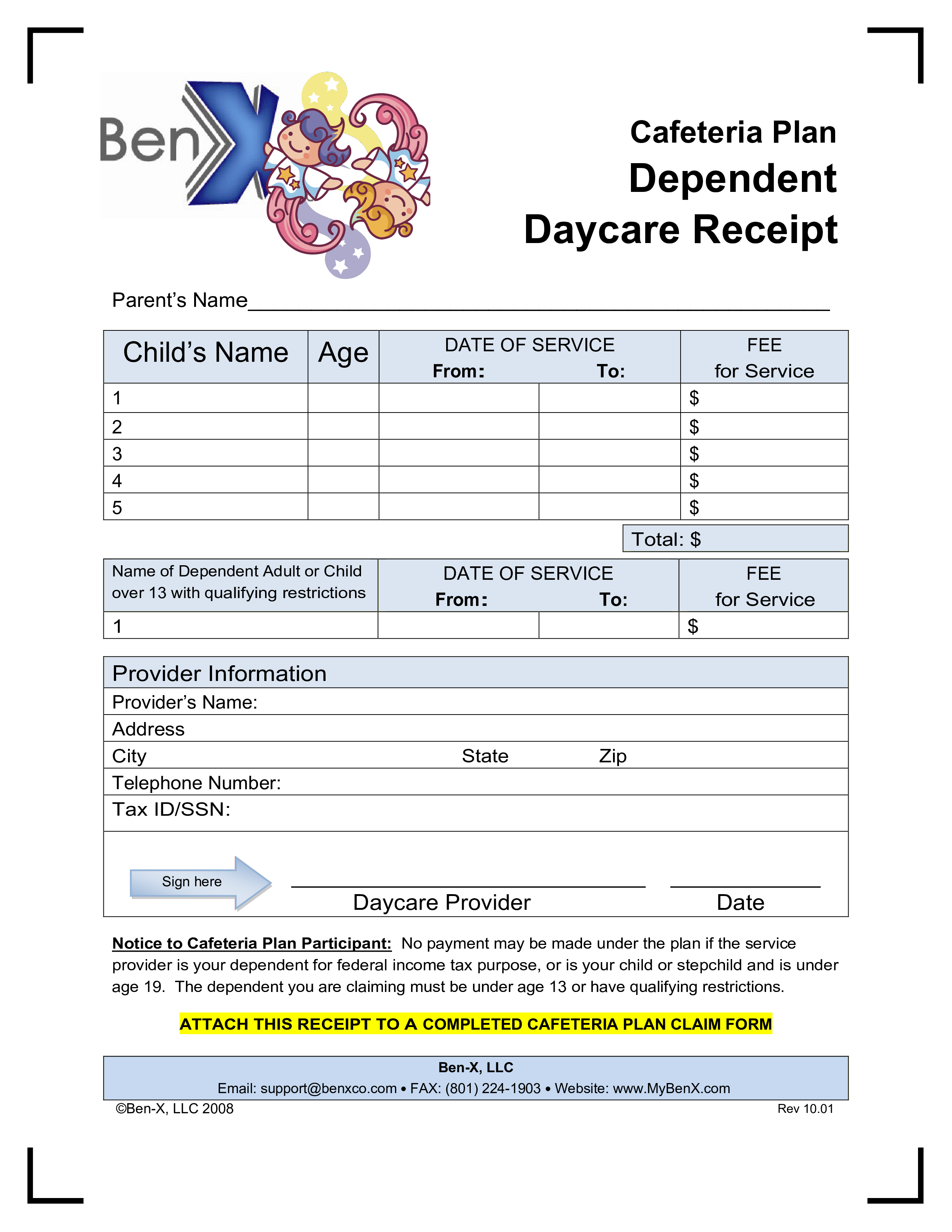

Daycare Tax Receipt Template Master Template

https://www.allbusinesstemplates.com/thumbs/d89f1e6f-988f-45c5-80f0-b007f1b9679b_1.png

Excellent School Fee Receipt Template In Html Cheap Receipt Templates

https://www.wordtemplatesonline.net/wp-content/uploads/2020/01/Receipt-for-School-Tuition.jpg

From 1 January 2025 all education and boarding services provided by a private school or connected person will be subject to VAT at the standard rate of 20 Pre payments of fees or boarding When you e file with TaxAct we ll ask you simple questions to identify which educational tax breaks you could qualify for as a student or a parent Our tax experts will guide you through the filing process provide you with the

Additional tax breaks You can save even more money on the cost of higher education thanks to a few other tax benefits Even if they don t itemize their deductions both parents and students can deduct up to 2 500 of interest on qualifying student loans through the end of the 2024 tax year There are tax breaks for people saving for college current students and graduates who are paying off student loans Taking advantage of these tax breaks may help you keep more of your

Tuition Fee Receipt Template Awesome Receipt Forms

https://www.wordtemplatesonline.net/wp-content/uploads/2020/01/School-Fee-Receipt-Sample.jpg

Federal Tax Breaks For Graduate School Other Tax Benefits Graduate

https://www.graduateprogram.org/wp-content/uploads/2020/04/Apr.-6-Federal-Tax-Breaks-for-Graduate-School-Other-Tax-Benefits-web.jpg

https://www.irs.gov › credits-deductions › individuals › ...

You must pay the expenses for an academic period that starts during the tax year or the first three months of the next tax year Eligible expenses also include student activity fees you are required to pay to enroll or attend the school

https://money.usnews.com › money › personal-finance › ...

Several tax breaks can help you cover the high costs of education future college expenses and interest you pay on student loans

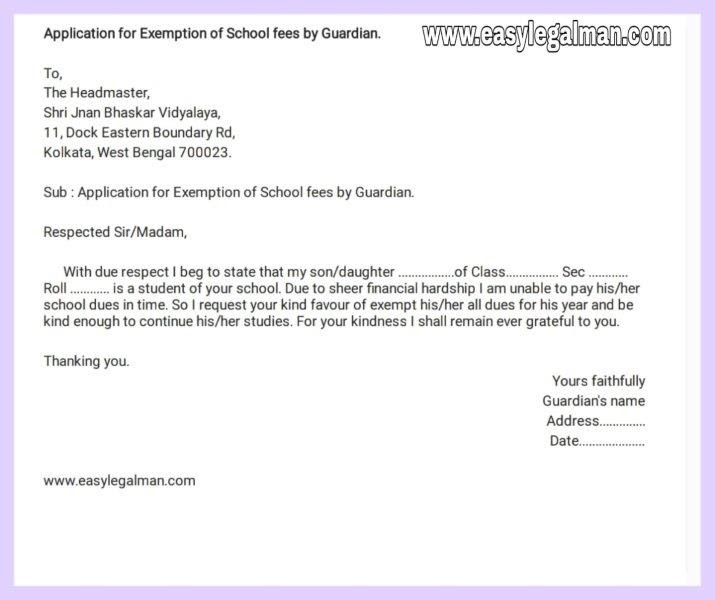

How To Write An Application For Exemption Of School Fees By Guardian

Tuition Fee Receipt Template Awesome Receipt Forms

Take Advantage Of These Tax Breaks For College Costs MONEY Money

Explore Our Example Of Tuition Fee Receipt Template Receipt Template

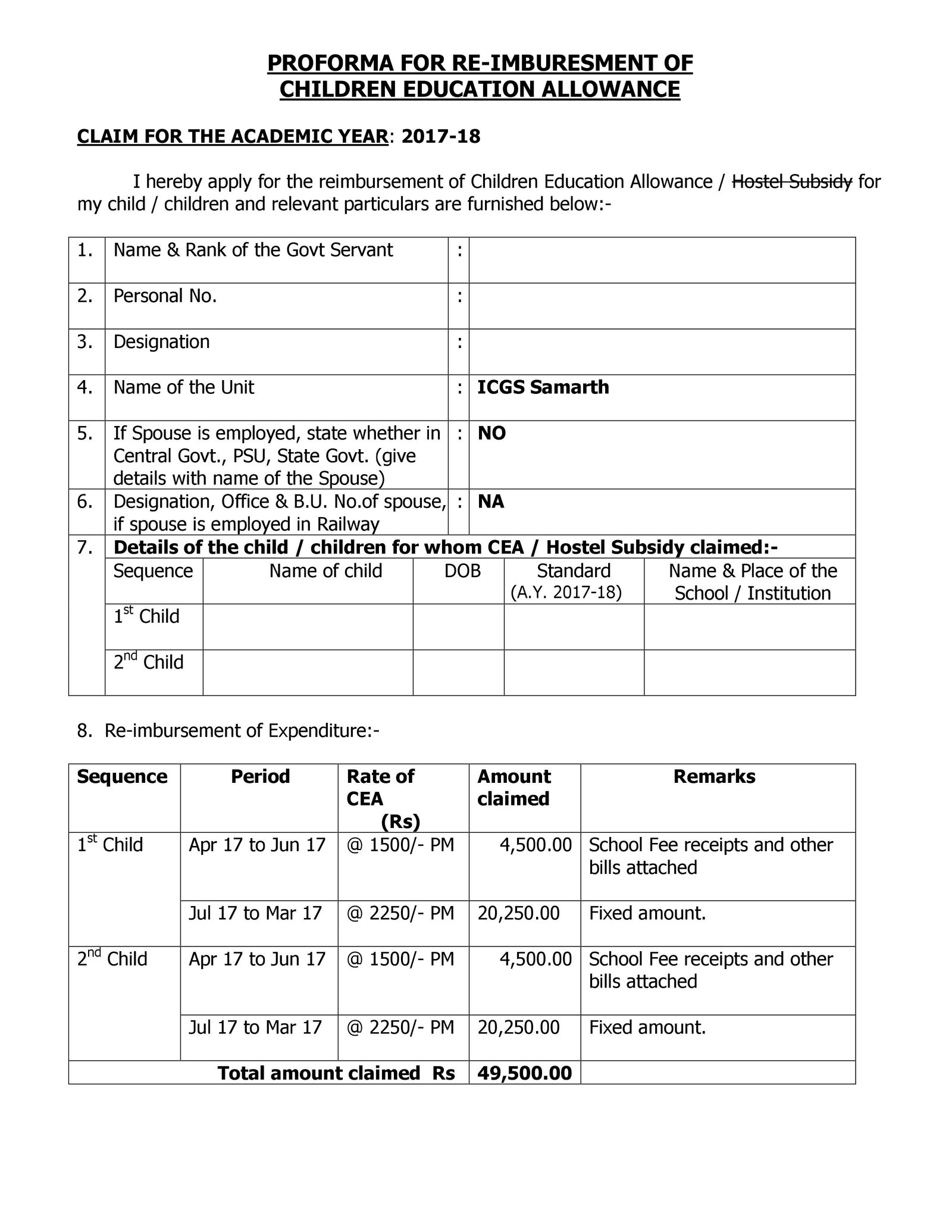

Guidelines For Submission Of Children Education Allowance Claim

Write An Application To The Principal For Fees Structure For Paying

Write An Application To The Principal For Fees Structure For Paying

Fees Receipt Format 8 Fee School Tuition For Income Tax Seminar Free

6 Tuition Receipt Templates PDF Word

Fees Receipt Invoice Customisation

Tax Breaks For School Fees - VAT at the standard rate of 20 will be added to private school fees from 1 January 2025 external The government said the tax would apply to all payments for the January term made from 29