Tax Calculator With Recovery Rebate Web 10 d 233 c 2021 nbsp 0183 32 When calculating the 2020 Recovery Rebate Credit using tax prep software or the 2020 Recovery Rebate Credit Worksheet in the 2020 Form 1040 and Form 1040

Web 13 janv 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal Web 12 oct 2022 nbsp 0183 32 As with the stimulus checks calculating the amount of your recovery rebate credit starts with a quot base quot amount For most people the base amount for the 2021 credit

Tax Calculator With Recovery Rebate

Tax Calculator With Recovery Rebate

https://kb.drakesoftware.com/Site/Uploads/Images/RRC reduction.jpg

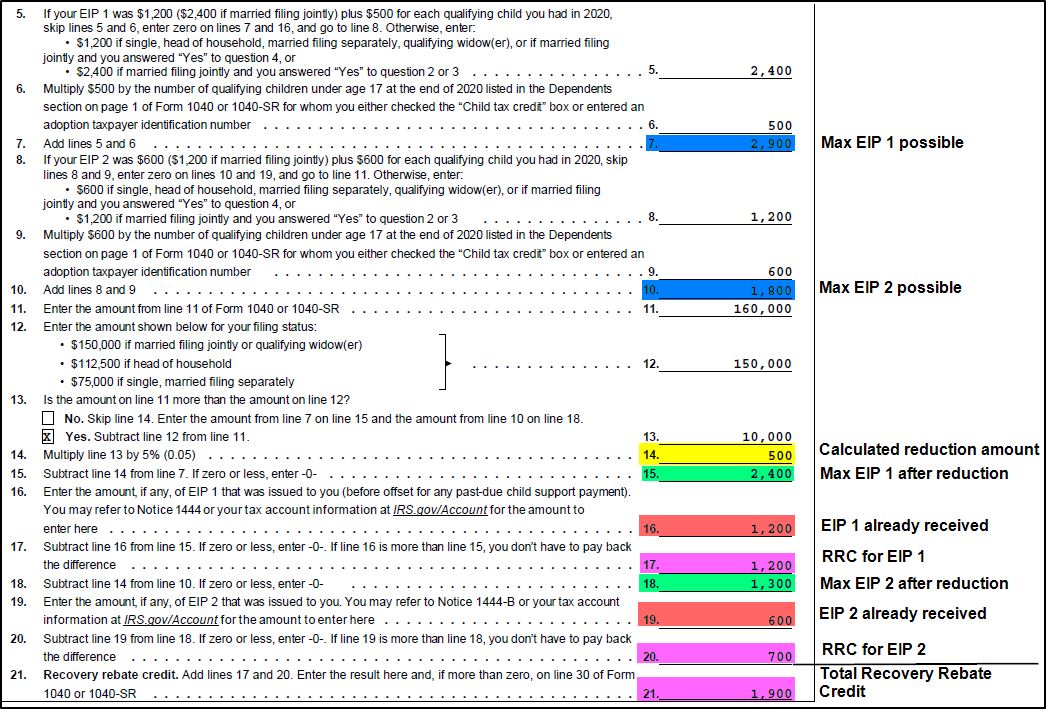

Calculate Your Recovery Rebate Credit With This Worksheet Pdf Style

https://i2.wp.com/www.legacytaxresolutionservices.com/2255lega/250w/cp11r-2page001.png

Taxes Recovery Rebate Credit Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/01/irs-recovery-rebate-credit-worksheet-pdf-irsyaqu-3.png?w=696&h=696&crop=1&ssl=1

Web 17 ao 251 t 2022 nbsp 0183 32 You could claim a Recovery Rebate Credit when you filed your 2020 and or 2021 taxes if you did not receive your full authorized Economic Impact Payments Investing Stocks Web 14 janv 2022 nbsp 0183 32 The 2021 EIP recovery rebate credit has the same income phaseout thresholds as for 2020 75 000 for single filers and 150 000 for married couples filing

Web This calculator helps estimate the amount of the first the second and the third Economic Impact Stimulus Payments for individuals provisioned under the Coronavirus Aid Relief and Economic Security CARES Act Web 30 d 233 c 2020 nbsp 0183 32 Generally the credit can increase your refund amount or lower the taxes you may owe When the IRS processes your 2020 tax return if you are claiming the

Download Tax Calculator With Recovery Rebate

More picture related to Tax Calculator With Recovery Rebate

The Recovery Rebate Credit Calculator ShauntelRaya Rebate2022

https://i0.wp.com/www.rebate2022.com/wp-content/uploads/2023/05/the-recovery-rebate-credit-calculator-shauntelraya-2.png?resize=768%2C472&ssl=1

2020 Tax Year Recovery Rebate Credit Calculation Expat Forum For

https://www.expatforum.com/attachments/1633512360704-png.100433/

The Recovery Rebate Credit Calculator MollieAilie

https://support.taxslayer.com/hc/article_attachments/4415858470797/mceclip3.png

Web 27 avr 2023 nbsp 0183 32 If you re one of the many who are owed stimulus money you may be able to claim the amount as a recovery rebate tax credit on your 2020 or 2021 federal tax return Web 1 d 233 c 2022 nbsp 0183 32 The 2020 Recovery Rebate Credit is actually a tax year 2020 tax credit The government sent payments beginning in April of 2020 and a second round beginning in

Web The tax calculator below allows you to estimate your share of the first Coronavirus related stimulus payments issued to most American taxpayers or residents If you did not receive Web 1 janv 2021 nbsp 0183 32 To claim a recovery rebate credit taxpayers will need to reconcile their economic impact payment with any recovery rebate credit amount for which they are

Calculate Your Recovery Rebate Credit With This Worksheet Pdf Style

https://i2.wp.com/www.legacytaxresolutionservices.com/2255lega/250w/cp12renglishpage001.png

Track Your Recovery Rebate With This Worksheet Style Worksheets

https://i1.wp.com/wisepiggybank.com/wp-content/uploads/2021/03/Screen-Shot-2021-03-17-at-4.22.28-PM.png?w=1046&ssl=1

https://www.irs.gov/newsroom/2020-recovery-rebate-credit-topic-d...

Web 10 d 233 c 2021 nbsp 0183 32 When calculating the 2020 Recovery Rebate Credit using tax prep software or the 2020 Recovery Rebate Credit Worksheet in the 2020 Form 1040 and Form 1040

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-topic-c...

Web 13 janv 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal

The Recovery Rebate Credit Calculator MollieAilie

Calculate Your Recovery Rebate Credit With This Worksheet Pdf Style

How To Claim Missing Stimulus Money On Your 2020 Tax Return In 2021

Recovery Rebate Credit 2020 Calculator KwameDawson

The Recovery Rebate Credit Calculator ShauntelRaya

The Recovery Rebate Credit Calculator MollieAilie

The Recovery Rebate Credit Calculator MollieAilie

The Recovery Rebate Credit Calculator MollieAilie

Recovery Rebate Credit Line 30 Form 1040 Printable Rebate Form

2023 Recovery Rebate Credit Calculator Recovery Rebate

Tax Calculator With Recovery Rebate - Web 8 f 233 vr 2023 nbsp 0183 32 The Recovery Rebate can be applied to federal income tax returns that are filed up to 2021 Each tax dependent is eligible to receive up to 1400 married couples