Tax Charitable Donations 2022 A deduction for charitable contributions It dis cusses the types of organizations to which you can make deductible charitable contributions and the types of contributions you can deduct It also

Learn how to claim a deduction for donations to qualified organizations in 2023 Find out the types of contributions limits records and rules that apply to charitable contributions The tax goes to you or the charity How this works depends on whether you donate through Gift Aid straight from your wages or pension through a Payroll Giving scheme land property or

Tax Charitable Donations 2022

Tax Charitable Donations 2022

https://i.pinimg.com/originals/6c/16/af/6c16af3ad58c7b51e20fad31e7bb90ad.jpg

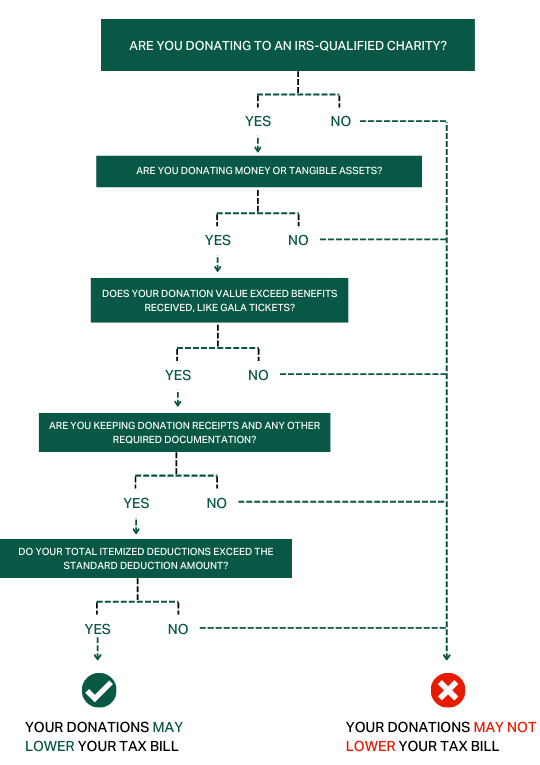

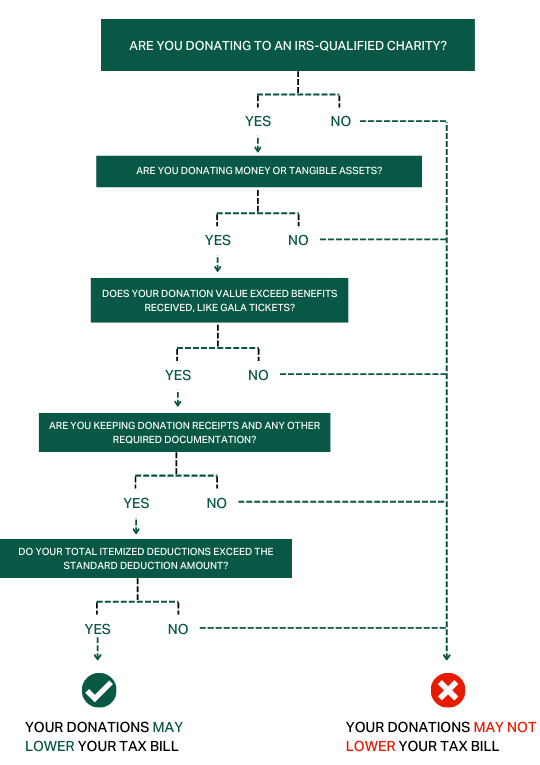

DOWNLOAD THIS FLOWCHART Should I Use A Donor Advised Fund When Giving

https://www.wisdomws.com/wp-content/uploads/2021/12/Donor-advised-funds-flowchart.png

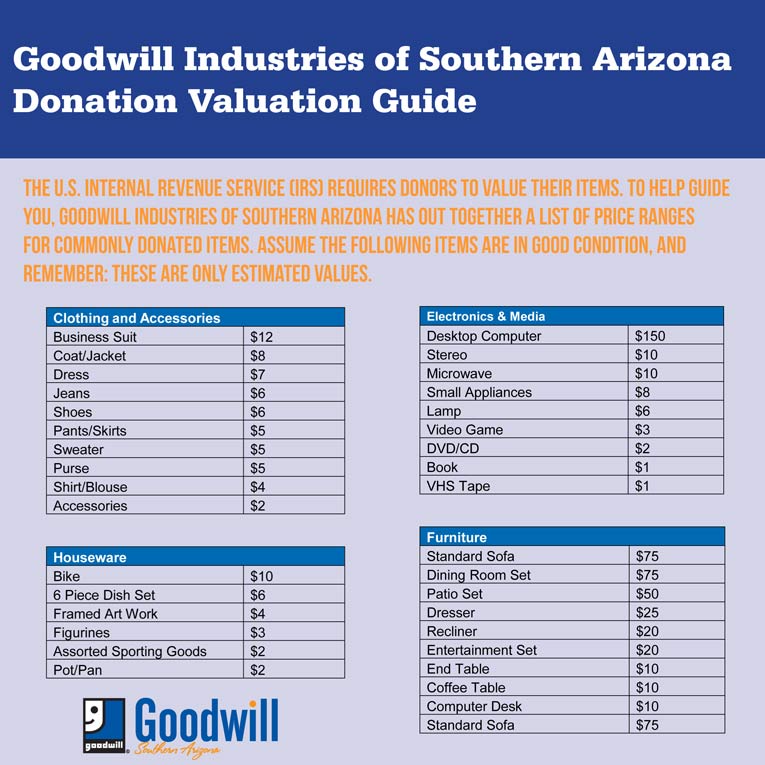

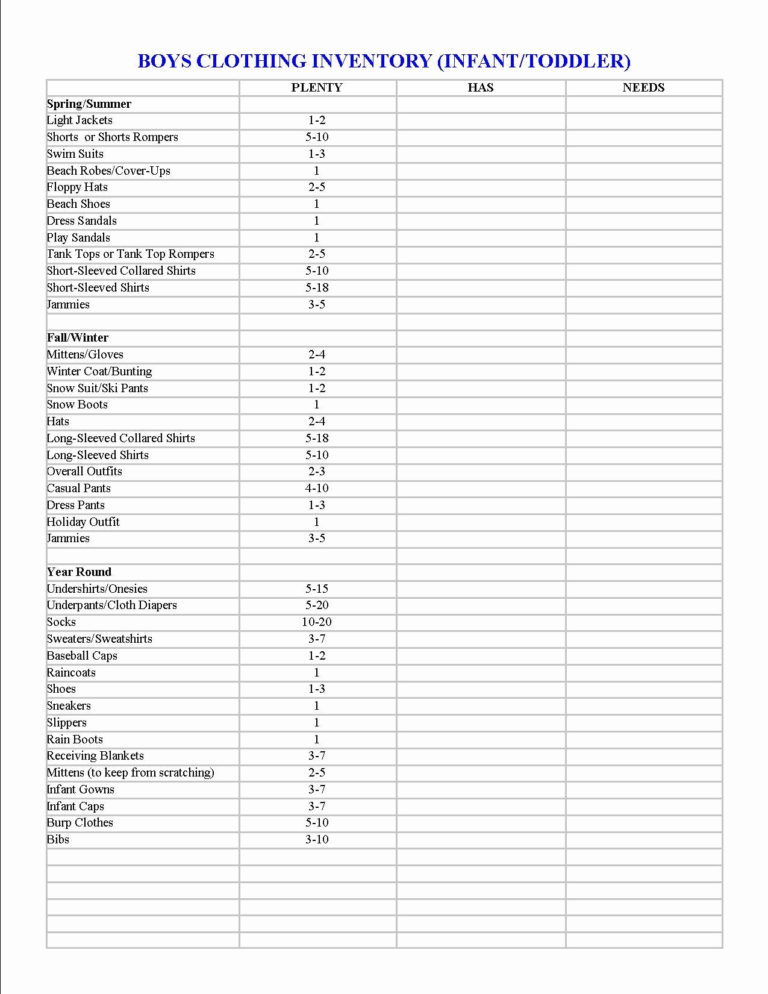

Goodwill Donation Estimate The Value Of Your Donation

http://www.goodwillsouthernaz.org/wp-content/uploads/2018/02/donationvaluationguidegisa.jpg

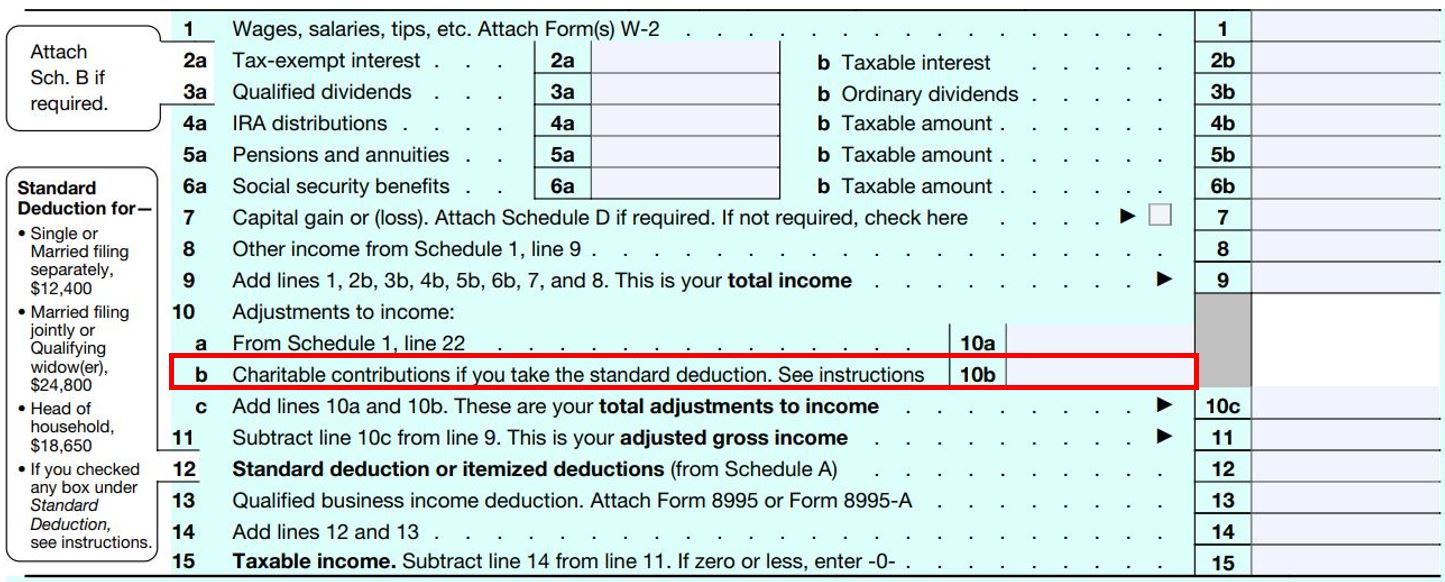

You can only deduct charitable contributions if you itemize your deductions Gifts of goods or money must be made to qualified tax exempt organizations To check an Charitable donations or contributions are potentially a tax saving opportunity Not only does the charity benefit but taxpayers enjoy tax savings by deducting part or all of their

How to claim relief on a Self Assessment tax return if you donate to charity through Gift Aid Payroll Giving or gifts of shares securities land or buildings Charitable giving during the holiday season this year takes on a new happier meaning when it comes to tax deductions Typically most people aren t able to get a tax break when they

Download Tax Charitable Donations 2022

More picture related to Tax Charitable Donations 2022

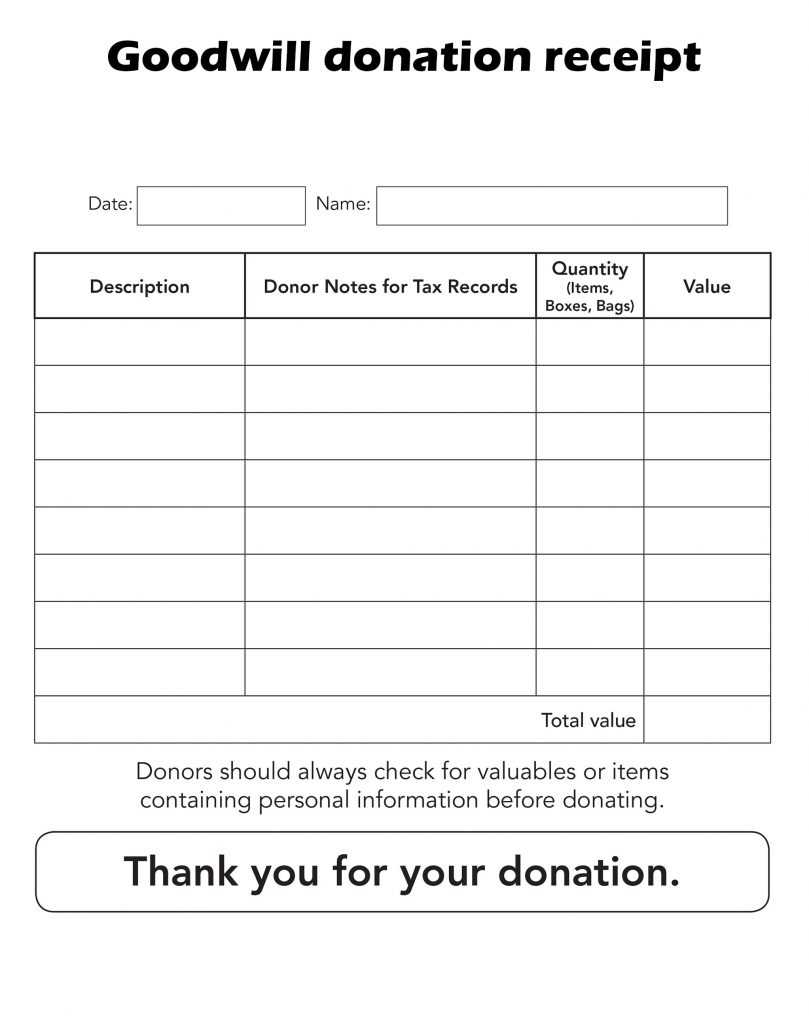

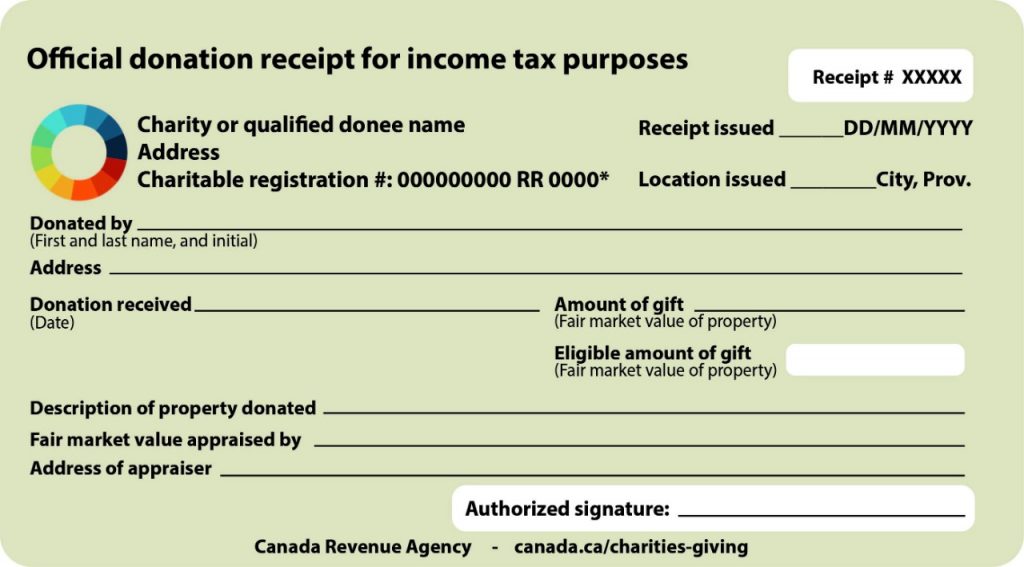

Free Sample Printable Donation Receipt Template Form

https://bestlettertemplate.com/wp-content/uploads/2020/08/Goodwill-donation-receipt-2-809x1024.jpg

![]()

Donation Tracker Spreadsheet Template Excelxo

https://excelxo.com/wp-content/uploads/2017/07/donation-tracker-spreadsheet-template--749x970.jpg

Giving Flowchart How To Donate Wisely My Money Blog

https://www.mymoneyblog.com/wordpress/wp-content/uploads/2018/01/givechart_full.gif

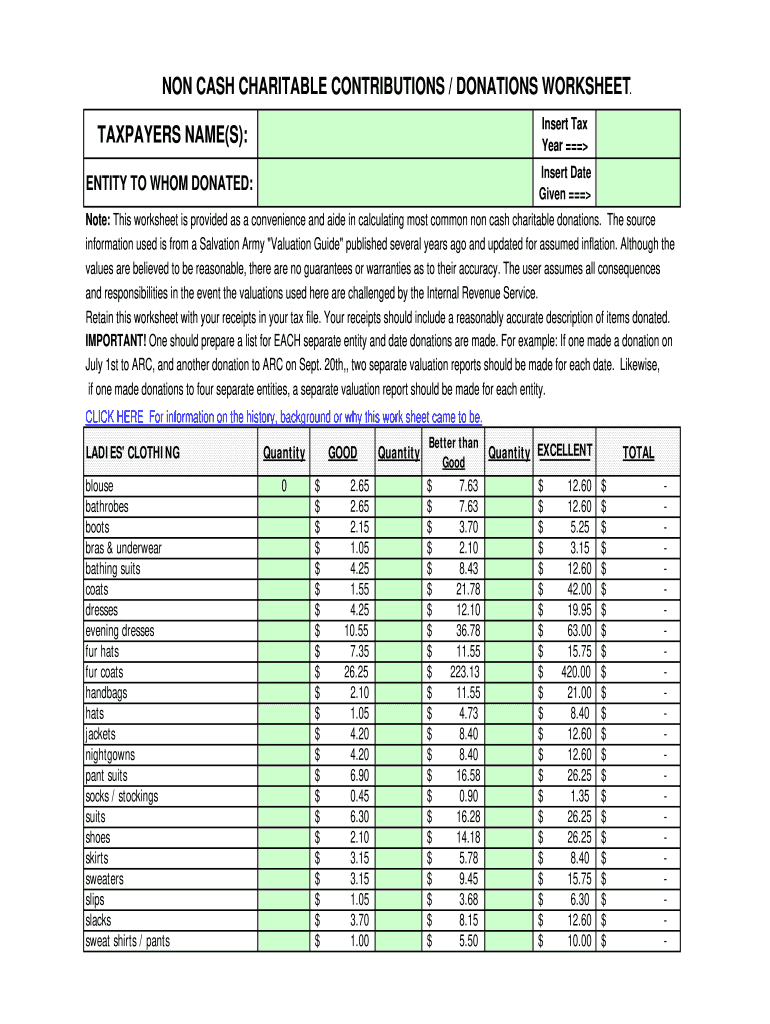

The tax deduction you receive for donations to charities is based on the fair market values of the items donated Here s a guide to check the values To get the charitable deduction you usually have to itemize your taxes You must make contributions to a qualified tax exempt organization You must have documentation for cash donations

Gifts to charity can still reduce your taxable income and increase your tax refund but some of the rules for deducting charitable donations are changing for 2022 What Is a Charitable Contributions Deduction The charitable contributions deduction reduces taxable income by allowing individual taxpayers and businesses to deduct

Guide To Charitable Tax Strategies GiveDirectly

https://www.givedirectly.org/wp-content/uploads/2022/09/Tax-Deduction-Flow-Chart-1-e1662601825248.png

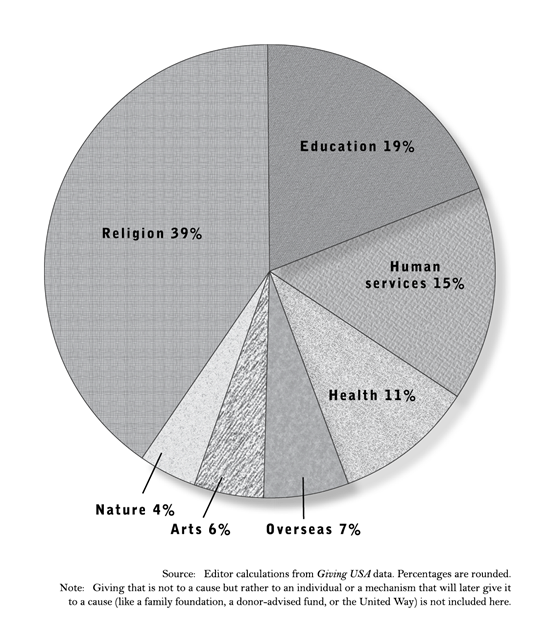

Statistics On U S Generosity Philanthropy Roundtable

https://www.philanthropyroundtable.org/wp-content/uploads/2022/02/2r-almanac-stats.png

https://www.irs.gov › pub › irs-prior

A deduction for charitable contributions It dis cusses the types of organizations to which you can make deductible charitable contributions and the types of contributions you can deduct It also

https://www.irs.gov › publications

Learn how to claim a deduction for donations to qualified organizations in 2023 Find out the types of contributions limits records and rules that apply to charitable contributions

Donation Value Guide Spreadsheet 2007 2024 Form Fill Out And Sign

Guide To Charitable Tax Strategies GiveDirectly

Charitable Donation Spreadsheet Pertaining To Excel Charitable Donation

Top 4 Charitable Donations Worksheet Printable Form 2022

Reasonable Cause Reporting Charitable Donations

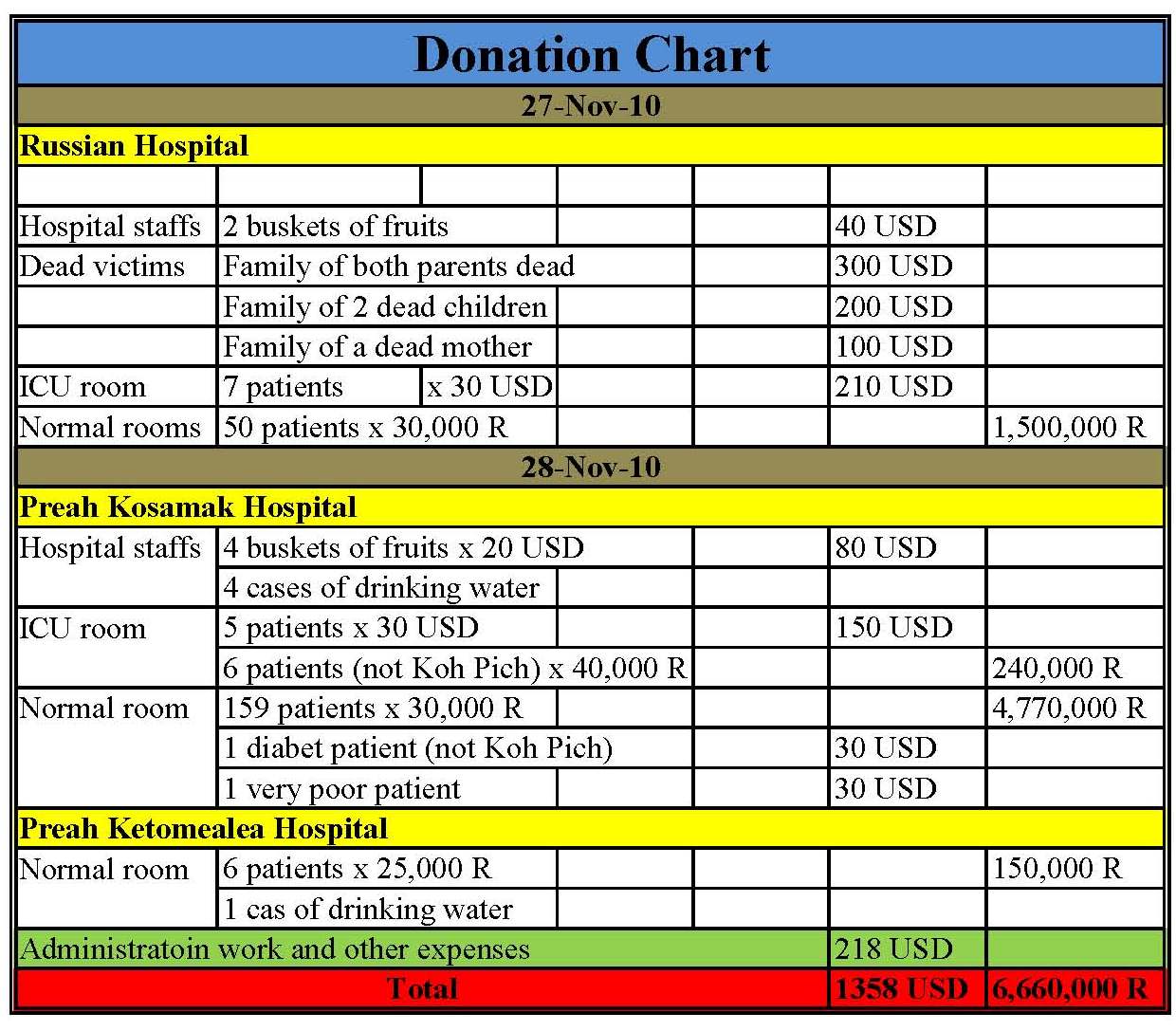

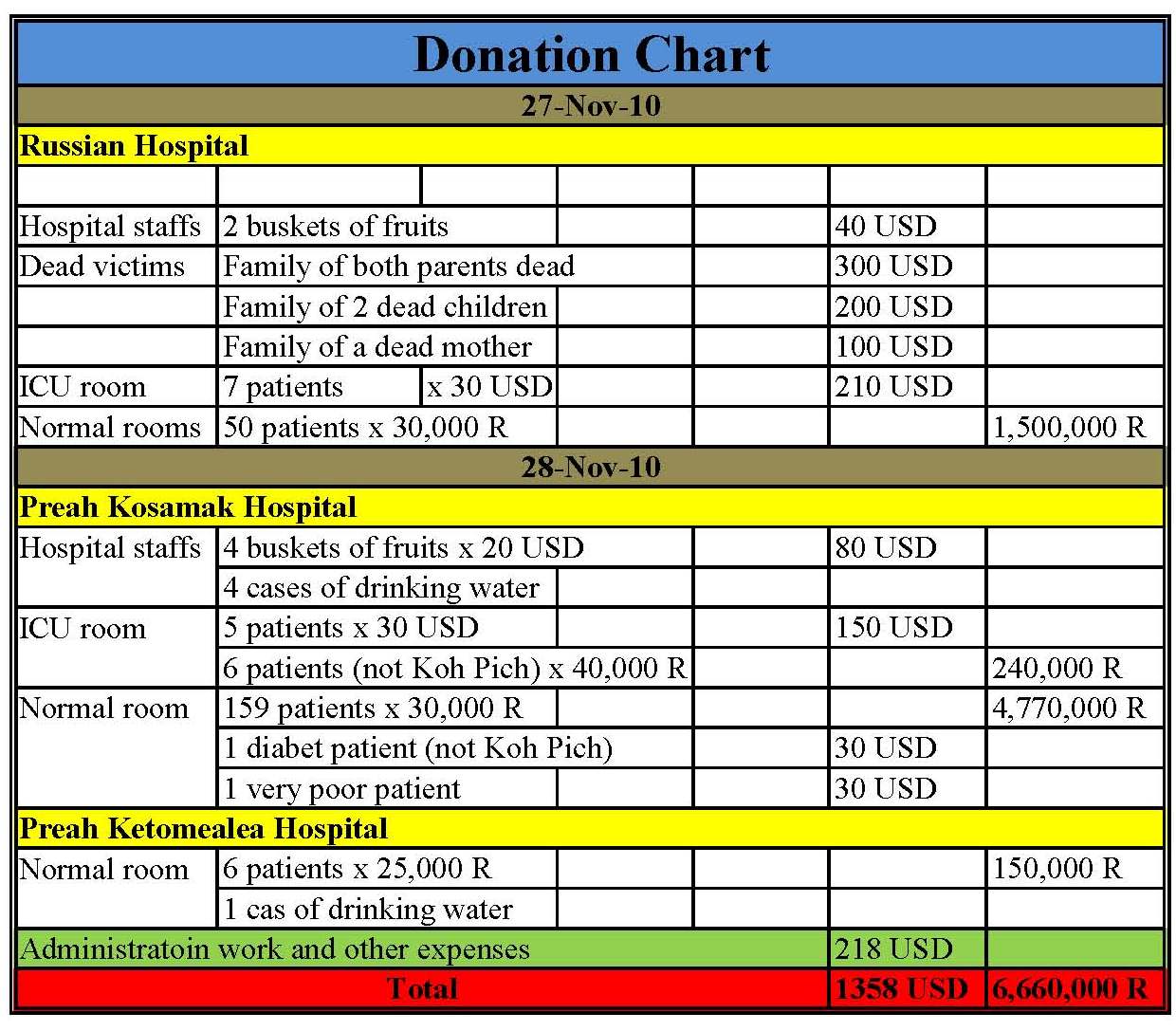

Donation Chart Template

Donation Chart Template

A 2020 Charitable Giving Strategy You Don t Want To Miss

Donation Receipts For Providing Services Smith Neufeld Jodoin LLP

Free Goodwill Donation Receipt Template PDF EForms

Tax Charitable Donations 2022 - You can only deduct charitable contributions if you itemize your deductions Gifts of goods or money must be made to qualified tax exempt organizations To check an