Tax Child Care Benefit The child benefit is paid monthly usually to the mother s father s or another guardian s bank account No tax is paid on the child benefit In some cases child benefit can also be paid abroad if you or your spouse are covered by Finnish social security

You can get up to 500 every 3 months up to 2 000 a year for each of your children to help with the costs of childcare This goes up to 1 000 every 3 months if a child is disabled up The Canada child benefit CCB is administered by the Canada Revenue Agency CRA It is a tax free monthly payment made to eligible families to help with the cost of raising children under 18 years of age

Tax Child Care Benefit

Tax Child Care Benefit

https://wowa.ca/static/img/opengraph/canada-child-benefit.png

Support Affordable Child Care And The American Families Plan Take

https://takeaction.imgix.net/1665997770-early-child-care-1000x1000-petition.jpg

Choosing Quality Child Care Seminar Child Care Services Association

https://18.235.122.25/wp-content/uploads/WMC-Event-Image-Choosing-Quality-Child-Care-Seminar.jpg

If you live in Canada and have a child below the age of 18 you may be eligible for the Canada Child Benefit CCB a monthly tax exempt payment administered by the Canada Revenue Agency CRA to help families with children If you re a parent registered for Tax Free Childcare or free childcare if you re working sign in to pay into your account reconfirm your eligibility update your details

Information about when to apply to the Canada child benefit CCB how to apply for benefits and when you may be required to provide additional documents The CCB young child supplement is paid to families who were entitled to receive a Canada child benefit CCB payment in January April July or October 2021 for each child under the age of six The amount you receive depends on your family net income in 2019 and 2020

Download Tax Child Care Benefit

More picture related to Tax Child Care Benefit

Child And Dependent Care Credit LO 7 3 Calculate Chegg

https://media.cheggcdn.com/media/c7a/c7a7e54f-d046-435c-826a-3945e90aad03/php4ulBhq

How Much Is Child Benefit 2023 Leia Aqui How Much Is Child Benefit In

https://i.cbc.ca/1.3687446.1469037817!/fileImage/httpImage/image.jpg_gen/derivatives/original_780/canada-child-benefit-graphic.jpg

How To Find A Tax ID Number For A Licensed Daycare Provider Home

https://i.pinimg.com/originals/c3/f4/fb/c3f4fb65fb839673e29d64d302657226.jpg

Canada child benefit The Canada child benefit CCB is a non taxable amount paid monthly to help eligible families with the cost of raising children under 18 years of age The CCB may include an additional amount for the child disability benefit see page 15 By applying for the CCB you also register your children for the goods and Child Benefit tax calculator Use this tool to get an estimate of how much money you get from Child Benefit in a tax year the High Income Child Benefit tax charge you or your partner

The Ontario Child Care Tax Credit supports families with incomes up to 150 000 particularly those with low and moderate incomes Learn how the credit is calculated To claim the Ontario Child Care Tax Credit you must be eligible to claim the Child Care Expense Deduction have a family income less than or equal to 150 000 The Government s confusingly named Tax Free Childcare scheme offers up to 2 000 a year per child towards childcare costs including nurseries childminders and even some holiday camps But while 1 3 million families are eligible around

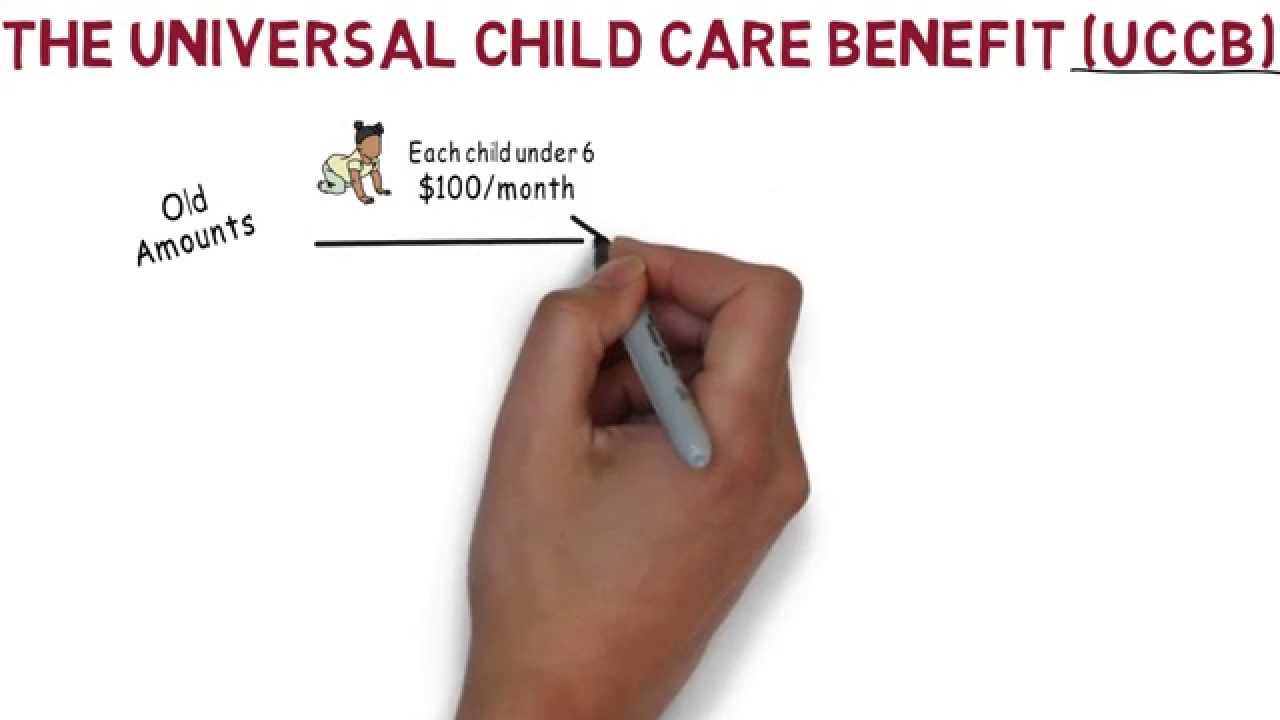

Enhancement To The Universal Child Care Benefit UCCB YouTube

https://i.ytimg.com/vi/hG7gS3lmu10/maxresdefault.jpg

T22 0188 Repeal Child Tax Credit CTC Earned Income Threshold By

https://www.taxpolicycenter.org/sites/default/files/styles/full-page-1500x700/public/model-estimates/images/t22-0188.gif?itok=6FfQuMuW

https://www.infofinland.fi › ... › child-benefit

The child benefit is paid monthly usually to the mother s father s or another guardian s bank account No tax is paid on the child benefit In some cases child benefit can also be paid abroad if you or your spouse are covered by Finnish social security

https://www.gov.uk › tax-free-childcare

You can get up to 500 every 3 months up to 2 000 a year for each of your children to help with the costs of childcare This goes up to 1 000 every 3 months if a child is disabled up

Does 2022 Get Child Credit Leia Aqui What Is The Tax Break For 2022

Enhancement To The Universal Child Care Benefit UCCB YouTube

Child Tax Benefit Application Form 2 Free Templates In PDF Word

BENEFIT CENTER

Check The Status Of Your Application For The Affordable Child Care

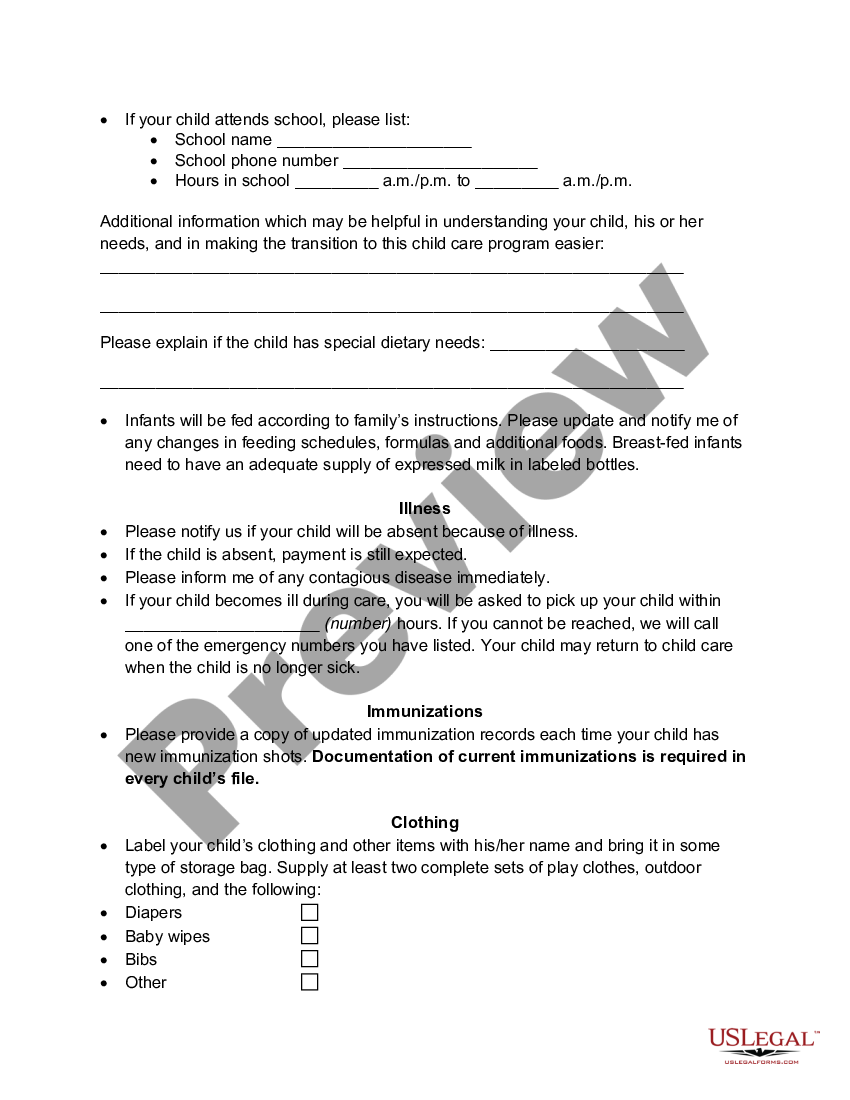

Iowa Child Care Agreement US Legal Forms

Iowa Child Care Agreement US Legal Forms

Child Care Benefit Best Insurance Buy Insurance Online Travel Insurance

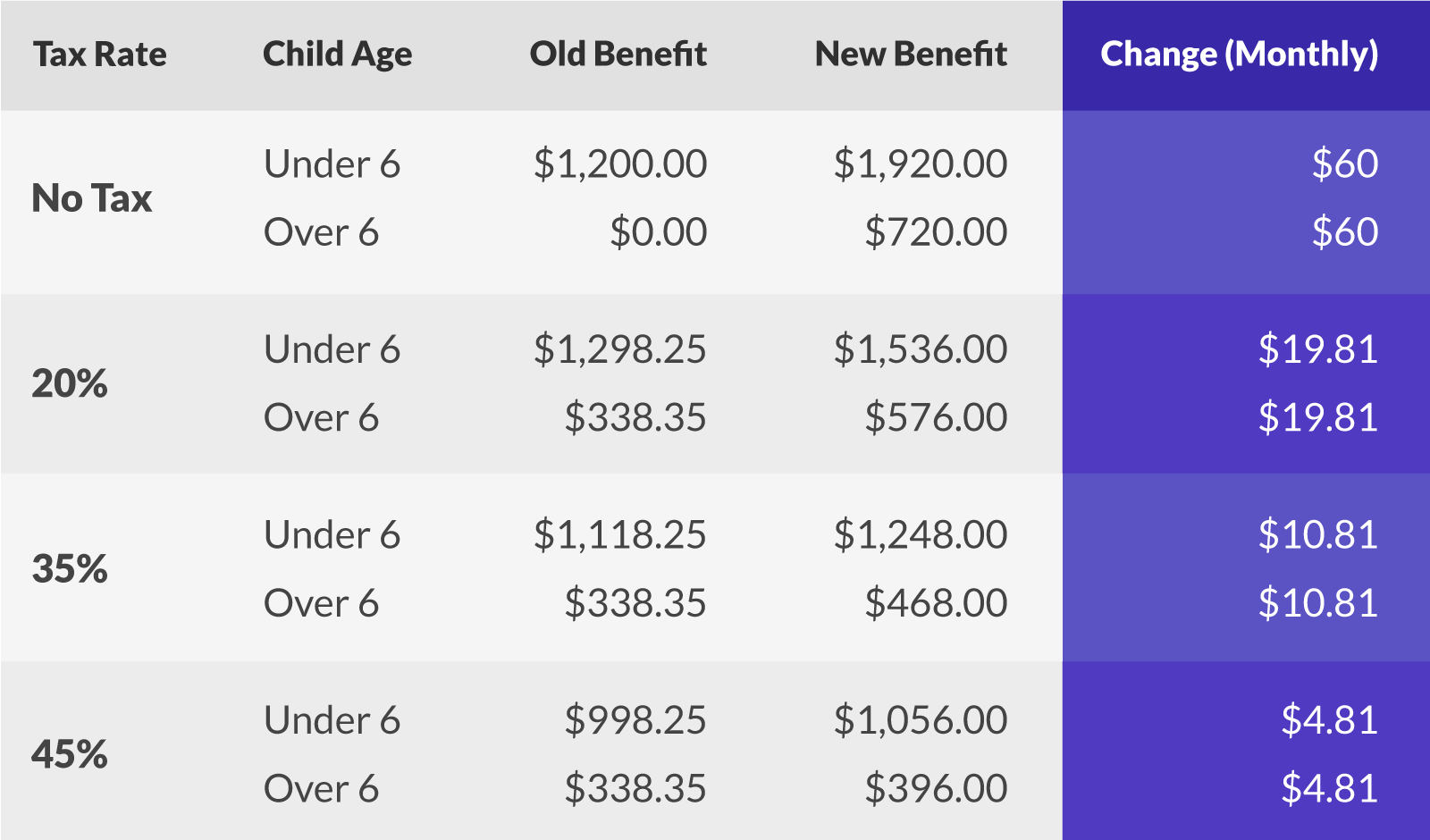

How Canada s Revamped Universal Child Care Benefit Affects You

Whole Care Insurance

Tax Child Care Benefit - The Canada child benefit CCB provides a tax free monthly payment to families to help them with the cost of raising children under the age of 18 You must meet specific criteria to qualify for the CCB such as living with the eligible child children and being a