Tax Claim Code Private Health Insurance Rebate Web 12 oct 2022 nbsp 0183 32 Oct 12 2022 Fact checked The Australian Government offers a tax rebate on private health insurance which is worked out depending on how much you earn In

Web 3 lignes nbsp 0183 32 Private health insurance rebate If you meet the eligibility requirements for a private Web If you are a single parent with a dependent child select tax claim code B to ensure that we apply the family thresholds to work out your private health insurance rebate

Tax Claim Code Private Health Insurance Rebate

Tax Claim Code Private Health Insurance Rebate

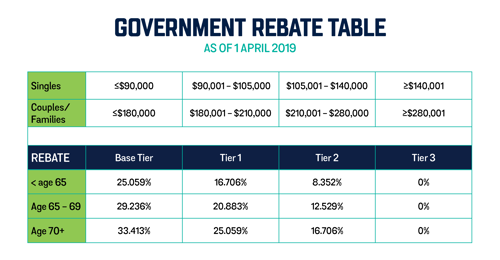

https://navyhealth.com.au/wp-content/uploads/2018/03/Federal-Government-Rebate-1-APR-2019.png

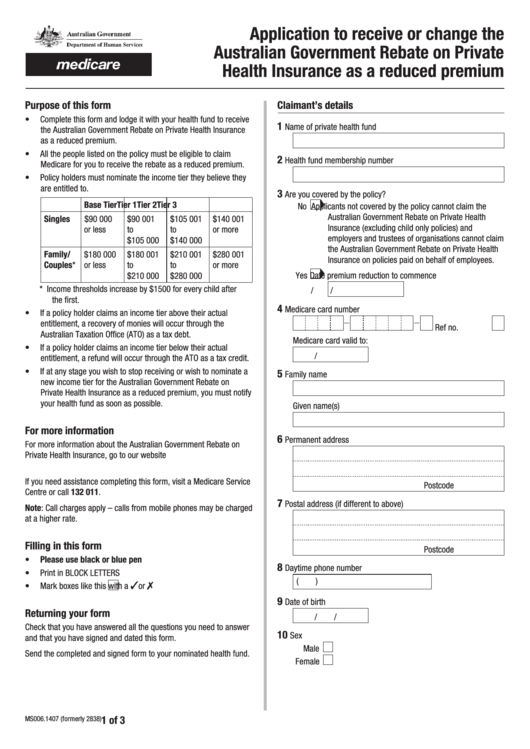

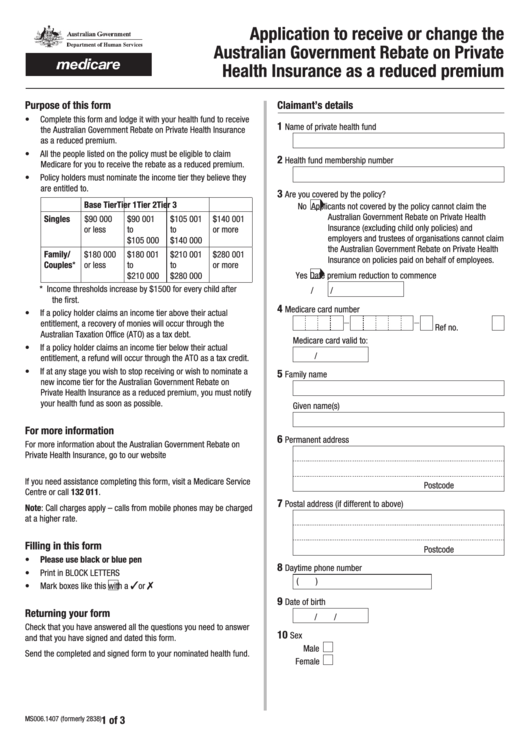

Fillable Application To Receive Or Change The Australian Government

https://data.formsbank.com/pdf_docs_html/143/1438/143819/page_1_thumb_big.png

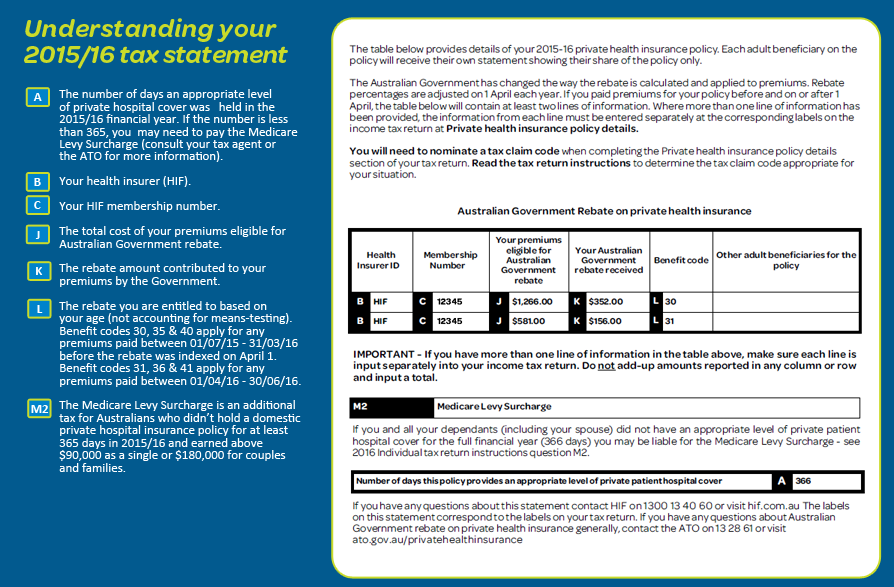

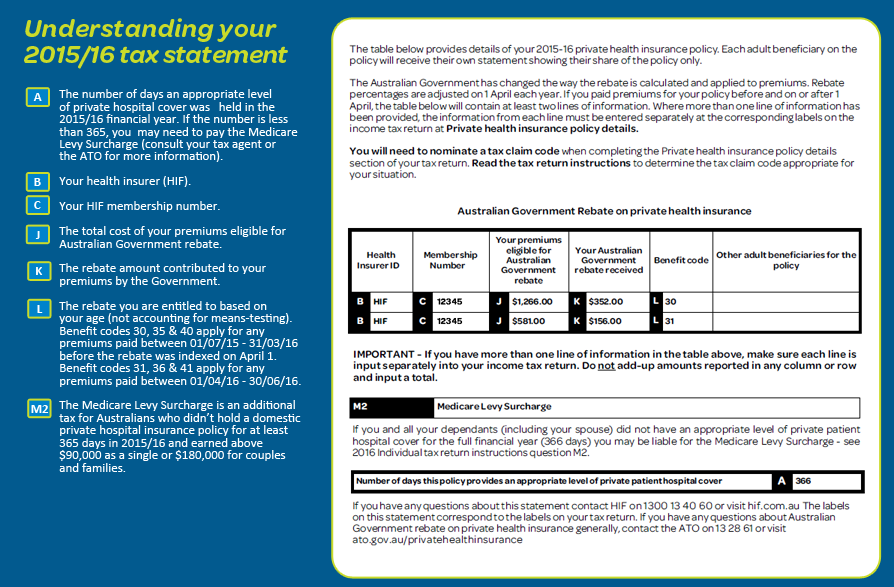

Tax Time And Private Health Insurance Teachers Health

https://www.teachershealth.com.au/media/2111/2019-govt-rebate-table2.png?width=500&height=260.4838709677419

Web At any time during 2022 23 were you covered by a private health insurance policy or did you pay for a dependent person only policy What you need to answer this question It is Web 3 juil 2020 nbsp 0183 32 Which tax claim code should I use for the private health insurance rebate section I assumed I would use code A as I m a single adult on 30 June 2020 Is that

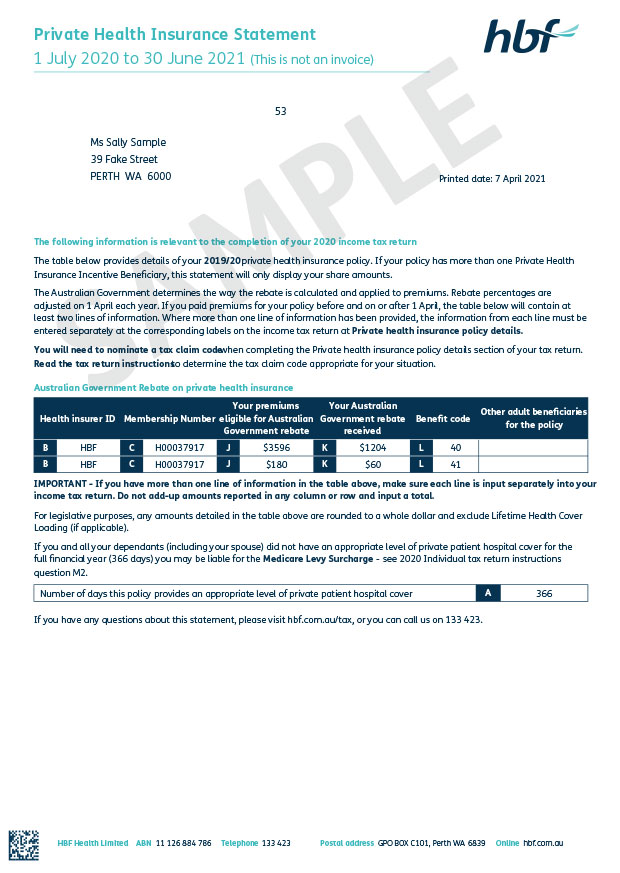

Web The private health insurance rebate is a government contribution to help with the cost of your private health insurance Private health insurance rebate eligibility Eligibility for Web to determine the tax claim code appropriate for your situation Statement print date Australian Government Rebate on private health insurance Important If you have

Download Tax Claim Code Private Health Insurance Rebate

More picture related to Tax Claim Code Private Health Insurance Rebate

Calculating Off set For Private Health Insurance Rebate Non Resident

https://s3.amazonaws.com/cdn.freshdesk.com/data/helpdesk/attachments/production/60010874030/original/8SLiRTx9hTsQHy3QgcVzsLBPzD1IEX-Qjw.png?1596765468

2014 Tax Time FAQs Defence Health

https://www.defencehealth.com.au/media/1193/phistmt2014.jpg?width=500&height=353.58711566617865

Australian Government Rebate On Private Health Insurance Form

https://imgv2-2-f.scribdassets.com/img/document/353886448/original/1e13db07e4/1620077418?v=1

Web You will need to nominate a tax claim code when completing the Private health insurance policy details section of your tax return Read the tax return instructions to determine the Web 30 juin 2023 nbsp 0183 32 your share will be the amount paid for the policy divided by the number of adults on the policy for example if the total payments for a premium are 2 000 and

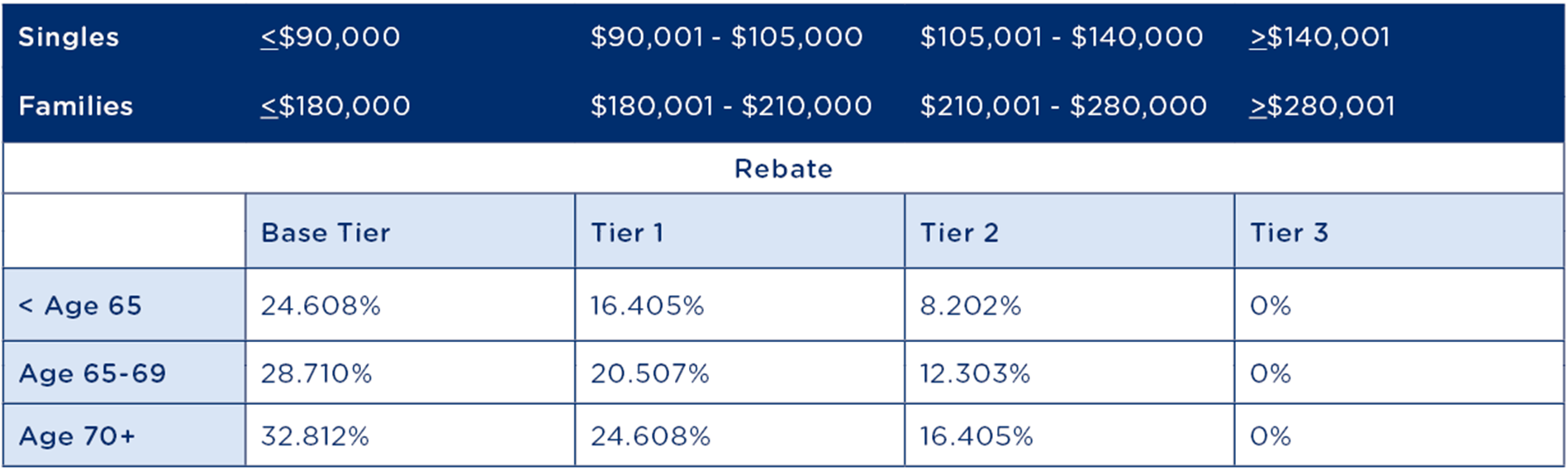

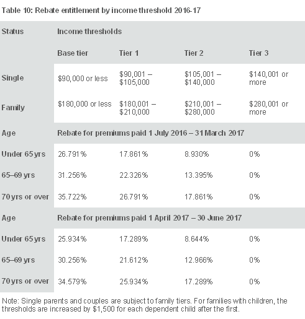

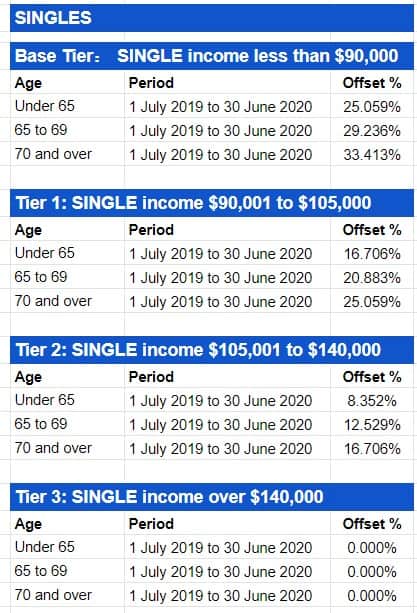

Web Before 1 July 2023 they remained unchanged for 8 years from 2015 16 to 2022 23 The thresholds remained at the 2014 15 levels during this period To calculate your private Web 3 mars 2022 nbsp 0183 32 From the Australian Taxation Office You can claim the rebate through your tax return if you don t get it as a premium reduction Your health insurer will send you a

Private Health Insurance Tax Claim Code Private Health Insurance

http://www.hif.com.au/sites/hifcomau/assets/public/Image/Tax/2016/HIF-Tax-Statement-2016-PHI.png

Bupa Tax Exemption Form Private Health Insurance Rebate On Your Tax

https://lh3.googleusercontent.com/blogger_img_proxy/AByxGDQS8nmwG6ouztF308jEfSySrXYw0H8N1idhlnA24WvKdZAhrfTE_xwJMrigw2IGKfN5etN4a65cLKNhM-sGysO_D_NlfBJve5pjRkHDzMtN-B-c6FH1Zu9UNXTIF6_iUpK194ythQZo2HF7JcV1Cq23zqCm8aUyA-Tb8FAXTFbT1olqOOwzzQIF4rdUmdnBi_uRvcwzmA=w1200-h630-p-k-no-nu

https://www.finder.com.au/.../private-health-insurance-tax-claim-code

Web 12 oct 2022 nbsp 0183 32 Oct 12 2022 Fact checked The Australian Government offers a tax rebate on private health insurance which is worked out depending on how much you earn In

https://www.ato.gov.au/.../Private-health-insurance-policy-details

Web 3 lignes nbsp 0183 32 Private health insurance rebate If you meet the eligibility requirements for a private

Private Health Rebate Calculator

Private Health Insurance Tax Claim Code Private Health Insurance

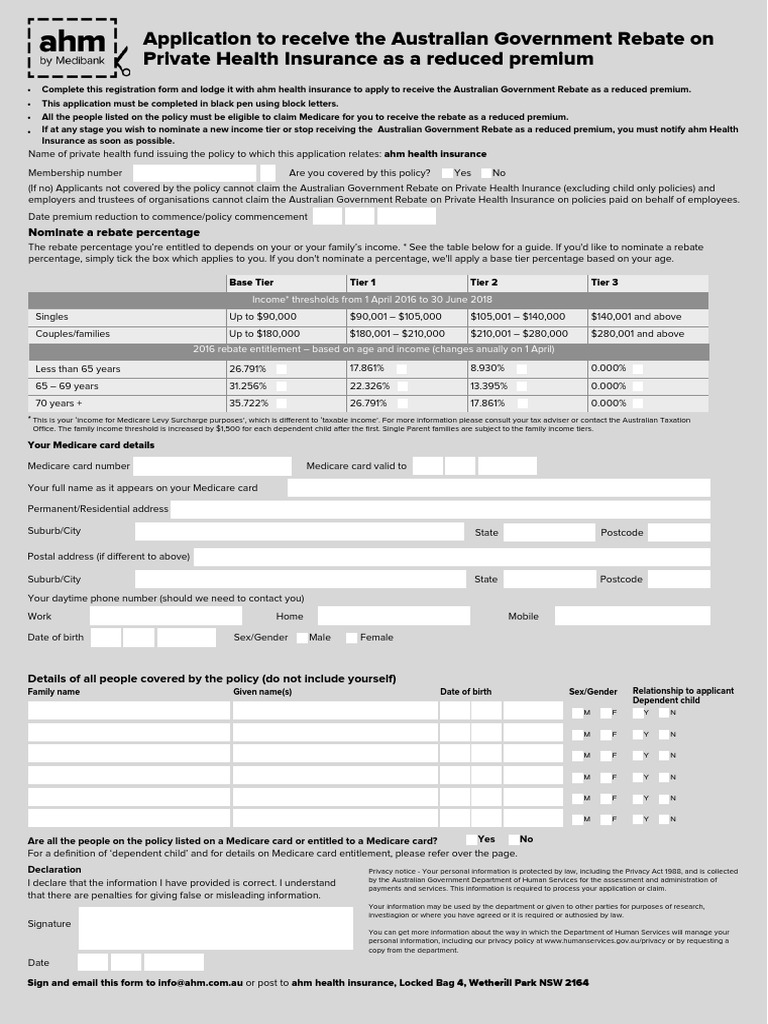

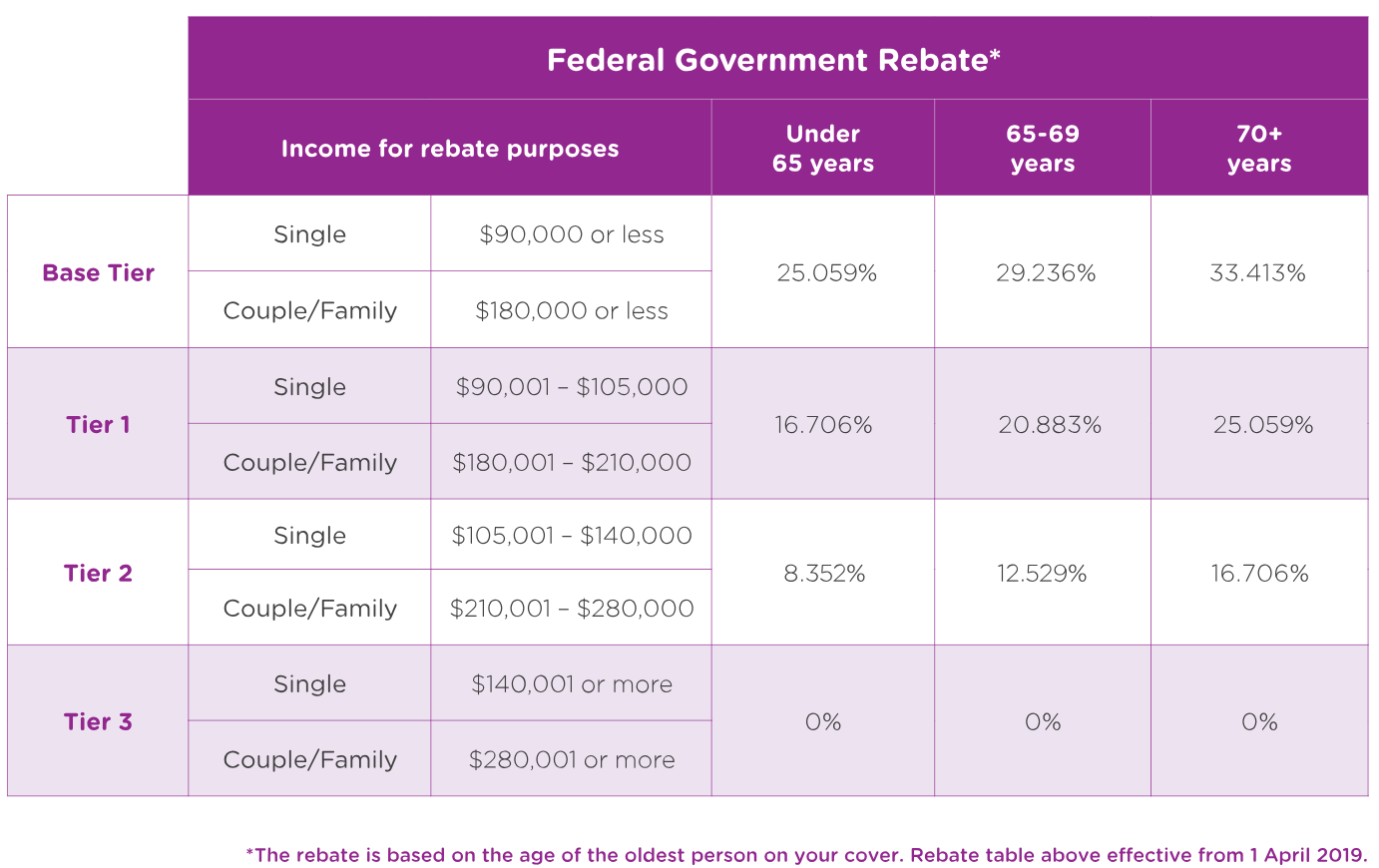

Private Health Insurance Rebate Navy Health

Medicare Levy Surcharge Private Health Insurance What s The Link

Private Health Insurance Tax Offset Atotaxrates info

Combined Insurance Claim Forms Printable Customize And Print

Combined Insurance Claim Forms Printable Customize And Print

What Is Australian Government Rebate On Private Health Insurance

Private Health Insurance Rebate Navy Health

Tax Statement Do I Still Need Private Health Benefit Code

Tax Claim Code Private Health Insurance Rebate - Web The rebate can be used to reduce your premiums or claimed when you lodge your tax return with the Australian Taxation Office Please note that if you have a Lifetime Health