Tax Claiming Medical Expenses You pay 700 in 2022 and the remaining 300 in 2023 You have two options when claiming tax relief for these health expenses Option 1 you can claim 1 000 for the 2022 tax year Option

The medical expenses tax offset was available from the 2015 16 to 2018 19 income years The offset is not available from 1 July 2019 You could claim the medical expenses tax offset for You can claim medical expenses on line 33099 or 33199 of your tax return under Step 5 Federal tax Line 33099 You can claim the total eligible medical expenses you or your

Tax Claiming Medical Expenses

Tax Claiming Medical Expenses

https://www.experienceyourblueprint.com/wp-content/uploads/Claiming-Medical-Expenses-on-Your-Personal-Tax-Return-Blog-Feature-Img-1080x675.png

Claim Medical Expenses On Your Taxes Health For CA

https://hp-prod-wp-data.s3.us-west-1.amazonaws.com/content/uploads/02x.jpeg

Quick Guide Who Should Claim Medical Expenses On Taxes Canada

https://www.olympiabenefits.com/hubfs/Who should claim medical expenses on taxes Canada-1.png

This publication explains the itemized deduction for medical and dental expenses that you claim on Schedule A Form 1040 It discusses what expenses and whose expenses you can and can t include in figuring the You generally receive tax relief for health expenses at your standard rate of tax 20 Nursing home expenses are given at your highest rate of tax up to 40 This section

133 rowsHow to claim eligible medical expenses on your tax return You can claim eligible medical expenses on line 33099 or line 33199 of your tax return Step 5 Federal tax Line This interview will help you determine if your medical and dental expenses are deductible Information you ll need Filing status Type and amount of expenses paid The year in which

Download Tax Claiming Medical Expenses

More picture related to Tax Claiming Medical Expenses

Frequently Asked Questions PHSP HSA Smartin Benefits

https://www.smartinbenefits.com/images/faq/data-claim-medical-expenses-personal-tax.png

How To Claim The Medical Expense Deduction On Your Taxes

https://cdn.aarp.net/content/dam/aarp/money/taxes/2019/03/1140-medical-expenses.jpg

Taxation Medical Expenses Sandycove Dental Care

http://sandycovedentalcare.ie/wp-content/uploads/2019/03/Screen-Shot-2019-03-28-at-13.20.15.jpg

Luckily you can recoup some of those costs when you file your taxes by taking a deduction for medical expenses To do so the expenses in question must meet the qualifications outlined by the IRS We ll show you how For 2023 tax returns filed in 2024 taxpayers can deduct qualified unreimbursed medical expenses that are more than 7 5 of their 2023 adjusted gross income The 7 5 threshold used to be 10

How To Claim Medical Expenses on Your Taxes To claim qualifying medical expenses on your tax return you ll need to complete Schedule A and file it with your Form 1040 The IRS allows all taxpayers to deduct their qualified unreimbursed medical care expenses that exceed 7 5 of their adjusted gross income You must itemize your deductions

Claiming Medical Expenses On Your Personal Income Tax Returns

https://www.dmtax.ca/wp-content/uploads/2022/12/medical-expenses.jpg

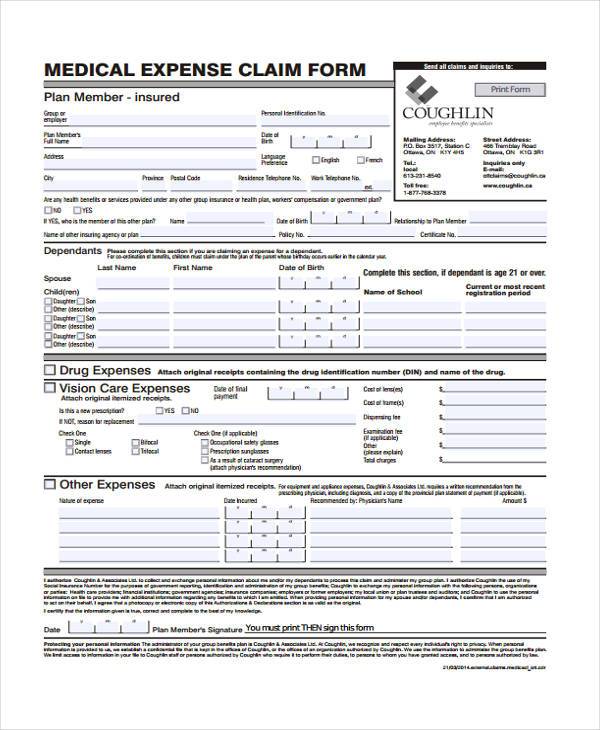

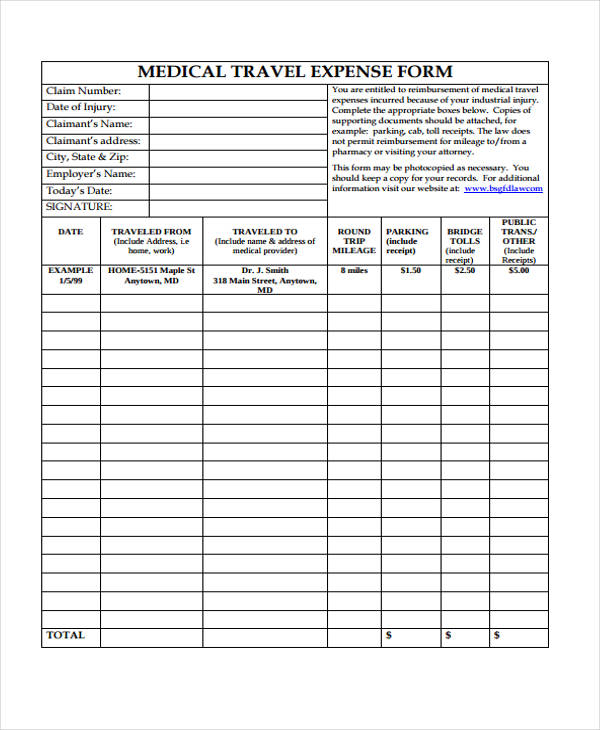

Can I Claim Medical Expenses Without Receipts

https://images.sampleforms.com/wp-content/uploads/2017/02/Medical-Expense-Claim-Form1.jpg

https://www.revenue.ie/en/personal-tax-credits...

You pay 700 in 2022 and the remaining 300 in 2023 You have two options when claiming tax relief for these health expenses Option 1 you can claim 1 000 for the 2022 tax year Option

https://www.ato.gov.au/.../tax-offsets/medical-expenses-tax-offset

The medical expenses tax offset was available from the 2015 16 to 2018 19 income years The offset is not available from 1 July 2019 You could claim the medical expenses tax offset for

CAOT BC Resource For Your Practice Claiming Medical Expenses On

Claiming Medical Expenses On Your Personal Income Tax Returns

Thousands Of Us Are Owed HUNDREDS In Tax Relief On Medical Expenses

Can I Claim Medical Expenses Without Receipts

Claiming Medical Expenses On Taxes An All Encompassing Guide For Tax

How To Claim Medical Expenses On Your 2022 Tax Return SARS EFiling

How To Claim Medical Expenses On Your 2022 Tax Return SARS EFiling

Claiming Medical Expenses On Your Personal Tax Return

Can I Claim Medical Expenses Without Receipts

Are You Claiming Medical Expenses On Tax Irish Life Health

Tax Claiming Medical Expenses - Medical expenses are deductible only to the extent the total exceeds 7 5 of your adjusted gross income AGI For example if you itemize your AGI is 100 000 and your total