Tax Code 0tm1 Rebate Under the 0T tax code you will be taxed on all of your income i e you won t receive your tax free personal allowance 163 12 570 for tax year 22 23 This could hit you right in the pocket and you could even be taxed up to 40 on all of your income if you fall into the higher earning bracket Afficher plus

Web Your tax code is used by your employer or pension provider to work out how much Income Tax to take from your pay or pension HM Revenue and Customs HMRC will tell them which code to use Web Tax codes made easy 0T 0T W1 and 0T M1 Nearly everyone is entitled to a tax free personal allowance which means that a certain amount of your earnings each year are paid to you without being taxed However 0T tax codes mean that you do not receive any

Tax Code 0tm1 Rebate

Tax Code 0tm1 Rebate

https://payadvicehome.files.wordpress.com/2019/06/img_0026-1.png

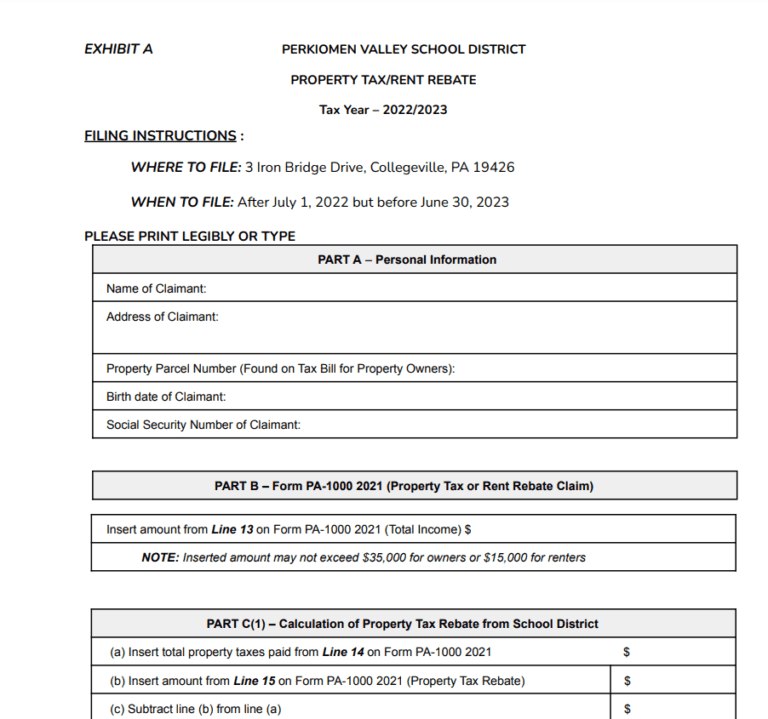

Property Tax Rebate Form For Seniors In Pa Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2022/11/PA-Property-Tax-Rebate-Form-768x719.png

Renters Rebate Form Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2021/07/Minnesota-Renters-Rebate-Form-2021.jpg

Web 0TM1 is a non cumulative and has no allowance meaning it should have been taxed at source edit correction edit This should have no effect on your current tax code or cumulative employment income as the tax code implies it was dealt with at source 0T Web 1 janv 2022 nbsp 0183 32 0T M1 Tax Code I ve just re located back to the UK after the several years of working aboard I ve received my first payslip this month and have been put on a 0T M1 Month 1 Tax Code I also received a bonus which pushed my monthly earnings into the

Web If you are a higher or additional rate taxpayer the 0T code imposes taxes at rates of 40 for higher rate and 45 for addtional rate Am I due an OT tax code tax rebate If you have had an OT tax code it s possible you will overpay income tax and be due a tax Web 11 oct 2022 nbsp 0183 32 An OT tax code indicates that you have no tax free personal allowance and the basic rate of 20 per cent will be applied for your tax deduction If you have been assigned this code in error you should inform the HMRC so that you are not overtaxed

Download Tax Code 0tm1 Rebate

More picture related to Tax Code 0tm1 Rebate

What Are The Best Ways To Manage Tax Rebates

https://bloggercreativa.com/wp-content/uploads/2022/08/Tax-Rebate-Calculator-2-scaled.jpg

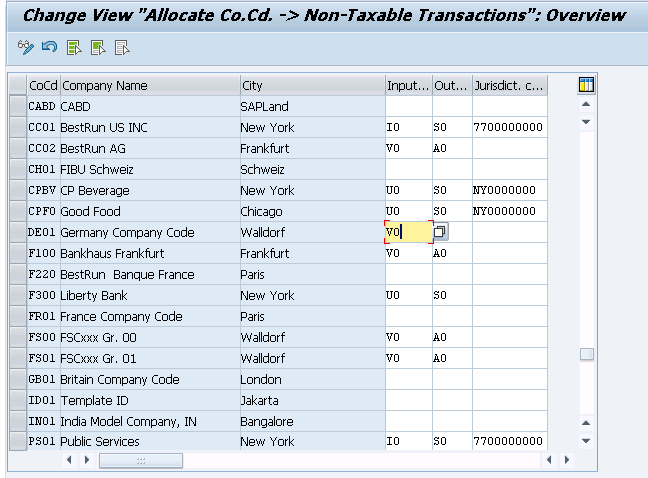

Assign Tax Codes For Non Taxable Transactions OBCL

https://etcircle.com/wp-content/uploads/2015/08/assign-tax-codes-for-non-taxable-transactions-obcl.png

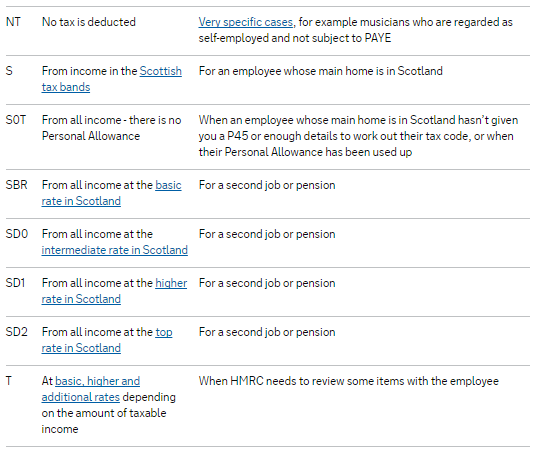

Tax Codes Overview BrightPay Documentation

https://documentation.thesaurussoftware.com/images/3460.png

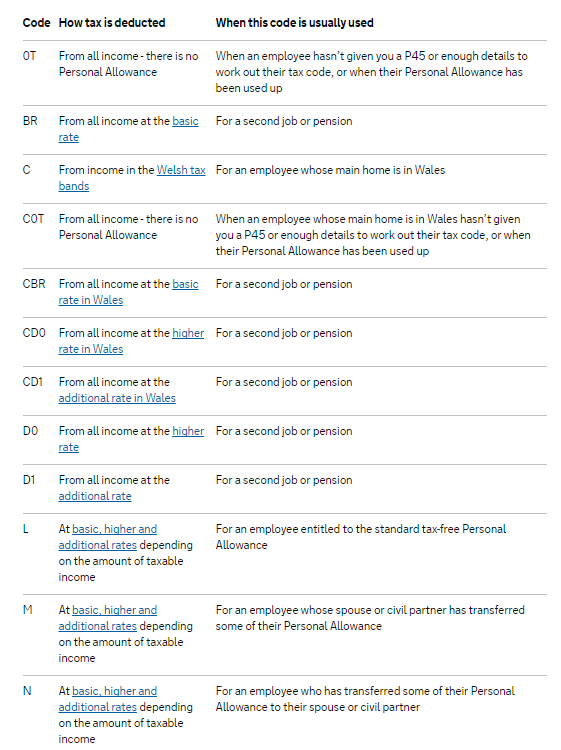

Web 21 lignes nbsp 0183 32 Code How tax is deducted When this code is usually used 0T From all income there is no Personal Allowance When an employee has not given you a P45 or enough details to work out their tax Web Ce convertisseur permet de calculer un prix toutes taxes comprises TTC 224 partir d un prix hors taxes HT et vice versa selon le taux de TVA applicable

Web 25 oct 2016 nbsp 0183 32 Tax code 0T M1 Bonus 163 8488 Hol Pay 163 356 18 PILON Notice period 163 6247 05 Redundancy 163 22 794 70 total 163 37 885 93 Taxed 163 5632 61 NI 163 365 92 Out of the above the Redundancy amount is tax free up to 163 30k so i should only be taxed on the Web Tax code 0T M1 My partner has recently started a new graduate job and had his first payslip today we ve noticed though that he s paying a lot more than expected on taxes and we saw he has the tax code 0T M1 a quick search saw that this means he s paying tax

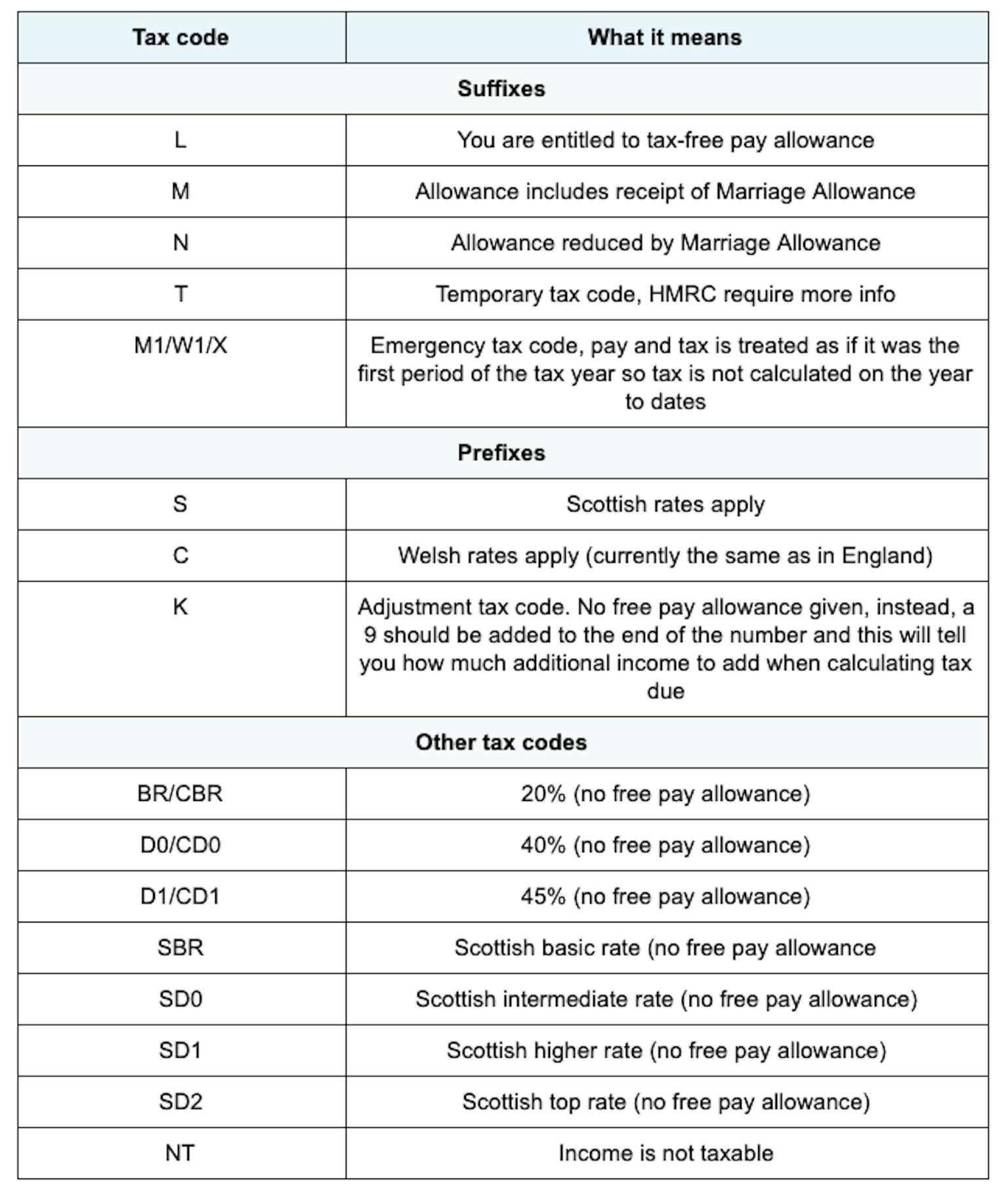

UK Tax Codes Explained 2022 Guide Raisin UK

https://cdn.raisin.co.uk/app/uploads/2022/03/uk_infographics_a_list_of_uk_codes-1.svg

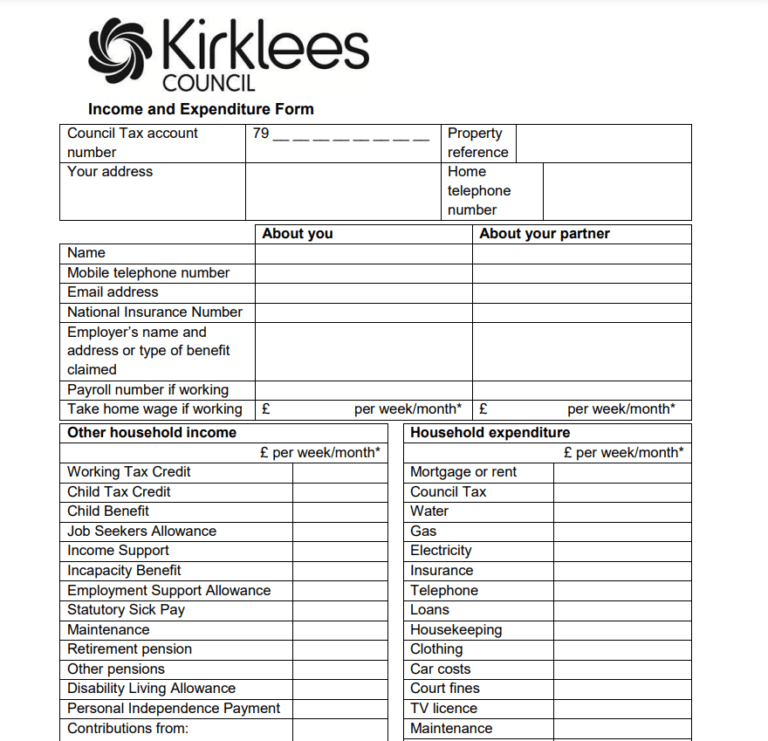

Council Tax Rebate Form Kirklees By Touch Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2022/10/Council-Tax-Rebate-Form-Kirklees-768x741.png

https://brianalfred.co.uk/guides/what-is-a-0t-tax-code

Under the 0T tax code you will be taxed on all of your income i e you won t receive your tax free personal allowance 163 12 570 for tax year 22 23 This could hit you right in the pocket and you could even be taxed up to 40 on all of your income if you fall into the higher earning bracket Afficher plus

https://www.gov.uk/tax-codes

Web Your tax code is used by your employer or pension provider to work out how much Income Tax to take from your pay or pension HM Revenue and Customs HMRC will tell them which code to use

Tax Codes Overview Brightpay Doentation

UK Tax Codes Explained 2022 Guide Raisin UK

2020 Form MN DoR M1 Fill Online Printable Fillable Blank PdfFiller

Form M1 Individual Income Tax Printable YouTube

Tulsa Sales Tax Rebate Form Fill Online Printable Fillable Blank

What s The New Tax Code For 2018 What Does 1185L Mean And How Do I

What s The New Tax Code For 2018 What Does 1185L Mean And How Do I

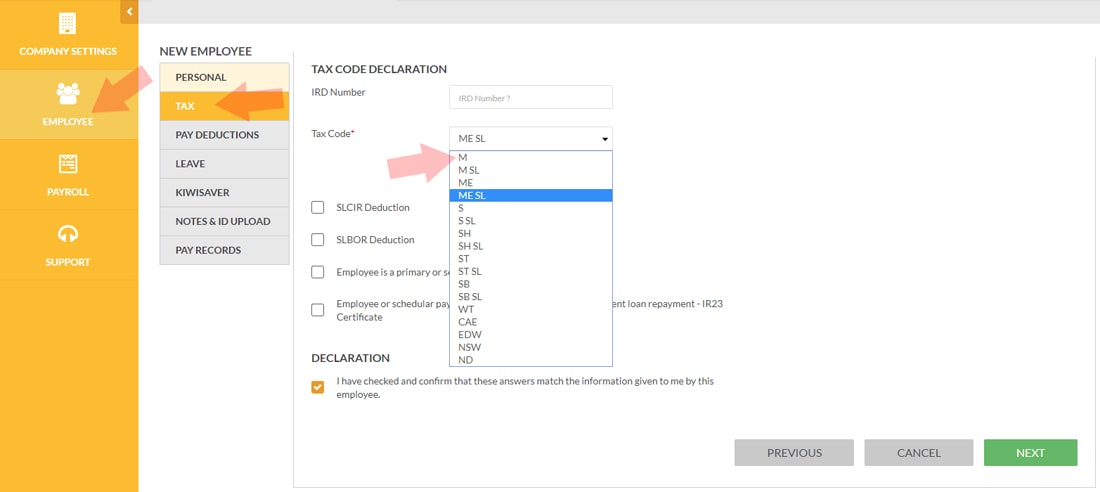

Primary Tax Code M Your Payroll NZ

Income Tax What s It All About

Luxury Car Tax Australia Only MYOB AccountRight MYOB Help Centre

Tax Code 0tm1 Rebate - Web 11 oct 2022 nbsp 0183 32 An OT tax code indicates that you have no tax free personal allowance and the basic rate of 20 per cent will be applied for your tax deduction If you have been assigned this code in error you should inform the HMRC so that you are not overtaxed