Tax Credit And Tax Rebate Web The IRS says that tax credits can reduce the amount of tax you owe or increase your tax refund They are different from deductions which reduce your taxable income Tax

Web One of the biggest differences between tax credits and rebates is the frequency with which they occur Every year the tax code contains several credits that taxpayers can Web The IRS is working on implementing the Inflation Reduction Act of 2022 This major legislation will affect individuals businesses tax exempt and government entities Many

Tax Credit And Tax Rebate

Tax Credit And Tax Rebate

https://blog.constellation.com/wp-content/uploads/2017/01/tax-credits-rebates-homeowners-guide.png

How To Claim Missing Stimulus Money On Your 2020 Tax Return In 2021

https://i.pinimg.com/originals/c5/01/7b/c5017b88440e5203d6056b3107d8882f.png

What Is Rebate Under Section 87A For AY 2020 21 Financial Control

https://financialcontrol.in/wp-content/uploads/2018/06/Difference-between-exemption-and-deduction-and-rebate-626x1024.png

Web 17 f 233 vr 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal Web 13 janv 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal

Web 20 d 233 c 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund You will need the total amount of your third Economic Web 17 ao 251 t 2022 nbsp 0183 32 The first and second rounds of Economic Impact Payments were advance payments of the 2020 Recovery Rebate Credit claimed on a 2020 tax return They were issued in 2020 and early 2021 The third

Download Tax Credit And Tax Rebate

More picture related to Tax Credit And Tax Rebate

Recovery Rebate Credit On 2021 Tax Return Could Help Get Missed COVID

https://dontmesswithtaxes.typepad.com/.a/6a00d8345157c669e20282e140c0ca200b-800wi

Pin On Tigri

https://i.pinimg.com/originals/10/8d/67/108d67ba03bfbe29e6cc964fb355f5ea.jpg

Federal Tax Rebates Electric Vehicles ElectricRebate

https://www.electricrebate.net/wp-content/uploads/2022/09/rebates-and-tax-credits-for-electric-vehicle-charging-stations-2.jpg

Web 2020 Recovery Rebate Credit Must file a 2020 tax return to claim if eligible Get My Payment When your Third Economic Impact Payment is scheduled find when and how Web Brenda s 4 000 tax credit resulted in a final tax bill that was 3 280 less than Andrew s Deductions are great Credits are even better What is a tax refund If you earn income

Web A tax credit is a dollar for dollar reduction in the amount of income tax you would otherwise owe You claim a tax credit as part of your annual tax return So if you make a Web 1 d 233 c 2022 nbsp 0183 32 OVERVIEW Tax rebates encourage taxpayers to make certain types of purchases or to stimulate a flagging economy quickly by getting cash into consumers

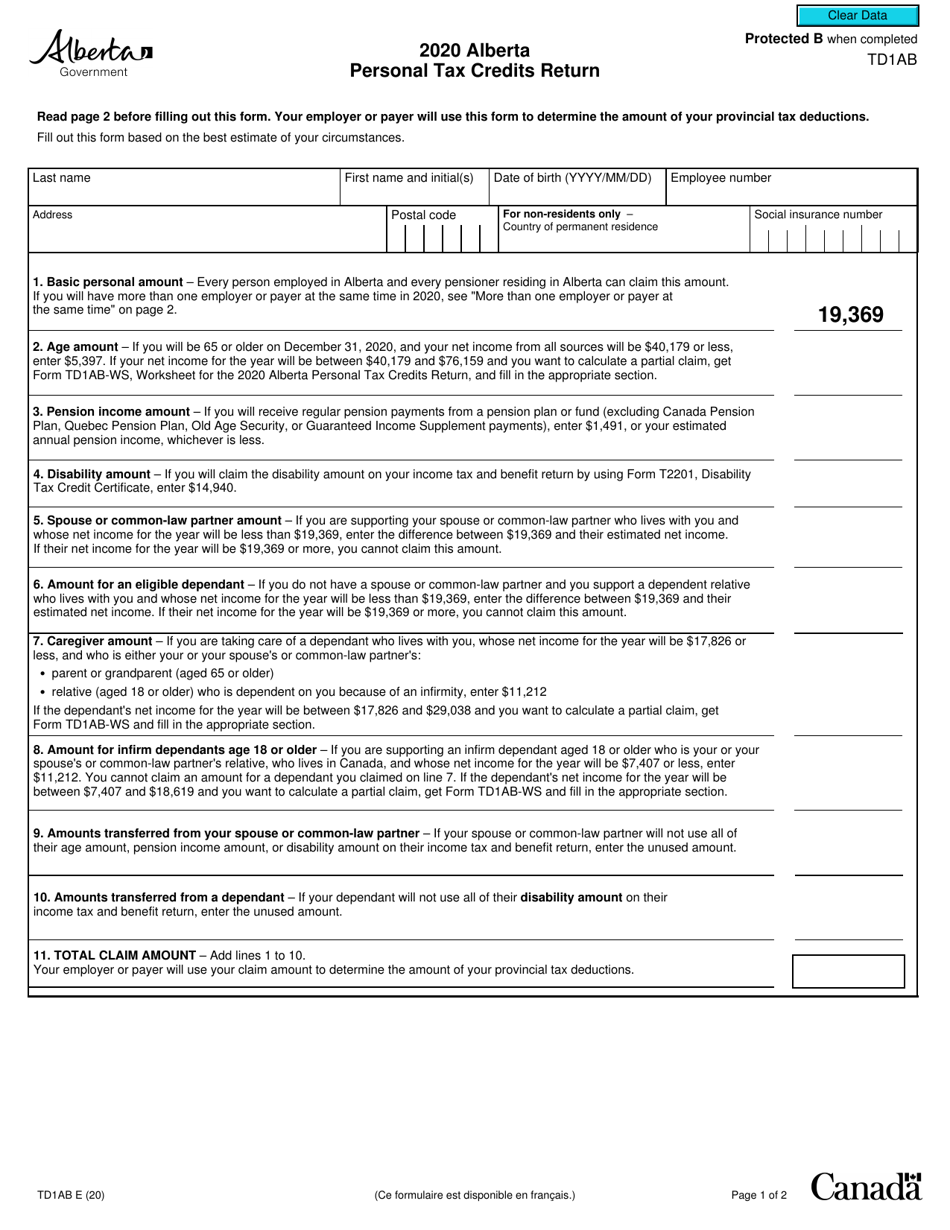

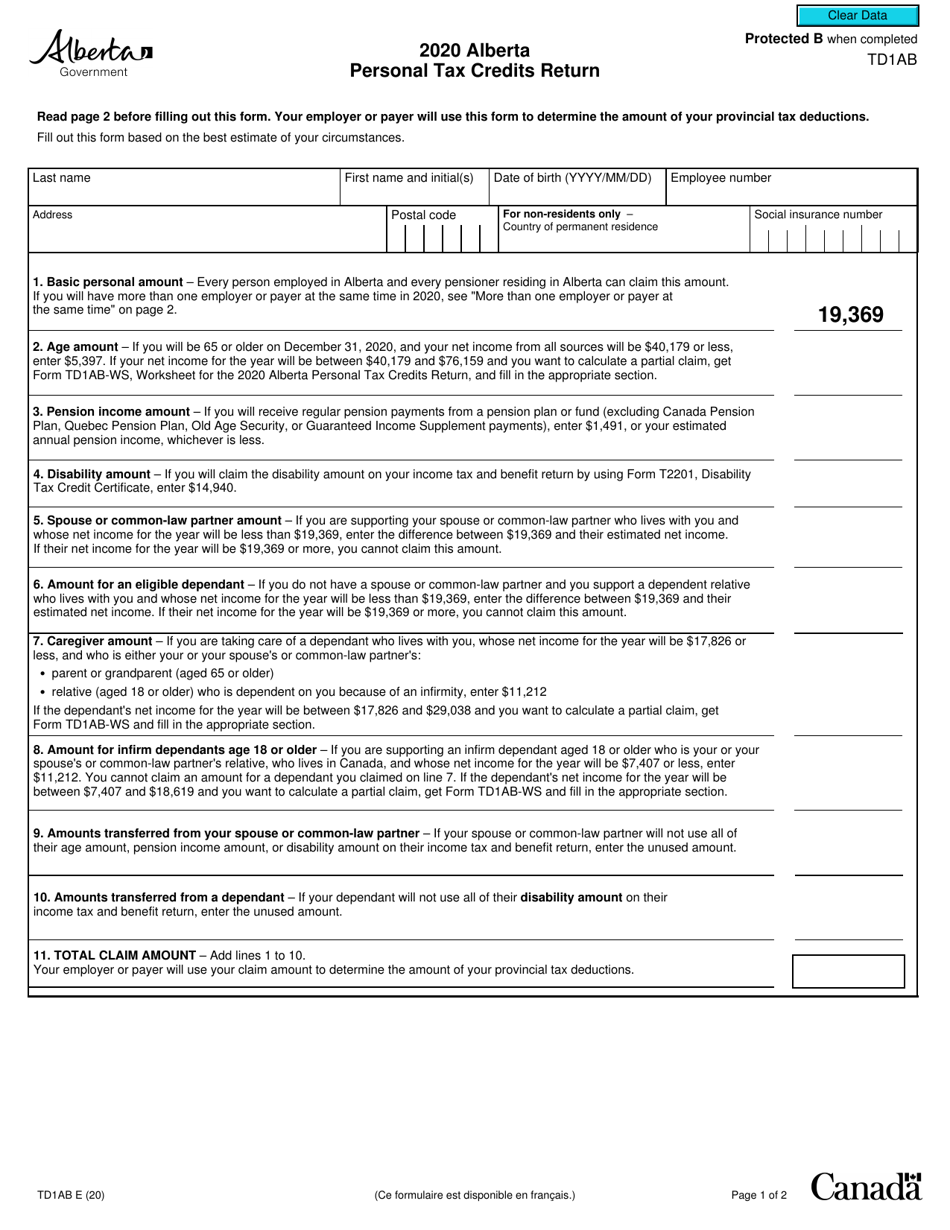

Form TD1AB 2020 Fill Out Sign Online And Download Fillable PDF

https://data.templateroller.com/pdf_docs_html/2031/20312/2031287/form-td1ab-personal-tax-credits-return-canada_print_big.png

Filing Your 2008 Taxes With The Economic Stimulus Recovery Rebate Credit

http://www.consumerismcommentary.com/wp-content/uploads/2009/01/recovery-rebate-credit-1040.jpg

https://www.bpihomeowner.org/blog/understanding-difference-between...

Web The IRS says that tax credits can reduce the amount of tax you owe or increase your tax refund They are different from deductions which reduce your taxable income Tax

https://www.sapling.com/7884940/tax-credit-vs-rebate

Web One of the biggest differences between tax credits and rebates is the frequency with which they occur Every year the tax code contains several credits that taxpayers can

Ready To Use Recovery Rebate Credit 2021 Worksheet MSOfficeGeek

Form TD1AB 2020 Fill Out Sign Online And Download Fillable PDF

Taking Advantage Of HVAC Rebates Federal Tax Credits With An

4 TAX REBATE U s 87A New TAX REBATE EXAMPLES Income Tax

4 4 Stimulus Calculator And Everything You Need To Know About The New

How To Calculate Tax Rebate On Home Loan Grizzbye

How To Calculate Tax Rebate On Home Loan Grizzbye

2007 Tax Rebate Tax Rebates Taxes History Deduction

National Budget Speech 2022 SimplePay Blog

Do Home Owners Qualify For Rental Credit Cmdesignstyle

Tax Credit And Tax Rebate - Web 5 mars 2009 nbsp 0183 32 Generally speaking tax credits only offset tax balances due meaning if you have low income and owe nothing in tax you get no benefit from a credit