Tax Credit Check 2022 FS 2022 14 March 2022 This Fact Sheet provides frequently asked questions FAQs for Tax Year 2021 Earned Income Tax Credit More people without children now qualify

File your taxes to get your full Child Tax Credit now through April 18 2022 Get help filing your taxes and find more information about the 2021 Child Tax Credit Prepare accurate tax returns for people who claim certain tax credits such as the Earned Income Tax Credit EITC Helps low to moderate income workers and families get a tax break Child Tax Credit Credit for Other

Tax Credit Check 2022

Tax Credit Check 2022

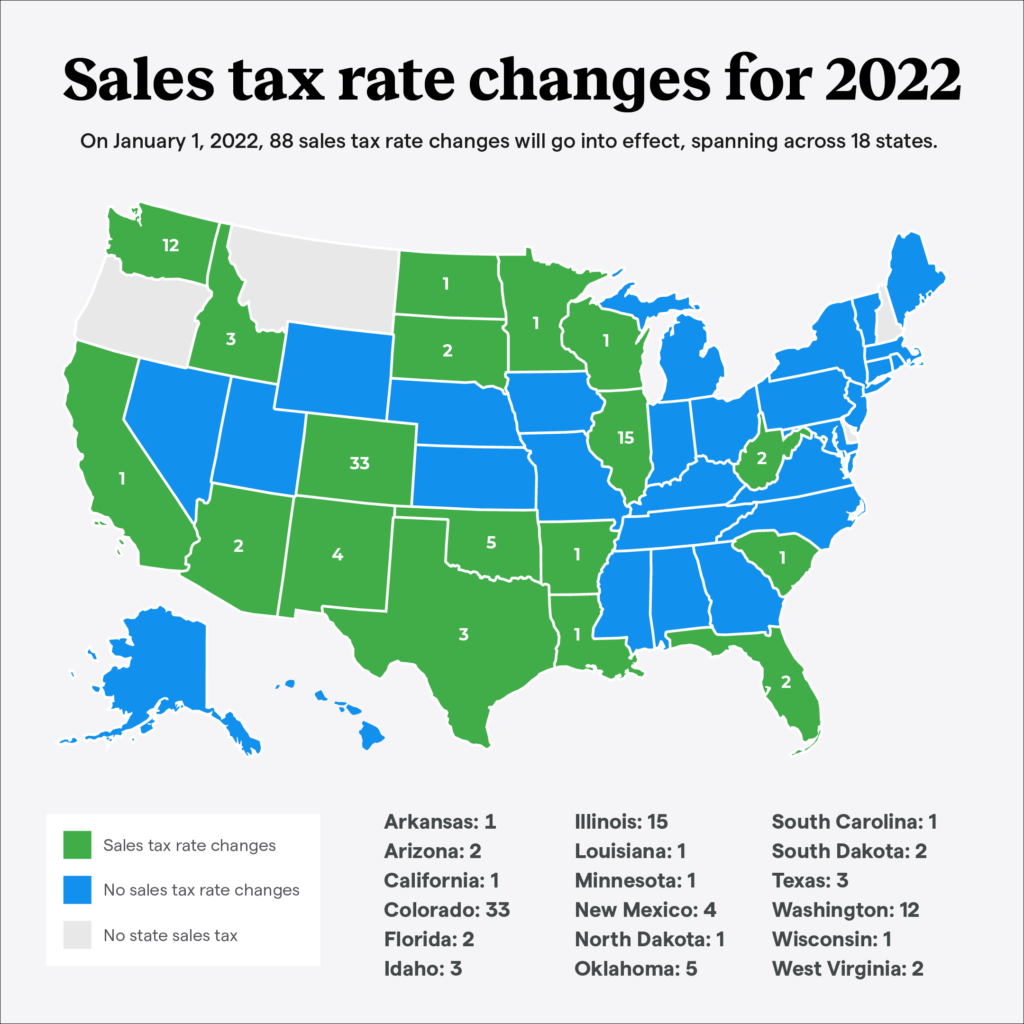

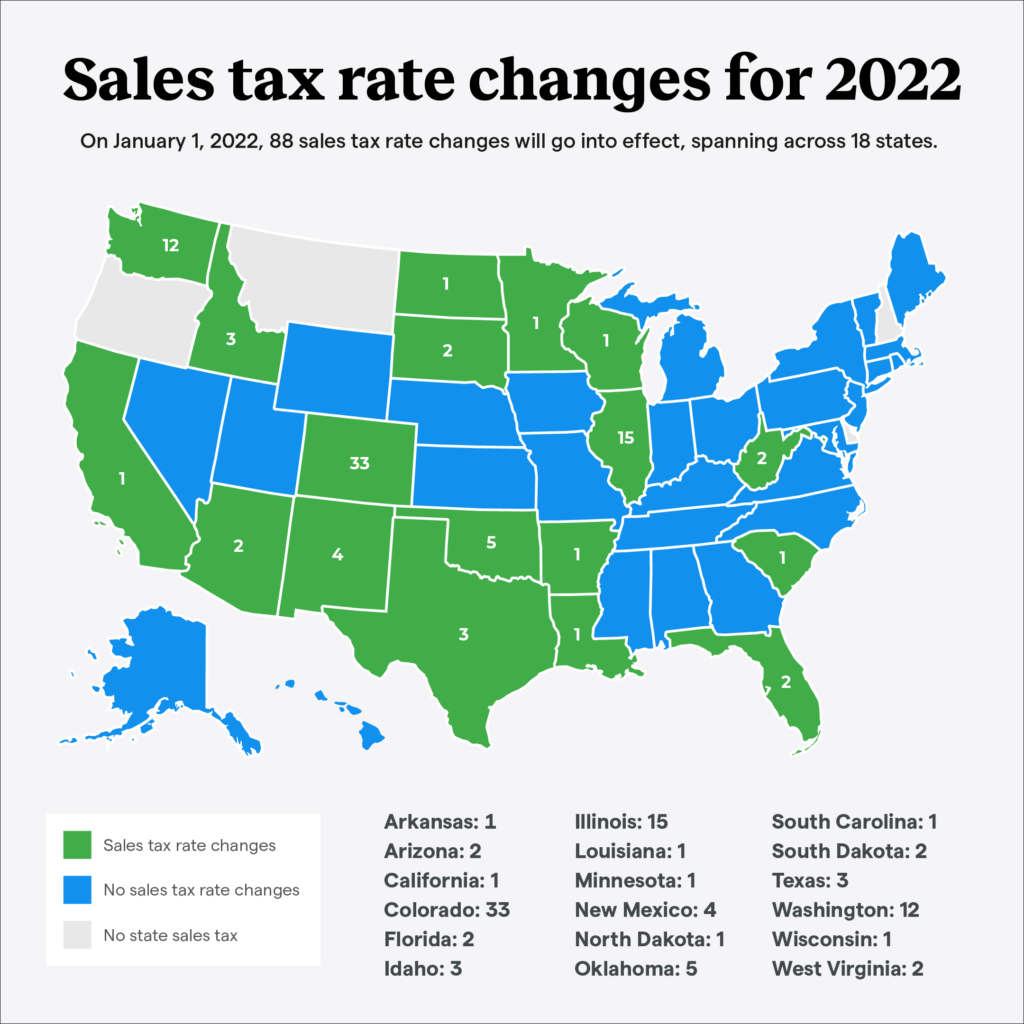

https://www.taxjar.com/wp-content/uploads/[email protected]

1 5 News 2022

https://lysa.book.fr/files/1/65011/g_30_zkBH1Pyfby.jpg

Here Are The Cars Eligible For The 7 500 EV Tax Credit In The

https://www.autopromag.com/usa/wp-content/uploads/2022/08/EV-Federal-Tax-Credits-5MgJUp.jpeg?is-pending-load=1

Consumer Reports details the list of 2023 and 2024 model year electric vehicles and plug in hybrids that qualify for federal tax credits of up to 7 500 under the Inflation Reduction Act The Child Tax Credit is one of the nation s strongest tools to provide tens of millions of families with some support and breathing room while raising children It has also being shown to be

A tax credit is an amount of money that you can subtract dollar for dollar from the income taxes you owe Find out if tax credits can save you money There s new hope the monthly child tax credit payments of up to 300 per month can be renewed Here s how those checks may be different

Download Tax Credit Check 2022

More picture related to Tax Credit Check 2022

Summer 2023 Newsletter A S Federal Credit Union

https://asfederal.org/wp-content/uploads/2022/05/2022-A-S-Logo_no-background.jpg.png

https://hesabdarema.com/wp-content/uploads/2022/04/Tax-credit.jpg

Credit Check

https://www.eonfinancial.us/storage/user-images/128/056f7b7b-bfef-4cf0-ad8e-ac4f987686fd.png

Here are some questions and answers about the expanded child tax credit and the 2022 tax filing season Will everyone eligible for the child tax credit get a letter For tax year 2022 the child tax credit is 2 000 per child under 17 who s claimed on your tax return as a dependent Last year the credit was bumped up to 3 000 per child 3 600 per

This tax season anyone aged 19 or older who earned money last year and who is not a full time student can claim the expanded credit Here s how long it will take IR 2021 255 December 22 2021 The Internal Revenue Service announced today that it will issue information letters to Advance Child Tax Credit recipients starting in

Tax Credit Universal Credit Impact Of Announced Changes House Of

https://commonslibrary.parliament.uk/wp-content/uploads/2015/11/IDS.jpg

Pricing Tax Credit Community

https://taxcreditcommunity.com/wp-content/uploads/2022/03/Tax_Credit_final_logo_colour_blue_background-03.png

https://www.irs.gov/newsroom/irs-issues-questions...

FS 2022 14 March 2022 This Fact Sheet provides frequently asked questions FAQs for Tax Year 2021 Earned Income Tax Credit More people without children now qualify

https://home.treasury.gov/.../child-tax-credit

File your taxes to get your full Child Tax Credit now through April 18 2022 Get help filing your taxes and find more information about the 2021 Child Tax Credit

File Credit cards jpg Wikimedia Commons

Tax Credit Universal Credit Impact Of Announced Changes House Of

Trademark Status Search Online Sales Save 60 Jlcatj gob mx

22 Questions Answered For 2022 Tax Filing Emerald Advisors

New Tax Credit To Fully Offset The Cost For Small Businesses Who

Vol 2 No 1 2021 Tax And Business Journal Jurnal Pajak Dan Bisnis

Vol 2 No 1 2021 Tax And Business Journal Jurnal Pajak Dan Bisnis

Here You Can Easily Short Out Your Fiscal Issues With The Simple And

Sample Background And Credit Check Authorization Form How To Create A

Why You Should Treat Business Security Like A Credit Check FITTS

Tax Credit Check 2022 - Find out how much and when you ll be paid It s quicker and easier to manage your tax credits online than over the phone