Tax Credit Check October 2022 Families will see the direct deposit payments in their accounts starting October 15 Like the prior payments the vast majority of families will receive them by direct deposit

COVID Tax Tip 2022 166 October 31 2022 More than nine million people may qualify for tax benefits but didn t claim them by filing a 2021 federal income tax return Many in this group October 19 2022 at 7 00 a m EDT With rent food prices and utility bills up many families could use some extra cash Inflation is stressing people s budgets big time If you re struggling

Tax Credit Check October 2022

Tax Credit Check October 2022

https://ajmtax.co.za/wp-content/uploads/2021/02/pexels-pixabay-128867.jpg

Child Tax Credit 2022 When Is The IRS Releasing Refunds With CTC Marca

https://phantom-marca.unidadeditorial.es/988259e034d1160741cebb5cc94b0719/resize/1320/f/jpg/assets/multimedia/imagenes/2021/12/18/16398410536614.jpg

What To Know When Filing Your 2022 Tax Return From JustAnswer Tax Experts

https://www.justanswer.com/blog/sites/blog/files/marketing_blog/images/Tax blog post.jpg

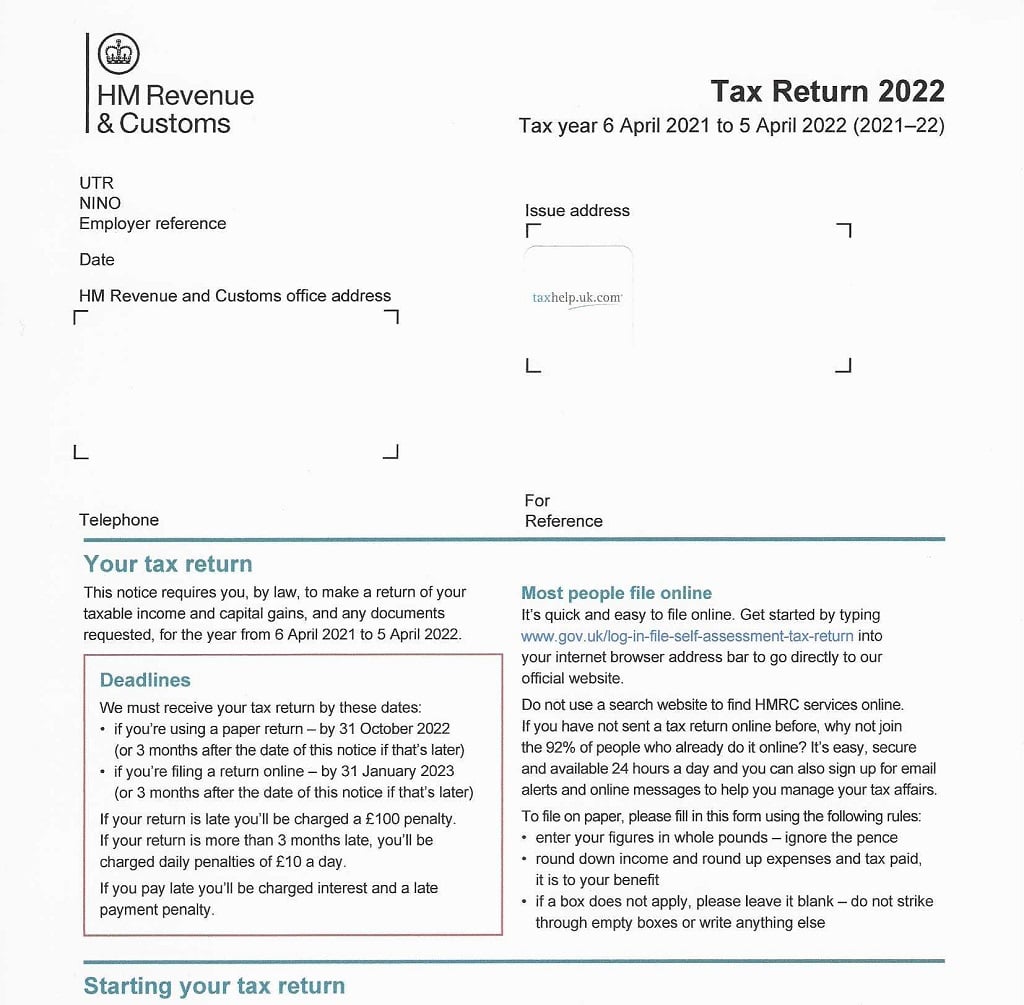

Individuals with income below 12 500 and couples with a joint income below 25 000 may be able to file a simple tax return to claim the missing stimulus payment and Child Tax Credit Find out how much and when you ll be paid It s quicker and easier to manage your tax credits online than over the phone

Guidance on getting extra payments to help with the cost of living from 2022 to 2024 if you were entitled to certain benefits or tax credits Tax Benefits of the Child Tax Credit October 2022 Individual Taxes Revenue Tables T22 0124 Tax Expenditure for the Child Tax Credit billions 2022 25 Aggregate

Download Tax Credit Check October 2022

More picture related to Tax Credit Check October 2022

Your Handy Tax Checklist 2022 CGH Accounting

https://cghaccounting.com.au/wp-content/uploads/2022/06/tax_checklist.jpg

What Is The Phase out For Child Tax Credit And How Does It Affects Your

https://www.the-sun.com/wp-content/uploads/sites/6/2022/03/kc-child-tax-credit-check-plat.jpg?w=1440

Tax Prep Checklist Tracker Printable Tax Prep 2022 Tax Etsy Australia

https://i.etsystatic.com/31990504/r/il/22f689/3639280950/il_fullxfull.3639280950_fitj.jpg

Find out when your tax credits payment is and how much you ll get paid Tax credit payments are made every week or every 4 weeks The first enhanced payment was made in October 2022 Additional affordability credits were made in January 2023 and April 2023 If you weren t eligible for the tax credit in July 2022 due to your income you may be eligible

Millions of dollars in tax relief checks will be hitting mailboxes in the coming weeks for New Yorkers who are eligible for the Empire State Child Credit or the Earned Income The fuel tax credit calculator is the easiest way to help you work out the fuel tax credit amount to report on your business activity statement BAS adjustments for fuel tax

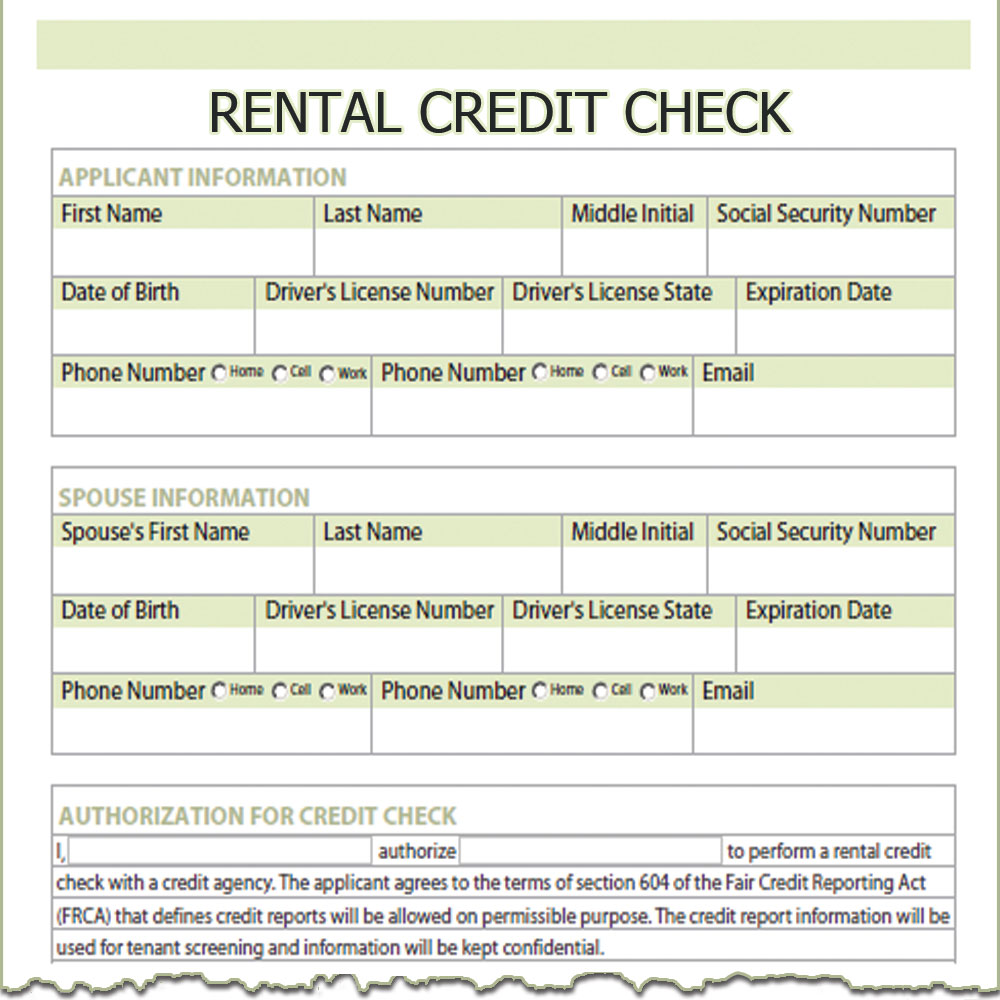

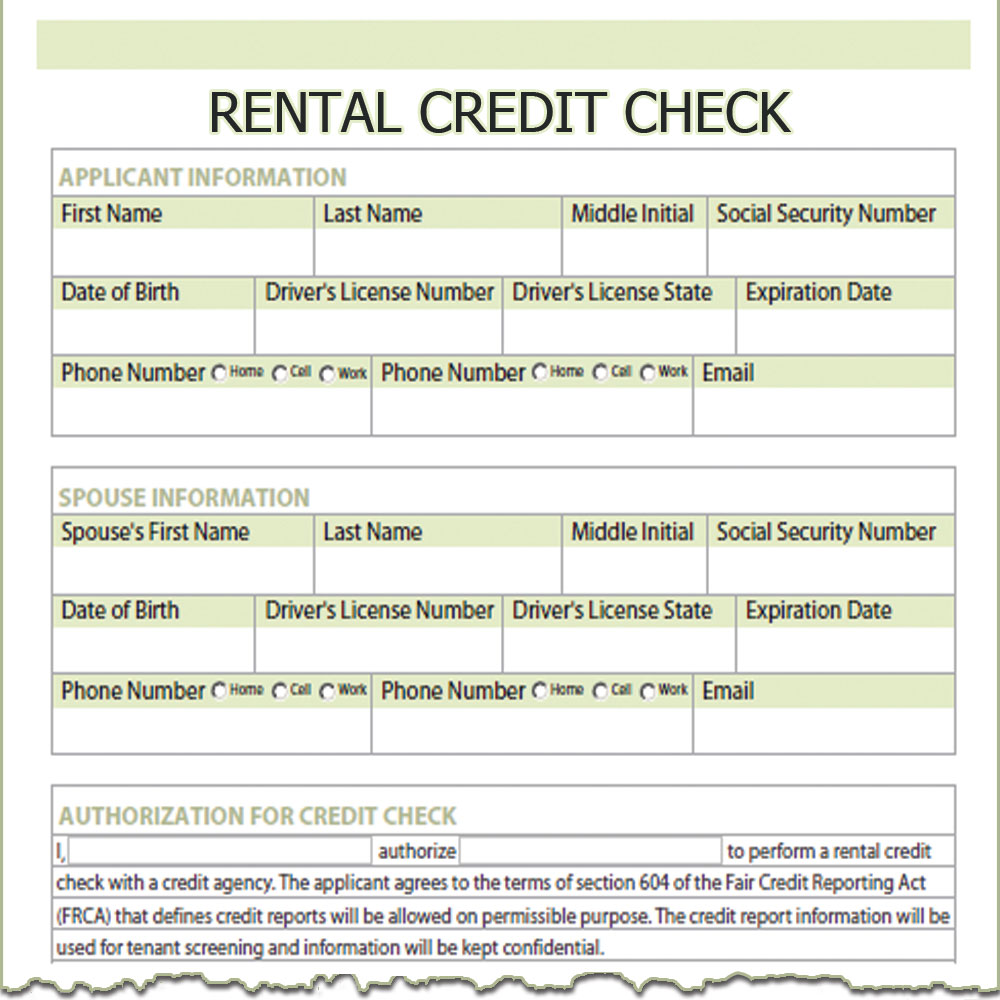

Rental Credit Check

https://www.simplifyem.com/forms/download/rental_credit_check.jpg

No Credit Check Credit Cards Instant Approval Australia

https://loanbubble.com.au/wp-content/uploads/2021/03/CRedit-Cards.jpg

https://www.irs.gov/newsroom/irs-families-now...

Families will see the direct deposit payments in their accounts starting October 15 Like the prior payments the vast majority of families will receive them by direct deposit

https://www.irs.gov/newsroom/tax-tips-for-october-2022

COVID Tax Tip 2022 166 October 31 2022 More than nine million people may qualify for tax benefits but didn t claim them by filing a 2021 federal income tax return Many in this group

Here Are The Cars Eligible For The 7 500 EV Tax Credit In The

Rental Credit Check

How To Fill TD1 2022 Personal Tax Credits Return Form Federal YouTube

Tax Extension 2022 AislingTyler

The 2022 Paper Tax Return

New 2022 IRS Income Tax Brackets And Phaseouts For Education Tax Breaks

New 2022 IRS Income Tax Brackets And Phaseouts For Education Tax Breaks

Tax Time Already 2022 Tax Deductions For Homeowners A COVID Rebate

ITR Filing 2022 What Are The Disadvantages Of Filing Income Tax Return

Child Tax Credit 2022 Still Time To Collect 3 600 Credit See How

Tax Credit Check October 2022 - Check Tax Credits Payment Online Setting up a personal tax account with HMRC has several benefits You will be able to check the amount of your next tax credits payment and how often