Tax Credit Eligibility A tax credit is an amount taxpayers claim on their tax return generally to reduce their income tax Eligible taxpayers can use them to potentially reduce their tax bill and increase their refund Refundable vs nonrefundable tax credits Some tax

A tax credit is an amount of money that you can subtract dollar for dollar from the income taxes you owe Find out if tax credits can save you money A tax credit is a benefit that lowers your taxes owed by the amount of the credit Tax credits can be nonrefundable refundable or partially refundable

Tax Credit Eligibility

Tax Credit Eligibility

https://i2.wp.com/static.twentyoverten.com/5afae91ee233a94fd2b8b963/AyQa5SwvUG/1616431432591.png

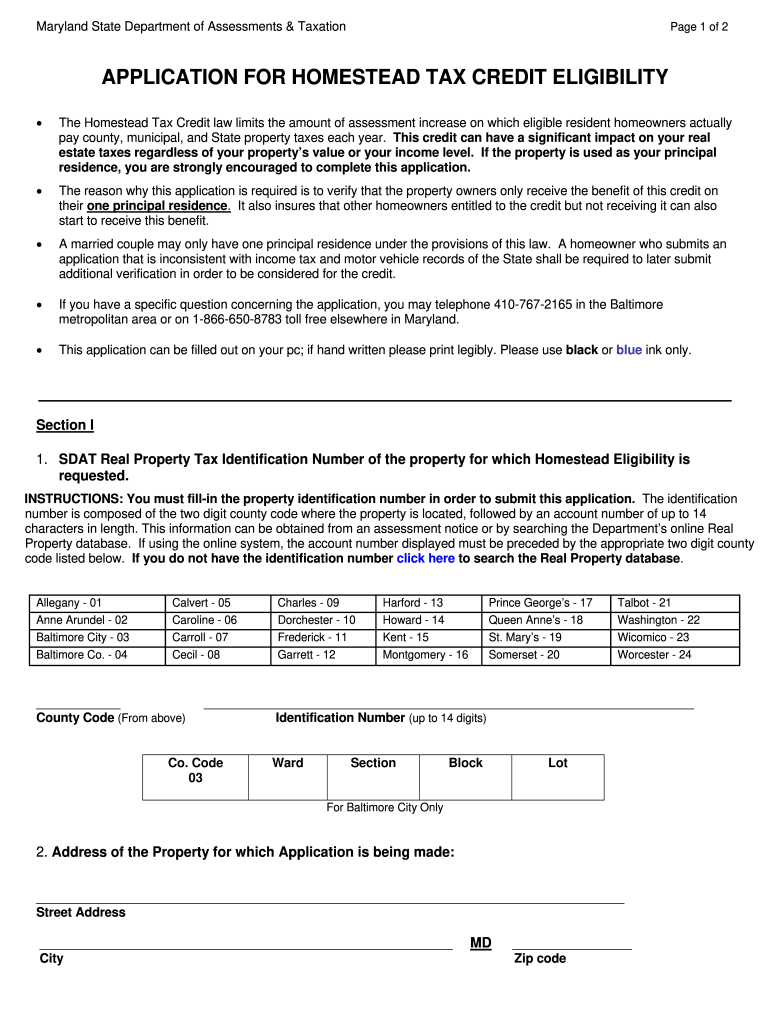

Baltimore City Homestead Tax Credit Form Fill Out And Sign Printable

https://www.signnow.com/preview/0/291/291671/large.png

What The New Child Tax Credit Could Mean For You Now And For Your 2021

https://cdn.newswire.com/files/x/32/c9/0bc29c33e2af4d42f581fad9e660.png

Working Tax Credit how much money you get hours you need to work eligibility claim tax credits when you stop work or go on leave If you have low to moderate income the earned income tax credit can give you a substantial financial boost Your eligibility can change from year to year so it s a good idea to use the EITC Assistant to find out if you qualify

The 2023 earned income tax credit is claimed on taxes that were due April 15 2024 or are due Oct 15 2024 with an extension You can get benefits and other financial support if you re eligible This tool does not include all the ways you can get help with living costs It will be updated with more types of support

Download Tax Credit Eligibility

More picture related to Tax Credit Eligibility

Setc tax Credit Eligibility 1099 Expert

https://1099.expert/wp-content/uploads/2023/12/image-title-Generate-high-resolution-45434.png

ITC Rules Under GST 2021 Guide On Types Conditions Eligibility

https://mybillbook.in/blog/wp-content/uploads/2021/03/input-tax-credit-under-gst.png

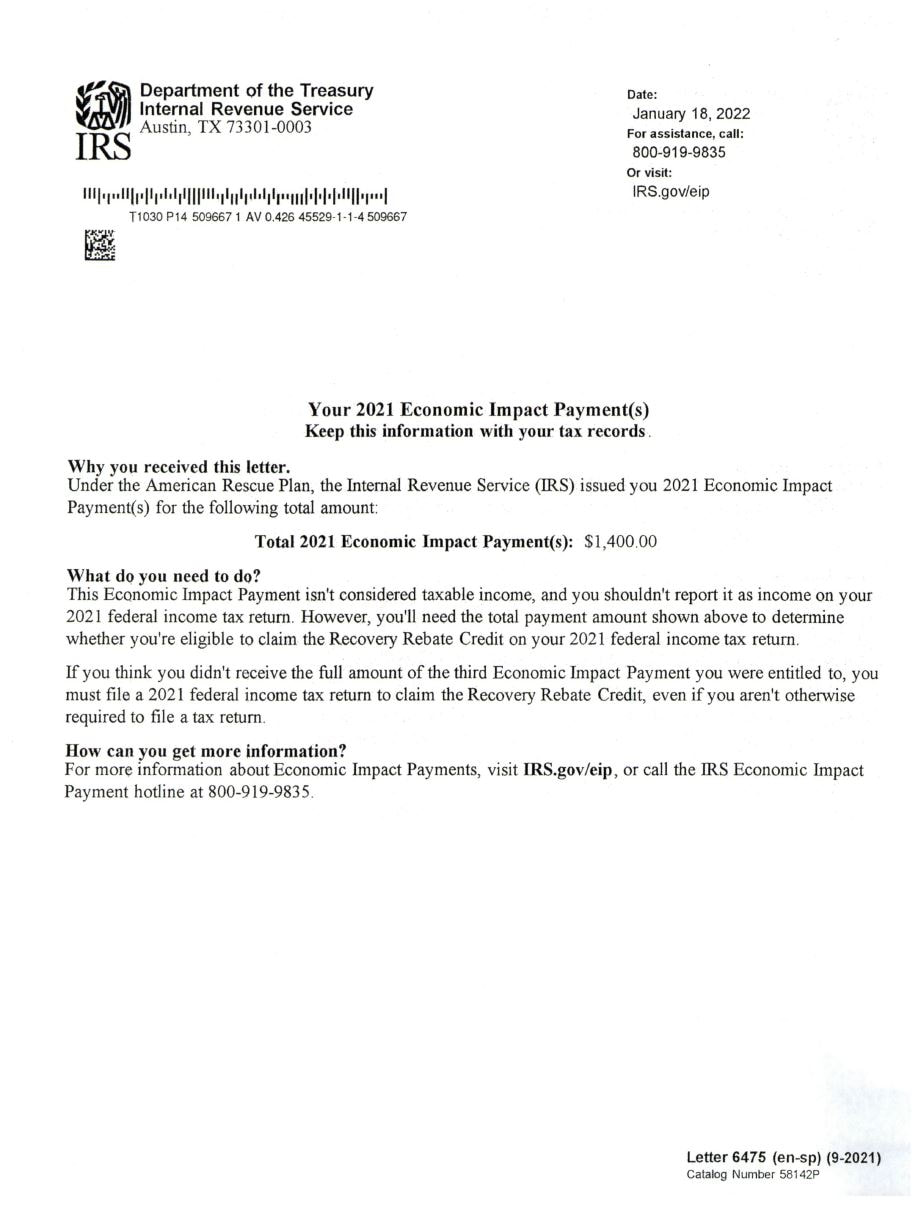

Tax Credit Letters Additional Information

https://www.masonrich.com/uploads/3/8/3/6/38361657/ltr-6475_orig.jpg

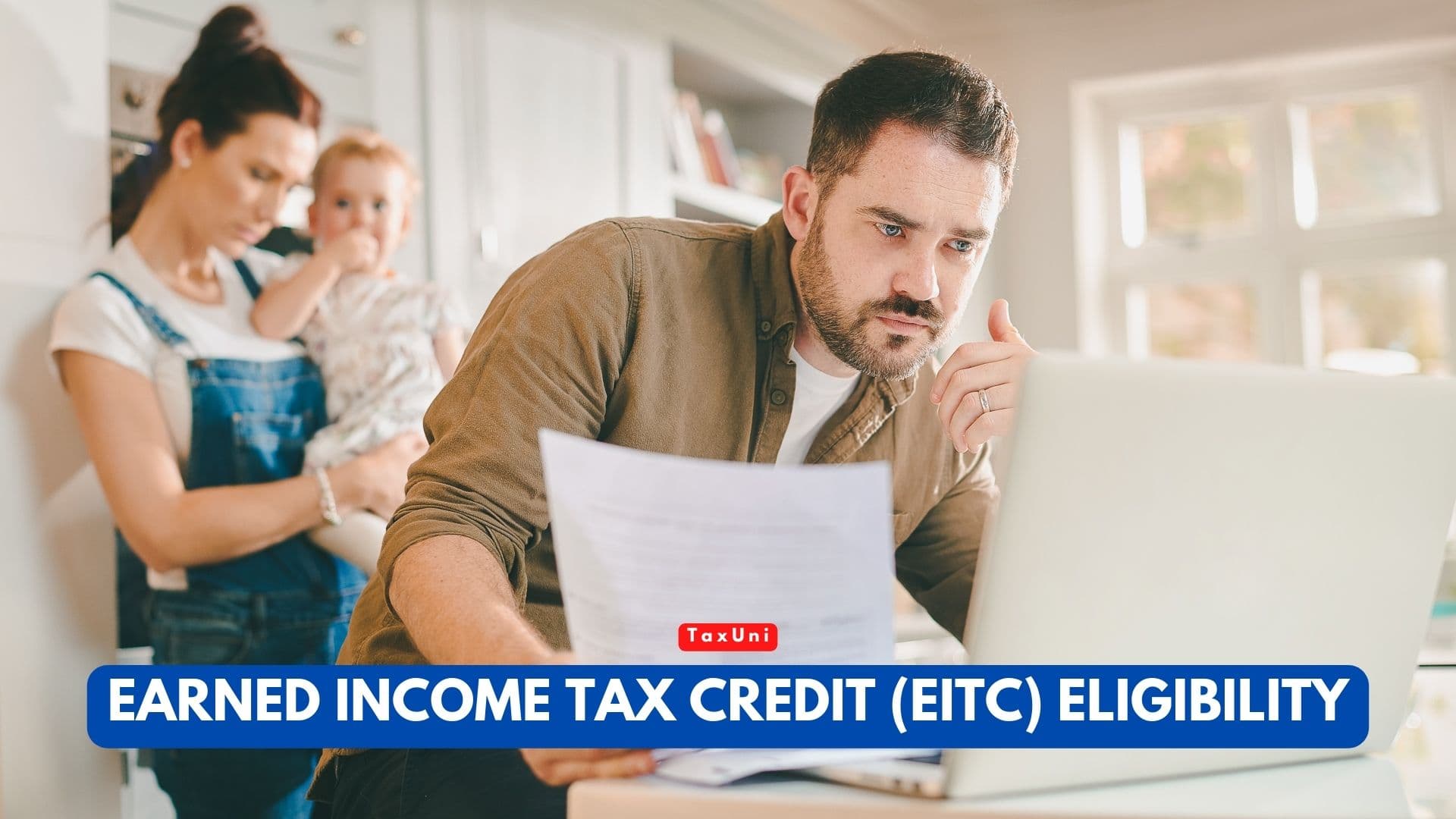

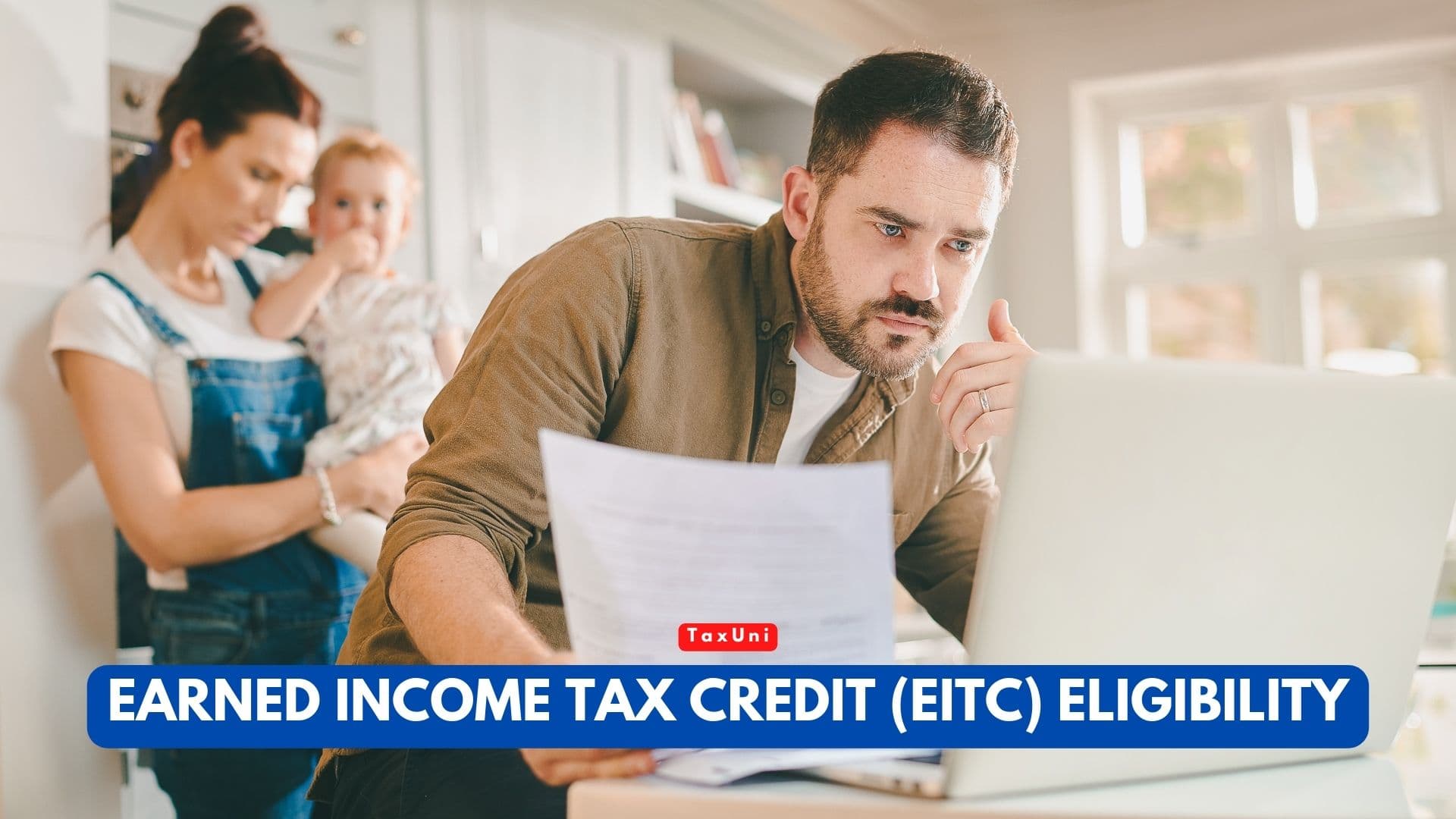

Find if you qualify for the Earned Income Tax Credit EITC with or without qualifying children or relatives on your tax return Low to moderate income workers with qualifying children may be eligible to claim the Earned Income Tax Credit EITC if certain qualifying rules apply to them What are tax credits Tax credits reduce the amount of tax you pay What are tax reliefs Tax reliefs reduce the amount of income that you pay tax on The tax credits and reliefs you are entitled to depend on your personal circumstances

[desc-10] [desc-11]

Update To List Of Eligible EVs Electric Vehicles For The Clean

https://i0.wp.com/alloysilverstein.com/wp-content/uploads/2022/09/Clean-Vehicle-Credit-2022.png?resize=800%2C1200&ssl=1

Do I Qualify For Working Tax Credit Eligibility Explained FNTalk

https://fntalk.com/wp-content/uploads/2021/05/Do-I-qualify-for-Working-Tax-Credit-Eligibility-explained-750x400.jpg

https://www.irs.gov/newsroom/tax-credits-for...

A tax credit is an amount taxpayers claim on their tax return generally to reduce their income tax Eligible taxpayers can use them to potentially reduce their tax bill and increase their refund Refundable vs nonrefundable tax credits Some tax

https://www.investopedia.com/terms/t/taxcredit.asp

A tax credit is an amount of money that you can subtract dollar for dollar from the income taxes you owe Find out if tax credits can save you money

Usda Loan Eligibility Map Florida Printable Maps

Update To List Of Eligible EVs Electric Vehicles For The Clean

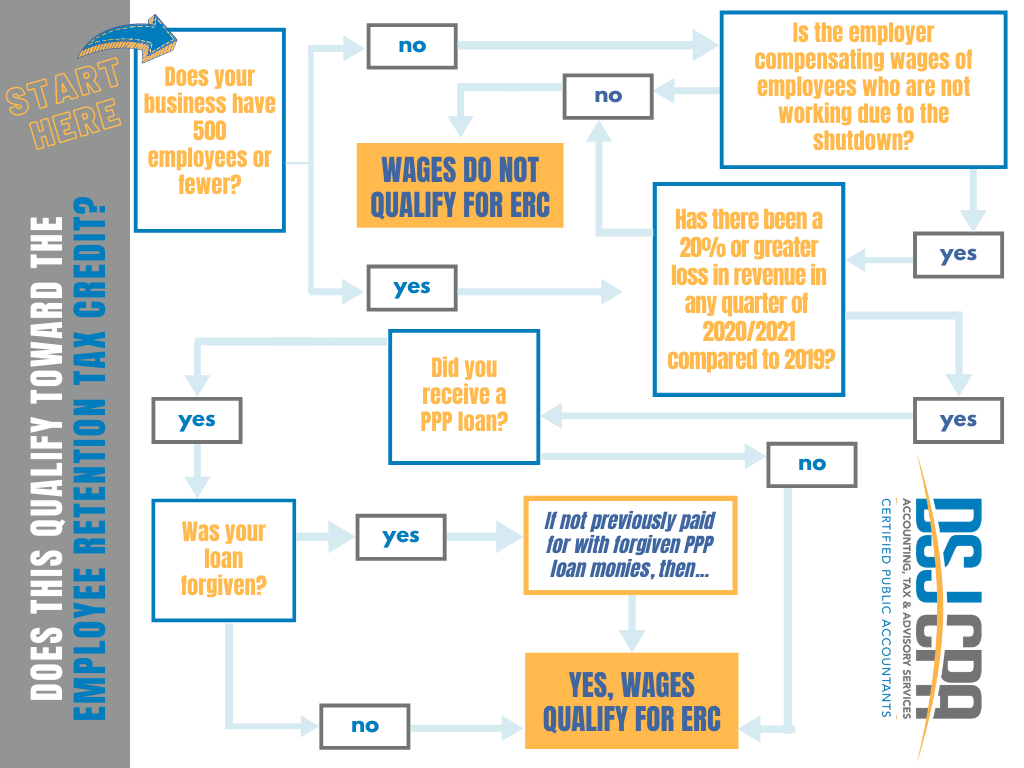

Employee Retention Tax Credit Eligibility A Step By Step Guide DSJ

Earned Income Tax Credit All It s Details AOTAX COM

Child Tax Credit Eligibility Checker Internal Revenue Code Simplified

Earned Income Tax Credit EITC Eligibility

Earned Income Tax Credit EITC Eligibility

Tax Credit Eligibility For Having An Electric Vehicle Has Many

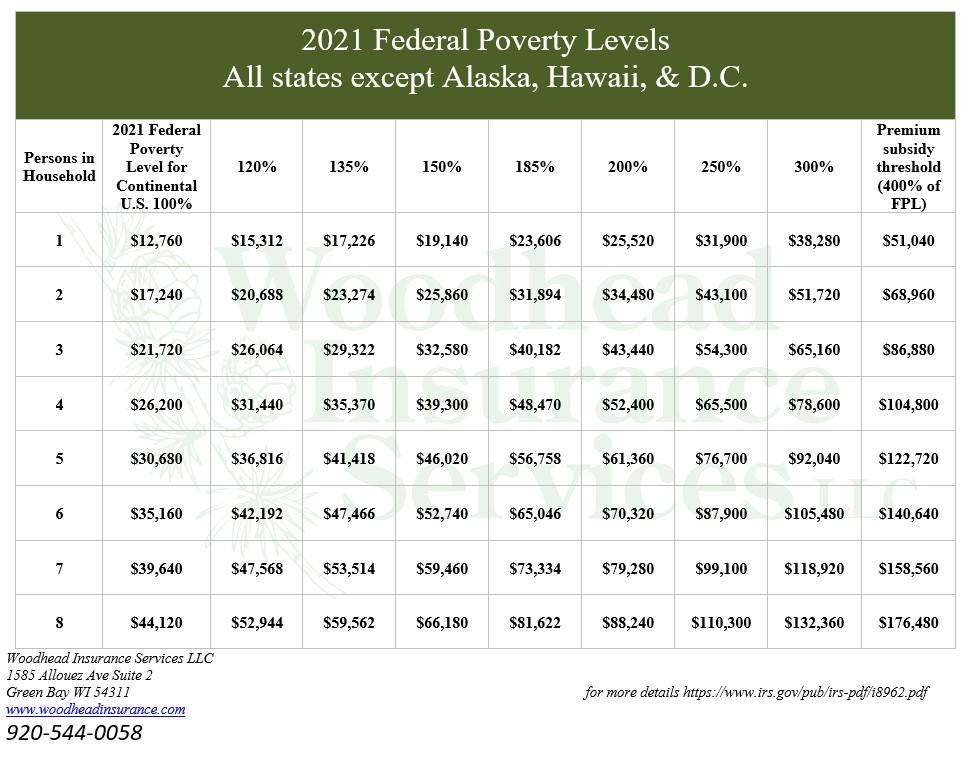

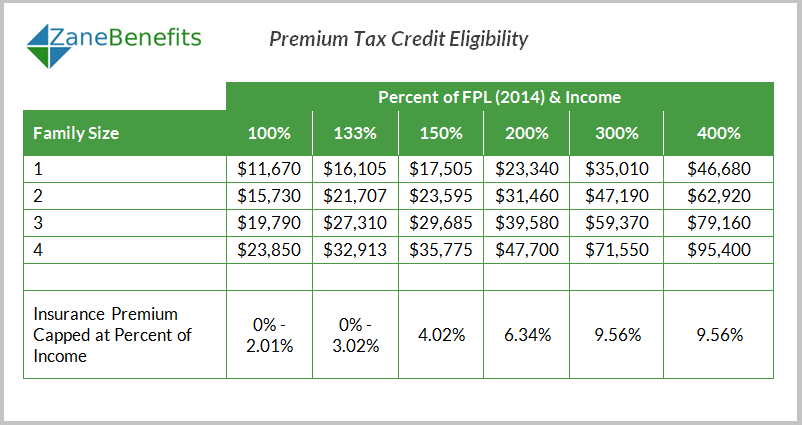

2021 Federal Levels For ACA Tax Credits Woodhead Insurance

Premium Tax Credit Charts 2015

Tax Credit Eligibility - [desc-14]