Tax Credit For Child Care Expenses 2022 To be able to claim the credit for child and dependent care expenses you must file Form 1040 1040 SR or 1040 NR and meet all the tests in Tests you must meet to claim a credit for child and dependent care expenses next

Taxpayers who are paying someone to take care of their children or another member of household while they work may qualify for child and dependent care credit regardless of their income For tax year 2021 the maximum eligible expense for this credit is 8 000 for one child and 16 000 for two or more The child and dependent care credit CDCC is a tax credit for parents or caregivers to help cover the cost of qualified care expenses for a child under 13 a spouse or parent unable to

Tax Credit For Child Care Expenses 2022

Tax Credit For Child Care Expenses 2022

https://i2.wp.com/www.cpabr.com/assets/htmlimages/Articles/child tax credit payments chart.JPG

New Child Tax Credit For 2021 Explained By CPA New Child Tax Credit

https://www.thetechsavvycpa.com/wp-content/uploads/2021/05/New-Child-Tax-Credit-Update-For-2021.jpg

Big Changes To The Child And Dependent Care Tax Credits FSAs In 2021

https://static.twentyoverten.com/5afae91ee233a94fd2b8b963/bGO8AFn9_9/1616431373979.png

Key Points For your 2021 tax return the cap on expenses eligible for the child and dependent care tax credit is 8 000 for one child up from 3 000 or 16 000 up from 6 000 for two or You can claim from 20 to 35 of your care expenses up to a maximum of 3 000 for one person or 6 000 for two or more people tax year 2023 Benefits of the tax credit The Child and Dependent Care Credit is a tax break specifically for working people to help offset the costs associated with caring for a child or dependent with disabilities

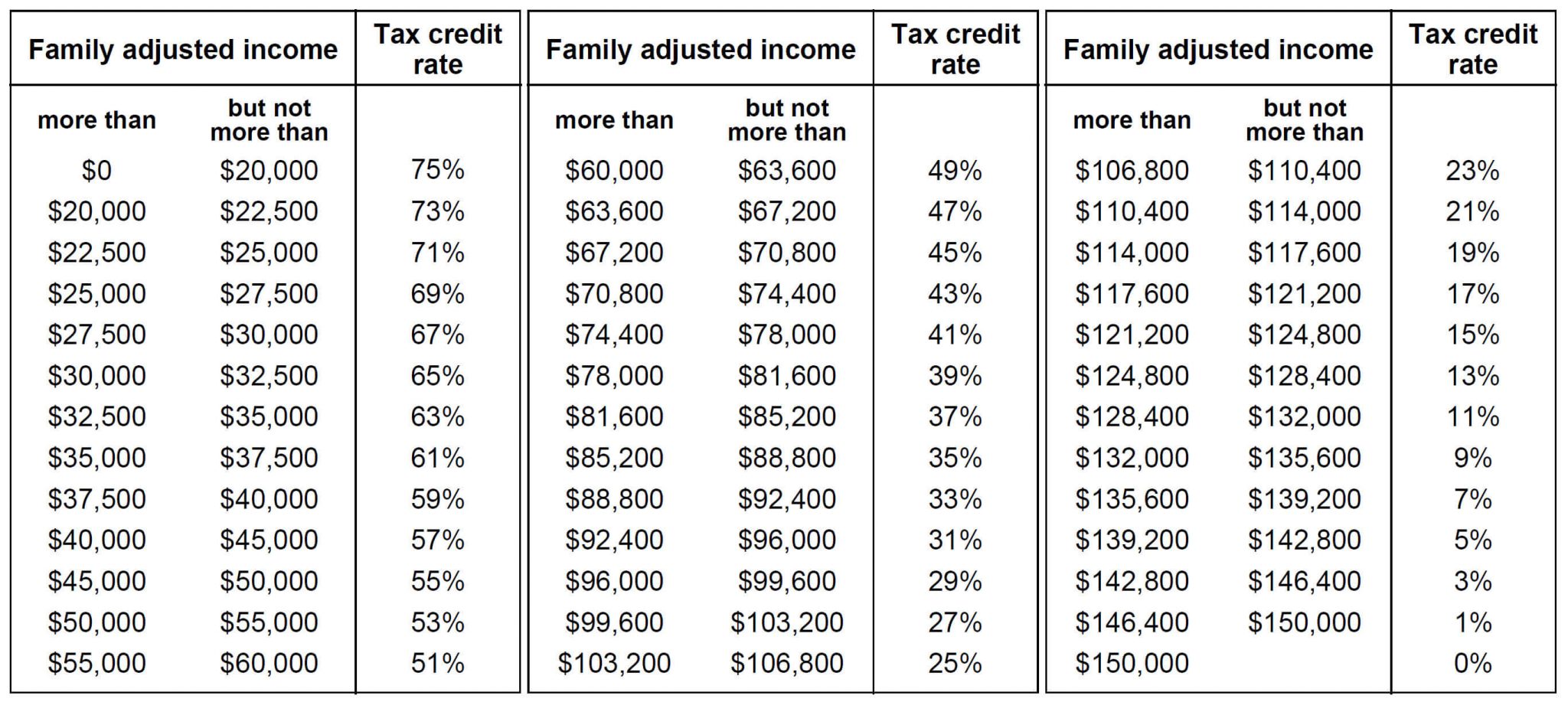

Thanks to a temporary change codified in the American Rescue Plan parents or guardians can now claim a maximum credit of 4 000 50 of 8 000 in expenses for one child and 8 000 for two or Your 2022 Child and Dependent Care Tax Credit ranges from 20 to 35 of what you spent on daycare up to 3 000 for one dependent or up to 6 000 for two or more dependents Your applicable percentage depends on your adjusted gross income AGI and decreases with the more you earn

Download Tax Credit For Child Care Expenses 2022

More picture related to Tax Credit For Child Care Expenses 2022

Ontario Childcare Tax Credit Refundable Tax Credit For Low income

https://cdn.taxory.com/wp-content/uploads/2021/01/childcare-access-and-relief-from-expenses-tax-credit-2048x917.jpg

Do You Have To Pay Back The Child Tax Credit In 2022 Leia Aqui Will

https://static01.nyt.com/images/2022/12/14/upshot/14up-child-tax-credit-promo-promo/14up-child-tax-credit-promo-promo-mediumSquareAt3X.png

Child Tax Credit Schedule 8812 H R Block

https://www.hrblock.com/tax-center/wp-content/uploads/2017/06/child-tax-credit-1080x675.jpg

The Child and Dependent Care Credit is a tax credit you may be able to claim for child care expenses you paid for your dependent child under 13 no age limit for a disabled dependent so that you and your spouse if filing a joint return can work or actively look for work Child and Dependent Care Credit Expenses In 2021 for the first time the credit is fully refundable if the taxpayer or the taxpayer s spouse if married filing jointly had a principal place of abode in the United States for more than one half of 2021 This means that an eligible family can get it even if they owe no federal income tax

The current child tax credit is a nonrefundable tax credit available to taxpayers with dependent children under the age of 17 The credit can reduce your tax bill on a dollar for dollar The Employer Provided Child Care Credit can save employers with eligible expenses more in taxes than using a deduction alone and employees can exclude some childcare benefits from their taxable wages

2022 Education Tax Credits Are You Eligible

https://www.taxdefensenetwork.com/wp-content/uploads/2022/11/2022-Education-Credits-Comparison-scaled.jpg

Earned Income Tax Credit For Households With One Child 2023 Center

https://www.cbpp.org/sites/default/files/2023-04/policybasics-eitc_rev4-28-23_f1.png

https://www.irs.gov/publications/p503

To be able to claim the credit for child and dependent care expenses you must file Form 1040 1040 SR or 1040 NR and meet all the tests in Tests you must meet to claim a credit for child and dependent care expenses next

https://www.irs.gov/newsroom/understanding-the...

Taxpayers who are paying someone to take care of their children or another member of household while they work may qualify for child and dependent care credit regardless of their income For tax year 2021 the maximum eligible expense for this credit is 8 000 for one child and 16 000 for two or more

Big Changes To The Child And Dependent Care Tax Credits FSAs In 2021

2022 Education Tax Credits Are You Eligible

What You Need To Know About The 2021 Child Tax Credit Pittman Legal

Tax Credit Or FSA For Child Care Expenses Which Is Better

FAQ WA Tax Credit

Child Tax Credit Payments 06 28 2021 News Affordable Housing

Child Tax Credit Payments 06 28 2021 News Affordable Housing

Everything You Need To Know About Child Tax Credits And The 2022 Tax

What To Do If You Didn t Get Your First Child Tax Credit Payment Newswire

Child Tax Credit 2022 What Will Be Different With Your Payments

Tax Credit For Child Care Expenses 2022 - You can claim from 20 to 35 of your care expenses up to a maximum of 3 000 for one person or 6 000 for two or more people tax year 2023 Benefits of the tax credit The Child and Dependent Care Credit is a tax break specifically for working people to help offset the costs associated with caring for a child or dependent with disabilities