Tax Credit For Contribution To Retirement Plan Eligible employers may be able to claim a tax credit of up to 5 000 for three years for the ordinary and necessary costs of starting a SEP SIMPLE IRA or qualified plan like a 401

Key Takeaways IRS Form 8880 calculates how much of a tax credit you may qualify for if you contribute to an eligible retirement savings plan Eligible plans to which you can make The Retirement Savings Contributions Credit also known as the Saver s Credit helps offset part of the first 2 000 workers voluntarily contribute to Individual Retirement

Tax Credit For Contribution To Retirement Plan

/investing-money-for-retirement-91516278-5a09401f9e942700374709e7.jpg)

Tax Credit For Contribution To Retirement Plan

https://fthmb.tqn.com/4lNKMPCkhWLOLdjlnkvMikx-bXU=/4368x2912/filters:fill(auto,1)/investing-money-for-retirement-91516278-5a09401f9e942700374709e7.jpg

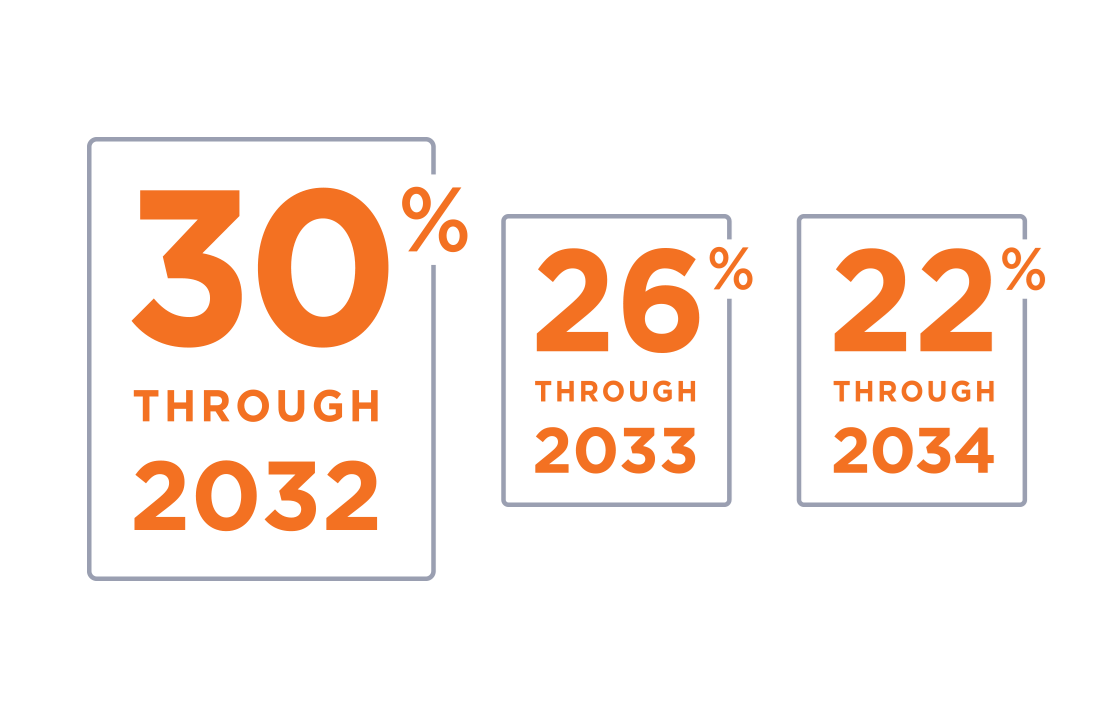

2021 Retirement Plan Contribution Limits Northwest Bank

https://www.northwestbank.com/wp-content/uploads/2021/01/2021-Contribution-Limits.png

What Is An R D Tax Credit

https://www.letsbegamechangers.com/wp-content/uploads/2020/01/load-image-2020-01-24T030638.645-1536x1024.jpeg

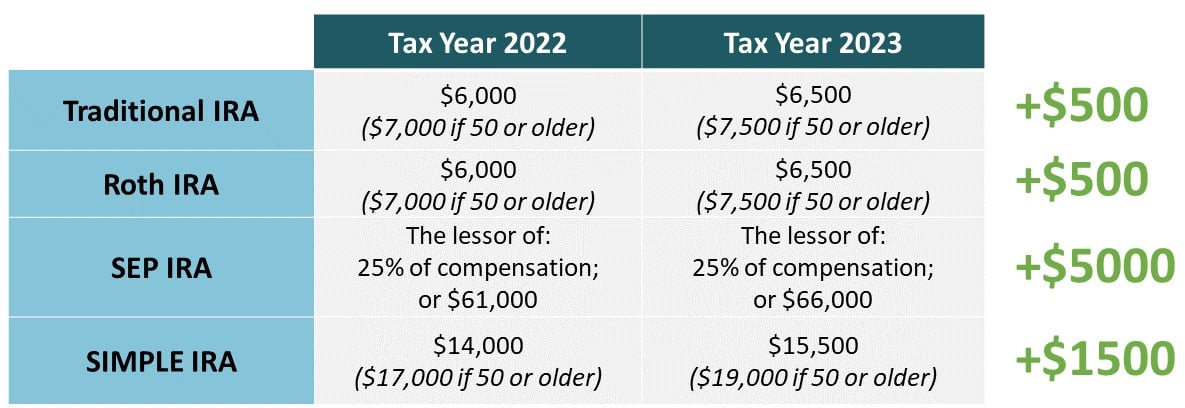

The Saver s Credit is a tax credit that low and moderate income individuals may claim for qualified contributions to eligible retirement accounts It is a nonrefundable credit The Qualified Retirement Savings Contribution Credit is also known as the Saver s Credit Taxpayers use IRS Form 8880 for the Qualified Retirement Savings Contribution Credit As of 2023 the

Usually referred to as the saver s tax credit it allows individuals and families with modest incomes to enjoy tax breaks above and beyond any deductions that they may receive The retirement savings contribution credit the saver s credit for short is a nonrefundable tax credit worth up to 1 000 2 000 if married filing jointly for mid and

Download Tax Credit For Contribution To Retirement Plan

More picture related to Tax Credit For Contribution To Retirement Plan

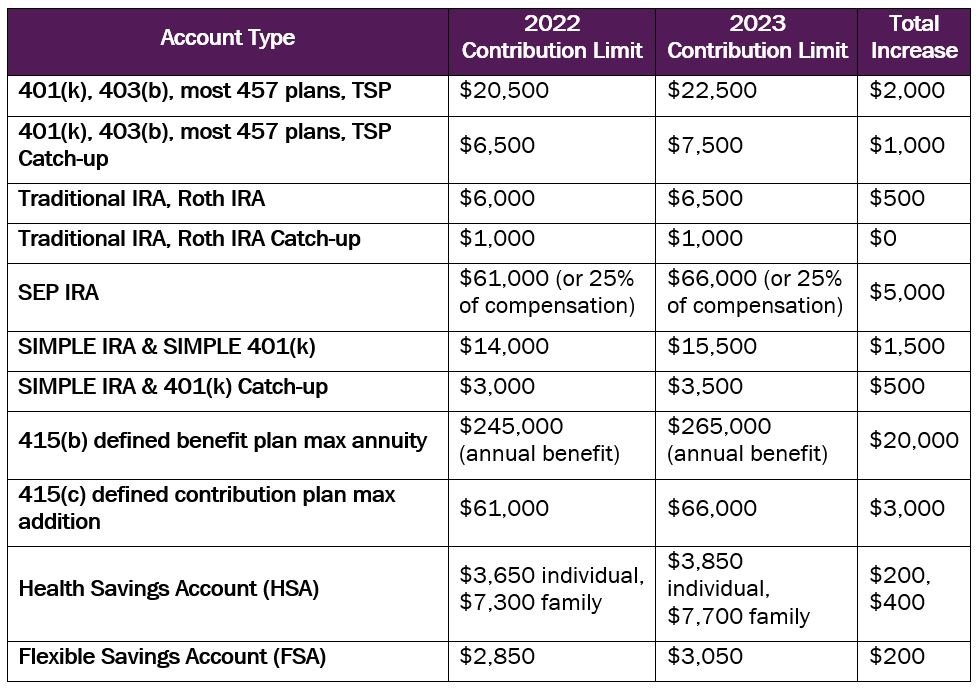

2023 Contribution Limits For Thrift Savings Plan And IRAs KateHorrell

https://www.katehorrell.com/wp-content/uploads/2021/11/Retirement-Savings-Accounts-Contribution-Limits-1-1536x1152.png

Tution Tax Credit For Students NCS CA

https://www.ncscorp.ca/wp-content/uploads/2022/03/Untitled-design-12-e1648708763193.png

2023 Contribution Limits And Standard Deduction Announced Day Hagan

https://images.squarespace-cdn.com/content/v1/5e68f47ca0d8573682071426/db14bc39-72bb-4656-9ad5-416374313bf0/2023-retirement-account-contribution-limits-announced-10.25.2022.JPG

The saver s tax credit also known as the retirement savings contributions credit is a federal tax credit that incentivizes low to moderate income American families to save for Retirement Savings Contributions Credit for Tax Year 2022 You can qualify for the Retirement Savings Tax Credit Saver s Credit if you contribute to a retirement plan Income limits and other rules apply

The saver s credit is a tax credit you can claim on your tax return if you are eligible Depending on your income level you may be able to claim the credit for up to 50 percent of eligible To be eligible for the retirement savings contribution credit Saver s Credit you must meet all of these requirements You make voluntary contributions to a qualified

Annual Retirement Plan Contribution Limits For 2023 Social K

https://socialk.com/wp-content/uploads/image-12.png

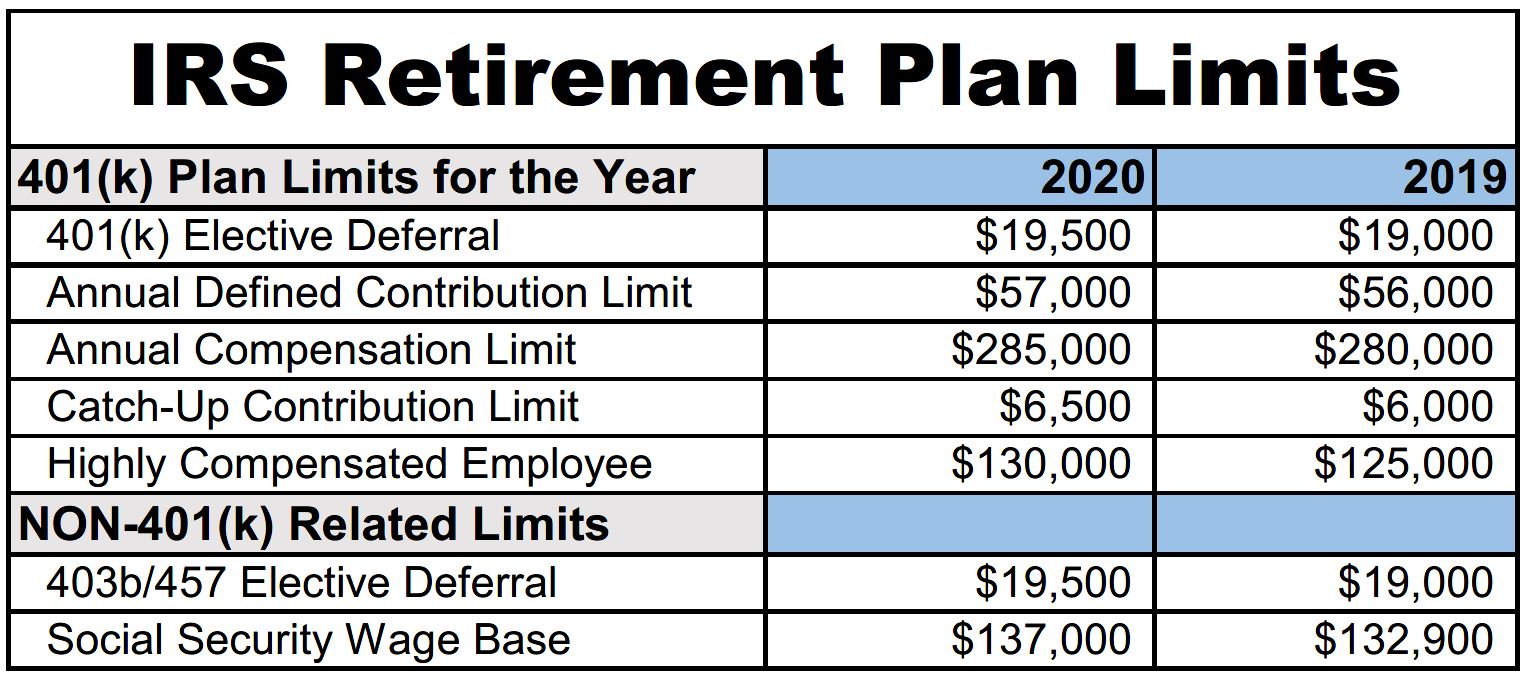

Retirement Plan Contribution Limits Will Increase In 2020 Ward And

https://jdsupra-html-images.s3-us-west-1.amazonaws.com/7cf3a793-0db4-4a3e-81a6-dba037a8c2c2-book-1.jpg

/investing-money-for-retirement-91516278-5a09401f9e942700374709e7.jpg?w=186)

https://www.irs.gov/retirement-plans/retirement...

Eligible employers may be able to claim a tax credit of up to 5 000 for three years for the ordinary and necessary costs of starting a SEP SIMPLE IRA or qualified plan like a 401

https://www.investopedia.com/irs-form-888…

Key Takeaways IRS Form 8880 calculates how much of a tax credit you may qualify for if you contribute to an eligible retirement savings plan Eligible plans to which you can make

How Much Is Social Security Retirement Benefit

Annual Retirement Plan Contribution Limits For 2023 Social K

Another Way To Save New Tax Credit For Plan Participants

Tax Credit Bill For Rural Physicians Passes House Committee

Georgia Tax Credits For Workers And Families

Geothermal Tax Credits Incentives

Geothermal Tax Credits Incentives

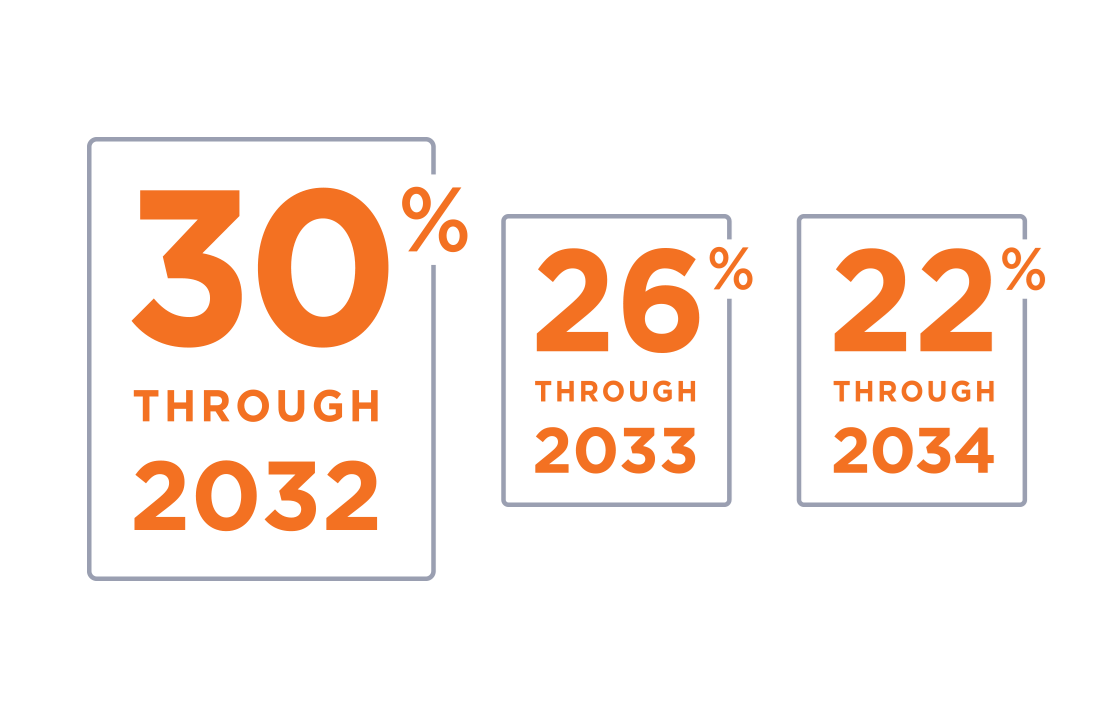

Taxpayer Relief 2023 Contribution Limits Increase

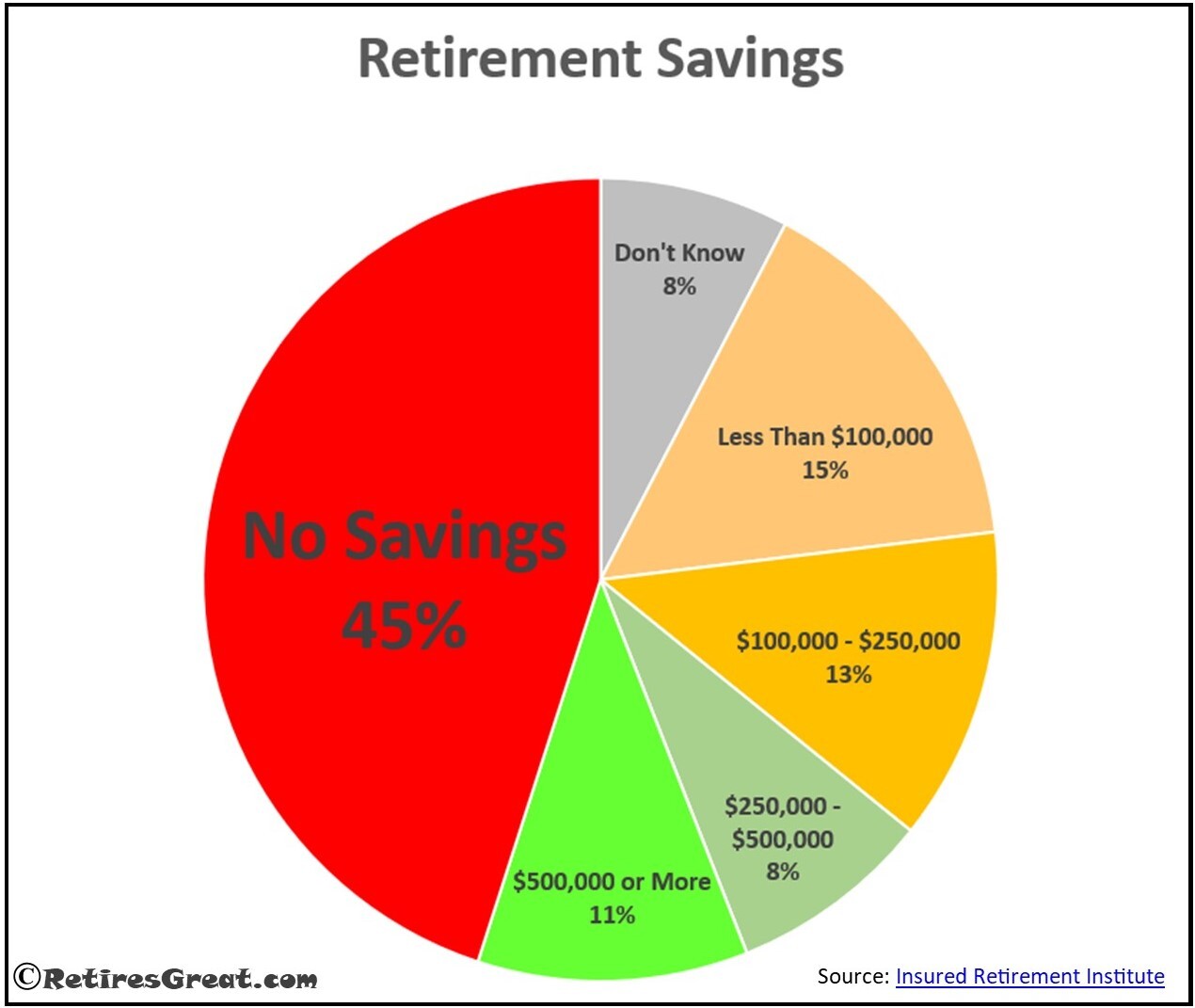

How Do You Write A Retirement Plan That Transforms Your Future

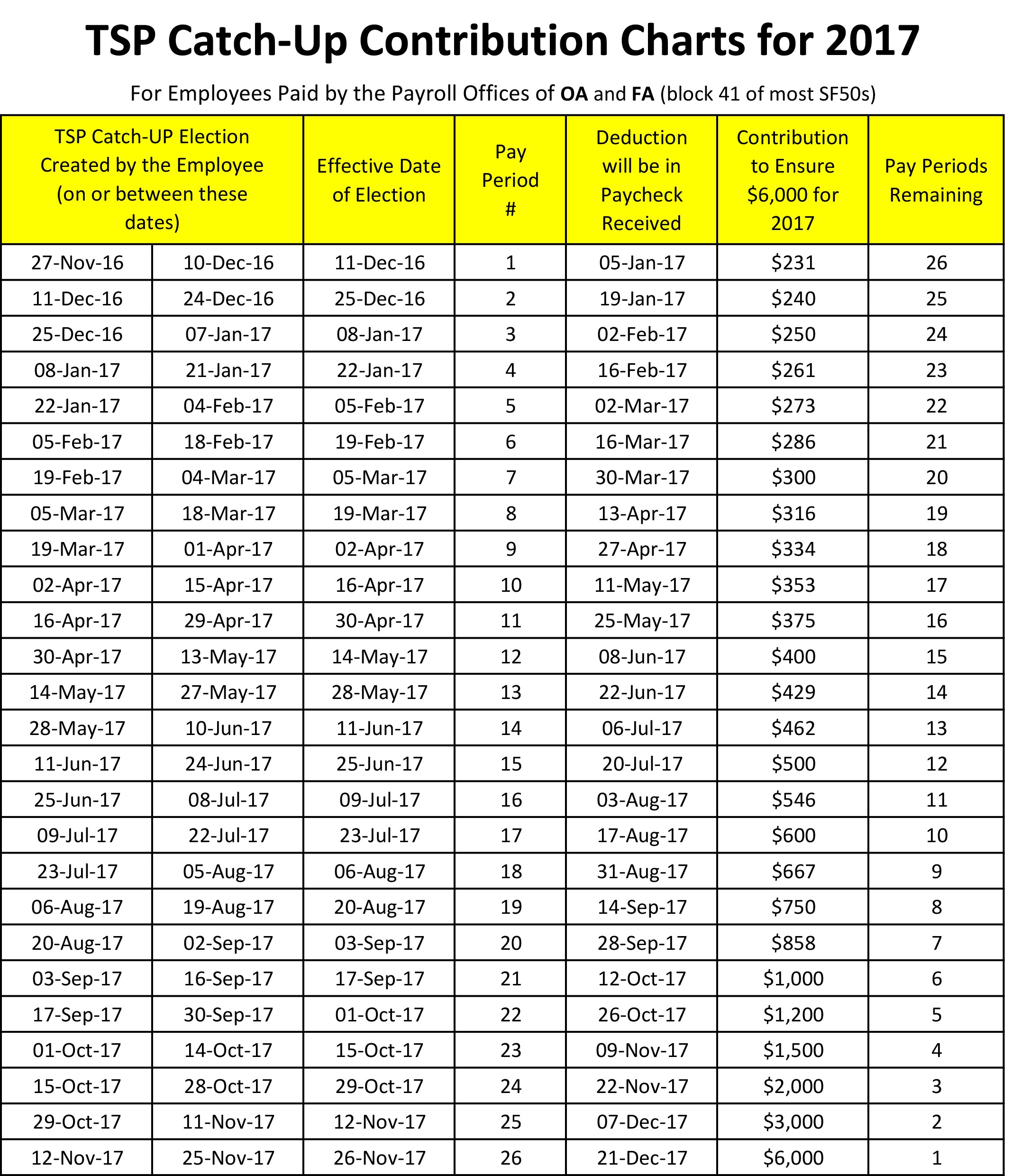

2023 Tsp Maximum Contribution 2023 Calendar

Tax Credit For Contribution To Retirement Plan - Also known as the retirement savings contribution credit the Savers Credit encourages lower income employees to save for retirement by giving them a tax credit based on a