Tax Credit For Education 2023 Students or their parents can claim the American Opportunity Tax Credit or Lifetime Learning Credit for eligible education costs on their 2023 taxes

There are two federal education tax credits that can cut your tax bill by thousands of dollars You ll save more with the American Opportunity Credit up to 2 500 per student but it s typically only For 2023 there are two education credits The American opportunity credit part of which may be refundable The lifetime learning credit which is nonrefundable A refundable

Tax Credit For Education 2023

Tax Credit For Education 2023

https://www.letsbegamechangers.com/wp-content/uploads/2020/01/load-image-2020-01-24T030638.645-1536x1024.jpeg

Pandemic Tax Credit Gets A Boost IndustryWeek

https://img.industryweek.com/files/base/ebm/industryweek/image/2021/03/tax_credit.60501bbf38caa.png?auto=format,compress&fit=crop&h=556&w=1000&q=45

2022 Education Tax Credits Are You Eligible

https://www.taxdefensenetwork.com/wp-content/uploads/2022/11/2022-Education-Credits-Comparison-scaled.jpg

18 rowsThere are several differences and some similarities between the American Opportunity Tax Credit AOTC and the Lifetime Learning Credit LLC You can claim In taxable year 2023 taxpayers with current education expenses for themselves or a dependent may be eligible for one of two education credits Taxpayers

Tax credits and deductions can help students their parents and educators offset the costs of higher education and classroom supplies For the Lifetime Learning credit and the American Opportunity In 2023 there are two main types of education credits you can claim the American Opportunity Credit AOC and the Lifetime Learning Credit LLC This article aims to simplify these credits their

Download Tax Credit For Education 2023

More picture related to Tax Credit For Education 2023

Unlock The Hidden Benefits Of Employee Retention Tax Credit For

https://ertcguy.com/wp-content/uploads/2023/05/yellow-card-and-a-red-and-gold-passport-flatlay-Image-of-Taxation-Employee-Retention-Tax-Credit.jpg

Historic Tax Benefit For Union Workers Championed By UDW Signed Into

https://udwa.org/wp-content/uploads/TaxCredit.png

Don t Forget The Healthy Homes Tax Credit Safe Home

https://safeathomewindsor.ca/wp/wp-content/uploads/2015/04/HHTCgentleman1.jpg

An education tax credit allows you to reduce your taxes owed and may in some cases generate a tax refund The IRS offers two types of education tax credits to An education credit helps with the cost of higher education by reducing the amount of tax you owe on your return The American Opportunity Tax Credit AOTC

The lifetime learning credit is a frequently overlooked tax break that can help pay for education expenses It can be worth up to 2 000 per tax return for an unlimited College is more expensive than ever but credits and deductions can help you cut thousands off your 2023 tax bill Not sure which credits to take The American

Another Way To Save New Tax Credit For Plan Participants

https://insights.rpag.com/hubfs/Imported_Blog_Media/GettyImages-1077235824-1.jpg

Your First Look At 2023 Tax Brackets Deductions And Credits 3

https://db0ip7zd23b50.cloudfront.net/dims4/default/aedfbe6/2147483647/resize/633x10000>/quality/90/?url=http:%2F%2Fbloomberg-bna-brightspot.s3.amazonaws.com%2Fae%2F00%2F2ce5bb3d4ec493a63ec4724e6e05%2Fd64957248d6c49ebb92ef34db2768c4e

https://www.nerdwallet.com/.../educati…

Students or their parents can claim the American Opportunity Tax Credit or Lifetime Learning Credit for eligible education costs on their 2023 taxes

https://turbotax.intuit.com/tax-tips/colle…

There are two federal education tax credits that can cut your tax bill by thousands of dollars You ll save more with the American Opportunity Credit up to 2 500 per student but it s typically only

Pa Lawmakers Need To Support Tax Credit For Education Letter

Another Way To Save New Tax Credit For Plan Participants

Tax Credit Bill For Rural Physicians Passes House Committee

The Earned Income Tax Credit EITC Refund Schedule For 2022 2023

Everything You Need To Know About Child Tax Credits And The 2022 Tax

U S Lawmakers Propose To Extend EV Tax Credit At A Cost Of 11 4

U S Lawmakers Propose To Extend EV Tax Credit At A Cost Of 11 4

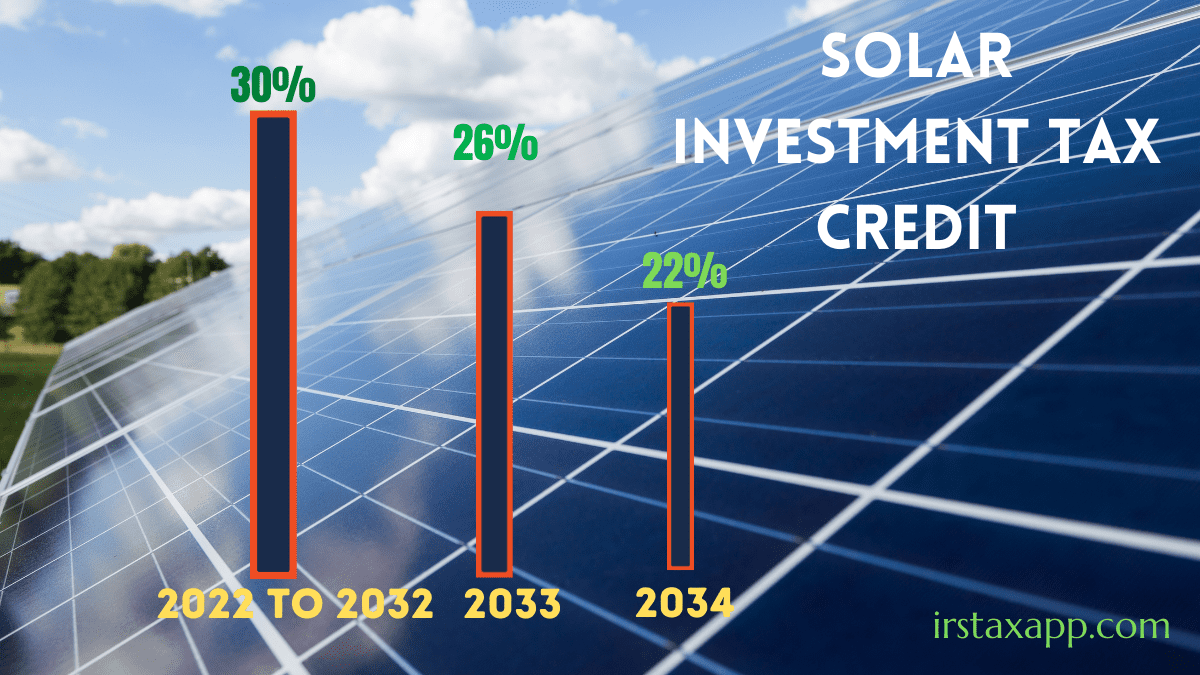

How To Claim Solar Tax Credit 2023 Internal Revenue Code Simplified

Learn About The NEW State Tax Credit For Working Families Key

Refundable Nonrefundable Education Tax Credits Finance Zacks

Tax Credit For Education 2023 - There are tax breaks for people saving for college current students and graduates who are paying off student loans Taking advantage of these tax breaks may