Tax Credit For Home Equity Loan Verkko 5 hein 228 k 2023 nbsp 0183 32 For tax years 2018 to 2025 you can only deduct interest on mortgages up to 750 000 That cap includes your existing mortgage balance one vacation or second home and any deductible

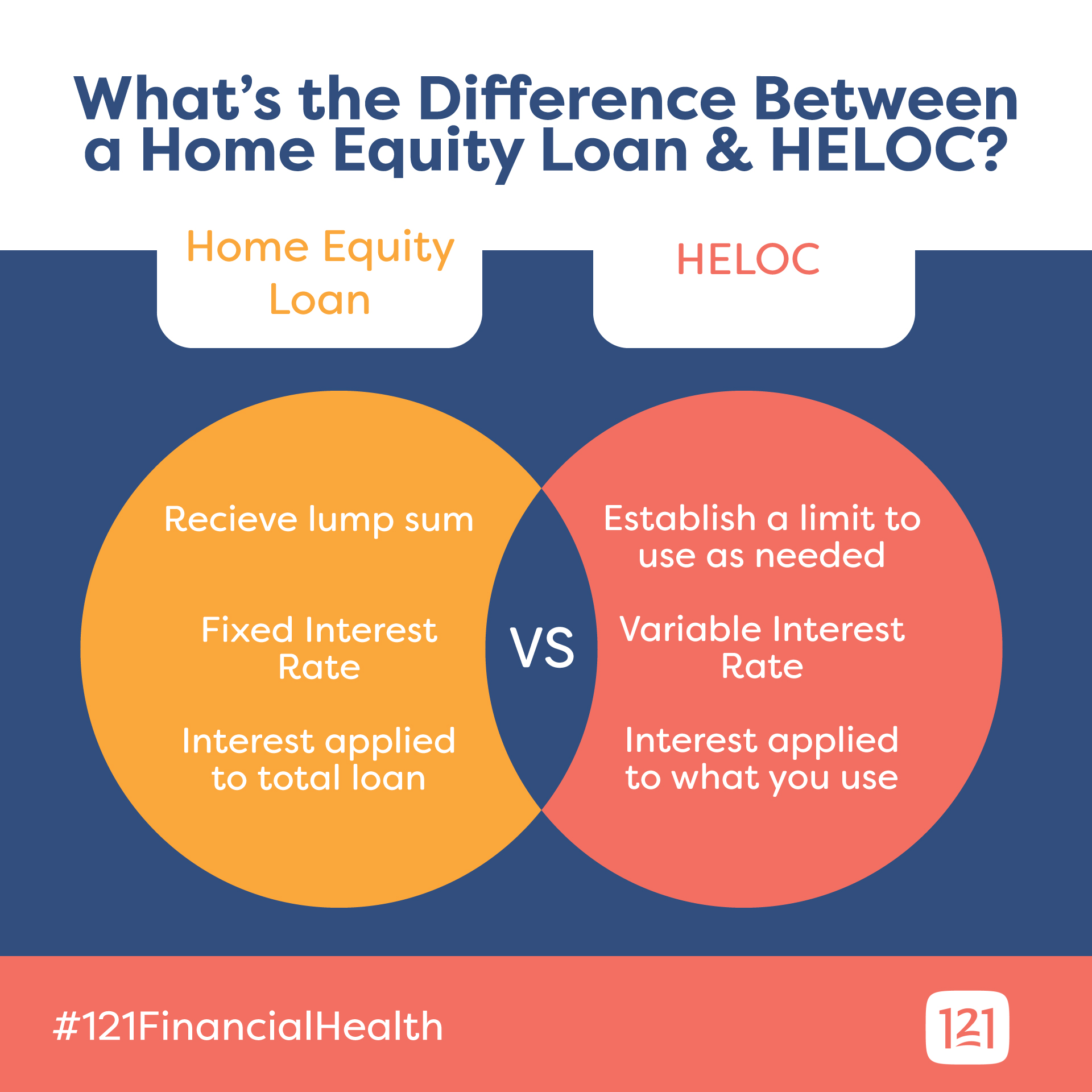

Verkko 3 p 228 iv 228 228 sitten nbsp 0183 32 Home equity loan and HELOC interest may be tax deductible if the borrowed money was used to buy build or improve Verkko 7 marrask 2022 nbsp 0183 32 Suzanne Kvilhaug If you need cash and have equity in your home a home equity loan or a home equity line of credit HELOC can be an excellent solution But the tax aspects of either

Tax Credit For Home Equity Loan

Tax Credit For Home Equity Loan

https://creditscoresrange.net/wp-content/uploads/2020/03/understanding-the-home-equity-line-of-credit-1024x794.png

Who Is Responsible For A Home Equity Loan

https://www.dupaco.com/wp-content/uploads/2019/06/HELOC-HomeEquity-chart.png

How Does A Home Equity Loan Work REVOLUTION REPORTS

https://www.visionbank.com/media/cms/HELOC_916px01_19435591CA1A5.jpg

Verkko 24 huhtik 2023 nbsp 0183 32 For home equity loans opened after the TCJA Any loans borrowed after December 16 2017 are subject to the TCJA limits of 750 000 in total mortgage debt This includes loans on a first or Verkko 4 tammik 2023 nbsp 0183 32 When the Tax Cuts and Jobs Act of 2017 went into effect on Jan 1 2018 it changed the loan limits for home equity deductions with different thresholds

Verkko 28 jouluk 2023 nbsp 0183 32 The home mortgage interest deduction allows you to deduct interest paid on your home equity loan in a given year Under the current guidelines taxpayers who took out a home equity loan after Verkko 28 kes 228 k 2022 nbsp 0183 32 A home equity loan also known as a second mortgage lets homeowners borrow money by drawing on the equity value in their homes Home

Download Tax Credit For Home Equity Loan

More picture related to Tax Credit For Home Equity Loan

4 Advantages Of A Home Equity Loan Denver Community Credit Union

https://denvercommunity.coop/wp-content/uploads/2021/08/Listicle-Home-Equity-Loan.jpg

Home Equity Loan Firstmark Credit Union

https://www.firstmarkcu.org/wp-content/uploads/2020/08/Home_Equity_Calculation_Example.png

How Does A Home Equity Line Of Credit or A HELOC Work YouTube

https://i.ytimg.com/vi/SGTclQMCYdc/maxresdefault.jpg

Verkko January 9 2024 12 52 PM EST CBS News If you used your home equity loan for qualifying purposes you may be eligible to deduct the interest paid from your 2023 Verkko 3 p 228 iv 228 228 sitten nbsp 0183 32 If you want to claim the deduction for a mortgage refinance home equity loan or home equity line of credit Be sure to investigate any other available tax

Verkko 18 hein 228 k 2023 nbsp 0183 32 If you ve closed on a mortgage on or after Jan 1 2018 you can deduct any mortgage interest you pay on your first 750 000 in mortgage debt 375 000 for married taxpayers who file Verkko 1 jouluk 2023 nbsp 0183 32 Joint filers who took out a home equity loan after Dec 15 2017 can deduct interest on up to 750 000 worth of qualified loans 375 000 if single or

Getting A Home Equity Loan What It Is And How It Works NerdWallet

https://www.nerdwallet.com/assets/blog/wp-content/uploads/2020/05/HEL-graphic_final%402x-770x711.jpg

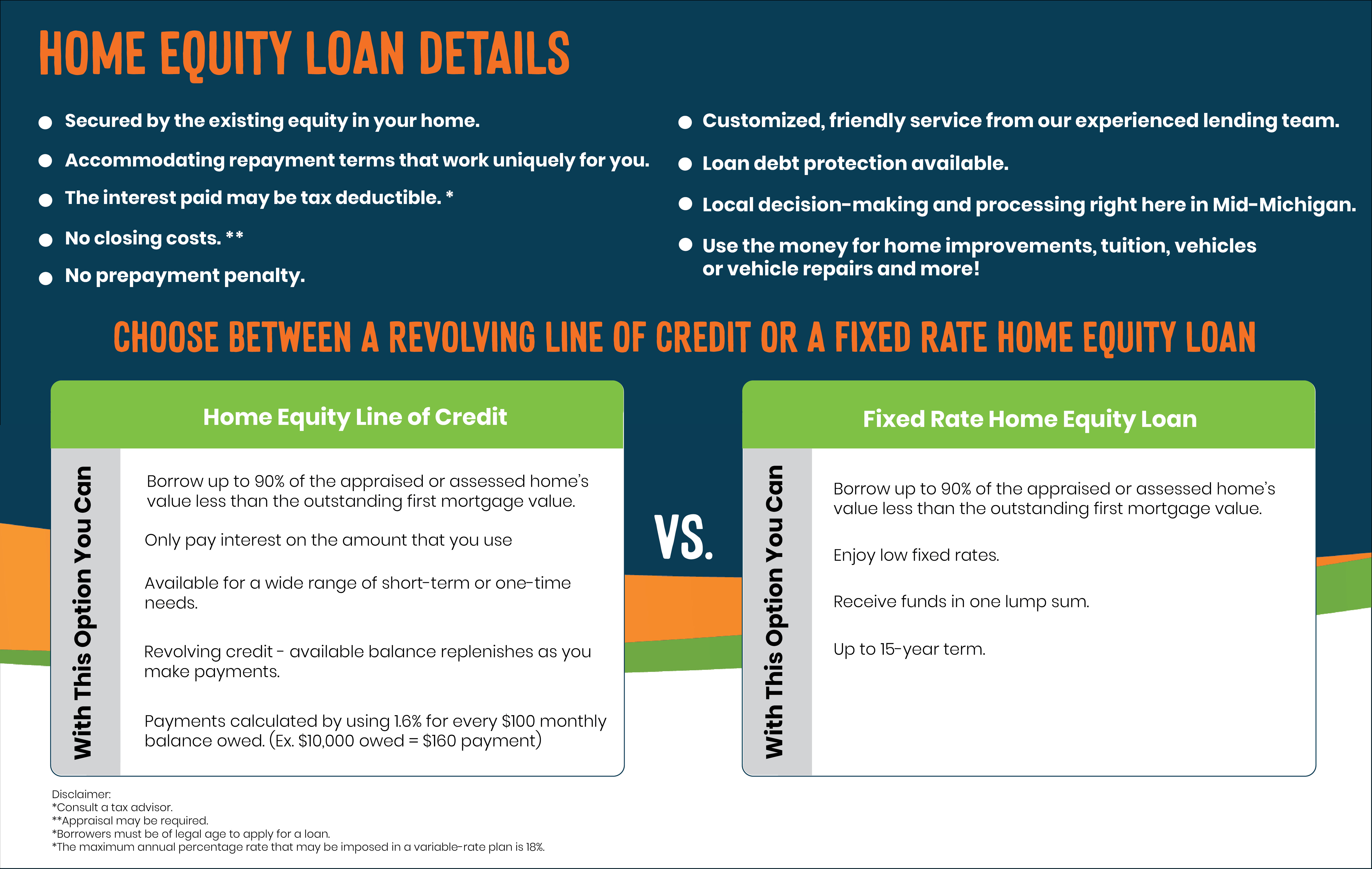

Home Equity Loans TRUE Community Credit Union Jackson Mason

https://www.trueccu.com/_/kcms-doc/583/72924/HELOC_Graph1.png

https://www.forbes.com/advisor/home-e…

Verkko 5 hein 228 k 2023 nbsp 0183 32 For tax years 2018 to 2025 you can only deduct interest on mortgages up to 750 000 That cap includes your existing mortgage balance one vacation or second home and any deductible

https://www.nerdwallet.com/article/mortg…

Verkko 3 p 228 iv 228 228 sitten nbsp 0183 32 Home equity loan and HELOC interest may be tax deductible if the borrowed money was used to buy build or improve

Home Equity Loan Full Guide How It Works YouTube

Getting A Home Equity Loan What It Is And How It Works NerdWallet

Home Equity Loan Vs Line Of Credit Clearview FCU

How Do Home Equity Loans Work And When To Use Them

The 5 Best Home Equity Loans For 2023 Free Buyers Guide

What Is A Home Equity Loan Market Business News

What Is A Home Equity Loan Market Business News

Pros And Cons Of A Home Equity Loan FortuneBuilders

Home Equity Loans Rockland Bergen County Palisades Credit Union

New Tax Law Home Equity Loan Deductibility

Tax Credit For Home Equity Loan - Verkko 4 tammik 2023 nbsp 0183 32 When the Tax Cuts and Jobs Act of 2017 went into effect on Jan 1 2018 it changed the loan limits for home equity deductions with different thresholds