Tax Credit For Home Purchase 2022 A first time homebuyer tax credit offers a direct reduction of the amount of income tax you owe The U S federal government offered a tax credit program to first

Credits for individuals From purchasing clean vehicles to making your home more energy efficient the Inflation Reduction Act of 2022 may have a significant effect on your taxes Homeowners may be able to save thousands of dollars by claiming tax credits and rebates under the Inflation Reduction Act of 2022

Tax Credit For Home Purchase 2022

Tax Credit For Home Purchase 2022

https://www.ecohousesolar.com/wp-content/uploads/2022/09/Ecohouse-Tax-Credit-Featured-09.png

The Electric Car Tax Credit What You Need To Know OsVehicle

https://cdn.osvehicle.com/can_i_claim_the_ev_tax_credit_every_year.png

Federal Solar Tax Credit What It Is How To Claim It For 2024

https://www.ecowatch.com/wp-content/uploads/2022/10/Solar-Investment-Tax-Credit-5-1-2.png

You can get a tax break for buying a house through tax deductions and credits for a few expenses you pay every month but rules and limits apply and you must The bill is designed to provide a tax credit for first time buyers worth up to 15 000 or 10 of a home s purchase price whichever is less The bill also known as

The tax credit you can claim if you received a mortgage credit certificate when you bought your home Why you should keep track of adjustments to the basis of your First time home buyers who acquire a qualifying home can claim a non refundable tax credit of up to 750 The value of the HBTC is calculated by multiplying

Download Tax Credit For Home Purchase 2022

More picture related to Tax Credit For Home Purchase 2022

Child Tax Credit 2022 Income Phase Out Latest News Update

https://i2.wp.com/www.taxpolicycenter.org/sites/default/files/model-estimates/images/t21-0190.gif

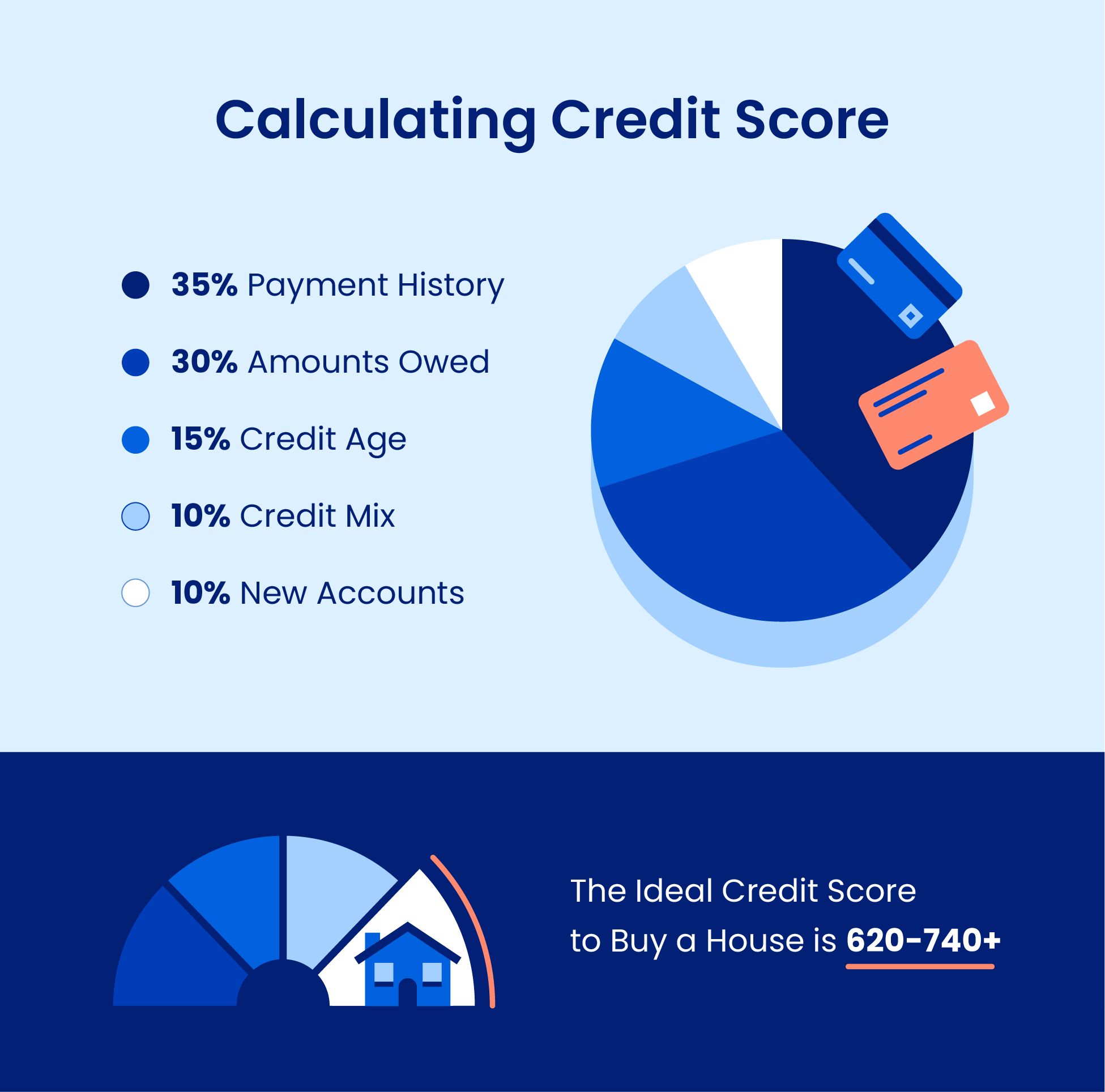

How To Fix Bad Credit For Home Loans Zillow

https://wp-tid.zillowstatic.com/7/shutterstock_500428714-abef49.jpg

Home Equity Loans How To Access Your Home s Equity

https://www.bmcmortgage.ca/media/website_pages/blog/home-equity-loans-how-to-access-your-homes-equity/Do-You-Know-How-to-Get-a-Bad-Credit-Home-Loan.jpg

Tax credits and breaks for first time home buyers can be an attractive incentive that makes purchasing a home more affordable These credits are designed to To encourage Americans to buy their first homes the government offers credits and tax breaks Here s the lowdown on who can qualify for each benefit

Buying your first home is a huge step but tax deductions available to you as a homeowner can reduce your tax bill Still need to file An expert can help or do A tax credit reduces the amount of income tax first time homeowners owe when they file their taxes While there isn t currently a tax credit for first time buyers in

Lost In Your Tax Return Ask All Your Questions To Our Specialist

https://fyooyzbm.filerobot.com/v7/RCANICXXQ507_DM_FINANCES_PUBLIQUES-2VTRj1eW.jpg?vh=92a79e&ci_seal=d26beb857f

Ev Tax Credit 2022 Cap Clement Wesley

https://electrek.co/wp-content/uploads/sites/3/2021/07/EV-Federal-Tax-Credit-Hero-2.jpg?quality=82&strip=all

https://www.bankrate.com/mortgages/first-time...

A first time homebuyer tax credit offers a direct reduction of the amount of income tax you owe The U S federal government offered a tax credit program to first

https://www.irs.gov/credits-and-deductions-under...

Credits for individuals From purchasing clean vehicles to making your home more energy efficient the Inflation Reduction Act of 2022 may have a significant effect on your taxes

Kentucky VA Loan Credit Score Requirements Fha Mortgage Mortgage

Lost In Your Tax Return Ask All Your Questions To Our Specialist

Income Tax Credit For Home schooling Families Libertas Institute

Solar Tax Credit And Your Boat Updated Blog

Who Gets Tax Credits Leia Aqui Who Gets Federal Tax Credits

The Tax Credit For Home Insulation Windows And Doors In 2022

The Tax Credit For Home Insulation Windows And Doors In 2022

Income Tax Ordinance 2022 Pdf Latest News Update

How To Fix Your Credit Fast To Buy A House

Federal Solar Tax Credit For Residential Solar Energy

Tax Credit For Home Purchase 2022 - The tax credit you can claim if you received a mortgage credit certificate when you bought your home Why you should keep track of adjustments to the basis of your