Tax Credit For Renters Nj You are eligible for a property tax deduction or a property tax credit only if You were domiciled and maintained a primary residence as a homeowner or tenant in

This program provides property tax relief to New Jersey residents who own or rent property in New Jersey as their principal residence and meet certain income The more than 2 billion in funding would pay up to 1 500 for eligible homeowners and 450 to renters with an extra 250 for seniors The state Treasury

Tax Credit For Renters Nj

Tax Credit For Renters Nj

https://www.rent.com/blog/wp-content/uploads/2019/03/tax_credits-min.jpg

What Is An R D Tax Credit

https://www.letsbegamechangers.com/wp-content/uploads/2020/01/load-image-2020-01-24T030638.645-1536x1024.jpeg

Tution Tax Credit For Students NCS CA

https://www.ncscorp.ca/wp-content/uploads/2022/03/Untitled-design-12-e1648708763193.png

Residents of New Jersey that pay property tax on the home they own or rent may qualify for a refundable tax credit or a deduction on their return You may claim only one of the Those with gross incomes between 150 000 and 250 000 will get up to 1 000 Renters with 2019 gross incomes of 150 000 or less will receive 450 You are

Qualified homeowners making less than 150 000 in 2021 will receive a tax credit of 1 500 while those making 150 000 to 250 000 will get a tax credit of 1 000 Renters who made 150 000 New Jersey homeowners and renters now have until Jan 31 to apply for relief and renters who were previously ineligible because their unit is under a Payment

Download Tax Credit For Renters Nj

More picture related to Tax Credit For Renters Nj

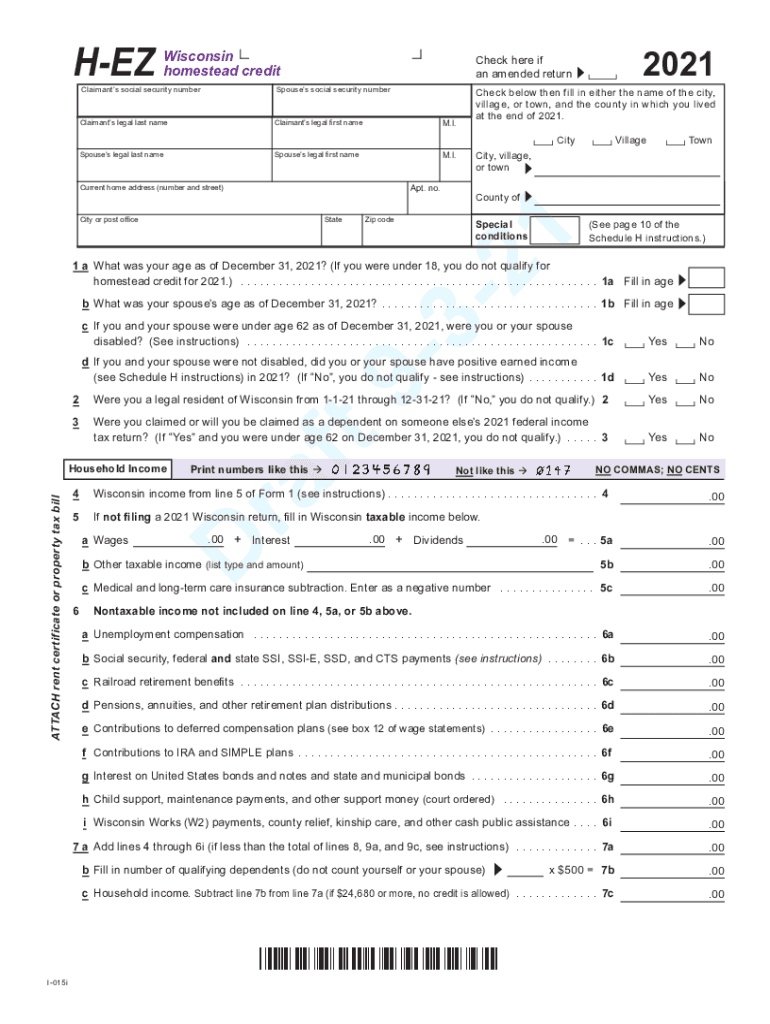

Renters Rebate 2021 Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2021/07/Minnesota-Renters-Rebate-Form-2021.jpg

2019 NJ Anchor Program 1 500 1 000 To Home Owners 405 For Renters

https://i.ytimg.com/vi/a_k4z41OSEo/maxresdefault.jpg

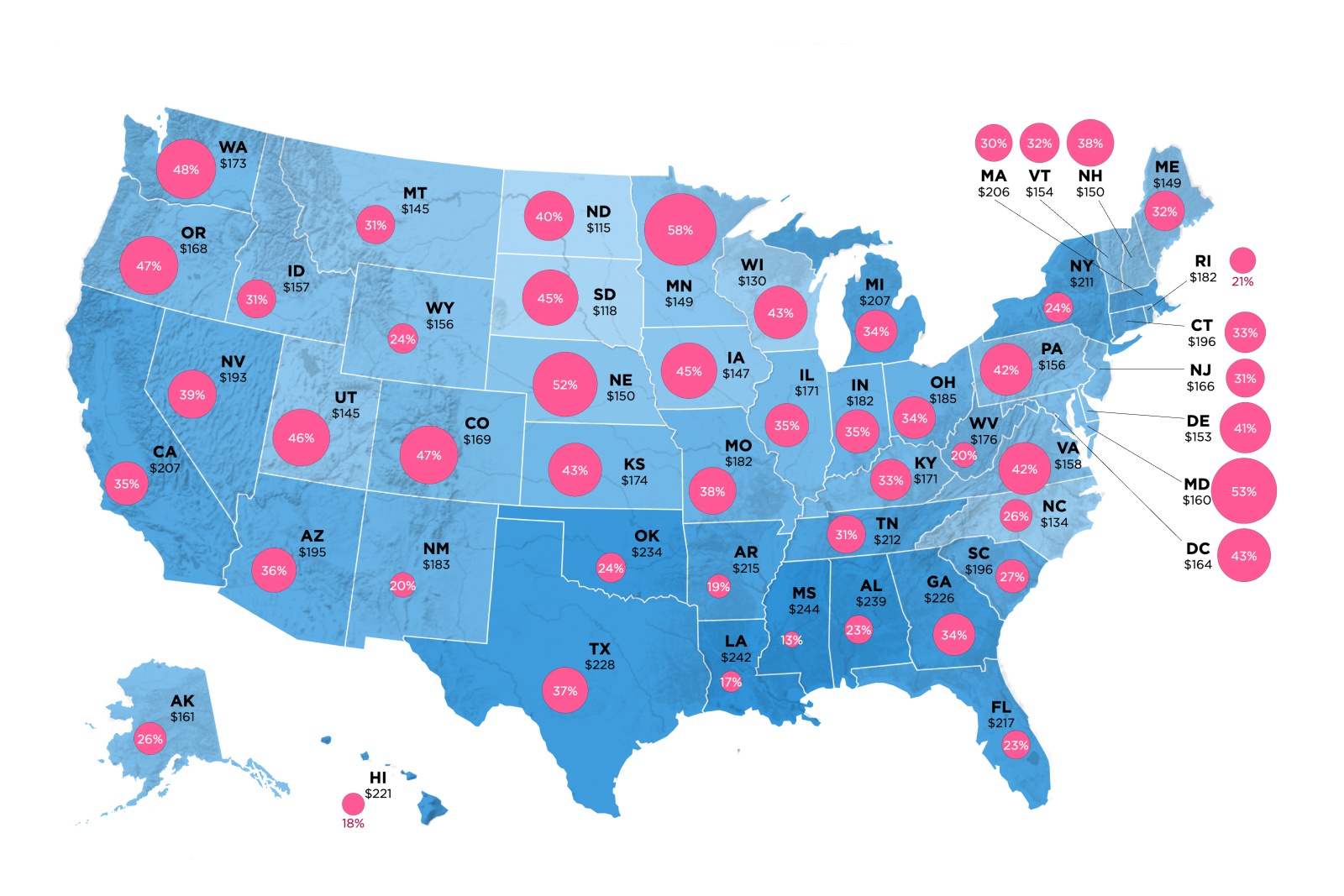

Looking At Average Renters Insurance Rates Across All 50 States

https://cdn.howmuch.net/articles/cover-f8e3.jpg

The Affordable New Jersey Communities for Homeowners and Renters ANCHOR Program is designed to offer property tax relief to both homeowners and Renters The ANCHOR proposal notably includes renters in property tax relief Renters on average have lower incomes than homeowners in New Jersey where median homeowner income

Homeowners and renters throughout the state will be sent key application information beginning this week about New Jersey s newest direct property tax relief To be eligible for this year s benefit homeowners and renters must have occupied their primary residence on Oct 1 2019 and file or be exempt from New

A Guide To Renters Insurance Avail

https://www.avail.co/wp-content/uploads/2015/06/a-guide-to-renters-insurance.jpg

California Gives Renters A Tax Credit

https://lirp.cdn-website.com/ee3e2d45/dms3rep/multi/opt/Depositphotos_63424347_s-2019-960w.jpg

https://www.nj.gov/treasury/taxation/proptaxdeduc_credit.shtml

You are eligible for a property tax deduction or a property tax credit only if You were domiciled and maintained a primary residence as a homeowner or tenant in

https://nj.gov/treasury/taxation/anchor/tenant.shtml

This program provides property tax relief to New Jersey residents who own or rent property in New Jersey as their principal residence and meet certain income

Millions Of Americans Could Be In Line For Boosted Tax Credits Worth

A Guide To Renters Insurance Avail

Wisconsin Homestead Credit 2021 2024 Form Fill Out And Sign Printable

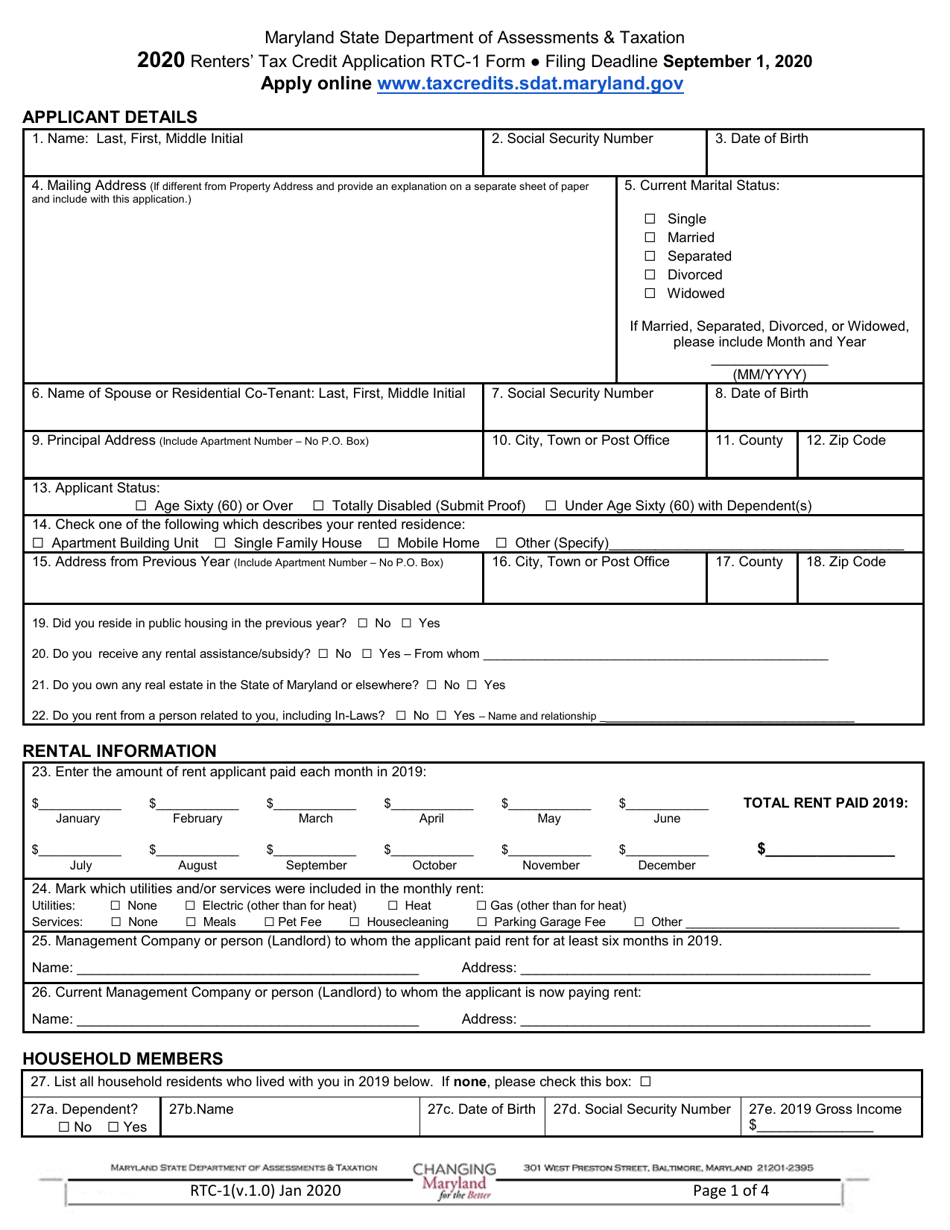

Rtc Form Printable Printable Forms Free Online

Renters Insurance How It Works And How Much You Need

Government Considering Tax Credit For Renters In Budget T naiste Says

Government Considering Tax Credit For Renters In Budget T naiste Says

Renter s Insurance Why Your Tenant Needs It ProRealty HOA Condo

Renters Tax Credit YouTube

Official Virginia Renters Insurance Guide YouTube

Tax Credit For Renters Nj - Qualified homeowners making less than 150 000 in 2021 will receive a tax credit of 1 500 while those making 150 000 to 250 000 will get a tax credit of 1 000 Renters who made 150 000