Tax Credit For Solar Panels Canada Verkko 23 kes 228 k 2022 nbsp 0183 32 Taxpayer s income for the tax year excluding the income from the solar panels included in Class 43 2 n a 100 Net income from solar panels included in Class 43 2 n a 30 Taxpayer s income from all sources for the tax year n a 130 Deduction of limited CCA because of the application of the specified energy property

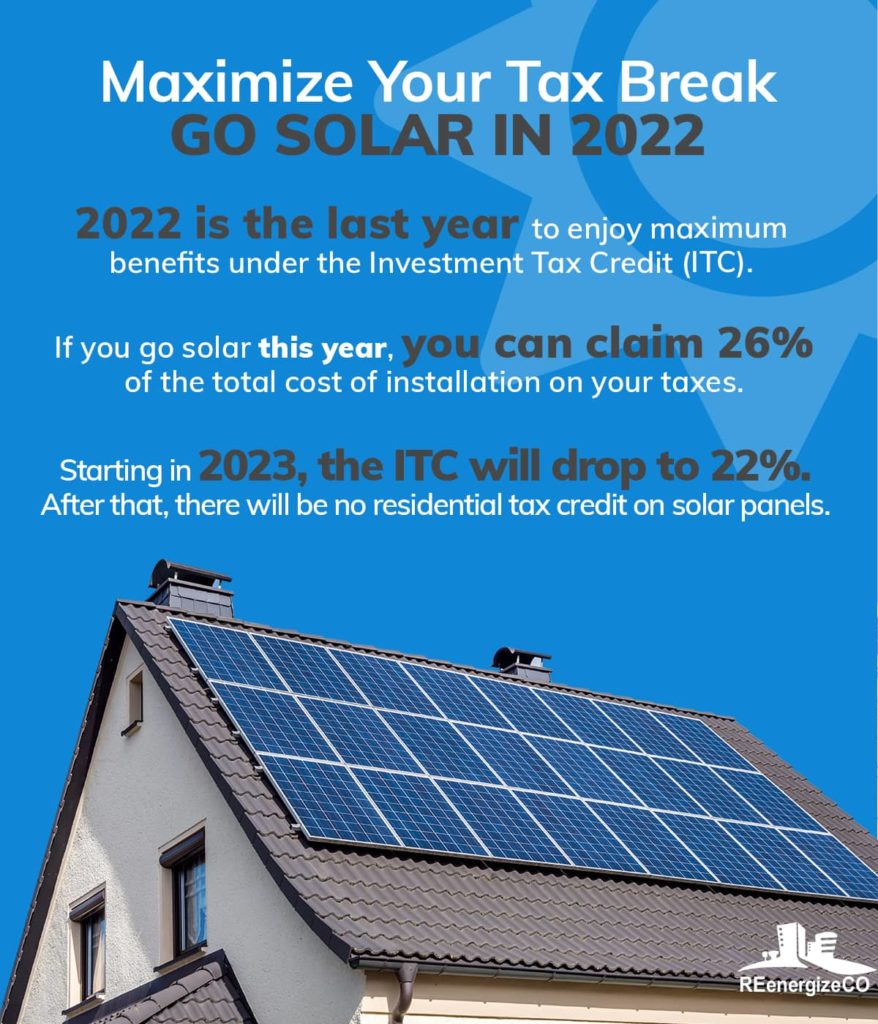

Verkko 31 maalisk 2023 nbsp 0183 32 Canada s federal government has outlined a new six year investment tax credit that puts a 30 tax credit in place for solar wind and energy storage projects deployed through March 2034 Verkko 27 toukok 2021 nbsp 0183 32 The government of Canada is launching a new program today that offers Canadians grants of up to 5 000 to pay for energy saving home upgrades

Tax Credit For Solar Panels Canada

Tax Credit For Solar Panels Canada

https://www.kr.solar/wp-content/uploads/2022/10/KR-Solar-Panels-Lease-Buy.jpg

Part 3 Investing In Solar Tax Credits Avisen Legal

https://www.avisenlegal.com/wp-content/uploads/2022/03/shutterstock_701016127-scaled.jpg

How Does The Federal Tax Credit For Solar Work Tampa Bay Solar

https://tampabaysolar.com/wp-content/uploads/2022/04/AdobeStock_201159810-2048x1365.jpeg

Verkko 2 marrask 2023 nbsp 0183 32 The Canada Greener Homes Grant Initiative offers a grant for installing a solar photovoltaic PV system including panels and an inverter that converts sunlight directly into electricity If you want to purchase batteries for storing the solar energy from your PV system a portion of the cost may be eligible for climate Verkko CanREA welcomes refundable investment tax credits that will bolster the competitiveness of Canada s renewable energy industry Ottawa March 28 2023 Recognizing the need for a Canadian response to the Inflation Reduction Act passed last summer in the United States the Canadian Renewable Energy Association CanREA

Verkko Canada introduces 30 refundable investment tax credits for energy storage Canada s government will introduce tax incentives for clean energy technologies including solar PV battery storage January 8 2024 Read More Alberta Slapped 7 Month Moratorium on Solar and Wind Put Booming Industry at Risk December 28 Verkko 30 maalisk 2023 nbsp 0183 32 The made in Canada plan mirrors the U S Inflation Reduction Act Canada s federal government outlined a six year investment tax credit this week that puts a 30 tax credit in place for solar wind and energy storage projects deployed through March 2034

Download Tax Credit For Solar Panels Canada

More picture related to Tax Credit For Solar Panels Canada

Property Assessed Financing For Solar Panels Reveal Serious Problems

https://floridapolitics.com/wp-content/uploads/2015/07/Solar-Panel-On-A-Red-Roof-Large.jpg

Understanding Tax Credits For Solar Energy Systems

https://thenewutility.com/wp-content/uploads/2016/11/solar-tax-credits.jpg

Requirements To Receive Up To 30 For The Tax Credit For Solar Panels

https://img.asmedia.epimg.net/resizer/v2/HK5MTCDKHFDZNDJ2R25XKLZLHM.jpg?auth=305980f43c758589e248993d4028a0ed57d02a42ab77cae9cfc55de9076317a6&width=1472&height=828&smart=true

Verkko Clean Energy Investment Tax Credit A refundable tax credit of 30 on the capital costs of investments until 2034 The Federal tax provision for clean energy extended until 2025 under this provision businesses including farms can depreciate the cost of their solar power system at an accelerated capital cost allowance rate of 100 in the first Verkko 8 marrask 2022 nbsp 0183 32 Canada s new 30 tax credits for clean technology are designed to level the playing field with the United States and spur the adoption of green technologies

Verkko Canada s Investment Tax Credit ITC was introduced in the 2022 Fall Economic Statement by the federal government This incentive targets clean technologies including solar PV battery storage and hydrogen The goal for this incentive is to enhance the country s competitiveness It will make Canada more attractive to investors and level Verkko The minimum allowable loan amount is 500 and the loan can go up to 30 000 for solar photovoltaic panels Solar PV financing is calculated based on 3 per watt installed the maximum term is 15 years no down payment is required the loan becomes due and payable when the house is sold the loan is not transferable and the annual interest

Tax Credit For Solar Panels How Does It Work Lifestyle

http://blog.nhregister.com/lifestyle/files/2022/05/tax-credit-for-solar-panels.jpeg

How Does The Federal Solar Tax Credit Work Nicki Karen

https://nickiandkaren.com/wp-content/uploads/2019/12/photo-1566093097221-ac2335b09e70.jpeg

https://www.canada.ca/en/revenue-agency/services/tax/technical...

Verkko 23 kes 228 k 2022 nbsp 0183 32 Taxpayer s income for the tax year excluding the income from the solar panels included in Class 43 2 n a 100 Net income from solar panels included in Class 43 2 n a 30 Taxpayer s income from all sources for the tax year n a 130 Deduction of limited CCA because of the application of the specified energy property

https://www.pv-magazine.com/2023/03/31/canada-formalizes-30-federal...

Verkko 31 maalisk 2023 nbsp 0183 32 Canada s federal government has outlined a new six year investment tax credit that puts a 30 tax credit in place for solar wind and energy storage projects deployed through March 2034

What Solar Tax Form Is Used To Claim Credits

Tax Credit For Solar Panels How Does It Work Lifestyle

What Is The Tax Credit For Solar Panels YouTube

Federal Solar Tax Credit A Quick Rundown Next Energy Solution

Understanding The Federal Tax Credit For Solar Panels

Solar Panels Other DIY Electricity Solutions Rethink Green

Solar Panels Other DIY Electricity Solutions Rethink Green

Colorado Government Solar Tax Credit Big History Blogger Photography

Is There A Tax Credit For Solar Panels 2023 Rules Reward

Is There A Federal Tax Credit For Solar Panels Best Rate Solar

Tax Credit For Solar Panels Canada - Verkko Canada introduces 30 refundable investment tax credits for energy storage Canada s government will introduce tax incentives for clean energy technologies including solar PV battery storage January 8 2024 Read More Alberta Slapped 7 Month Moratorium on Solar and Wind Put Booming Industry at Risk December 28