Tax Credit For Unemployed Spouse The 150 000 limit would disqualify each spouse in a higher earning couple who both lost their jobs in 2020 and typically file a joint tax return from getting the tax

If you or your spouse if filing a joint return received or were approved to receive unemployment compensation for any week beginning during 2021 the amount of your There are two types of tax relief for spouses Injured spouse relief lets you reclaim money taken from your tax refund to cover your spouse s debts Innocent

Tax Credit For Unemployed Spouse

Tax Credit For Unemployed Spouse

https://www.letsbegamechangers.com/wp-content/uploads/2020/01/load-image-2020-01-24T030638.645-1536x1024.jpeg

Tution Tax Credit For Students NCS CA

https://www.ncscorp.ca/wp-content/uploads/2022/03/Untitled-design-12-e1648708763193.png

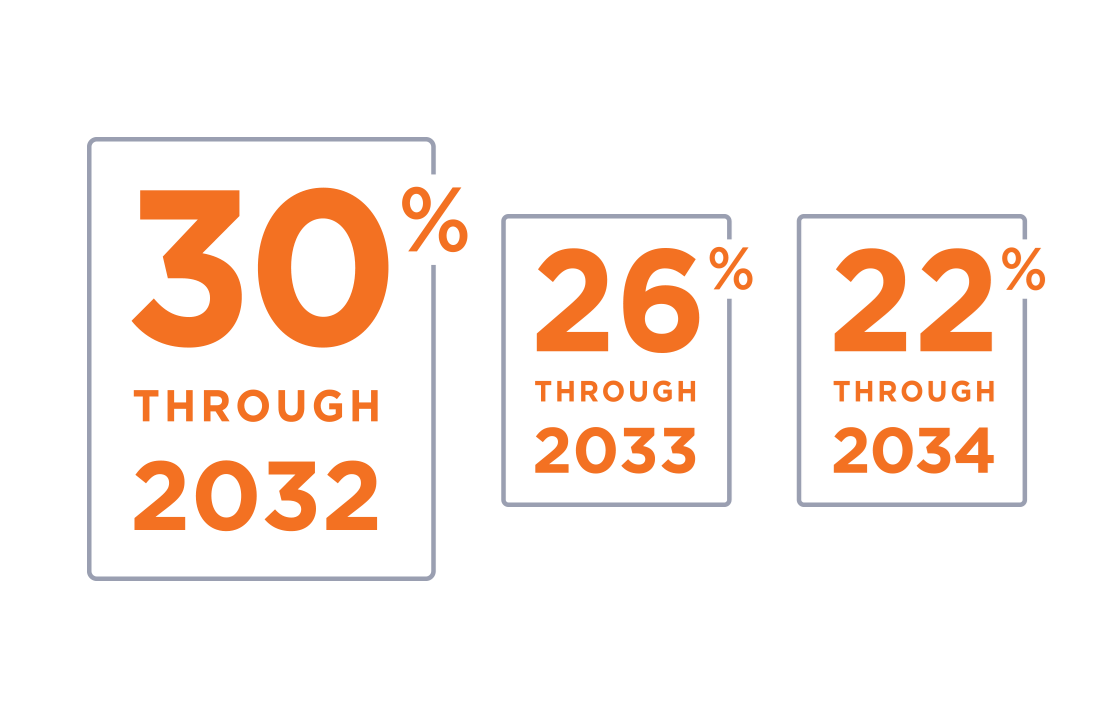

Inflation Reduction Act Expands 45L Tax Credit For Energy Efficient

https://www.revireo.com/wp-content/uploads/2022/08/iStock-1360720433-1-1-1024x512.jpeg

If you reconciled with your spouse or common law partner and were living together on December 31 2023 you can claim an amount on line 30300 of your return If you filed married filing joint and live in a community property state each spouse can exclude up to 10 200 even if only one of you received unemployment

A tax credit is an amount taxpayers claim on their tax return generally to reduce their income tax Eligible taxpayers can use them to potentially reduce their tax The exclusion is up to 10 200 of jobless benefits for each spouse for married couples So it s possible that if both lost work in 2020 a married couple filing a joint return might not have

Download Tax Credit For Unemployed Spouse

More picture related to Tax Credit For Unemployed Spouse

Unified Tax Credit Definition InfoComm

https://www.infocomm.ky/wp-content/uploads/2020/09/1600289863.jpeg

Here Are The Cars Eligible For The 7 500 EV Tax Credit In The

https://www.autopromag.com/usa/wp-content/uploads/2022/08/EV-Federal-Tax-Credits-5MgJUp.jpeg?is-pending-load=1

EU built Electric Vehicle Tax Credit Approval Will Face Internal And

https://s1.cdn.autoevolution.com/images/news/approval-of-tax-credit-for-union-built-evs-will-face-internal-and-foreign-disputes-173073_1.jpg

Disability tax credit People who are unable to work and are receiving disability payments might also qualify for a tax break called the credit for the elderly and The IRS is now automatically correcting tax returns for those who paid taxes on their unemployment compensation in 2020 Here s who might qualify for a refund

President Joe Biden signed a 1 9 trillion Covid relief bill Thursday that waives federal tax on up to 10 200 of unemployment benefits an individual received in You may be eligible to claim the Earned Income Credit if you earned income from a job or self employment for at least part of the tax year You can only receive the Earned

Historic Tax Benefit For Union Workers Championed By UDW Signed Into

https://udwa.org/wp-content/uploads/TaxCredit.png

Another Way To Save New Tax Credit For Plan Participants

https://insights.rpag.com/hubfs/Imported_Blog_Media/GettyImages-1077235824-1.jpg

https://www.cnbc.com/2021/03/26/american-rescue...

The 150 000 limit would disqualify each spouse in a higher earning couple who both lost their jobs in 2020 and typically file a joint tax return from getting the tax

https://www.irs.gov/affordable-care-act/...

If you or your spouse if filing a joint return received or were approved to receive unemployment compensation for any week beginning during 2021 the amount of your

Unemployed Spouse And Income Ambrose Family Law

Historic Tax Benefit For Union Workers Championed By UDW Signed Into

Georgia Tax Credits For Workers And Families

Geothermal Tax Credits Incentives

Tax Credit Bill For Rural Physicians Passes House Committee

Individuals Children s Promise Act Tax Credit Canopy Children s

Individuals Children s Promise Act Tax Credit Canopy Children s

Who Gets Tax Credits Leia Aqui Who Gets Federal Tax Credits

Everything You Need To Know About Child Tax Credits And The 2022 Tax

Modifications To The 45Q Tax Credit Great Plains Institute

Tax Credit For Unemployed Spouse - If you reconciled with your spouse or common law partner and were living together on December 31 2023 you can claim an amount on line 30300 of your return