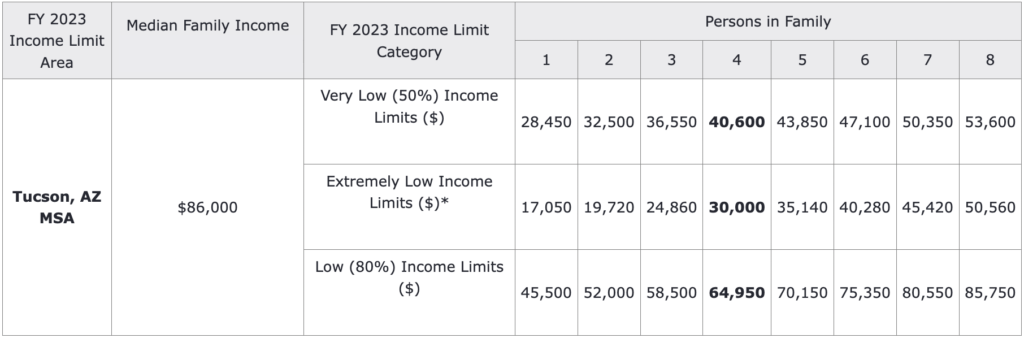

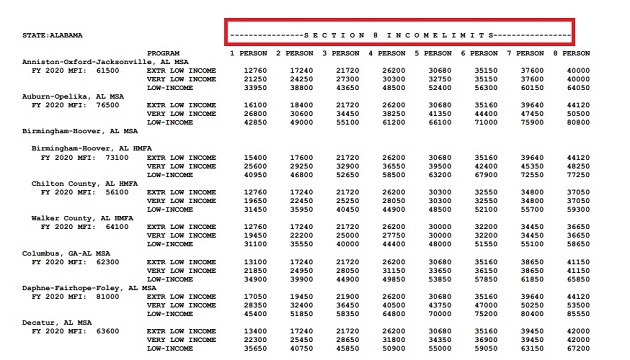

Tax Credit Housing Income Limits 2023 For the Low Income Housing Tax Credit program users should refer to the FY 2023 Multifamily Tax Subsidy Project income limits available at https www huduser gov portal datasets mtsp html The formula used to compute these income limits is as follows take 120 percent of the Very Low Income Limit

On May 15 HUD released the 2023 income limits for the Multifamily Tax Subsidy Projects MTSP housing programs MTSPs a term coined by HUD are all Low Income Housing Tax Credit projects under Section 42 of the Internal Revenue Code and multifamily projects funded by tax exempt bonds under Section 142 which generally also benefit from LIHTC The Department of Housing and Urban Development HUD sets income limits for various affordable housing programs including public housing Section 8 vouchers and Low Income Housing Tax Credit LIHTC properties

Tax Credit Housing Income Limits 2023

Tax Credit Housing Income Limits 2023

https://www.oregonhealthcare.us/uploads/2/9/6/1/29613079/2017-2018fplgraphic_1_orig.png

2023 2024 Income Eligibility Guidelines CDPHE WIC

https://www.coloradowic.gov/sites/default/files/media/image/IEG 22-23 English_02.png

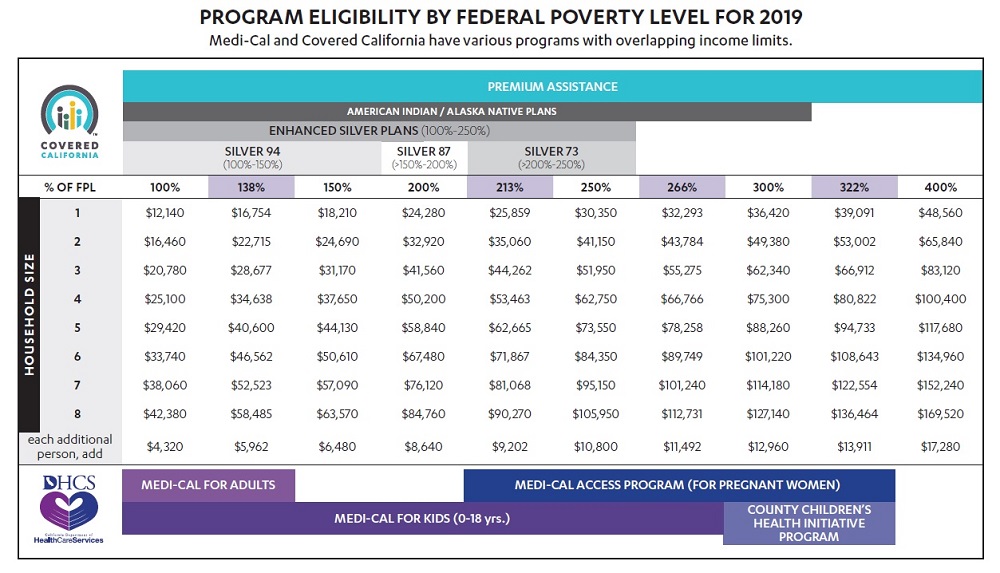

What Is The Medi Cal Income Limit For 2022 INVOMERT

https://i2.wp.com/insuremekevin.com/wp-content/uploads/2019/09/2020-Subsidy-Eligibility-Income-Chart-Covered-California-Medi_Cal-09_2019.jpg

As the affordable housing world anxiously awaits the fiscal year FY 2023 income limits the Novogradac Income Limits Working Group continues to monitor significant issues that will affect income limits in 2023 and beyond The Low Income Housing Tax Credit LIHTC program is the most important resource for creating affordable housing in the United States today

Calculating Costs and Benefits The Joint Committee on Taxation estimates LIHTC will cost around 13 2 billion in 2023 increasing to 15 2 billion by 2025 It is by far the largest federal program encouraging the creation of affordable What you need to know Because of the pandemic HUD will use 2021 ACS data to determine FY23 median family incomes and income limits for LIHTC sites Owners will have to wait until May 15 2023 for the new limits

Download Tax Credit Housing Income Limits 2023

More picture related to Tax Credit Housing Income Limits 2023

California HUD Income Limits 2023 2024 Enjoy OC

https://enjoyorangecounty.com/wp-content/uploads/2023/03/california-hud-income-limits-chart.jpg

Earned Income Tax Credit For Households With One Child 2023 Center

https://www.cbpp.org/sites/default/files/2023-04/policybasics-eitc_rev4-28-23_f1.png

.png)

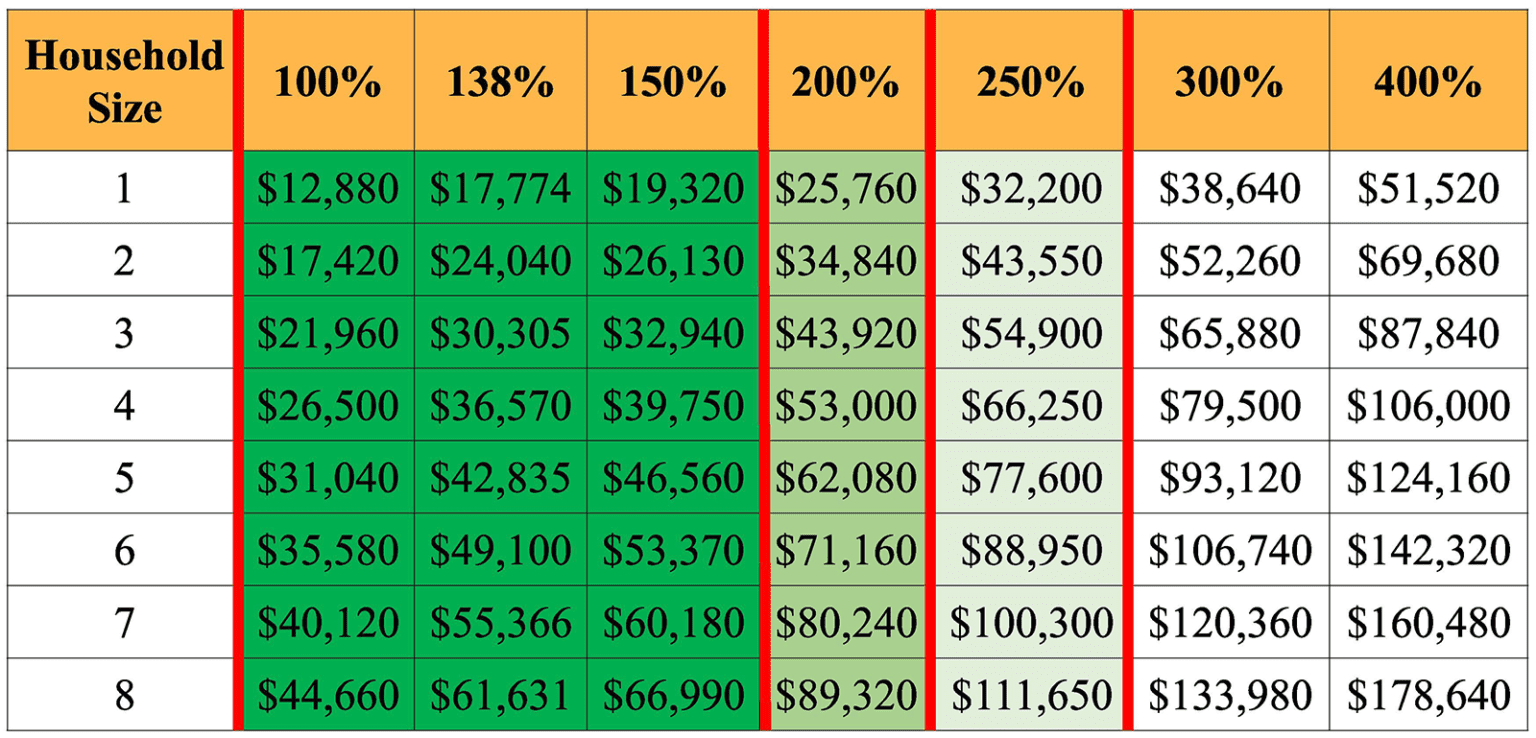

Health Insurance Income Limits For 2023 To Receive ACA Premium S

https://img1.wsimg.com/isteam/ip/cdfbdeb1-9bb8-4d54-828b-6c8a27c8b1f0/image (1).png

Increasing the amount of tax credits states receive in 2023 from 2 75 per person to 3 90 per person and then to 4 875 per person in 2024 not including an inflation adjustment that would apply in 2024 and For the second year in a row U S Department of Housing and Urban Development HUD income limits to determine eligibility for HUD assisted programs and low income housing tax credit LIHTC properties increased in more than 98 of areas but for the second year in a row the increase was limited in the majority of areas

Here are some key questions and answers about the HUD 2023 income limits When will 2023 income limits be released HUD has a stated target of May 15 to release income limits for 2023 This is much later than in previous years and later than HUD s recent goal of releasing limits April 1 each year FY 2024 HOME Income Limits are effective June 1 2024 The HOME Income Limits are calculated using the same methodology that HUD uses for calculating the income limits for the Section 8 program in accordance with Section 3

2022 Affordable Housing Income Limits By Household Wyckoff NJ

https://www.wyckoff-nj.com/sites/g/files/vyhlif5246/f/imce/income_limits_2022-page-0.jpg

S8.png)

Eastern Regional Housing Authority IA

https://eirha.org/Images/22- INCOME LIMITS -(1) S8.png

https://www.huduser.gov › portal › datasets › il.html

For the Low Income Housing Tax Credit program users should refer to the FY 2023 Multifamily Tax Subsidy Project income limits available at https www huduser gov portal datasets mtsp html The formula used to compute these income limits is as follows take 120 percent of the Very Low Income Limit

https://www.taxcredithousinginsider.com › article

On May 15 HUD released the 2023 income limits for the Multifamily Tax Subsidy Projects MTSP housing programs MTSPs a term coined by HUD are all Low Income Housing Tax Credit projects under Section 42 of the Internal Revenue Code and multifamily projects funded by tax exempt bonds under Section 142 which generally also benefit from LIHTC

Covered California Income Tables IMK

2022 Affordable Housing Income Limits By Household Wyckoff NJ

Solar Empowerment Program Sonora Environmental Research Institute

2023 Tax Brackets The Best Income To Live A Great Life

ACA Tax Credits To Help Pay Premiums White Insurance Agency

Maximize Your Paycheck Understanding FICA Tax In 2023

Maximize Your Paycheck Understanding FICA Tax In 2023

FAQ WA Tax Credit

Income Limits San Benito TX Official Website

Section 8 Program Limits And Types Of Income Help With Taxes In USA

Tax Credit Housing Income Limits 2023 - What you need to know Because of the pandemic HUD will use 2021 ACS data to determine FY23 median family incomes and income limits for LIHTC sites Owners will have to wait until May 15 2023 for the new limits