Tax Credit Income Limits 2023 Ev Updated FAQs were released to the public in Fact Sheet 2023 29 PDF Dec 26 2023 The Inflation Reduction Act of 2022 IRA makes several changes to the tax

Due to ongoing changes to U S Treasury Department and IRS rules there are questions about which electric vehicles qualify for the full tax credit for the 2023 tax The new climate law also added income limits for the tax credit a maximum of 300 000 for a household 150 000 for an

Tax Credit Income Limits 2023 Ev

Tax Credit Income Limits 2023 Ev

https://ohfablog.org/wp-content/uploads/2019/04/income-1024x683.jpg

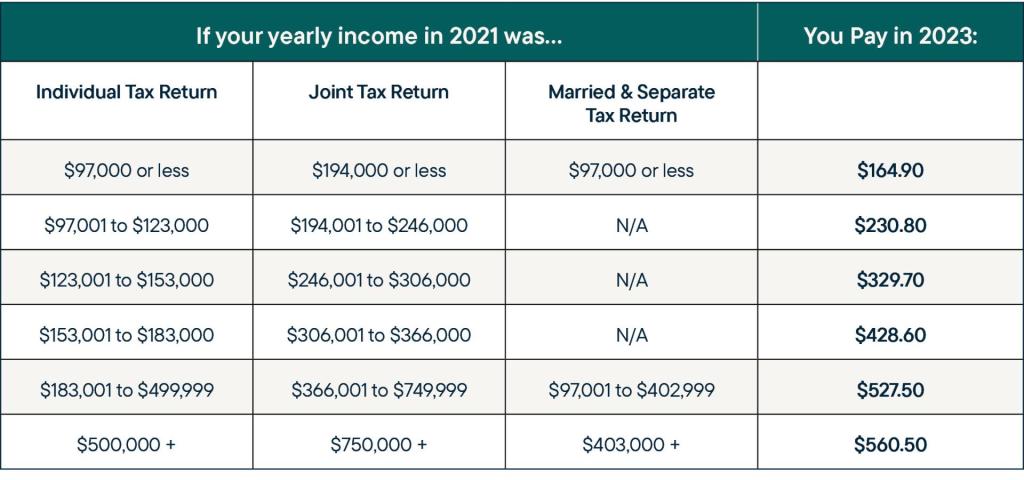

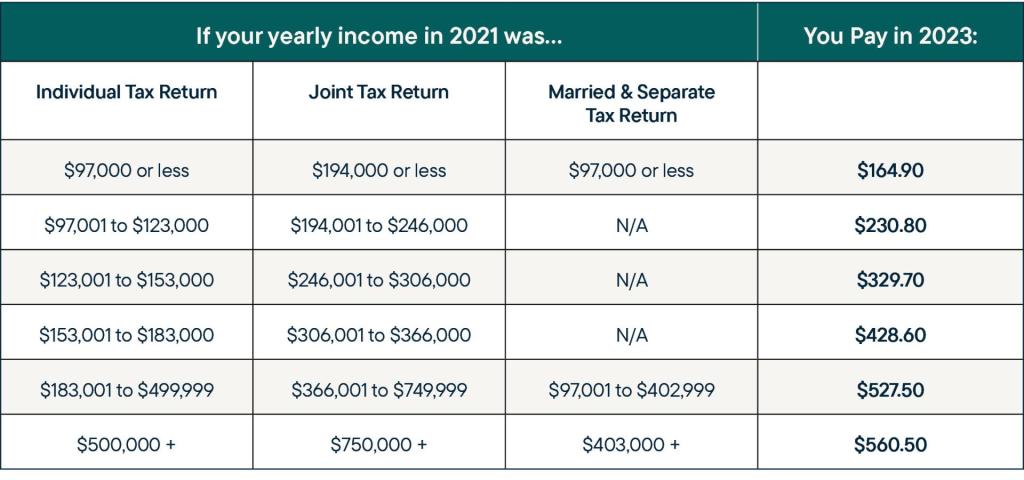

What Is Medicare Part B Your 2023 Costs Coverage Simplified RetireMed

https://www.retiremed.com/sites/default/files/styles/half/public/2022-11/RetireMed_New Brand_IRMAA Chart-Part B 2021 Income.jpg?itok=UmXlfMwe

Earned Income Tax Credit For Households With One Child 2023 Center

https://www.cbpp.org/sites/default/files/2023-04/policybasics-eitc_rev4-28-23_f1.png

All electric plug in hybrid and fuel cell electric vehicles purchased new in 2023 or after may be eligible for a federal income tax credit of up to 7 500 The Inflation Reduction Act of 2022 IRA makes several changes to the tax credit provided in 30D of the Internal Revenue Code Code for qualified plug in

For heads of households that income cap rises to 225 000 Joint filers are eligible for the EV tax credit if their income is below 300 000 GM says its eligible EVs should qualify for the 3 750 credit by March with the full credit available in 2025 Until Treasury issues its rules though the requirements governing where

Download Tax Credit Income Limits 2023 Ev

More picture related to Tax Credit Income Limits 2023 Ev

.png)

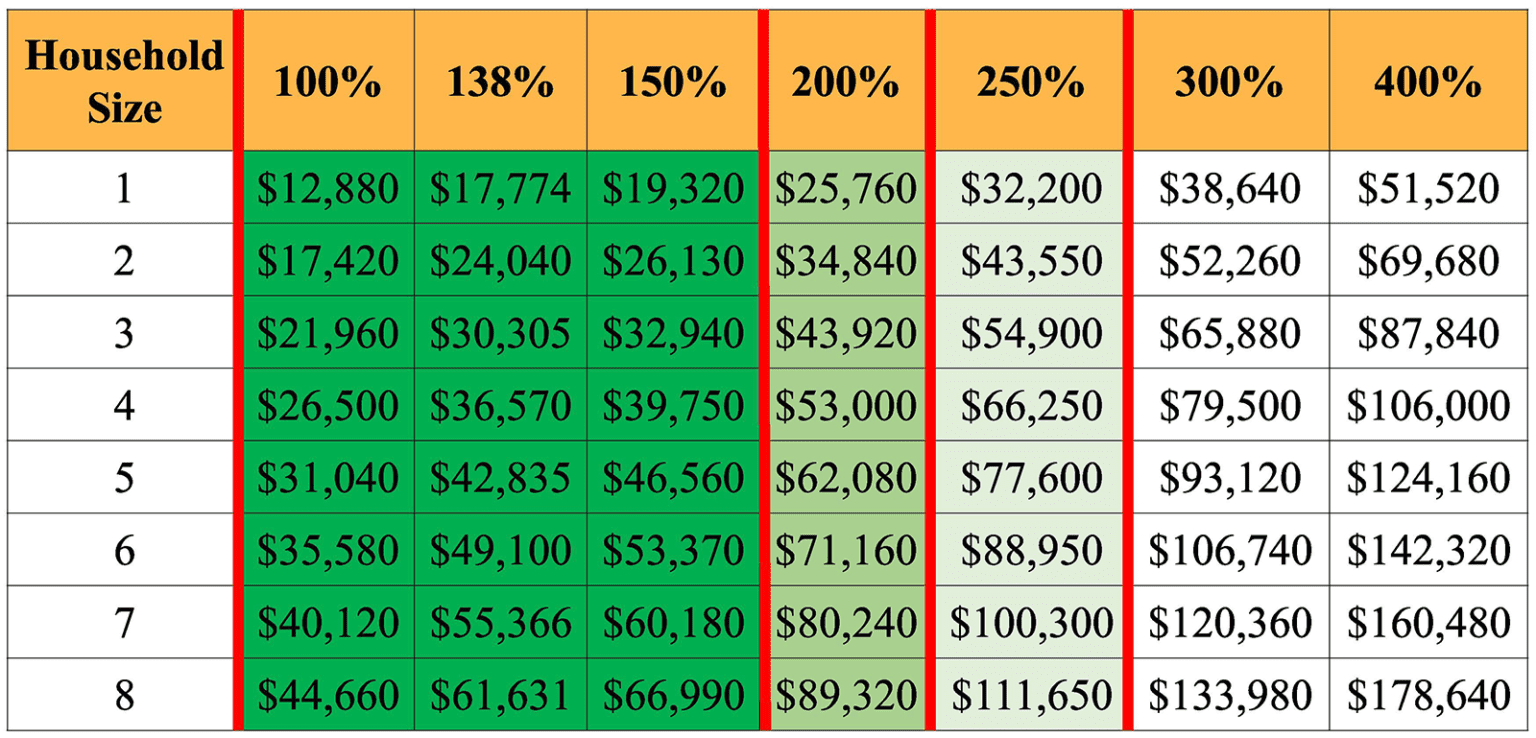

Health Insurance Income Limits For 2023 To Receive ACA Premium S

https://img1.wsimg.com/isteam/ip/cdfbdeb1-9bb8-4d54-828b-6c8a27c8b1f0/image (1).png

Earning Income Tax Credit Table

https://www.taxestalk.net/wp-content/uploads/earned-income-tax-credit-city-of-detroit-768x389.jpeg

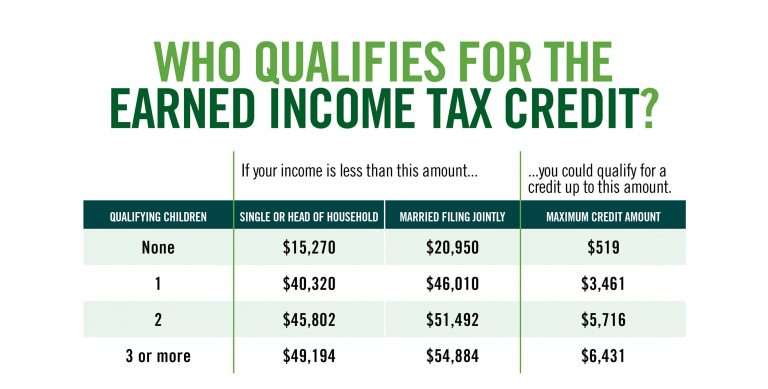

Earned Income Tax Credit EITC Who Qualifies

https://assets-global.website-files.com/600089199ba28edd49ed9587/63ab2cfeb6ed4e84980e9602_5Q05z7zzxkuPsQXDnaB9jShs6SVdcb0uB84DMBeLXFAIZJwwSAmHnQ4a7WbGqdLfxs9kSpNnGo8K3YMonR0wgBTu--Pgkhfuie7pFBG4XhGd3Kj-sMXIsb9rNoZWGXn0fc0IkJZa7T7C3Hhn3f492M_Gdep5jUnJluN29uavkjwe4XzK-GPA4B6nDNjE00CQKNhoDAt7LA.png

Jameson Dow Apr 5 2023 2 59 pm PT 79 Comments Last week the IRS updated the EV tax credit with new battery sourcing requirements set to go into place on April 17 with the effect of How the 2023 EV Tax Credit Works The electric vehicle tax credit works by lowering your tax bill on a dollar for dollar basis So if you owe the IRS 5 000 and you

What is the electric vehicle tax credit Which cars qualify for a federal EV tax credit How to qualify for the 2024 EV tax credit How the electric vehicle tax credit is New electric vehicles may be eligible for a tax credit of either 7 500 or 3 750 if they are delivered on or after April 18 2023 Vehicle Eligibility Vehicles must

Hsa 2023 Contribution Limit Irs Q2023F

https://i2.wp.com/www.wexinc.com/wp-content/uploads/2022/05/ContributionLimitsChart_Blog_SupplementalGraphic_2023-1-1024x768.jpg

Child Tax Credit Income Limit 2024 Credits Zrivo

https://www.zrivo.com/wp-content/uploads/2021/01/Child-Tax-Credit-Income-Limit.jpg

https://www.irs.gov/newsroom/topic-b-frequently...

Updated FAQs were released to the public in Fact Sheet 2023 29 PDF Dec 26 2023 The Inflation Reduction Act of 2022 IRA makes several changes to the tax

https://www.kiplinger.com/taxes/ev-tax-credit

Due to ongoing changes to U S Treasury Department and IRS rules there are questions about which electric vehicles qualify for the full tax credit for the 2023 tax

EV Tax Credit 2024 Credits Zrivo

Hsa 2023 Contribution Limit Irs Q2023F

Income Limits Before Tax Deductions Start Phasing Out

Maximize Your Paycheck Understanding FICA Tax In 2023

FAQ WA Tax Credit

Earned Income Tax Credit 2023 Income Limits Age Limit Eligibility Refund

Earned Income Tax Credit 2023 Income Limits Age Limit Eligibility Refund

ACA Tax Credits To Help Pay Premiums White Insurance Agency

2023 Tax Bracket Changes And IRS Annual Inflation Adjustments

incometax tax taxguru law Tax Deductions Income Tax Limits

Tax Credit Income Limits 2023 Ev - CNN The Treasury Department has revealed which cars will be eligible for the new electric vehicle tax credits Fewer models are eligible for the new subsidy than