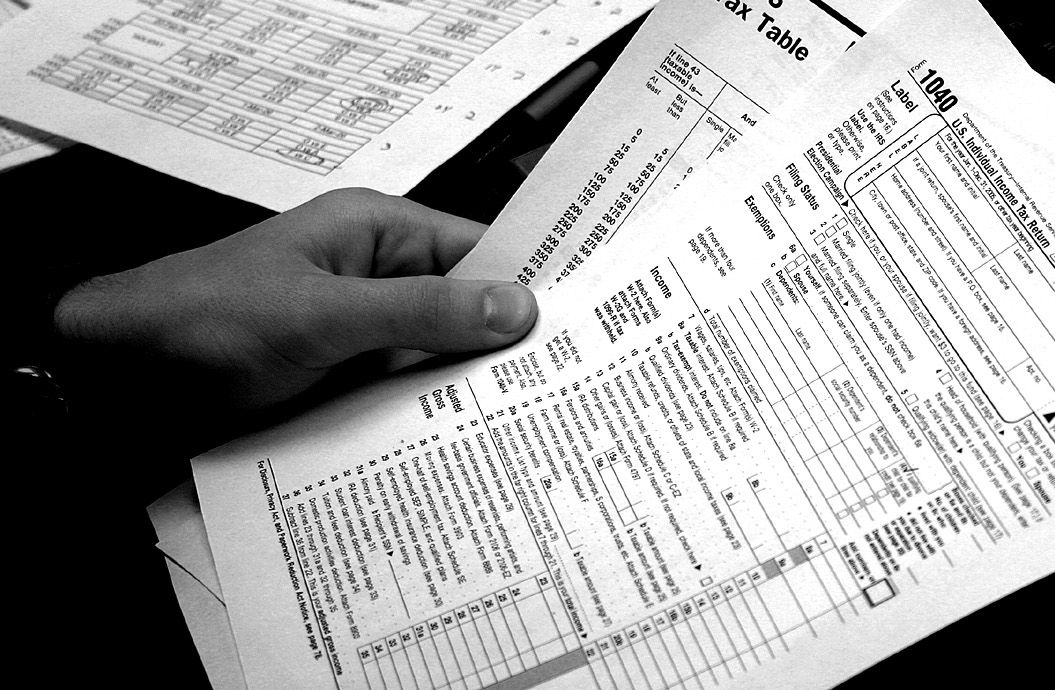

Tax Credit Interest Income Tax credits directly reduce the amount of tax you owe while tax deductions reduce your taxable income For example a tax credit of 1 000 lowers your tax bill by that same 1 000

When you claim tax credits you ll need to give details of your total income You ll also need to work out your income when you renew your tax credits each year Most interest earned in a year is considered taxable income and is taxed at ordinary income tax rates Interest excluded from taxable income includes interest from Series EE and Series I bonds

Tax Credit Interest Income

Tax Credit Interest Income

https://www.financialmirror.com/wp-content/uploads/2023/09/DOC.20230626.5165526.01MK06-scaled.jpg

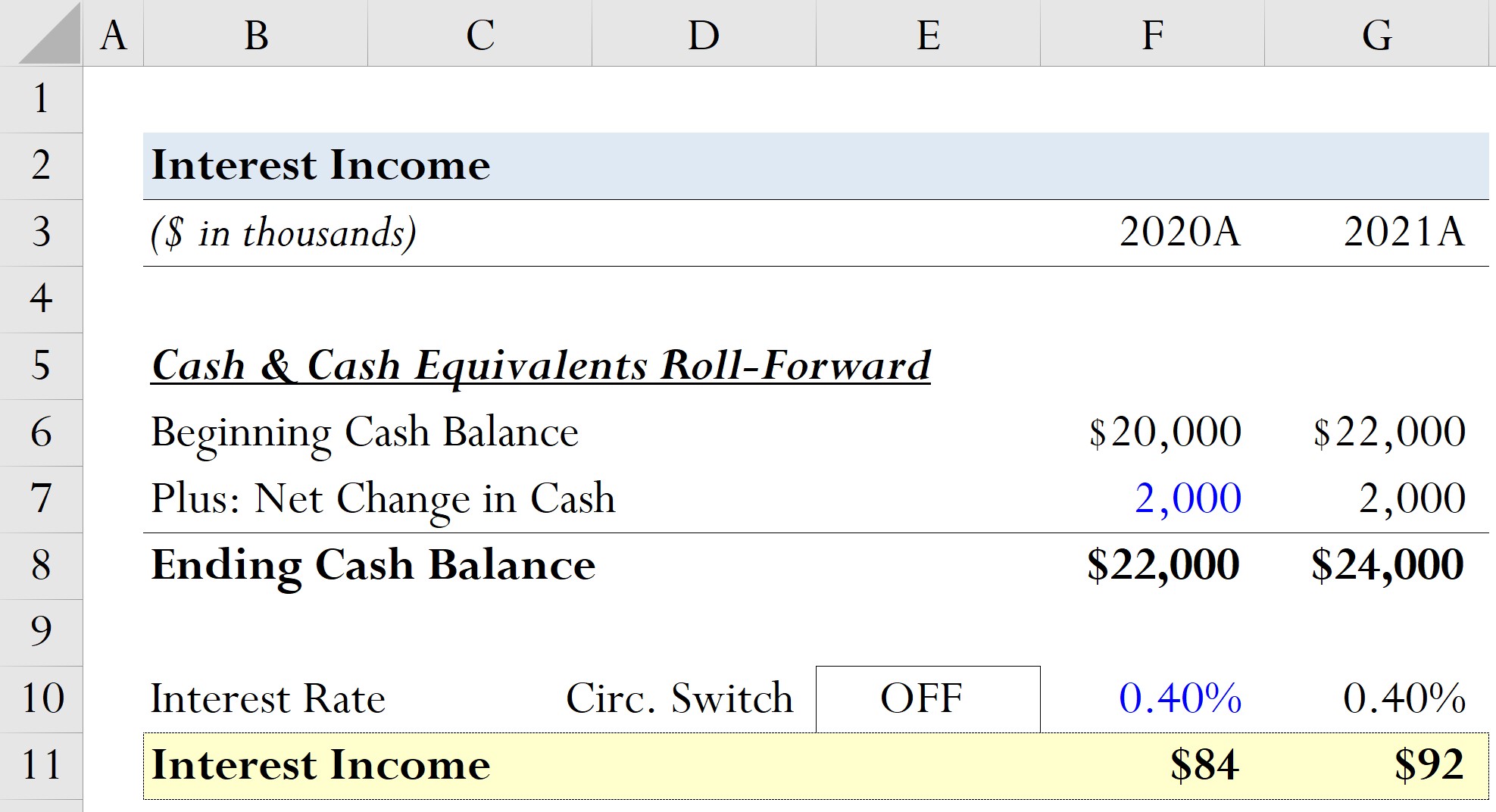

How Is Interest Income Taxed

https://img-s-msn-com.akamaized.net/tenant/amp/entityid/AA1h7EAT.img?w=2048&h=1365&m=4&q=88

Earned Income Tax Credit EITC Get Your Payment IL

https://getmypaymentil.org/wp-content/uploads/2022/10/gmpil-website-poll-banner.jpg

Most interest that you receive or that is credited to an account that you can withdraw from without penalty is taxable income in the year it becomes available to you However A tax credit is an amount taxpayers claim on their tax return generally to reduce their income tax Eligible taxpayers can use them to potentially reduce their tax

To claim the Earned Income Tax Credit EITC you must have what qualifies as earned income and meet certain adjusted gross income AGI and credit To qualify for the EITC your investment income cannot have exceeded 11 000 in 2023 Investment income includes interest income dividends rents and royalties

Download Tax Credit Interest Income

More picture related to Tax Credit Interest Income

Tax Accounting Services Lee s Tax Service

https://leestaxservicellc.com/files/IMG_1348.png

The Electric Car Tax Credit What You Need To Know OsVehicle

https://cdn.osvehicle.com/can_i_claim_the_ev_tax_credit_every_year.png

https://hesabdarema.com/wp-content/uploads/2022/04/Tax-credit.jpg

Most all earned interest is taxable at both the federal and state levels in the year that it is earned An exception to this rule would be if you earned interest in a tax deferred account such as an IRA You won t The earned income tax credit EITC is a refundable tax credit used to supplement the wages of low income workers and help offset the effect of Social Security taxes The EITC is

One of the most beneficial and refundable tax credits for families with low or moderate incomes is the EIC Here are five facts about the EIC all taxpayers should know 1 If you earned less than 63 398 if Married Filing Jointly or 56 838 if filing as an individual surviving spouse or Head of Household in tax year 2023 you may

Tax Credit Universal Credit Impact Of Announced Changes House Of

https://commonslibrary.parliament.uk/wp-content/uploads/2015/11/IDS.jpg

Pricing Tax Credit Community

https://taxcreditcommunity.com/wp-content/uploads/2022/03/Tax_Credit_final_logo_colour_blue_background-03.png

https://www.investopedia.com/terms/t/t…

Tax credits directly reduce the amount of tax you owe while tax deductions reduce your taxable income For example a tax credit of 1 000 lowers your tax bill by that same 1 000

https://www.gov.uk/guidance/tax-credits-working-out-income

When you claim tax credits you ll need to give details of your total income You ll also need to work out your income when you renew your tax credits each year

Interest Income Formula And Calculation

Tax Credit Universal Credit Impact Of Announced Changes House Of

Earned Income Tax Credit Claims Are Less Likely After IRS Audits

More Americans Carry Credit Card Debt Due To COVID 19 Debt

New Tax Credit To Fully Offset The Cost For Small Businesses Who

Reporting Interest Income On Your 2020 Federal Income Tax Return

Reporting Interest Income On Your 2020 Federal Income Tax Return

Income Tax On Interest On Savings Bank FD Account In India Fintrakk

Free Money 1099 Interest Income Is Rarely Tax free

Individual Tax WEC CPA Blog

Tax Credit Interest Income - Most interest you receive that s available for a withdrawal is taxable income This can include interest on Bank accounts Money market accounts Deposited insurance