Tax Credit Iras Singapore tax residents may claim foreign tax credit FTC when filing their Income Tax Returns in Singapore to avoid paying income taxes on the same income which was taxed in the foreign

IRAS will automatically refund tax credits and pay interest on credits that were not refunded within 30 days from the date the tax credit arises This excludes situations when automatic You can set up an IRA with a bank insurance company or other financial institution Traditional IRAs You may be able to deduct some or all of your contributions to a traditional IRA You

Tax Credit Iras

Tax Credit Iras

https://www.kitces.com/wp-content/uploads/2020/09/Distributions-from-Traditional-IRAs-Cannot-Be-Separated-Into-Pre-Tax-and-Post-Tax-Components-V01.png

How To Claim The Retirement Saver s Credit IRAs US News

https://www.usnews.com/dims4/USNEWS/d99fc73/2147483647/resize/1200x>/quality/85/?url=http:%2F%2Fcom-usnews-beam-media.s3.amazonaws.com%2F7a%2Fbd%2Fc8b6a08d41788e95d3dba838bfb6%2F141210-nesteggblue-stock.jpg

Income Taxes In Singapore You Need To Know About Procosec Asia

https://www.procosecasia.com/portal/wp-content/uploads/2021/09/4-Foreign-tax-credit-IRAS.jpg

A tax credit is an amount of money that taxpayers can subtract dollar for dollar from the income taxes they owe Tax credits are more favorable than tax deductions because they reduce How to claim the Foreign Tax Credit File Form 1116 Foreign Tax Credit to claim the foreign tax credit if you are an individual estate or trust and you paid or accrued certain foreign taxes to a

Usually referred to as the saver s tax credit it allows individuals and families with modest incomes to enjoy tax breaks above and beyond any deductions that they may receive This major legislation will affect individuals businesses tax exempt and government entities We ll post guidance for taxpayers on all credits and deductions from the Inflation Reduction

Download Tax Credit Iras

More picture related to Tax Credit Iras

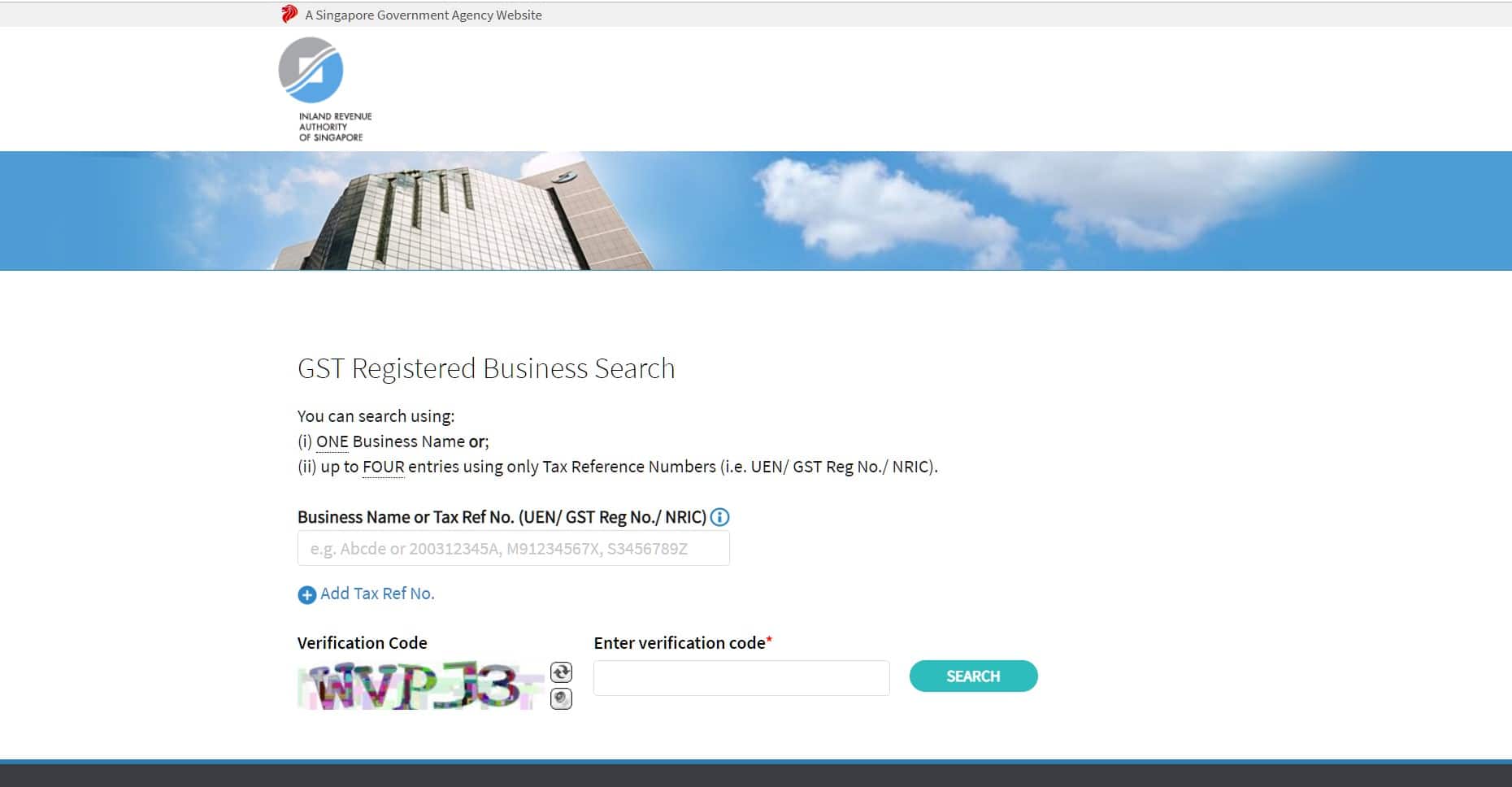

Singapore Tax Guide Check A Company s GST Registration Number Paul

https://pwco.com.sg/wp-content/uploads/2019/11/check-gst-registration.jpg

IRAs Vs 401 k Napkin Finance

https://napkinfinance.com/wp-content/uploads/2016/10/NapkinFinance-IRAvs401k-Napkin-12-19-2018-v05.jpg

Singapore GST Goods Services Tax ACHIBIZ

https://achibiz.com/wp-content/uploads/2019/04/IRAS-GST-Input-Output-Tax-Image-V-3.1-E.jpg

IRA Related Tax Guidance Last updated October 30 2024 U S Code Section Tax Incentive or Policy Most Recent Information Energy Generation and Carbon Capture The contribution limits for a traditional or Roth IRA increased last year but remain steady for 2025 You can contribute a maximum of 7 000 same as 2024 Catch up

Some 43 billion in IRA tax credits aim to lower emissions by making EVs energy efficient appliances rooftop solar panels geothermal heating and home batteries When the Inflation Reduction Act IRA was first enacted into law in August 2022 it included provisions that allow businesses and investors to transfer tax credits as a financial

How To Calculate Foreign Tax Credit Iras TAXIRIN

https://lh3.googleusercontent.com/proxy/p5tand3bs5H46rgM_42VVtHVbn_uCs7yPX6cGyyfMcYeTCEr5j2l1j65BHWtnE5oNe-pQ9qPFYw682sDikk6mpG5A8y3_AcvzH595_JJrCPVja4YcGq2hj_Jxhij7FDPbS-_9A_BPGewCov8Ji5UHIzC5Ulq26HKoTsvb85CGkkrkw87QA3I1oGKLQMmz6Nouu69z6Gdjmoc5xAGz9lO1Q0Trydt__7j3uTAAgYX2dzJDHzYScTrMZC0kkFmfpDbJus86ouodN4-LyNCsc1HCOF5aAh9bN-GBLeHT1tkAHgcg8aq7myDb9AkLNloVL7DfX4HLyevmWey9k5m3YPkMyVrM7pa8bI1uRuq8G7WT7J_gv8JGYlU9p86gABI42HmzFqjs7xK2H3jcIWCrEQOZWYU8IeEe8WQVYQbscmFe2WhCcGD55HwVshDc3LV=w1200-h630-p-k-no-nu

Solved Scenario 1 Individual Retirement Accounts IRAs Chegg

https://d2vlcm61l7u1fs.cloudfront.net/media/803/8032b918-953e-46dc-8b28-26bff8aeb937/phplDhLNM.png

https://www.iras.gov.sg › taxes › individual-income...

Singapore tax residents may claim foreign tax credit FTC when filing their Income Tax Returns in Singapore to avoid paying income taxes on the same income which was taxed in the foreign

https://www.iras.gov.sg › quick-links › refunds

IRAS will automatically refund tax credits and pay interest on credits that were not refunded within 30 days from the date the tax credit arises This excludes situations when automatic

Scam Email Claims To Be From IRAS Offers Tax Refund And Wants Your

How To Calculate Foreign Tax Credit Iras TAXIRIN

Scam Email Claims To Be From IRAS Offers Tax Refund And Wants Your

IRAs

GET SUPPORT FROM SINGAPORE New

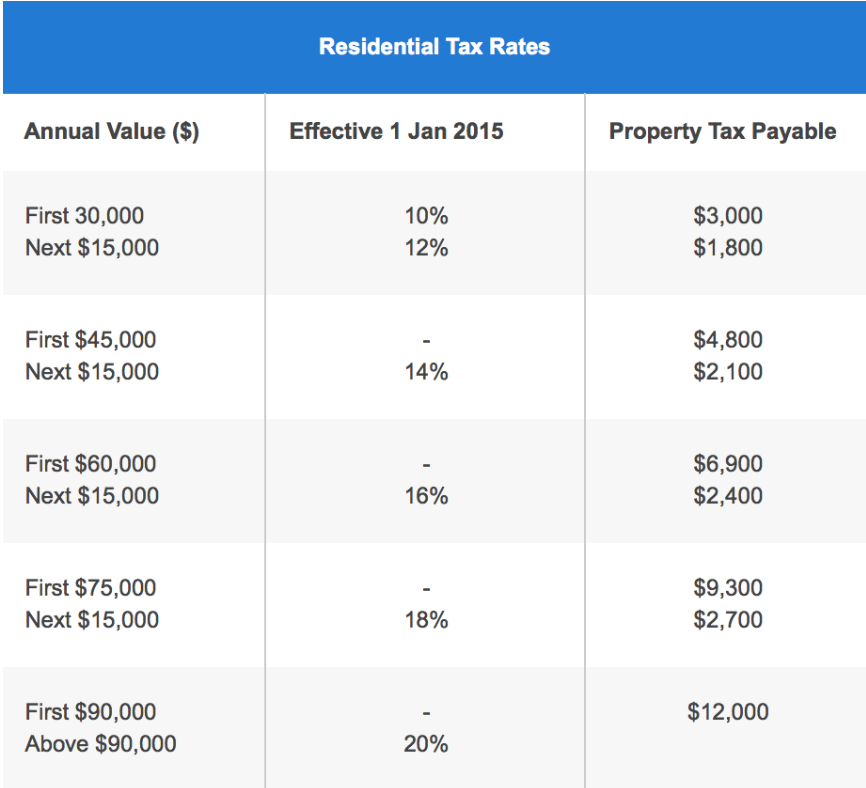

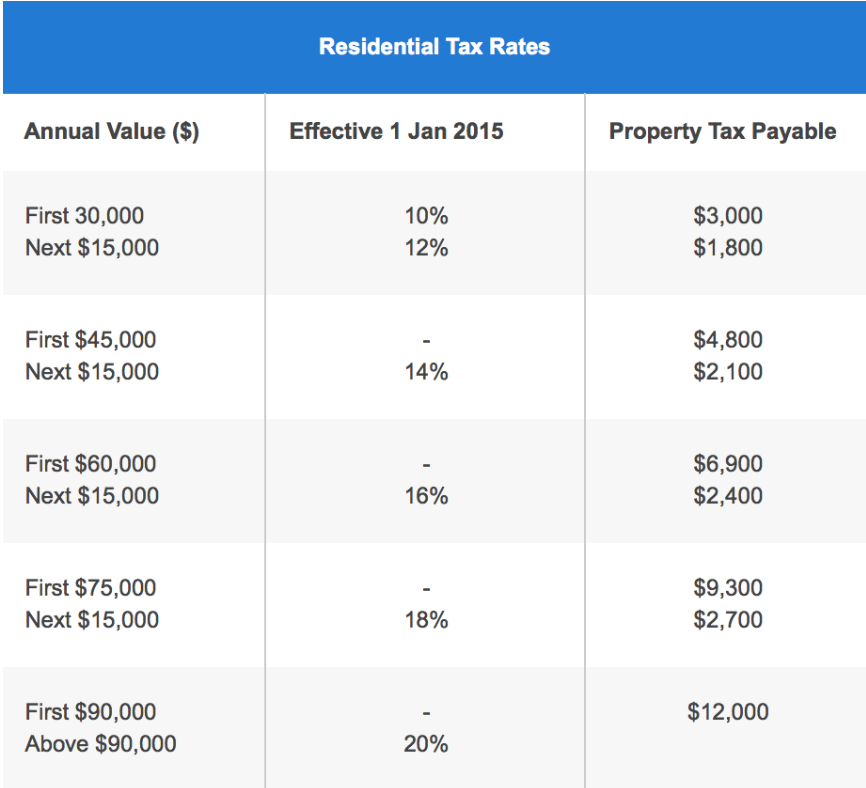

Property Tax For Homeowners In Singapore How Much To Pay Rebates

Property Tax For Homeowners In Singapore How Much To Pay Rebates

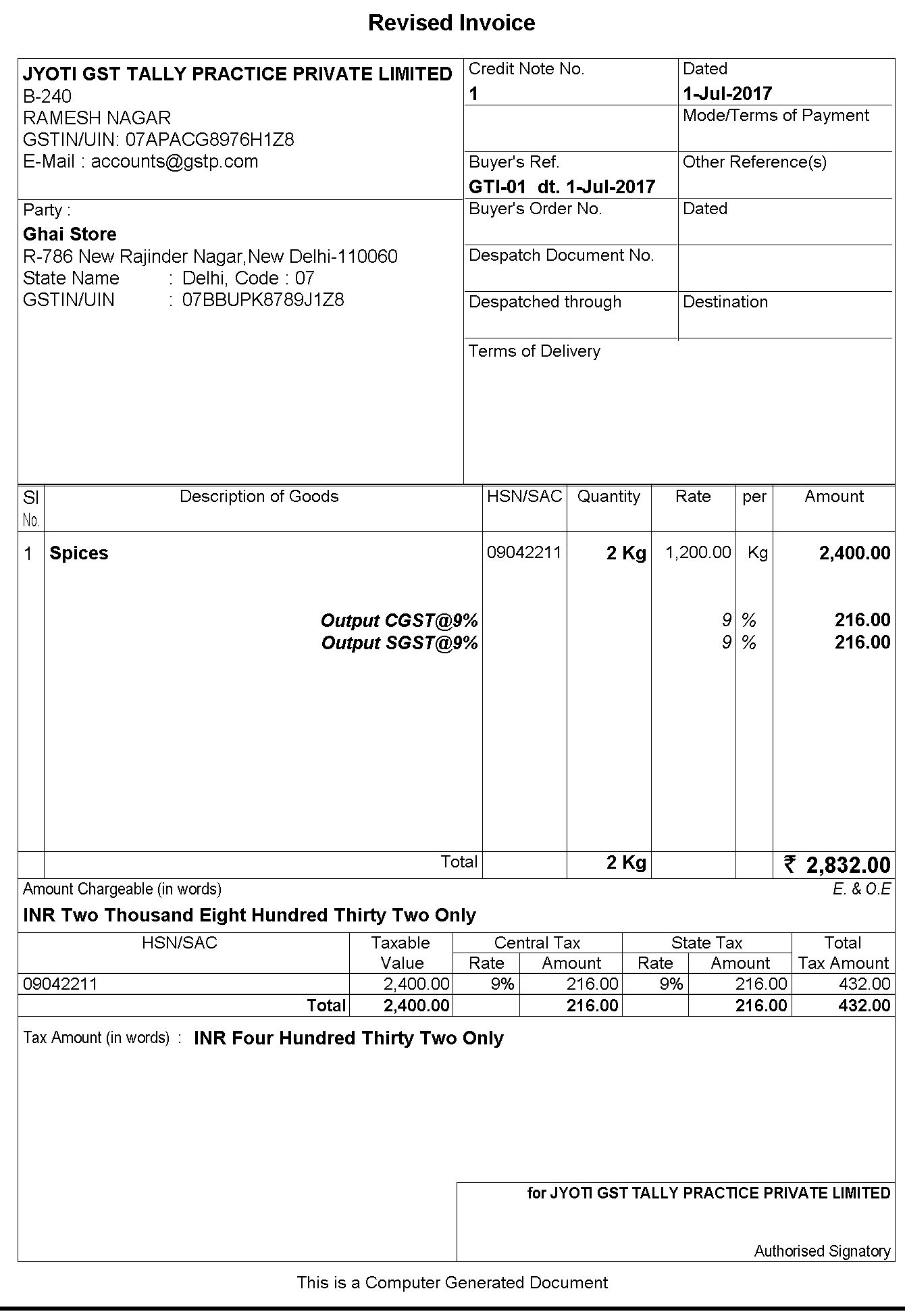

Tax Invoice Format Under Gst Invoice Template Ideas

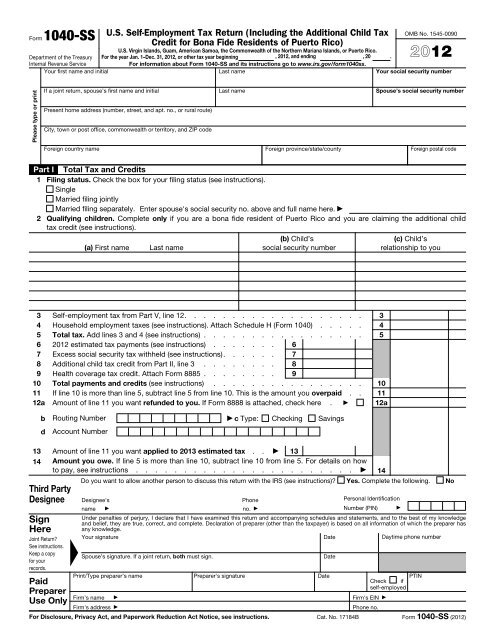

Can I Claim Child Tax Credit If Self Employed Credit Walls

Solved Individual Retirement Accounts IRAs Allow People To Chegg

Tax Credit Iras - The Inflation Reduction Act IRA has revolutionized the way federal clean energy tax credits are monetized and has transformed the way companies approach how they