Tax Credit Michigan The checks come after a state law was passed last March that expanded Michigan s Earned Income Tax Credit from 6 to 30 of the federal tax credit Who will get a check Recipients will be taxpayers who qualified for the Earned Income Tax Credit in 2022 designed to benefit residents who have a job

Michigan plans to mail refund checks to anyone who qualified for the Earned Income Tax Credit in 2022 Checks will average 550 and benefit an estimated 700 000 households according to Gov Gretchen Whitmer The checks will accelerate a planned expansion of the tax credit which is available to lower The maximum credit in Michigan is 2 229 for 2023 And taxpayers will benefit retroactively as well since the maximum credit was boosted to 2 080 for 2022

Tax Credit Michigan

Tax Credit Michigan

https://www.pdffiller.com/preview/540/440/540440856/large.png

Coalition Wants Michigan Legislature To Boost Earned Income Tax Credit

https://www.mlive.com/resizer/nC29jCns4BZ_jxpHzKObtpknQ-c=/1280x0/smart/advancelocal-adapter-image-uploads.s3.amazonaws.com/image.mlive.com/home/mlive-media/width2048/img/news_impact/photo/incometaxformjpg-aae0d8be6eb92619.jpg

What Is A Tax Credit Tax Credits Explained

https://media.valuethemarkets.com/img/Whatisataxcredit__685660f27b96fbc6e0edb67eb5c59039.jpg

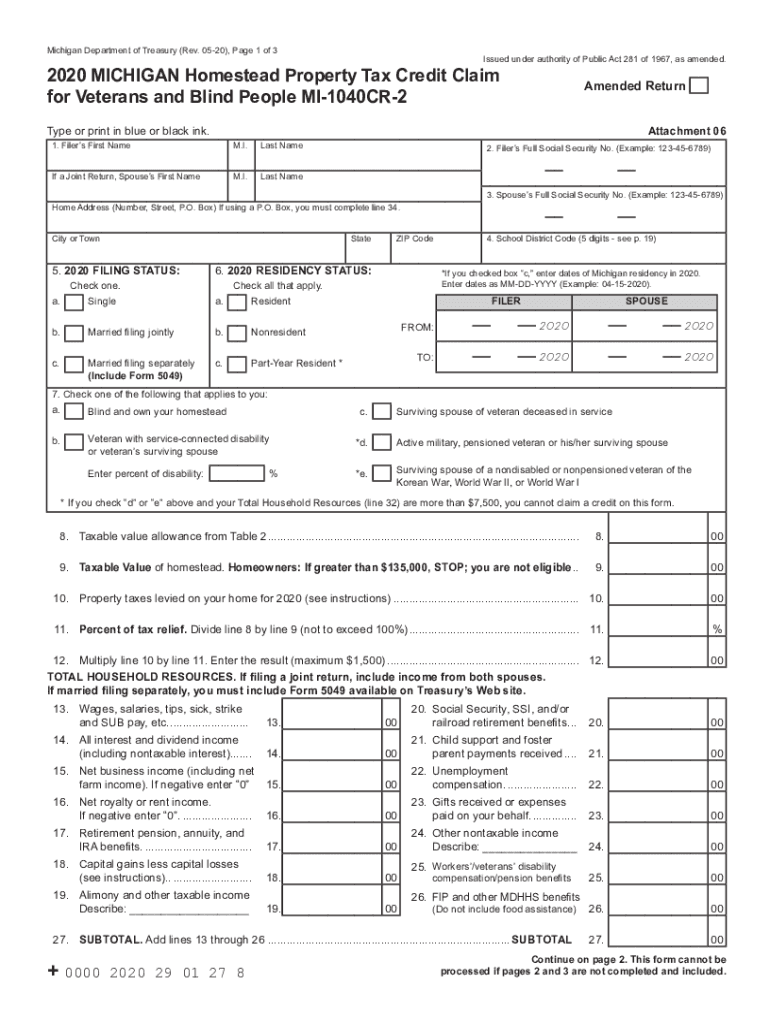

Homestead Property Tax Credit Michigan s homestead property tax credit is how the State of Michigan can help you pay some of your property taxes if you are a qualified Michigan homeowner or renter and meet the requirements Learn More About the Homestead Property Tax Credit Credits and Exemptions The Michigan EITC is a tax benefit for individuals who work in the state and have an income level below a certain level Similar to the federal EITC it s intended to help put more money back

It is possible for Michiganders to receive both the additional Working Families Tax Credit check from their 2022 tax return and also receive the full 30 tax credit on their 2023 tax The Michigan tax credit checks will begin being processed on February 13 as part of a 1 billion tax cut package signed last year but the process is expected to take up to six weeks That

Download Tax Credit Michigan

More picture related to Tax Credit Michigan

Earned Income Tax Credit Info United Way For Southeastern Michigan

https://unitedwaysem.org/wp-content/uploads/EITC-qualifying-children-chart.png

Michigan Advances A New Child Tax Credit Program The National Interest

https://nationalinterest.org/sites/default/files/main_images/whitmer.jpg

Tax Accounting Services Lee s Tax Service

https://leestaxservicellc.com/files/IMG_1348.png

FOR IMMEDIATE RELEASE December 14 2023 Contact press michigan gov Gov Whitmer Announces Working Families Tax Credit Checks will be Sent to Michigan Families in Early 2024 An average of 550 will be mailed to 700 000 households beginning February 13 2024 LANSING Mich The Michigan credit provides up to 2 080 for the 2022 tax year and 2 229 for the 2023 tax year according to a release from Whitmer s office Those eligible to receive the 2022 credit do not

Your Guide to Tax Credits Michigan Free Tax Help DO YOU KNOW EVERY CREDIT YOU RE ELIGIBLE FOR Every year Michiganders leave thousands of dollars on the table Make sure you get what s owed to you Below you ll find everything you need to know about all federal and state credits available to you Published December 10 2022 at 12 57 AM EST khrawlings creative commons http j mp 1SPGCl0 When Michigan lawmakers adjourned this week they left many priorities sitting on the table That includes an expansion of the Earned Income Tax Credit The federal credit offers tax breaks depending on income level and

What To Know In MI As Deadline To File 2022 Income Tax Returns Nears

https://patch.com/img/cdn20/shutterstock/25383440/20230412/114448/styles/patch_image/public/shutterstock-458564560-1___12114428365.jpg

Earned Income Tax Credit EITC Get My Payment IL

https://getmypaymentil.org/wp-content/uploads/2022/10/gmpil-website-poll-banner.jpg

https://www.bridgemi.com/michigan-government/550...

The checks come after a state law was passed last March that expanded Michigan s Earned Income Tax Credit from 6 to 30 of the federal tax credit Who will get a check Recipients will be taxpayers who qualified for the Earned Income Tax Credit in 2022 designed to benefit residents who have a job

https://www.bridgemi.com/michigan-government/...

Michigan plans to mail refund checks to anyone who qualified for the Earned Income Tax Credit in 2022 Checks will average 550 and benefit an estimated 700 000 households according to Gov Gretchen Whitmer The checks will accelerate a planned expansion of the tax credit which is available to lower

Guide To The Michigan Homestead Property Tax Credit Action Economics

What To Know In MI As Deadline To File 2022 Income Tax Returns Nears

Minnesota Property Tax Refunds MNbump

Tax Credit Universal Credit Impact Of Announced Changes House Of

New Tax Credit To Fully Offset The Cost For Small Businesses Who

New Tax Credit To Fully Offset The Cost For Small Businesses Who

Michigan Can Reinvest In Itself Again With The Return Of The Historic

Individual Tax WEC CPA Blog

F i Tax Credit Financial Services LLC San Leandro CA

Tax Credit Michigan - It is possible for Michiganders to receive both the additional Working Families Tax Credit check from their 2022 tax return and also receive the full 30 tax credit on their 2023 tax