Tax Credit On Energy Efficient Shades In fact studies by the United States Department of Energy National Laboratories have shown that homeowners can save up to 15 on their annual energy bill with energy efficient Hunter Douglas Duette Honeycomb Shades

The federal government offers an energy tax credit on select energy efficient Hunter Douglas Duette Honeycomb Shades letting you earn 30 of the purchase price back in the form of a tax credit up to a maximum annual amount of 1 200 Taxpayers that make qualified energy efficient improvements to their home after Jan 1 2023 may qualify for a tax credit up to 3 200 As part of the Inflation Reduction Act beginning Jan 1 2023 the credit equals 30 of certain qualified expenses

Tax Credit On Energy Efficient Shades

Tax Credit On Energy Efficient Shades

https://tax.thomsonreuters.com/blog/wp-content/uploads/sites/17/2022/11/AdobeStock_440097569-scaled.jpeg

2023 Energy Efficient Home Credits Tax Benefits Tips

https://accountants.sva.com/hubfs/sva-certified-public-accountants-biz-tip-energy-efficient-home-improvement-credit-more-opportuniities-in-2023-01.png

What To Know About Health Care Credits The Hayes Law Firm

https://www.losangelestrustlaw.com/wp-content/blogs.dir/94/files/2022/09/shutterstock_103349744-scaled.jpg

PEARL RIVER N Y Jan 9 2023 PRNewswire Hunter Douglas the world s leading manufacturer of custom window coverings announced that starting today consumers can save up to 1 200 on PEARL RIVER N Y Jan 9 2023 PRNewswire Hunter Douglas the world s leading manufacturer of custom window coverings announced that starting today consumers can save up to 1 200 on

The overall total limit for an efficiency tax credit in one year is 3 200 This breaks down to a total limit of 1 200 for any combination of home envelope improvements windows doors skylights insulation electrical plus furnaces boilers and The energy efficient home improvement credit can help homeowners cover costs related to qualifying improvements made from 2023 to 2032 The maximum credit amount is 1 200 for home improvements

Download Tax Credit On Energy Efficient Shades

More picture related to Tax Credit On Energy Efficient Shades

What Qualifies For The Energy Tax Credit

https://s3media.angieslist.com/s3fs-public/HOUSE-~1.jpeg

Here Are The Cars Eligible For The 7 500 EV Tax Credit In The

https://www.autopromag.com/usa/wp-content/uploads/2022/08/EV-Federal-Tax-Credits-5MgJUp.jpeg?is-pending-load=1

Home Energy Tax Credits Will Ease The Pain Of An Ailing A C

https://www.fredsheatingandair.com/wp-content/uploads/2017/03/TaxCredits-770x494.jpg

Save energy year round and earn a Federal Tax Credit of up to 1 200 on select energy efficient shade styles Get the Details Cool for the Summer Savings Event Enjoy Rebates Starting at 300 on Energy Efficient Shades 75 Rebate per shade when you purchase 4 10 Duette Honeycomb Shades with PowerView Automation The energy efficient home improvement credit is subject to the following limitations Sec 25C b as amended by the act Annual overall limitation The credit allowed for any tax year cannot exceed 1 200

About 30 of a home s heating energy is lost through windows In cooling seasons about 76 of sunlight that falls on standard double pane windows enters to become heat Window coverings can help with this loss of energy by providing comfort regulating temperatures and lowering energy bills Obtain a tax credit of up to 1 200 with your purchase of select Hunter Douglas energy efficient Duette Honeycomb Shades Save on your monthly utility bill with shades designed to provide superior insulation A bonus reducing your energy use helps create a more sustainable environment

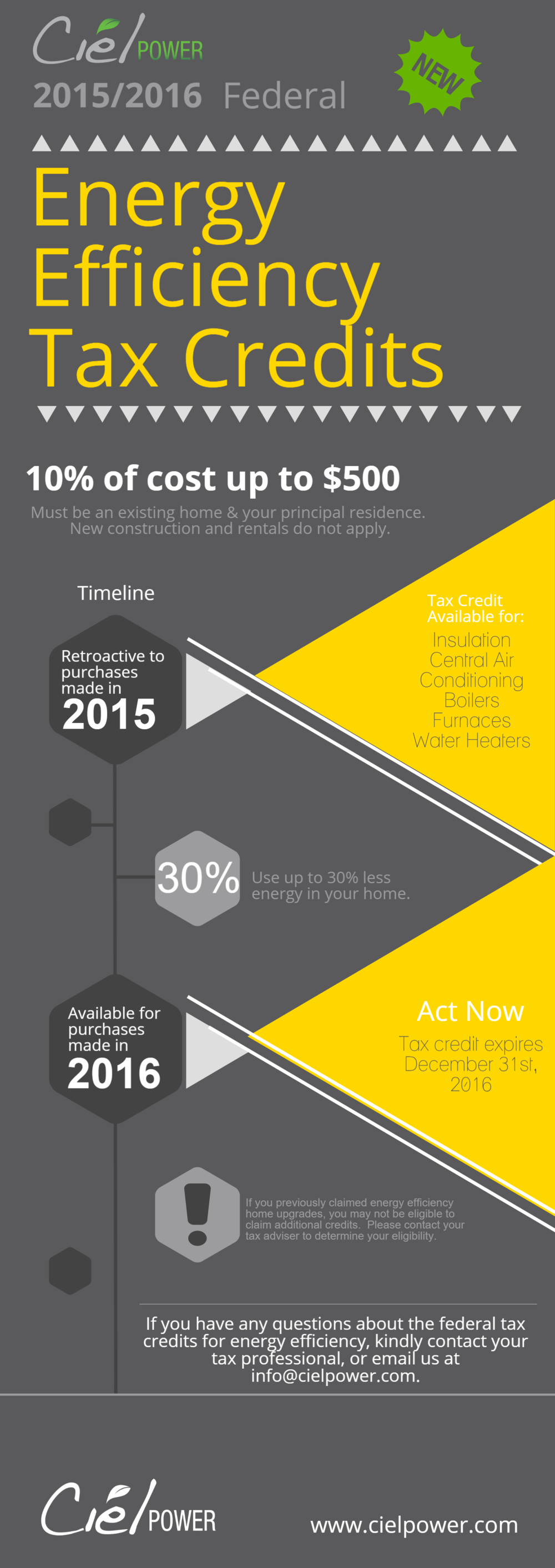

2015 2016 Federal Energy Efficiency Tax Credit Ciel Power LLC

https://static1.squarespace.com/static/55b78a58e4b0e36966db31f9/t/56c73587cf80a157221137e4/1455896001786/

The New Federal Tax Credits And Rebates For Home Energy Efficiency

https://www.ny-engineers.com/hs-fs/hubfs/energy efficient home.jpg?width=1500&name=energy efficient home.jpg

https://www.hunterdouglas.com/stories/press...

In fact studies by the United States Department of Energy National Laboratories have shown that homeowners can save up to 15 on their annual energy bill with energy efficient Hunter Douglas Duette Honeycomb Shades

https://www.hunterdouglas.com/tax-credit

The federal government offers an energy tax credit on select energy efficient Hunter Douglas Duette Honeycomb Shades letting you earn 30 of the purchase price back in the form of a tax credit up to a maximum annual amount of 1 200

Cautious Lawmakers Put 1 48B In Tax Credit Proposals In Holding

2015 2016 Federal Energy Efficiency Tax Credit Ciel Power LLC

Pin By 360 Realtors LLP On Article Ambiguity Tax Credits Old Things

45L New Energy Efficient Home Tax Credit Quality Built

25C Tax Credit Fact Sheet Building Performance Association

Tax Credits Save You More Than Deductions Here Are The Best Ones

Tax Credits Save You More Than Deductions Here Are The Best Ones

Tax Credits For Working Families What Is The Earned Income Tax Credit

Federal Solar Tax Credit Take 30 Off Your Solar Cost Page 2 Of 3

Corporation Prepaid Insurance Tax Deduction Financial Report

Tax Credit On Energy Efficient Shades - The new federal tax credit program is for energy efficient Hunter Douglas Duette Honeycomb Shades The government is offering a chance for homeowners to earn back 30 of the purchase price in the form of a tax credit with a