Tax Credit On Pension Income Earnings related pensions the national pension and the guarantee pension are taxable income in Finland However pensioners housing allowance care allowance front veteran s

The federal non refundable pension income tax credit is on the first 2 000 of eligible pension income which translates into a maximum federal annual tax savings of 300 You can only take advantage of the pension income tax credit if you have a pension defined benefit or defined contribution and you take income from that pension That can be done as early as age 55 with some exceptions

Tax Credit On Pension Income

Tax Credit On Pension Income

https://www.legendfinancial.co.uk/wp-content/uploads/2022/01/Pensiontax-Main.jpg

Valuing Pension Rights On Divorce Bowcock Cuerden

https://bowcockcuerden.co.uk/wp-content/uploads/2018/01/pension-pot.jpg

Income Tax On Pensions Tax Rules After Retirement

https://www.bankindia.org/wp-content/uploads/2015/06/tax-on-pensions.jpg

See the tables of non refundable tax credits for amounts and tax rates for all provinces and territories The pension income amount tax credit is claimed on line 58360 line 5836 prior to The pension income tax credit allows a taxpayer to claim a non refundable federal tax credit on up to 2 000 of eligible pension income Who can claim it Your clients may be

The pension income amount allows a taxpayer to claim a federal non refundable tax credit on up to 2 000 of eligible pension income The federal tax credit rate is 15 so the You may have to pay Income Tax at a higher rate if you take a large amount from a private pension You may also owe extra tax at the end of the tax year If you take some or all of your

Download Tax Credit On Pension Income

More picture related to Tax Credit On Pension Income

Are You Due A Huge Pension Tax Refund Which News

https://s3.eu-west-1.amazonaws.com/prod.news.product.which.co.uk/news/wp-content/uploads/2017/03/Pensions.jpg

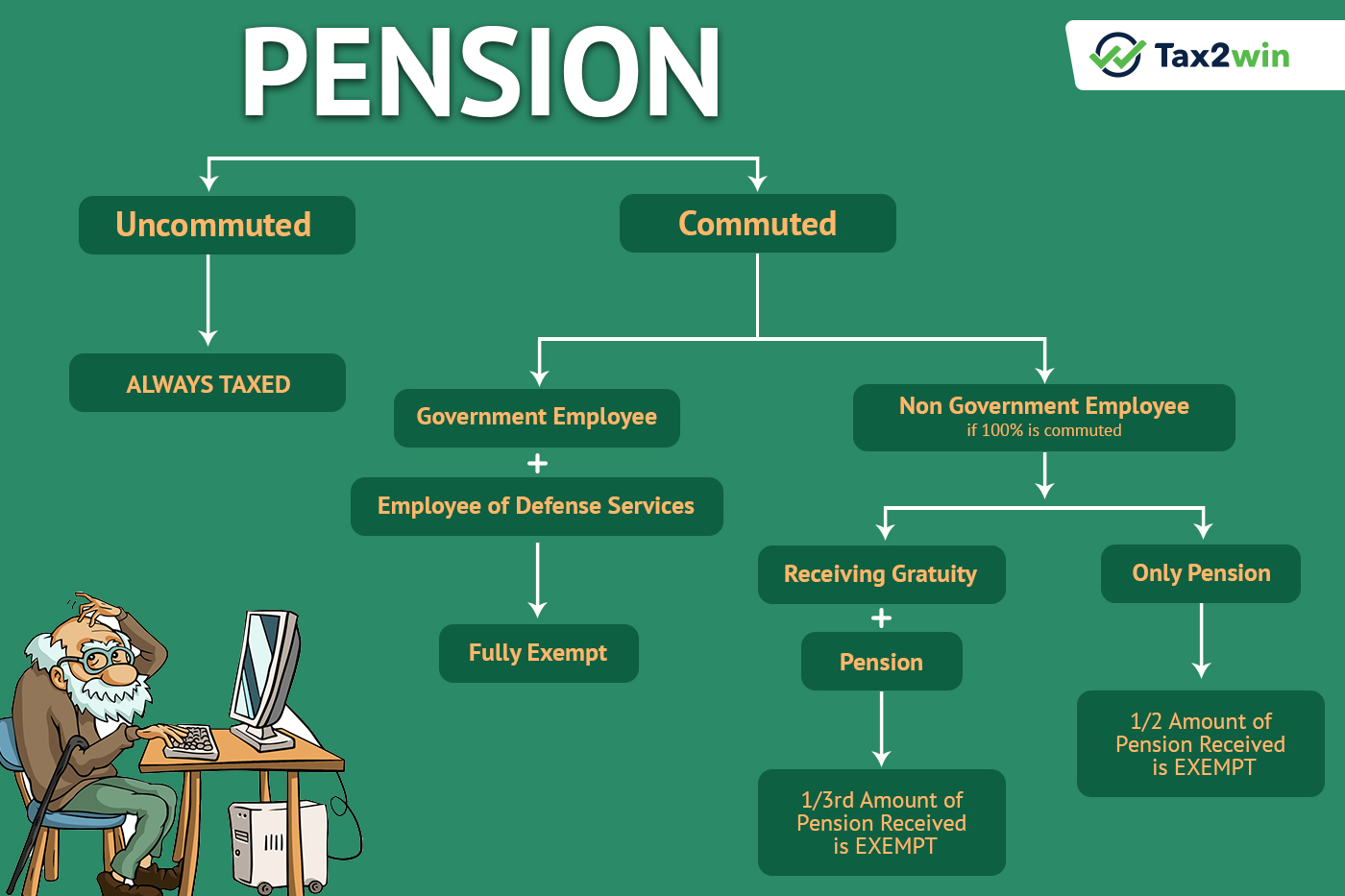

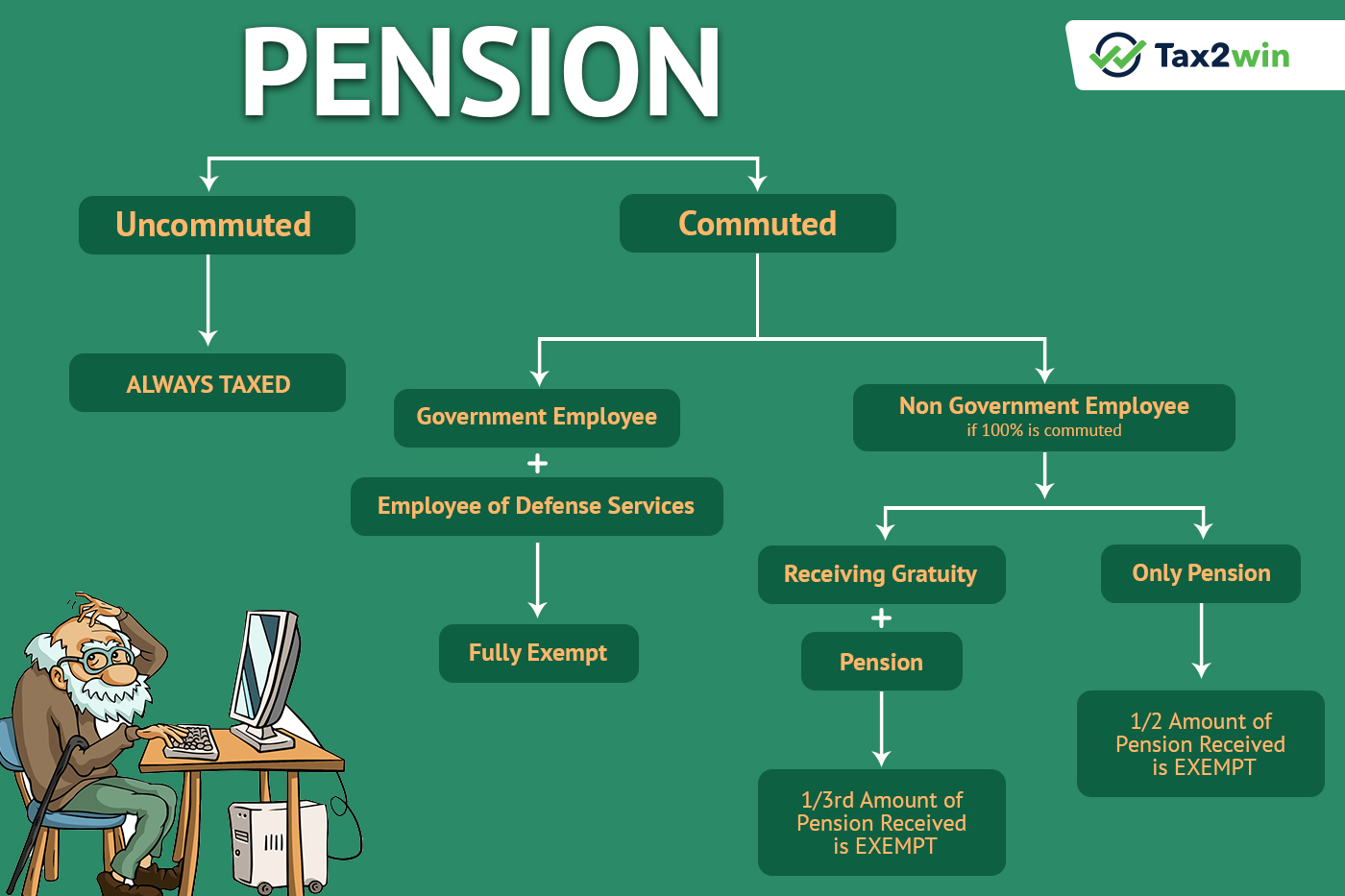

How To Calculate Exemption On Pension Income

https://i0.wp.com/financefriend.in/wp-content/uploads/2014/01/Pension.jpg

Budget 2020 Pension Relief For Dentists SmallBiz Accounts

https://smallbizaccounts.co.uk/wp-content/uploads/2020/03/shutterstock_1387425773-scaled.jpg

Pension income is included in your Income Tax calculation each year This is why your tax code can change if your pension income changes You should consider updating your Do I pay tax on my pension You pay tax on your pension if your total annual income adds up to more than your Personal Allowance For 2024 2025 this means you pay tax on your pension if

The pension income tax credit PITC is a non refundable tax credit that can be claimed on eligible pension income The tax credit allows seniors to save on taxes payable by Tax Tip If you have pension or annuity income which is reported on line 11500 or 12900 of your tax return it may qualify for the pension income tax credit and for pension splitting with your

How To Calculate Tax On Pension Income Retire Gen Z

https://retiregenz.com/wp-content/uploads/2023/05/how-to-calculate-tax-on-pension-income-QHHQ.jpg

Do I Qualify For The Pension Tax Credit Objective Financial Partners

https://objectivefinancialpartners.com/wp-content/uploads/2016/05/Pension-Tax-Credit-1000x675.jpg

https://www.etk.fi › ... › pensions › taxation-of-pensions

Earnings related pensions the national pension and the guarantee pension are taxable income in Finland However pensioners housing allowance care allowance front veteran s

https://ca.rbcwealthmanagement.com › documents

The federal non refundable pension income tax credit is on the first 2 000 of eligible pension income which translates into a maximum federal annual tax savings of 300

INCOME TAX ON PENSION HOW TO CALCULATE TAX ON PENSION IS PENSION

How To Calculate Tax On Pension Income Retire Gen Z

Pension Tax Credit

Tax Credits For Working Families What Is The Earned Income Tax Credit

Age Pension Income Test Rules from September 2023

Income Tax Return For Pension Earners No More A Tedious Task Tax2win Blog

Income Tax Return For Pension Earners No More A Tedious Task Tax2win Blog

The Pension Income Tax Credit Using An Insurance Company GIA Advisor

See The EIC Earned Income Credit Table Income Tax Return Income

Pension Tax Relief In The United Kingdom UK Pension Help

Tax Credit On Pension Income - The pension income amount allows a taxpayer to claim a federal non refundable tax credit on up to 2 000 of eligible pension income The federal tax credit rate is 15 so the