Tax Credit On Rent Paid The income you receive as you rent out your investment property is treated as capital income taxed at the tax rate in force The rate for capital income tax is 30 up to 30 000 and it rises

Yes you can claim the rent if you satisfy the following requirement If you live in Manitoba or Ontario you can claim a credit for rent paid To claim the Manitoba Education You can apply for the Ontario Energy and Property Tax Credit if you have a low to middle income and you live in Ontario This tax credit helps with rent and property taxes paid to your municipal government and is part of

Tax Credit On Rent Paid

Tax Credit On Rent Paid

https://s.hdnux.com/photos/01/23/44/75/21909356/4/rawImage.jpg

Be Aware Before Submit Fake Rent Receipts At Your Office To Claim HRA

https://4.bp.blogspot.com/-8OthH2RBWqQ/WfQj6x_bZfI/AAAAAAAAFsk/eAYaok4XSiU0MbR5qoPDsyV-hFlHryTfACLcBGAs/s1600/HRA%2BRENT%2BRECEIPT.jpg

Cautious Lawmakers Put 1 48B In Tax Credit Proposals In Holding

https://lailluminator.com/wp-content/uploads/2023/04/Dist22-scaled.jpg

If you pay rent you may qualify for the Rent Tax Credit The tax credit reduces the income tax you owe by the amount of the credit You can claim the tax credit for rent payments you Report the amount from your RL 31 in the Solidarity Tax Credit section You may also claim your rent if you are self employed or if you are allowed to claim employment expenses i e

The Rent Tax Credit is available for the tax years 2022 to 2025 The Rent Tax Credit reduces the amount of Income Tax that you are due to pay for a tax year To benefit from the Rent Tax You can t claim a tax credit for the rent you paid during 2023 There are as always some exceptions to this general rule If you re eligible for one of the following benefits or credits then

Download Tax Credit On Rent Paid

More picture related to Tax Credit On Rent Paid

Income Tax Benefits On Rent Paid Housing News

https://housing.com/news/wp-content/uploads/2017/06/Income-tax-benefits-on-rent-paid-Feature-compressed.jpg

Tax Credits For Working Families What Is The Earned Income Tax Credit

https://i.vimeocdn.com/video/1167310911-4fb29b6b078596d6410b96e83c4aad2a24825b00bfcb3268e567fcb1784ab6b3-d

Pin By 360 Realtors LLP On Article Ambiguity Tax Credits Old Things

https://i.pinimg.com/originals/e5/7a/59/e57a596909536f0ec7f6176803502153.jpg

In general rent payments can t be claimed on a tenant s tax return This rule does have a few exceptions which means some financial relief is available for tenants Here s how you can help your tenant get a tax break on The Rent Tax Credit is 20 of the rent you paid in a year up to a maximum of 500 per person or 1 000 if you are a couple jointly assessed for tax In Budget 2024 the Rent Tax Credit

Many states allow you to claim a credit if your rent is above a certain percentage of your total income This can make you a cost burdened renter and the tax credit can help If you are a PAYE taxpayer you are able to claim the credit in year through myAccount for rent paid in 2024 You will need to Sign into myAccount Go to the PAYE

Income Tax Benefits On Rent Paid Housing News

https://assets-news.housing.com/news/wp-content/uploads/2017/06/23162856/Tax-Benefits-1-1.png

Tenant Payment Record Rental Payment Record Template 25 Properties Etsy

https://i.etsystatic.com/7727197/r/il/8531ef/1409894857/il_1588xN.1409894857_m90y.jpg

https://www.vero.fi › en › individuals › property › rental_income

The income you receive as you rent out your investment property is treated as capital income taxed at the tax rate in force The rate for capital income tax is 30 up to 30 000 and it rises

https://turbotax.community.intuit.ca › community › ...

Yes you can claim the rent if you satisfy the following requirement If you live in Manitoba or Ontario you can claim a credit for rent paid To claim the Manitoba Education

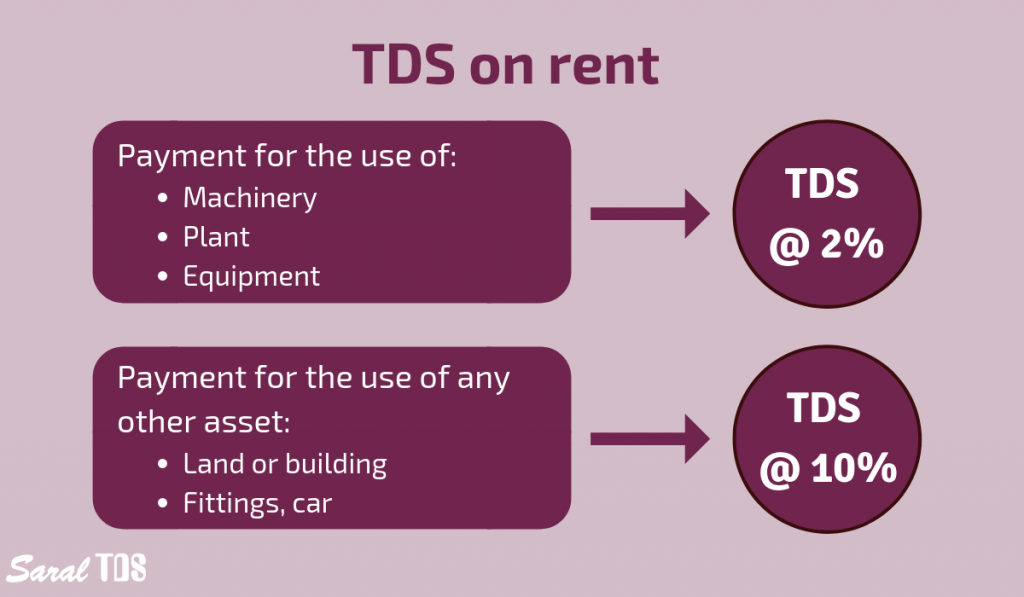

TDS On Rent Detailed Explanation On Section 194I

Income Tax Benefits On Rent Paid Housing News

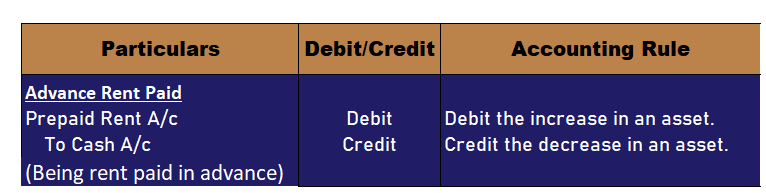

What Is The Journal Entry For Rent Paid In Advance Accounting Capital

Electric Vehicles And Government issued Checks

Tax Credit Al Meezan Group

What Is Employee Retention Tax Credit

What Is Employee Retention Tax Credit

Section 80GG Deduction On Rent Paid Yadnya Investment Academy

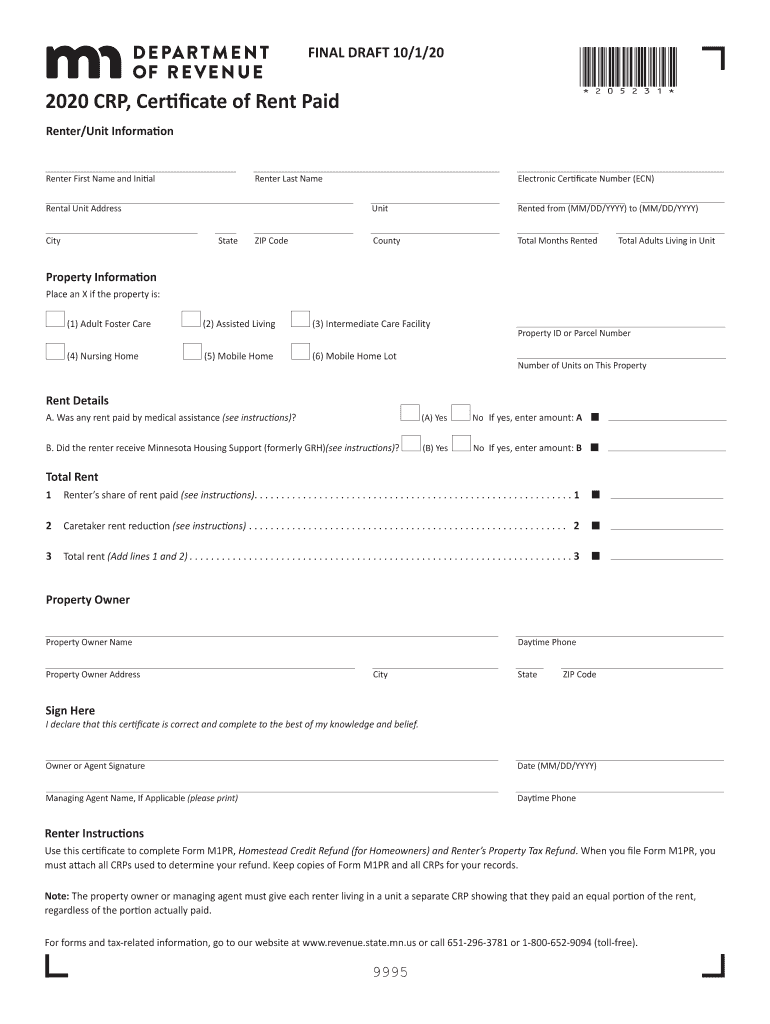

Printable Rent Certificate Form Printable Forms Free Online

:max_bytes(150000):strip_icc()/child-tax-credit-4199453-1-7dd01914195e4ab2bc05ae78a40f8f0c.jpg)

Tax Credits

Tax Credit On Rent Paid - While you can t deduct rent on taxes in most cases there are some situations in which you can receive a renter s tax credit or a rent tax deduction First you may be eligible