Tax Credit Overpayment Time Limit For tax credit overpayments time starts to run from the date a final decision was made to recover the debt Once the limitation period is running the debt will normally be statute

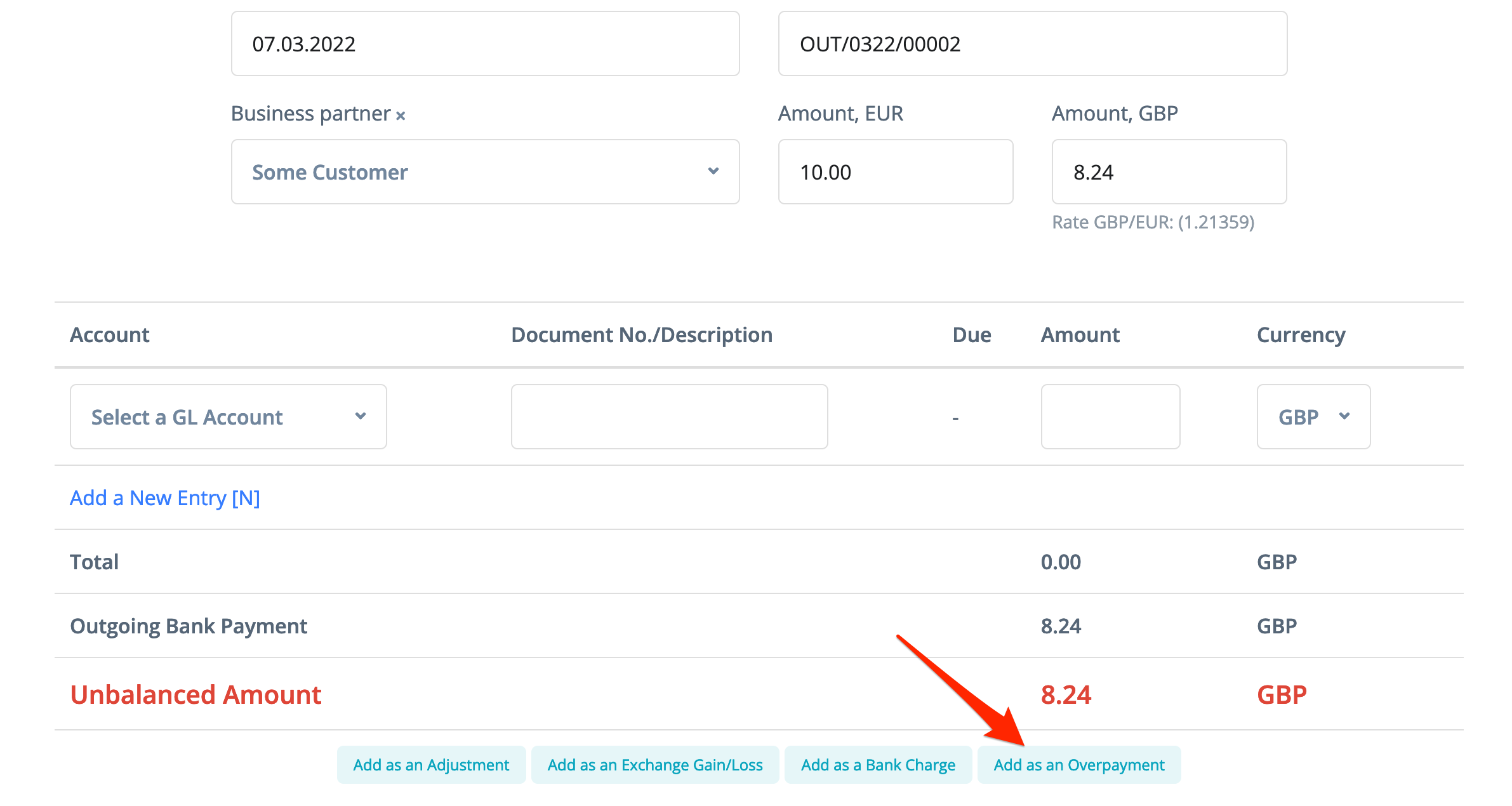

They ll ask you to pay them directly if you no longer get tax credits the overpayment was for a joint claim and you re now making a single claim the overpayment was for a joint As explained above HMRC may recover overpayments under the TCA 2002 Section 29 3 to 5 in one of three ways by deduction from any tax credit award made to the

Tax Credit Overpayment Time Limit

Tax Credit Overpayment Time Limit

https://studholme-bell.com/wp-content/uploads/2016/05/change-2022-11-12-01-36-03-utc-1-2048x1536.jpg

https://hesabdarema.com/wp-content/uploads/2022/04/Tax-credit.jpg

Tax Credit Overpayment Document United States PNG 612x792px Tax

https://img.favpng.com/25/1/10/tax-credit-overpayment-document-united-states-png-favpng-V6RShJxqZGPGiLTiYtkxgiQjq.jpg

The annual nature of the system What are overpayments Causes of overpayments Underpayments Challenging overpayments Dealing with overpayments The annual Since tax credit calculations can change if people s circumstances change overpayments can sometimes occur that we need to recoup This briefing provides information about

Time limit You have up to three months from the date you were sent the decision that you have been overpaid to dispute recovery of that overpayment This is usually when Updated on 6 April 2024 Tax credits overpayments Overpayments and underpayments are a normal part of the tax credits system This is because tax credits entitlement is not

Download Tax Credit Overpayment Time Limit

More picture related to Tax Credit Overpayment Time Limit

How To Return An Overpayment

https://cdn.filestackcontent.com/opoZ8OgRQ8OUUqzrbZUD

Tax Reduction Company Inc

https://lookaside.fbsbx.com/lookaside/crawler/media/?media_id=100064489757770

Simplicontent

https://img.tradepub.com/free/w_aaaa5309/images/w_aaaa5309c8.jpg

Home Benefits Help on a low income Working and child tax credits Tax credits appeals If HMRC says you ve had a tax credits overpayment This advice applies to England HMRC will take payments from your future tax credit payments meaning you will repay the debt over the course of many months Your income and household circumstances will

You must pay this 30 days and you must ensure payments reach HMRC in good time So it is always best to check the processing times and transaction limits of your bank Note HMRC will need to get your completed form or letter within 3 months of whichever is the latest the letter that told you about the overpayment this is known as a final award

New Overpayment Check Scam Making Rounds In Tri Cities

https://townsquare.media/site/136/files/2019/03/money-2-.jpg?w=1200&h=0&zc=1&s=0&a=t&q=89

7 Easy Ways To Save On Your Taxes This Year Ways To Save Money

https://i.pinimg.com/originals/ae/14/3d/ae143d4c581ef3a868aa1efb5f115293.png

https://nationaldebtline.org/fact-sheet-library/...

For tax credit overpayments time starts to run from the date a final decision was made to recover the debt Once the limitation period is running the debt will normally be statute

https://www.citizensadvice.org.uk/benefits/help-if...

They ll ask you to pay them directly if you no longer get tax credits the overpayment was for a joint claim and you re now making a single claim the overpayment was for a joint

Tax Time It s Time To Pay Tax Like Much Of Our Work We Ha Flickr

New Overpayment Check Scam Making Rounds In Tri Cities

Sample Letter Of Request For Refund Of Overpayment LETTER GHW

Example Of Free Free Insurance Company Demand Letter Pdf Word Eforms

Don t Worry If You Exceed The Social Security Earnings Limit Rebel

Overpayment Money Stock Illustrations 85 Overpayment Money Stock

Overpayment Money Stock Illustrations 85 Overpayment Money Stock

Overpayment Money Stock Illustrations 85 Overpayment Money Stock

Are You Planning To Take Advantage Of The IRS s Employer Tax Credit For

Medicare Advantage Enrolls Lower Spending People Leading To Large

Tax Credit Overpayment Time Limit - The annual nature of the system What are overpayments Causes of overpayments Underpayments Challenging overpayments Dealing with overpayments The annual