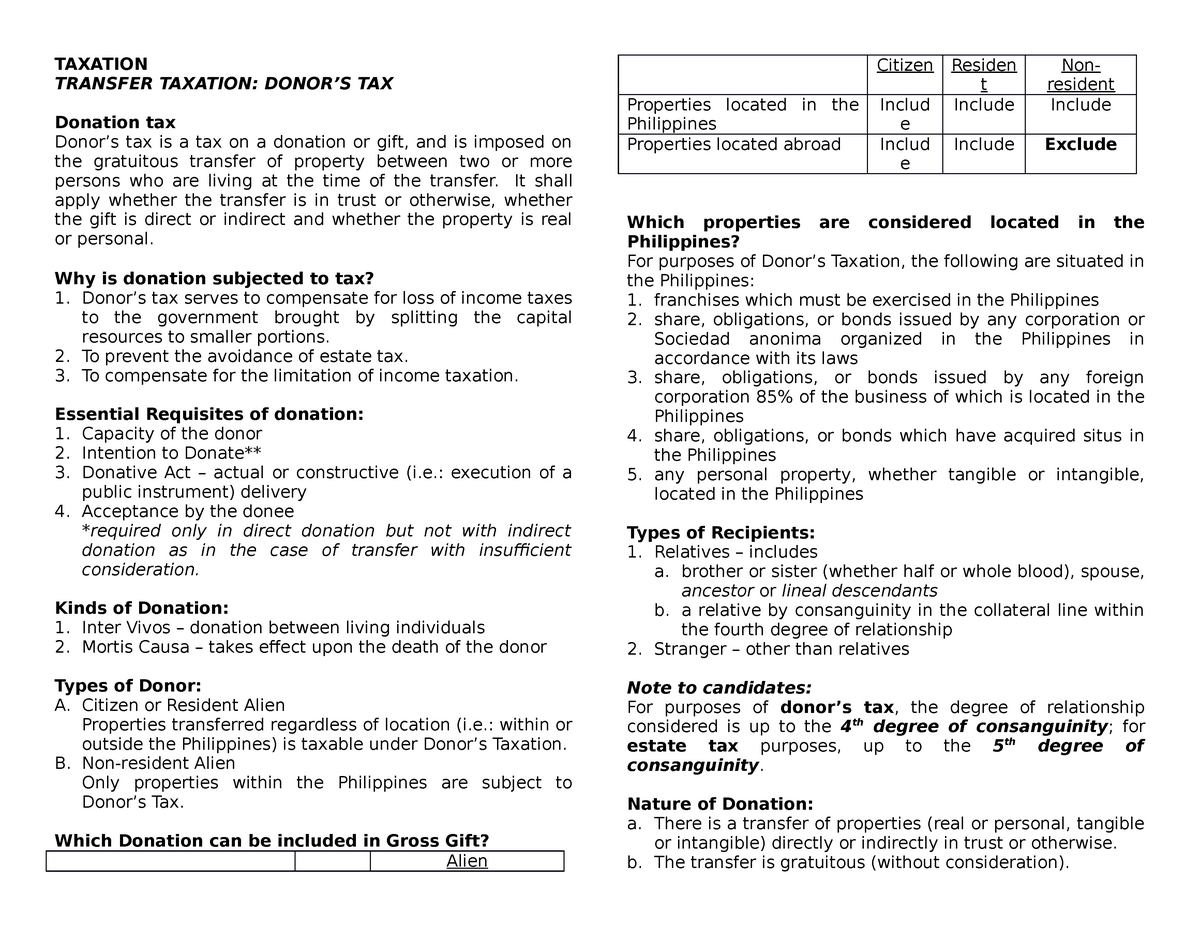

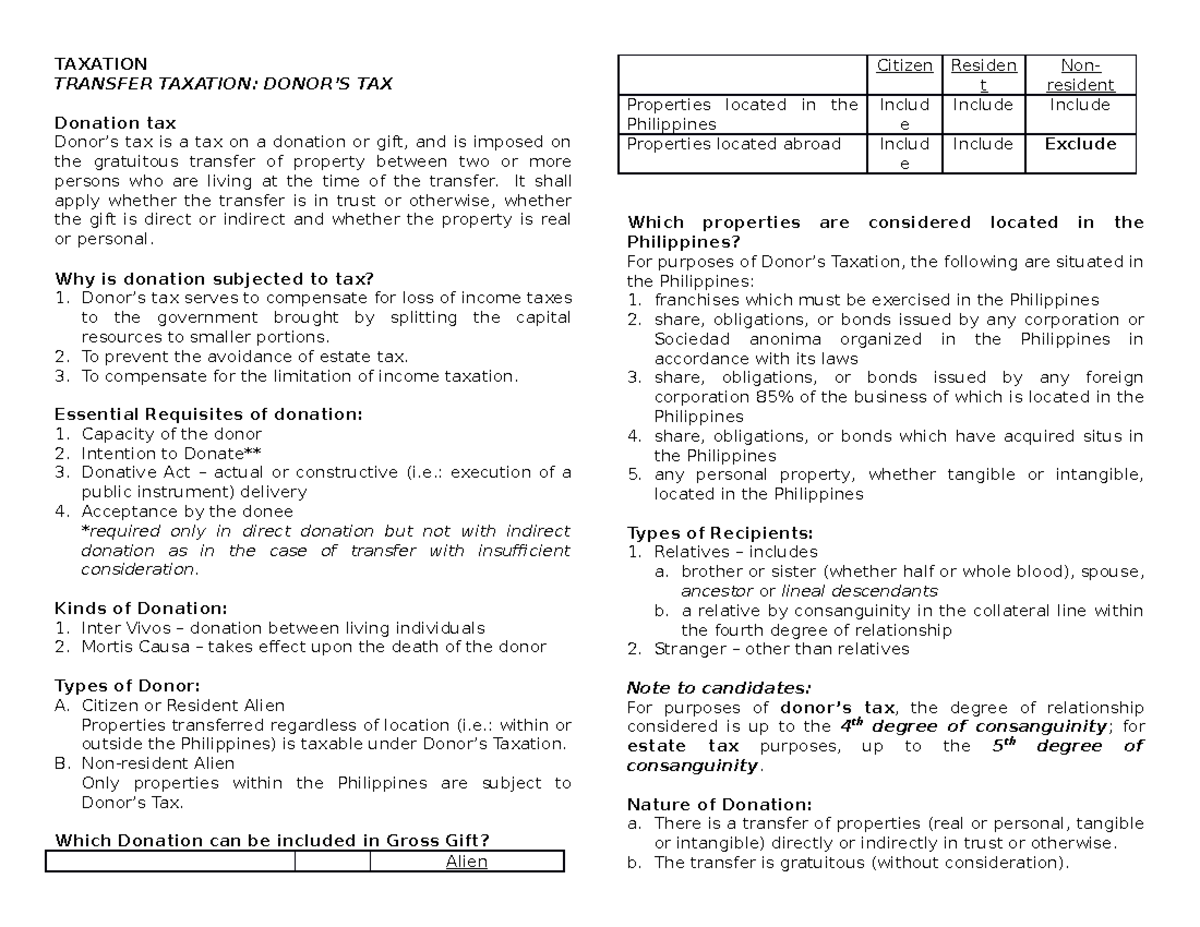

Tax Credit Philippines Tax credits are direct reductions in the amount of tax you owe Ensure that you claim all eligible tax credits you qualify for For example if you donate to a BIR accredited charity you can claim a tax credit for the donated amount

A tax credit generally refers to an amount that may be subtracted directly from ones total tax liability It is therefore an allowance against the tax itself or a deduction from what is owed by a taxpayer to the government The tax treaty relief for foreign taxes is in the form of deductions or foreign tax credits for tax paid in the country income was derived The allowable credits vary from country to country and are based on the country s Double Taxation Agreement DTA with the Philippines

Tax Credit Philippines

Tax Credit Philippines

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/43e3f4975355d70e3b55f7947fc96f24/thumb_1200_927.png

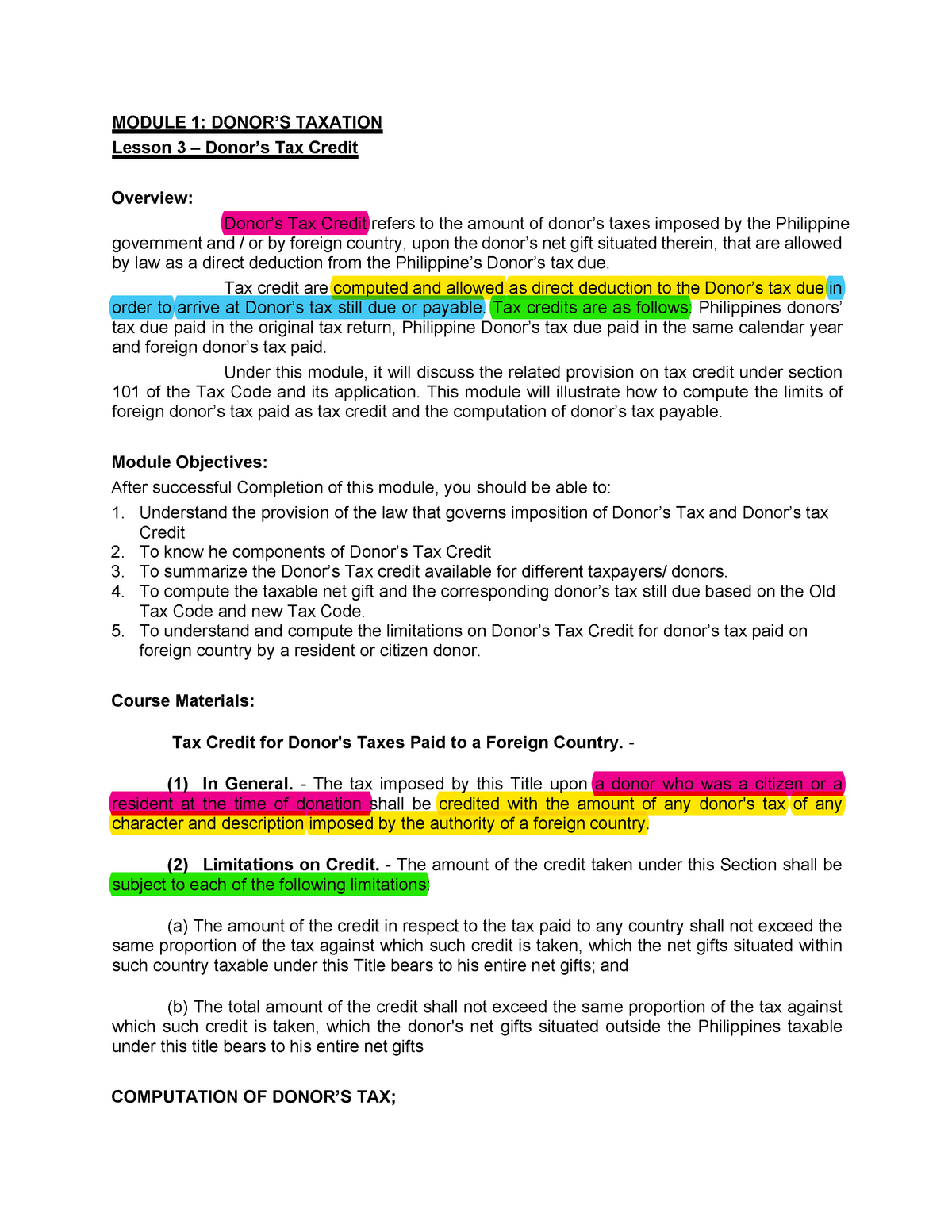

Module 1 Lesson 3 Lecture Notes 3 MODULE 1 DONOR S TAXATION Lesson

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/ae17693b9b1d085288ddbd2580b815da/thumb_1200_1553.png

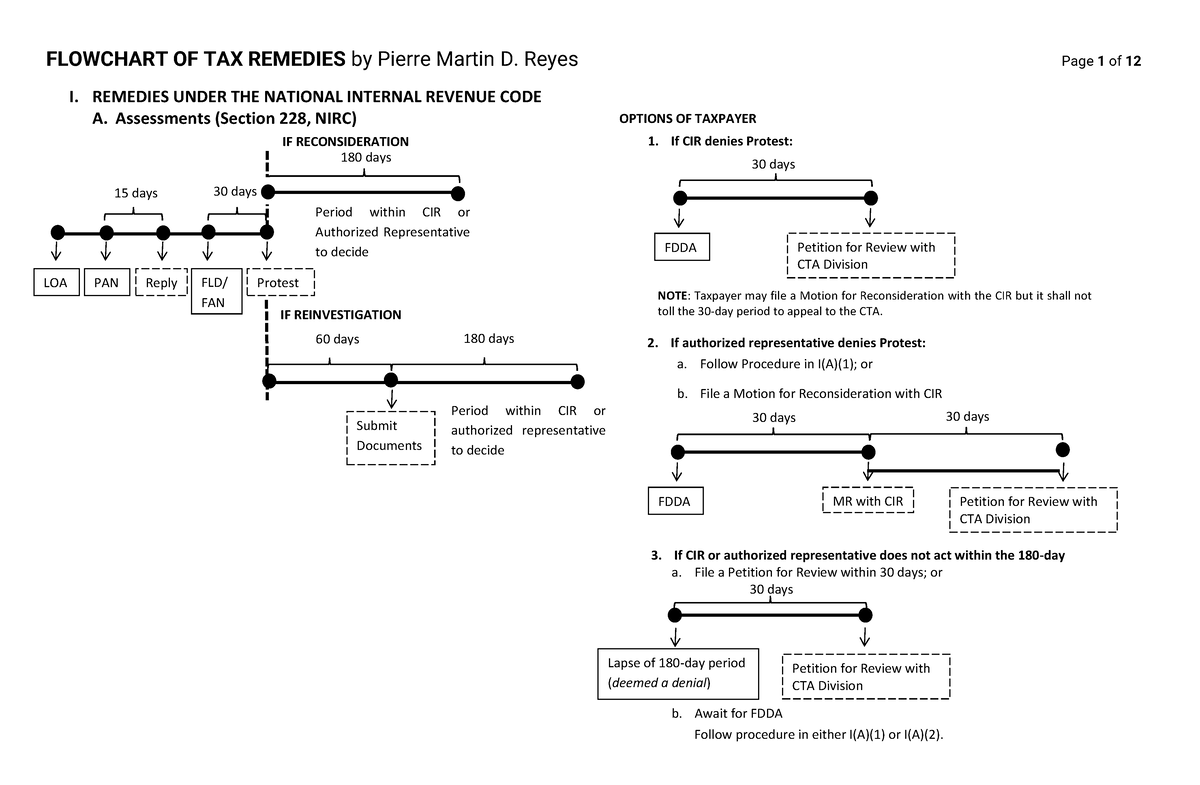

Tax Remedy Flowcharts Flowchart Of Tax Remedies In Philippine

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/237a01eba6cae3c3af3816ef503e2207/thumb_1200_785.png

Claims for tax refund or tax credit are construed strictly against the taxpayer as they partake the nature of a tax exemption Tax credits for exporters using local materials as provided under RA 7844 exemption from expanded withholding tax additional deduction for labor expenses employment of foreign nationals in supervisory technical or advisory positions PEZA Registration Requirements

Forvis Mazars gives a short guide on how a company can become eligible for all kinds of tax incentives in the Philippines how to avail them correctly and how these practices can attract additional foreign investors to the country Basis of Taxation The tax base for domestic corporations and resident foreign corporations is taxable income gross income less allowable deductions 30 regular corporate income tax or gross income 2 minimum corporate income tax whichever is applicable

Download Tax Credit Philippines

More picture related to Tax Credit Philippines

Estimate Your Tax Credit Deduction Alliantgroup

https://www.alliantgroup.com/wp-content/uploads/2022/05/web-photo_aglogo-04-scaled-1.jpg

Tax Uncomplicated US Expat Taxes In Korea Yongin

https://lookaside.fbsbx.com/lookaside/crawler/media/?media_id=198839168706991

Tax Credit Scholarship Oklahoma City OK

https://lookaside.fbsbx.com/lookaside/crawler/media/?media_id=100061266284369

The rules on claims for tax credit or refund of CWT are set forth in Section 2 58 3 of Revenue Regulations RR 2 98 as amended It provides that the amount of CWT shall be allowed as a tax credit against the income tax liability of the payee in the quarter in which income was earned or received Taxpayers earning income outside the Philippines need tax residency certificates TRC in claiming tax treaty benefits The BIR has a newly imposed rule that aims to streamline the process of issuing TRCs yet it can get tricky

[desc-10] [desc-11]

Tax App

https://lookaside.fbsbx.com/lookaside/crawler/media/?media_id=100087510464361

New Tax Credit Helps Entrepreneurs Start Businesses Flickr

https://live.staticflickr.com/1965/44495171025_587c909a1c_b.jpg

https://grit.ph/tax

Tax credits are direct reductions in the amount of tax you owe Ensure that you claim all eligible tax credits you qualify for For example if you donate to a BIR accredited charity you can claim a tax credit for the donated amount

https://www.projectjurisprudence.com/2017/12/tax-credit...

A tax credit generally refers to an amount that may be subtracted directly from ones total tax liability It is therefore an allowance against the tax itself or a deduction from what is owed by a taxpayer to the government

Simplifying The Complexities Of R D Tax Credits TriNet

Tax App

Tax Credit Universal Credit Impact Of Announced Changes House Of

Setc Tax Credit Eligibility 1099 Expert

Saver s Tax Credit 2022 Credit

House Lawmakers Scrutinize Pandemic era Employee Retention Tax Credit

Freelance Accounting Personal Tax Services

Tax Credit Information 2023 A New Leaf

Tax Credit Philippines - [desc-12]