Tax Credit Que Significa Tax credit Significado definici n qu es tax credit 1 an amount of money that is taken off the amount of tax you must pay 2 an amount of money that Aprender m s

Un cr dito tributario es una cantidad d lar por d lar que los contribuyentes reclaman en su declaraci n de impuestos para reducir el impuesto sobre el ingreso que deben Los Tax credits reduce the amount of Income Tax that you pay Revenue will apply them after your tax has been calculated You can find out more about how tax credits work in

Tax Credit Que Significa

Tax Credit Que Significa

https://houstonwindowexperts.com/wp-content/uploads/TaxCredit-1024x576.jpg

Giving Tax Credit Where Credit Is Due

https://www.chevyhardcore.com/image/2023/12/giving-tax-credit-where-credit-is-due-2023-12-29_09-27-16_080592.jpg

Rent Tax Credit

https://www.finegael.ie/app/uploads/2023/02/RTC_webpage.png

El Cr dito tributario por ingreso del trabajo EITC por sus siglas en ingl s ayuda a los trabajadores y a familias con ingresos bajos a moderados a recibir un cr dito tributario Si The word tax credit refers to a sum of money that taxpayers can deduct directly from their taxes This is distinct from tax deductions which reduce an individual s taxable income The worth of

Un cr dito fiscal es como una recompensa financiera del gobierno por acciones o circunstancias espec ficas que reducen su factura fiscal general A diferencia de las deducciones fiscales que reducen su ingreso imponible los cr ditos Tax credit significado definici n qu es tax credit an amount of money on which you do not h Conozca m s

Download Tax Credit Que Significa

More picture related to Tax Credit Que Significa

How Does The Research And Development Tax Credit Work YouTube

https://i.ytimg.com/vi/Z6-AOMib9do/maxresdefault.jpg

Income Tax ShareChat Photos And Videos

https://cdn.sharechat.com/2b0d0eef_1588734670621.jpeg

Earned Income Tax Credit EITC Explained YouTube

https://i.ytimg.com/vi/PvNgs8ZCx-Q/maxresdefault.jpg

A tax credit is a provision that reduces a taxpayer s final tax bill dollar for dollar A tax credit differs from deductions and exemptions which reduce taxable income rather than the taxpayer s tax bill directly Tax credits are subtracted directly from a person s tax liability they therefore reduce taxes dollar for dollar Credits have the same value for everyone who can claim their full value Most tax

Del Longman Business Dictionary tax credit tax credit countable TAX an amount of money on which you do not have to pay tax A tax credit is a dollar for dollar reduction of your tax liability This means a 1 000 tax credit would reduce a 5 000 tax bill to 4 000 Tax credits are typically more valuable than

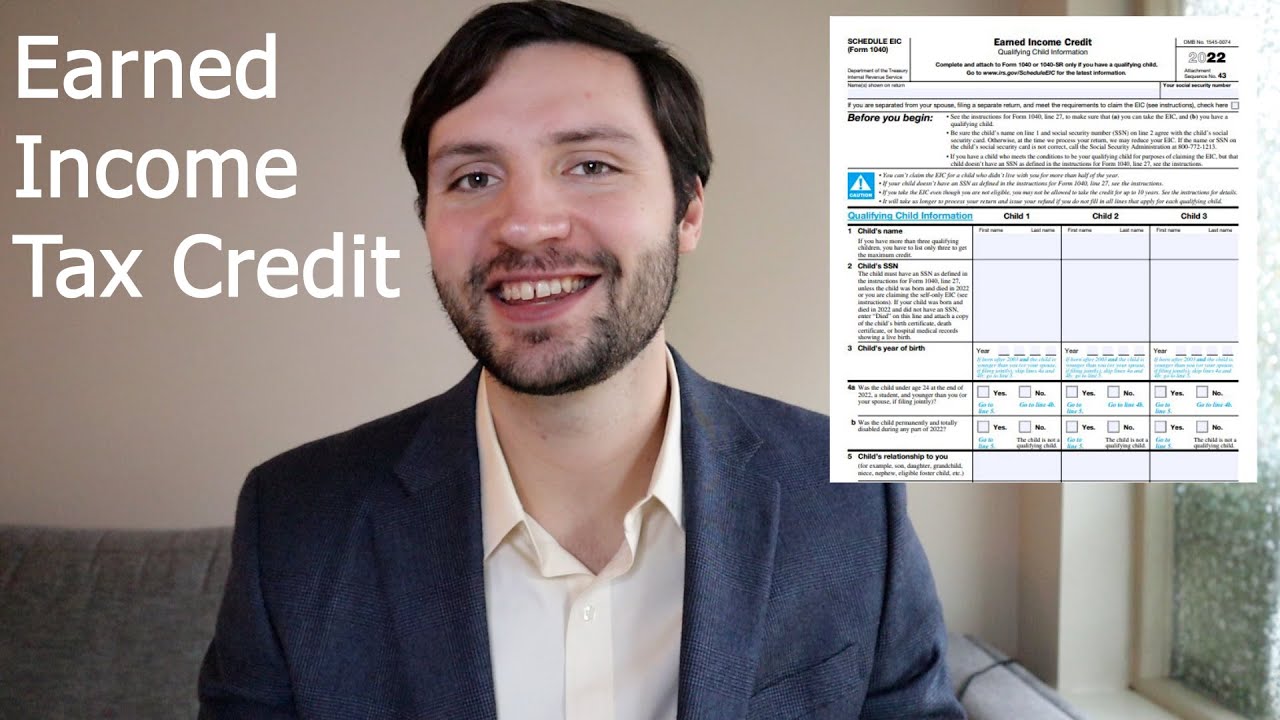

Reform A Fuel Tax Credit Scheme With No Real Rationale

https://images.theconversation.com/files/508032/original/file-20230203-2044-mgwnqd.JPG?ixlib=rb-1.1.0&q=45&auto=format&w=754&fit=clip

500 Rent Tax Credit Earnest Property Agents

https://earnest.ie/wp-content/uploads/2023/01/E500-Rent-Tax-Credit.jpg

https://dictionary.cambridge.org › es › diccionario › ingles › tax-credit

Tax credit Significado definici n qu es tax credit 1 an amount of money that is taken off the amount of tax you must pay 2 an amount of money that Aprender m s

https://www.irs.gov › es › newsroom › tax-credits-for...

Un cr dito tributario es una cantidad d lar por d lar que los contribuyentes reclaman en su declaraci n de impuestos para reducir el impuesto sobre el ingreso que deben Los

Estimate Your Tax Credit Deduction Alliantgroup

Reform A Fuel Tax Credit Scheme With No Real Rationale

Setc Tax Credit Calculator 1099 Expert

Tax Accounting Services Lee s Tax Service

Blog Tax Deed Center

300 000 TAX FREE INCOME Sell THIS Tax Credit New IRS Approved

300 000 TAX FREE INCOME Sell THIS Tax Credit New IRS Approved

Self Employed Tax Credit Calculator 1099 Expert

Simplifying The Complexities Of R D Tax Credits TriNet

Tax Free Retirement Income TransGlobal Holding Company

Tax Credit Que Significa - The word tax credit refers to a sum of money that taxpayers can deduct directly from their taxes This is distinct from tax deductions which reduce an individual s taxable income The worth of