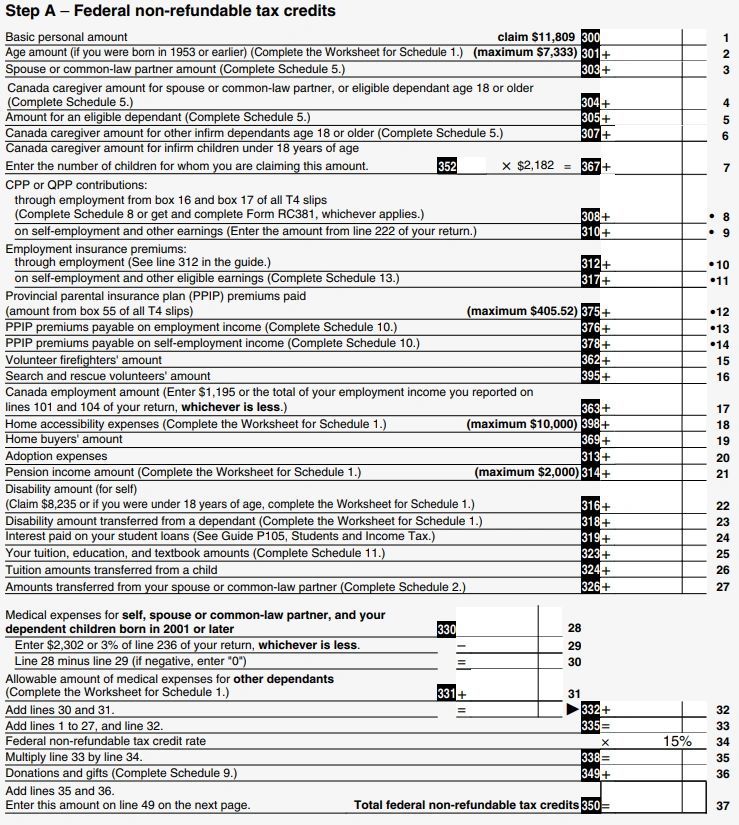

Tax Credit Refundable Or Nonrefundable Verkko 19 lokak 2023 nbsp 0183 32 Nonrefundable tax credits A nonrefundable credit essentially means that the credit can t be used to increase your tax refund or to create a tax refund

Verkko 13 marrask 2023 nbsp 0183 32 Key Takeaways A tax credit is a tax break that reduces a filer s tax liability dollar for dollar A nonrefundable tax credit can only reduce tax liability to zero A refundable Verkko 16 kes 228 k 2023 nbsp 0183 32 Tax credits can reduce the amount of income tax you have to pay and even get you money from the government Refundable tax credits are amounts that you receive regardless of how much

Tax Credit Refundable Or Nonrefundable

Tax Credit Refundable Or Nonrefundable

https://i.ytimg.com/vi/38DAHVg252Q/maxresdefault.jpg

Refundable Vs Nonrefundable Tax Credits Experian

https://s28126.pcdn.co/blogs/ask-experian/wp-content/uploads/A-Person-Holds-A-Coffee-Cup-While-Writing-On-Tax-Forms-On-Their-Desk.jpg

Nonrefundable Tax Credit Requirements Examples How To Claim

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEgTMqGwItilexEoZQJNU2GLzvaTnbp258m3Nzi1jN5_u_xZrw9g4yvAOf-x19hxqiU9DeOiOw1hi2gBes0jtQ0dcT_GInA7ahKGKakdw3MTzOcVxOwEOQGghxnLpUEkrfRSkg2e_WCMS9N8qZQ0gbar9AiZYRe4B7qUOtVIttiBL_Nbs8SN0XKhBm7fd4k/s944/non.jpg

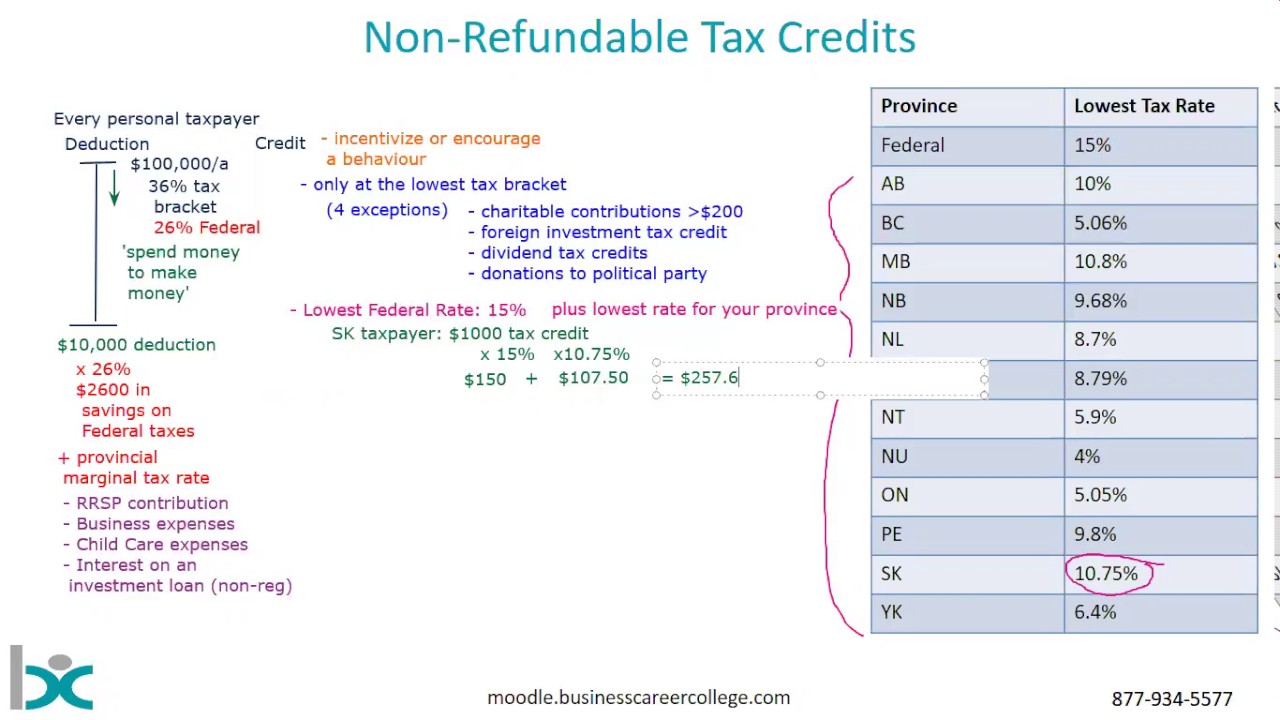

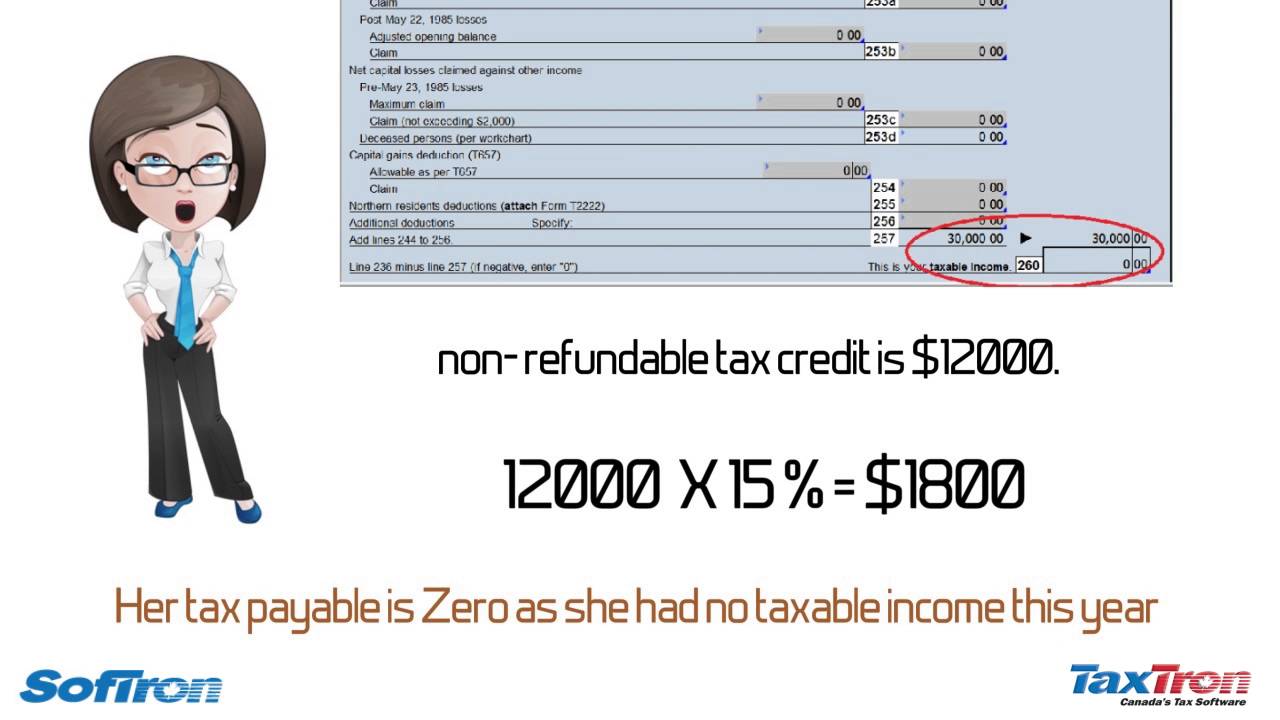

Verkko The maximum value of a nonrefundable tax credit is capped at a taxpayer s tax liability In contrast taxpayers receive the full value of Verkko 16 toukok 2022 nbsp 0183 32 Both refundable and nonrefundable tax credits lower your tax bill dollar for dollar Nonrefundable credits only apply to your tax liability while

Verkko 14 maalisk 2021 nbsp 0183 32 Typically a tax credit is non refundable which means that the credit offsets any tax liability the taxpayer owes but if the credit takes this liability amount Verkko 13 huhtik 2023 nbsp 0183 32 A tax credit is a dollar for dollar amount taxpayers claim on their tax return to reduce the income tax they owe Eligible taxpayers can use them to reduce

Download Tax Credit Refundable Or Nonrefundable

More picture related to Tax Credit Refundable Or Nonrefundable

REFUNDABLE TAX CREDITS Expat Tax Professionals

https://expattaxprofessionals.com/File/utgunmw2jru

Refundable Nonrefundable Tax Credit Tax Accountant In Missouri

https://swrmissouricpa.com/wp-content/uploads/2019/04/Refundable-Nonrefundable-Tax-Credit-Tax-Accountant-in-Missouri.jpg

Refundable Vs Non Refundable Tax Credits

https://heavencpa.com/wp-content/uploads/2019/04/tax-credits-768x403.jpg

Verkko 25 tammik 2023 nbsp 0183 32 Definition A refundable tax credit is a tax break that not only lowers the amount of tax you owe but may even pay you above and beyond that Key Verkko 19 lokak 2023 nbsp 0183 32 Written by a TurboTax Expert Reviewed by a TurboTax CPA There are two types of tax credits available for taxpayers refundable and nonrefundable

Verkko 1 kes 228 k 2023 nbsp 0183 32 A nonrefundable tax credit is a type of state or federal credit that offsets your tax bill dollar for dollar It s called nonrefundable because once your tax bill has been reduced Verkko 9 toukok 2019 nbsp 0183 32 quot A refundable credit is a tax credit you get on your tax return no matter what your tax liability is quot says Lawrence Pon a tax specialist who owns an

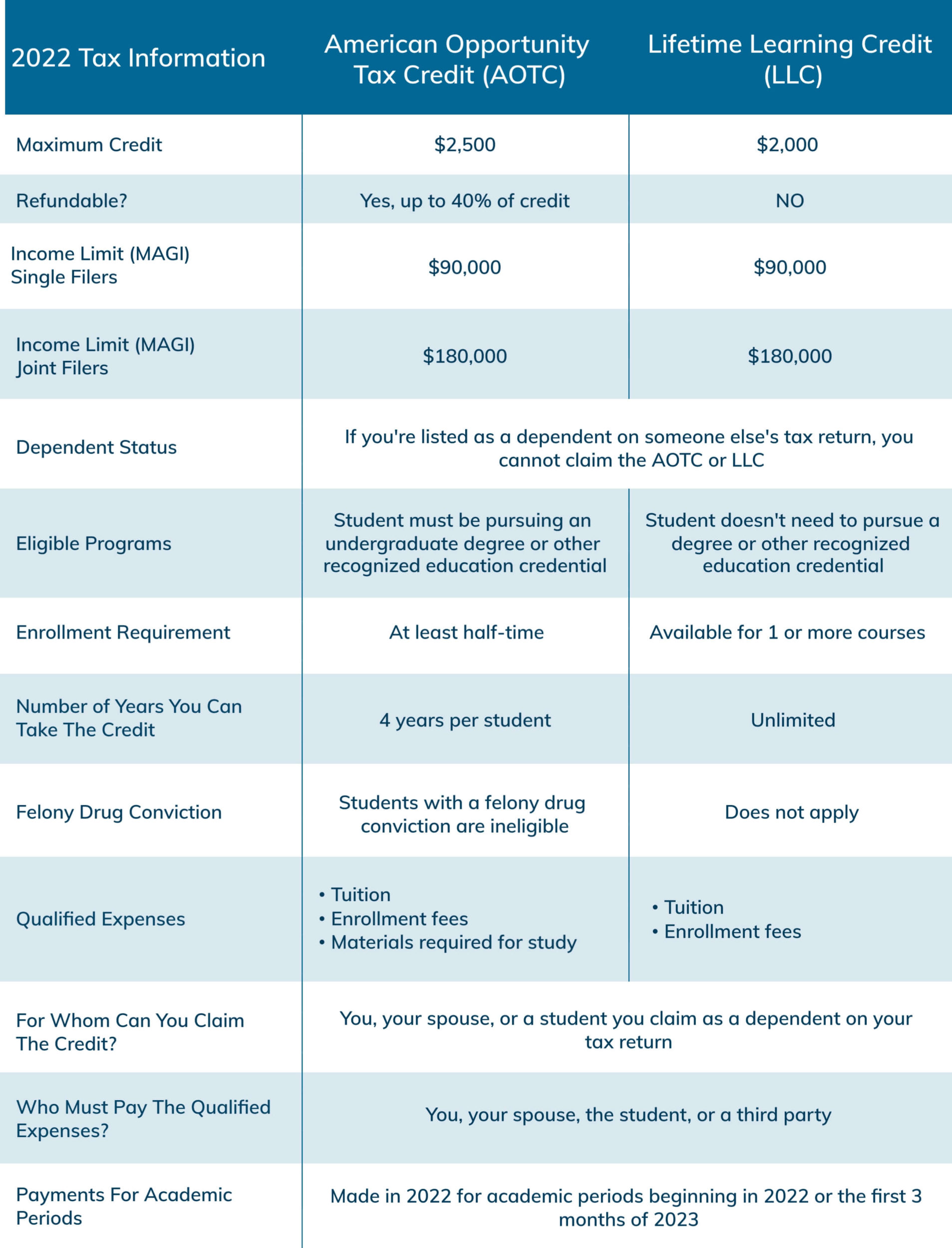

Refundable Education Credit Designbagssmall

https://i.ytimg.com/vi/oGMJ_-CbAgo/maxresdefault.jpg

2022 Education Tax Credits Are You Eligible

https://www.taxdefensenetwork.com/wp-content/uploads/2022/11/2022-Education-Credits-Comparison-1907x2500.jpg

https://turbotax.intuit.com/tax-tips/tax-deductions-and-credits/what...

Verkko 19 lokak 2023 nbsp 0183 32 Nonrefundable tax credits A nonrefundable credit essentially means that the credit can t be used to increase your tax refund or to create a tax refund

https://www.investopedia.com/terms/n/nonref…

Verkko 13 marrask 2023 nbsp 0183 32 Key Takeaways A tax credit is a tax break that reduces a filer s tax liability dollar for dollar A nonrefundable tax credit can only reduce tax liability to zero A refundable

TaxTips ca Canadian Non refundable Personal Tax Credits

Refundable Education Credit Designbagssmall

Child Tax Credit Nonrefundable Refundable Credits Explained YouTube

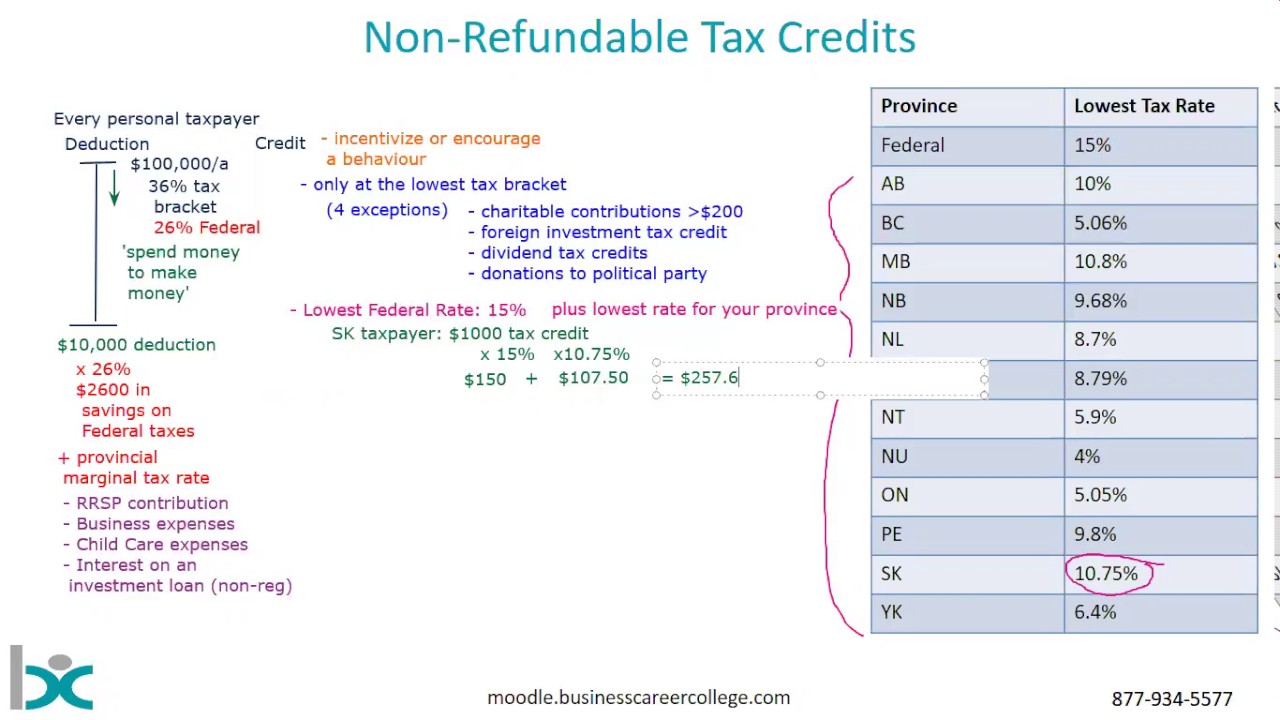

Difference Between Refundable And Nonrefundable Tax Credits Canada

What Is A Nonrefundable Tax Credit Universal CPA Review

2022 Child Tax Credit Refundable Amount Latest News Update

2022 Child Tax Credit Refundable Amount Latest News Update

Refundable Credits The Earned Income Tax Credit And The Child Tax

Can A Nonrefundable Tax Credit Increase My Refund Leia Aqui What Is

Non Refundable Tax Credits In Canada

Tax Credit Refundable Or Nonrefundable - Verkko As you can see tax credits save you more money than tax deductions Tax Credits Refundable vs Nonrefundable A refundable tax credit not only reduces the federal