Tax Credit Structures As discussed in TX 18 5 2 some tax credit investment structures may meet the criteria for their tax equity investors to elect to account for their investment using a method other than the

In March 2023 the FASB issued ASU 2023 02 Investments Equity Method and Joint Ventures Topic 323 Accounting for Investments in Tax Credit Structures Using the The FASB recently issued ASU 2023 02 Accounting for Investments in Tax Credit Structures Using the Proportional Amortization Method a consensus of the Emerging Issues Task Force which allows an entity to

Tax Credit Structures

Tax Credit Structures

https://www.energy.gov/sites/default/files/styles/full_article_width/public/2022-10/Summary-ITC-and-PTC-Values-Table.png?itok=_72eWNBC

Unified Tax Credit Definition InfoComm

https://www.infocomm.ky/wp-content/uploads/2020/09/1600289863.jpeg

Property Tax Credit YouTube

https://i.ytimg.com/vi/HWpSdKWw_T0/maxresdefault.jpg

On March 29 2023 The Financial Accounting Standards Board FASB issued an Accounting Standards Update ASU that improves the accounting and disclosures for investments in tax Recent legislation has introduced or modified several tax credits available to entities in the United States including introducing both refundable and nonrefundable transferable credits at the

Handbook Tax credits Our in depth guide explains the accounting for various forms of tax credits in accordance with US GAAP The FASB is issuing this Accounting Standards Update to allow reporting entities to consistently account for equity investments made primarily for the purpose of receiving

Download Tax Credit Structures

More picture related to Tax Credit Structures

Tax Accounting Services Lee s Tax Service

https://leestaxservicellc.com/files/IMG_1348.png

Income Tax ShareChat Photos And Videos

https://cdn.sharechat.com/2b0d0eef_1588734670621.jpeg

Minnesota Property Tax Refunds MNbump

https://mnbump.com/wp-content/uploads/2022/04/Housing-Tax-Credit.jpg

Accounting standards update 2023 02 investments equity method and joint ventures topic 323 accounting for investments in tax credit structures using the proportional amortization The FASB recently issued ASU 2023 02 Accounting for Investments in Tax Credit Structures Using the Proportional Amortization Method a consensus of the Emerging Issues Task

Accordingly tax equity investments in NMTC structures RETC structures or other tax credit programs can now be accounted for using the PAM if all the criteria are met and the tax equity investor elects to do so The FASB has issued new guidance that expands use of the proportional amortization method of accounting to investments in more types of income tax credit programs

Tax Credit Universal Credit Impact Of Announced Changes House Of

https://commonslibrary.parliament.uk/wp-content/uploads/2015/11/IDS.jpg

https://hesabdarema.com/wp-content/uploads/2022/04/Tax-credit.jpg

https://viewpoint.pwc.com › ...

As discussed in TX 18 5 2 some tax credit investment structures may meet the criteria for their tax equity investors to elect to account for their investment using a method other than the

https://viewpoint.pwc.com › dt › us › en › pwc › in_depths

In March 2023 the FASB issued ASU 2023 02 Investments Equity Method and Joint Ventures Topic 323 Accounting for Investments in Tax Credit Structures Using the

Tax Credit ClimaCool

Tax Credit Universal Credit Impact Of Announced Changes House Of

Pricing Tax Credit Community

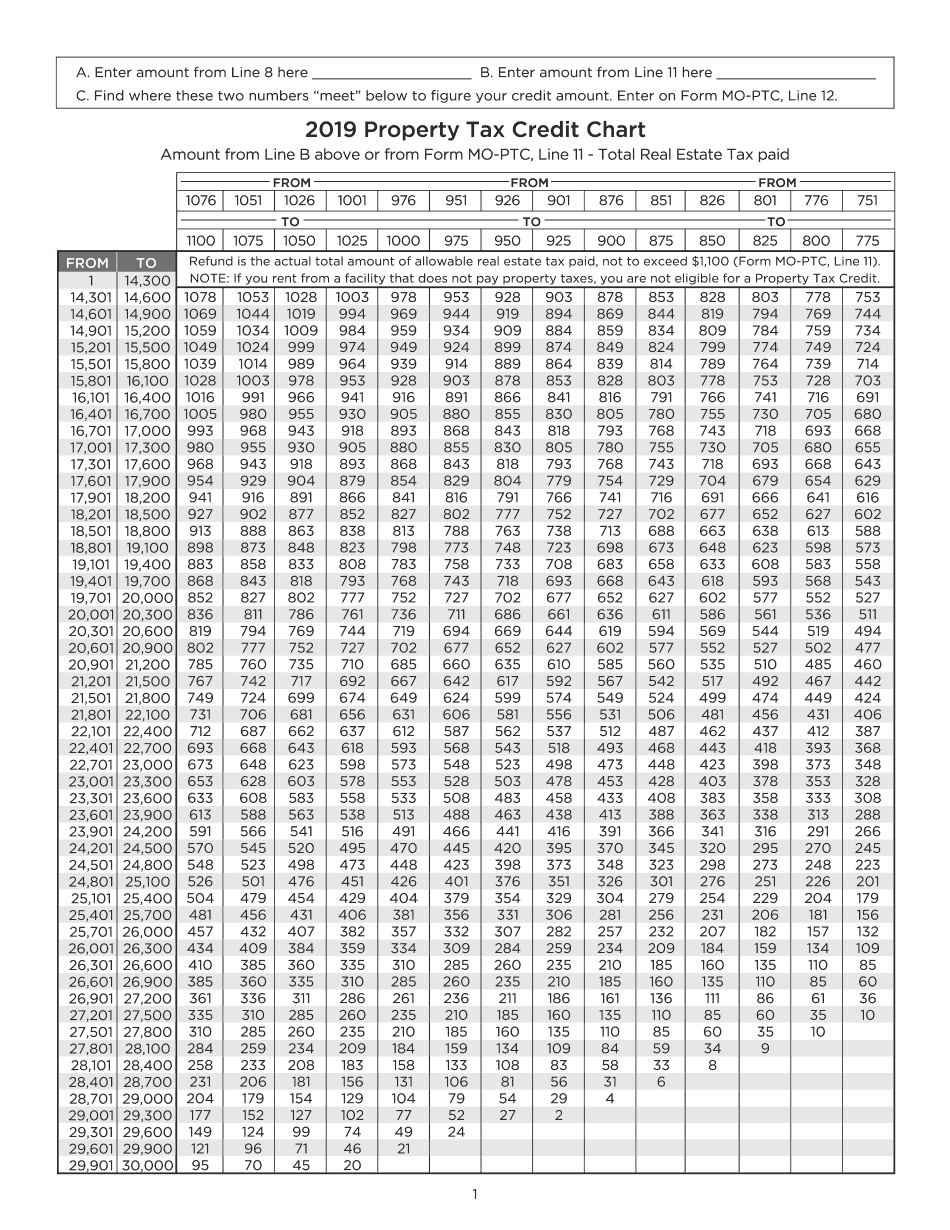

Manage Documents Using Our Editable Form For Property Tax Credit Chart Form

Tax Deduction Vs Tax Credit What s The Difference With Table

Tax Credit To Spur Carbon Capture Utilization And Storage Tech

Tax Credit To Spur Carbon Capture Utilization And Storage Tech

New Tax Credit To Fully Offset The Cost For Small Businesses Who

Earned Income Tax Credit Claims Are Less Likely After IRS Audits

Private Equity Fund Structure A Simple Model

Tax Credit Structures - Handbook Tax credits Our in depth guide explains the accounting for various forms of tax credits in accordance with US GAAP