Tax Credit Student Loan Interest The short answer is yes You can deduct all or a portion of your student loan interest if you meet all of the following requirements You paid interest on a qualified

Best credit cards Best credit cards Best bonus offer credit cards Best balance transfer credit cards Best travel credit cards Best cash back credit Student loan interest deduction lets you claim those interest payments when you file your taxes If you paid more than 600 in interest this year you ll receive a form 1098 E from your loan

Tax Credit Student Loan Interest

Tax Credit Student Loan Interest

https://live.staticflickr.com/65535/51286655453_c2e24c3cf3_b.jpg

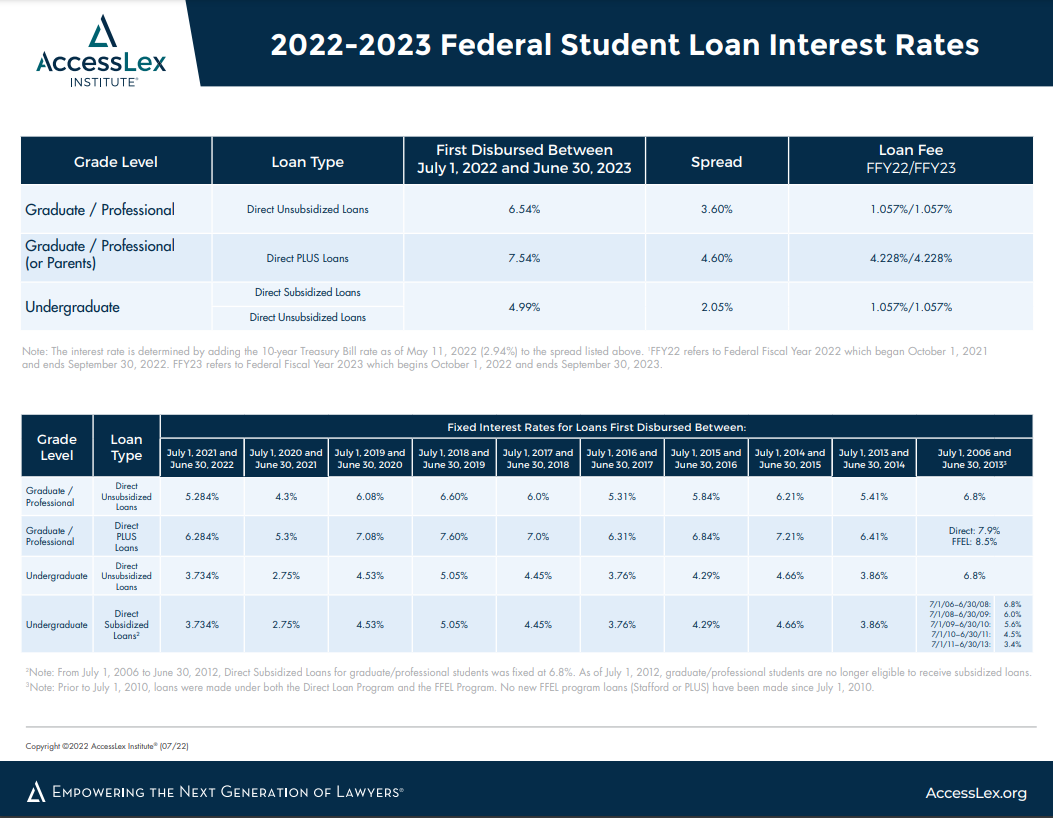

Guide To Student Loan Interest Rates And How Much You Will Pay

https://www.gannett-cdn.com/-mm-/3095bbe1c7b29d9ac3460534e28a55c79c2eb0ef/c=0-226-1942-1318/local/-/media/2019/02/28/USATODAY/usatsports/MotleyFool-TMOT-d92ea364-student-loans.jpg?width=3200&height=1680&fit=crop

Federal Student Loan Interest Rates AccessLex

https://www.accesslex.org/sites/default/files/inline-images/Federal Student Loan Interest Rates_2022 2023.png

You may be able to deduct up to 2 500 of student loan interest from your taxes You may be limited or prevented from claiming the deduction entirely depending If you made federal student loan payments in 2023 you may be eligible to deduct a portion of the interest paid on your 2023 federal tax return This is known as a student loan

When you use student loan funds to finance your education if you are eligible the IRS allows you to claim qualifying expenses that you pay with those funds You can deduct the interest you pay on your student loans Deducting student interest lowers your adjusted gross income AGI which can help you qualify for

Download Tax Credit Student Loan Interest

More picture related to Tax Credit Student Loan Interest

Pin On Debt Advice

https://i.pinimg.com/originals/00/c7/04/00c7043fe95938f3bfec1298b1032386.png

How Do Your Student Loans Affect Your Credit Score Pinned By Http

https://i.pinimg.com/originals/d9/13/08/d91308e22f07c84732d2f11732d69a17.jpg

CHILD TAX CREDIT STUDENT LOAN FORGIVENESS STIMULUS CHECK UPDATE

https://i.ytimg.com/vi/Xl2N8ZVPUiU/maxresdefault.jpg

Taxpayers can deduct student loan interest up to 2 500 in 2023 The deduction can be claimed as an adjustment to income Here s what you need to know If you re paying off your student loans you may qualify for a student loan interest deduction which can reduce your taxable income and make up for some of the

Key Takeaways If you include student loan interest in you tax deductions you can lower your tax bill Up to 2 500 of student loan interest can be tax deductible each What is the student loan interest deduction The student loan interest deduction is a tax break you may be able to claim on your federal income tax return It

/student-loan-interest-deduction-3193022_HL-6a2dfcbfdccb47479d5a544f175feaf1.gif)

The Federal Student Loan Interest Deduction

https://www.thebalancemoney.com/thmb/4CpyfpIiY3PR6DdBUhGkiXJXdEE=/1500x1000/filters:fill(auto,1)/student-loan-interest-deduction-3193022_HL-6a2dfcbfdccb47479d5a544f175feaf1.gif

What Credit Score Is Needed For A Student Loan Student Loan Planner

https://i.pinimg.com/736x/2e/07/9f/2e079f114099105e16f736f2fbed4d0c.jpg

https://www.forbes.com/advisor/taxes/student-loan...

The short answer is yes You can deduct all or a portion of your student loan interest if you meet all of the following requirements You paid interest on a qualified

https://www.nerdwallet.com/article/loans/student...

Best credit cards Best credit cards Best bonus offer credit cards Best balance transfer credit cards Best travel credit cards Best cash back credit

Can I Get A Student Loan With Bad Credit Student Loans For Poor

/student-loan-interest-deduction-3193022_HL-6a2dfcbfdccb47479d5a544f175feaf1.gif)

The Federal Student Loan Interest Deduction

Certificate Courses Student Loans Higher Education Expand Goo

Lower Your Student Loan Interest Rate NOW

Average Private Student Loan Interest Rates Remain Low Data Shows How

Treasury Sets Student Loan Interest Rates Near Historic Lows

Treasury Sets Student Loan Interest Rates Near Historic Lows

Federal Student Aid Changes Announced From Department Of Education

Why You Should Prepare For Student Loan Payments To Resume even If

Is My First Student Loan Bill Really Over 1 000

Tax Credit Student Loan Interest - Our student loan interest tax deduction calculator is fully updated for the 2023 tax year ready for filing by April 2024 Most borrowers had zero interest for most of 2023 but the