Tax Credit System Definition A tax credit is a provision that reduces a taxpayer s final tax bill dollar for dollar A tax credit differs from deductions and exemptions A tax credit differs from deductions and exemptions which reduce taxable income rather than the taxpayer s tax bill directly

A tax credit is a tax incentive which allows certain taxpayers to subtract the amount of the credit they have accrued from the total they owe the state 1 It may also be a credit granted in recognition of taxes already paid or a form Tax credit can be defined as a reduction in the total tax amount someone owes to the Internal Revenue Service IRS It can be considered a type of financial incentive provided to the citizens by the government to promote activities largely advantageous to

Tax Credit System Definition

Tax Credit System Definition

https://propertymanagerinsider.com/wp-content/uploads/2022/12/Commercial-Solar-Tax-Credit-Guide-2023.png

Tax Accounting Services Lee s Tax Service

https://leestaxservicellc.com/files/IMG_1348.png

Income Tax ShareChat Photos And Videos

https://cdn.sharechat.com/2b0d0eef_1588734670621.jpeg

A tax credit is a dollar for dollar amount taxpayers claim on their tax return to reduce the income tax they owe Eligible taxpayers can use them to reduce their tax bill and potentially increase their refund Refundable vs nonrefundable tax credits Some tax credits are refundable Definition of Tax Credits Tax credits are a type of financial incentive offered by the government to reduce an individual s or a company s tax liability They directly reduce the amount of tax owed dollar for dollar as opposed to tax deductions which lower the amount of taxable income Tax credits play a significant role in promoting

The credit is a minimum of 12 5 of the wages paid to qualifying employees increasing incrementally based on the wage percentage covered during leave Credit can be claimed on wages paid during tax years beginning in 2018 through 2025 Tax credits are meant to bring some relief to taxpayers typically those who earn low to moderate income and take care of children invest in education or save for retirement

Download Tax Credit System Definition

More picture related to Tax Credit System Definition

Tax Credit Universal Credit Impact Of Announced Changes House Of

https://commonslibrary.parliament.uk/wp-content/uploads/2015/11/IDS.jpg

https://hesabdarema.com/wp-content/uploads/2022/04/Tax-credit.jpg

Pricing Tax Credit Community

https://taxcreditcommunity.com/wp-content/uploads/2022/03/Tax_Credit_final_logo_colour_blue_background-03.png

The earned income tax credit EITC is a refundable tax credit used to supplement the wages of low income workers and help offset the effect of Social Security taxes The EITC is Tax credits are a mechanism to redistribute income to people on lower wages There are two types child tax credits paid to families with children and working tax credits paid to

A tax credit is a benefit that lowers your taxes owed by the amount of the credit Tax credits can be nonrefundable refundable or partially refundable The word tax credit refers to a sum of money that taxpayers can deduct directly from their taxes This is distinct from tax deductions which reduce an individual s taxable income The worth of a tax credit is dependent on its type Individuals or businesses in specified areas classifications or industries may be eligible for tax credits

Tax Deduction Vs Tax Credit What s The Difference With Table

https://www.diffzy.com/wordpress/wp-content/uploads/2023/06/difference-between-tax-deduction-and-tax-credit.jpg

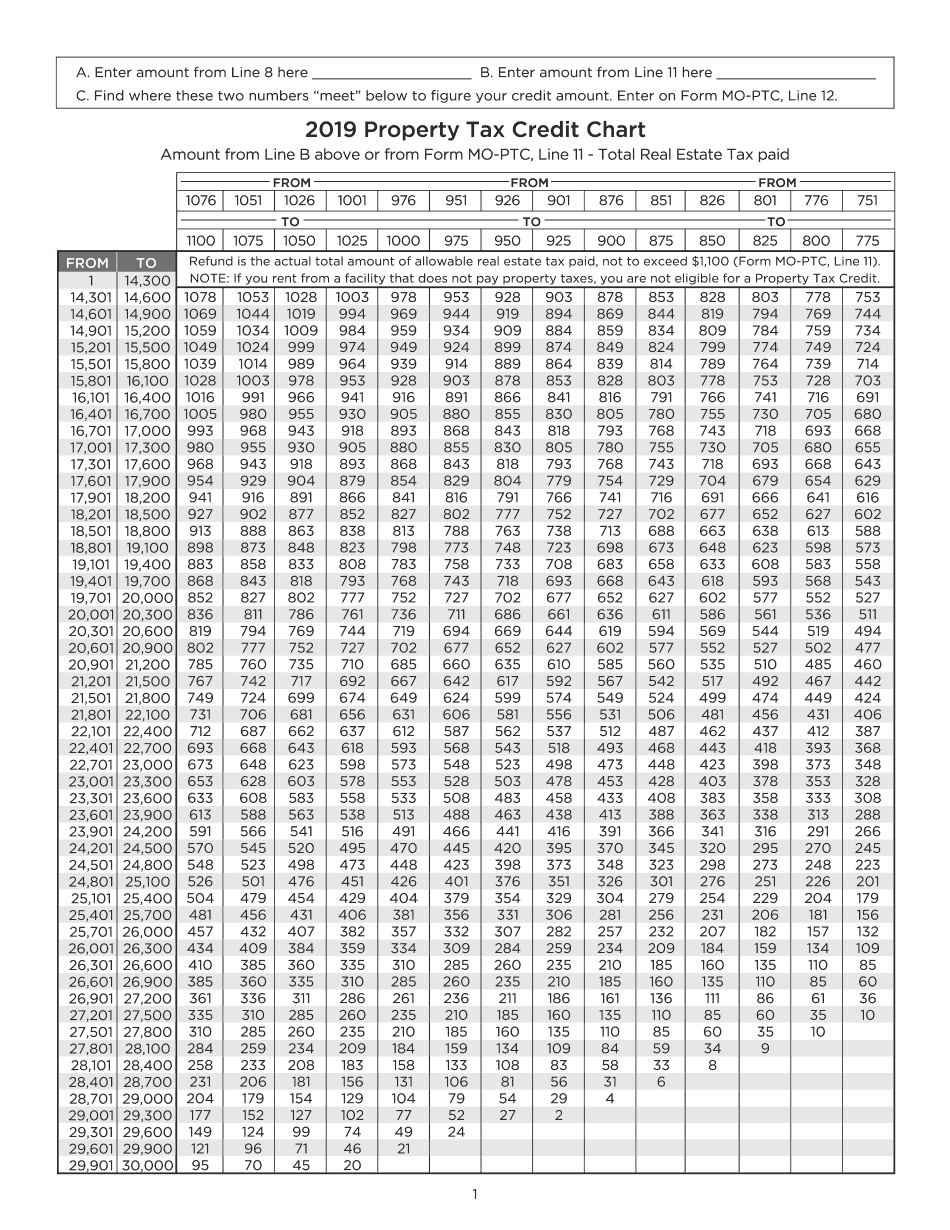

Edit Document Property Tax Credit Chart Form With Us Fastly Easyly

https://www.pdffiller.com/preview/491/866/491866144/big.png

https://taxfoundation.org/taxedu/glossary/tax-credit

A tax credit is a provision that reduces a taxpayer s final tax bill dollar for dollar A tax credit differs from deductions and exemptions A tax credit differs from deductions and exemptions which reduce taxable income rather than the taxpayer s tax bill directly

https://en.wikipedia.org/wiki/Tax_credit

A tax credit is a tax incentive which allows certain taxpayers to subtract the amount of the credit they have accrued from the total they owe the state 1 It may also be a credit granted in recognition of taxes already paid or a form

Act Fast The Solar Tax Credit Will Soon Expire

Tax Deduction Vs Tax Credit What s The Difference With Table

Earned Income Tax Credit Claims Are Less Likely After IRS Audits

New Tax Credit To Fully Offset The Cost For Small Businesses Who

Taxmann s Cyber Crimes Laws Choice Based Credit System CBCS B

New Tax Credit Helps Entrepreneurs Start Businesses Flickr

New Tax Credit Helps Entrepreneurs Start Businesses Flickr

Tax Reduction Company Inc

Individual Tax WEC CPA Blog

R D Tax Credit Calculator How Much Can You Claim RAndD Tax

Tax Credit System Definition - A tax credit is a dollar for dollar reduction in your income For example if your total tax on your return is 1 000 but you are eligible for a 1 000 tax credit your net liability drops to zero Some credits such as the Earned Income Credit are refundable which means that you still receive the full amount of the credit even if the credit