Tax Credit Under Section 168 Except as provided in this section the term class life means the class life if any which would be applicable with respect to any property as of January 1 1986

1 Introduction to Tax Code Section 168 2 Benefits of Accelerated Depreciation 3 Eligible Assets for Section 168 Deductions 4 Calculating Depreciation Breaking Down Bonus Depreciation Under IRC Section 168 Bonus depreciation generally allows an additional first year depreciation deduction with respect to qualifying property acquired and placed in

Tax Credit Under Section 168

Tax Credit Under Section 168

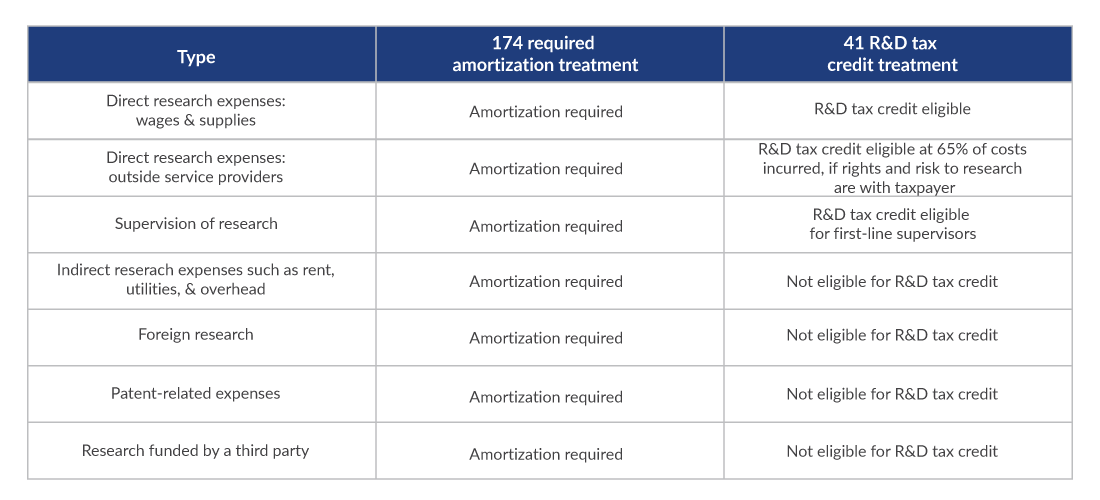

https://www.plantemoran.com/-/media/images/insights-images/2022/07/tx_sec174rdcontentdevandproduction_table1.png

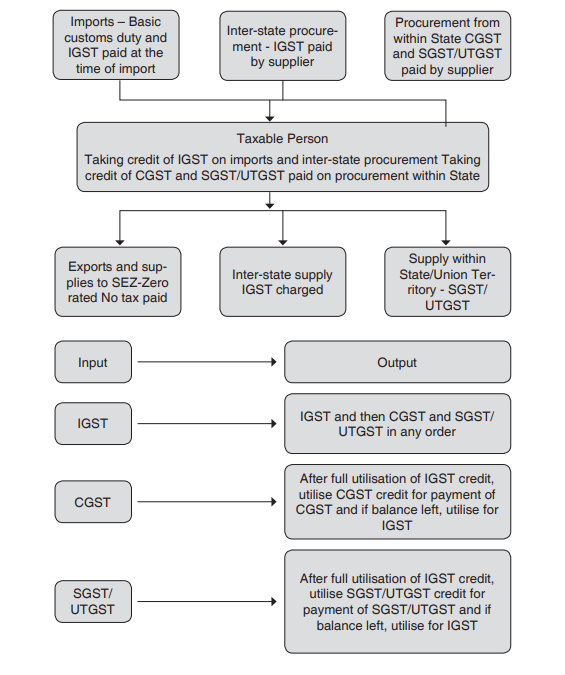

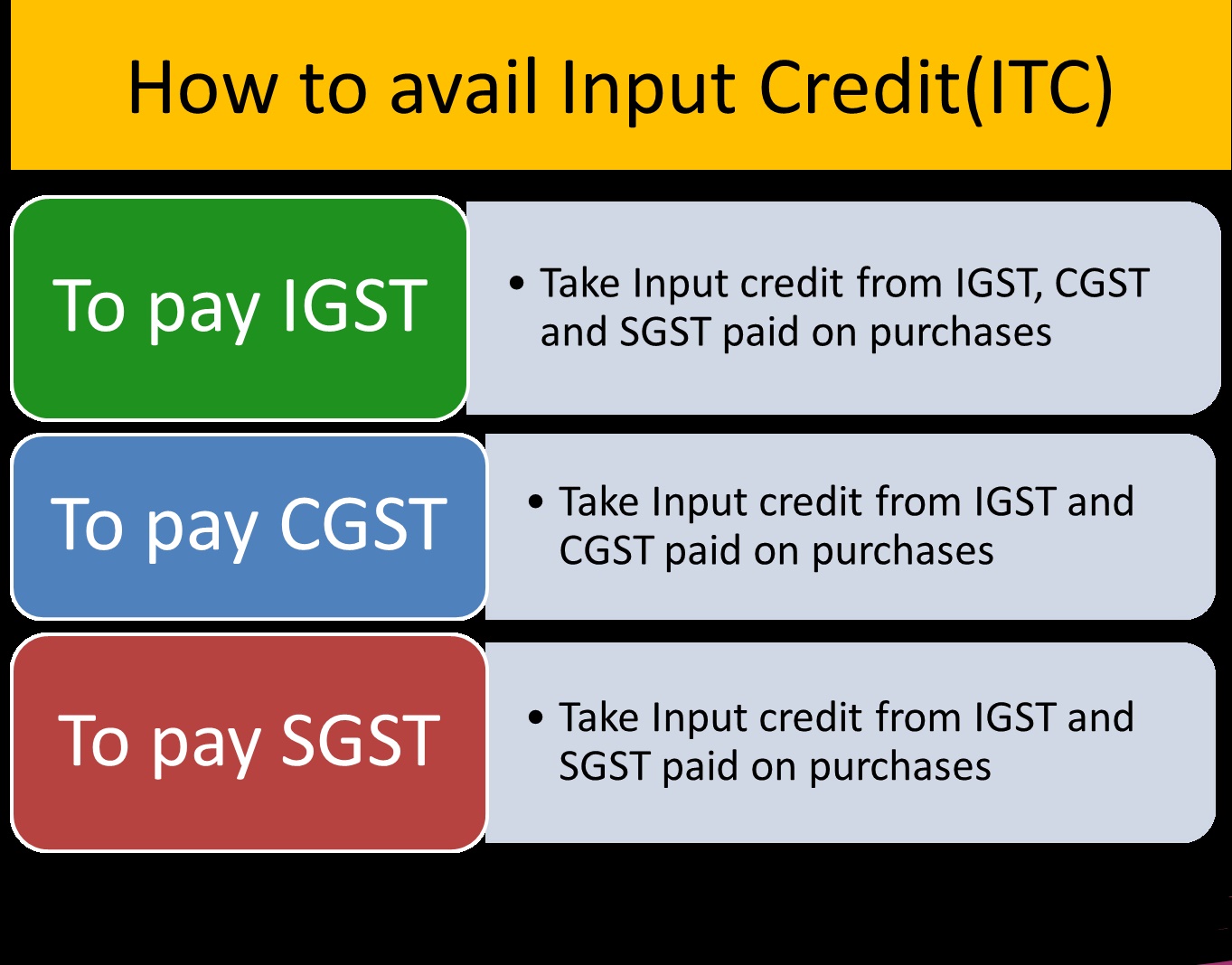

GST Input Tax Credit Definitions And Conditions For Claiming GST ITC

https://www.taxmann.com/post/wp-content/uploads/2021/10/BlogBanner_Pushpinder1.jpg

Ready Reckoner On Input Tax Credit Under GST Taxmann

https://www.taxmann.com/post/wp-content/uploads/2021/07/Screenshot-2022-05-23-132914-e1653293146602.png

These requirements are 1 the depreciable property must be of a specified type 2 the original use of the property must commence with the taxpayer or used depreciable IRC Section 168 k which is commonly known as bonus depreciation BD allows taxpayers to expense up to 60 of the cost of qualified assets they place in

Under Internal Revenue Code Section 168 e 3 B qualified facilities qualified property and energy storage technology are considered 5 year property These types of property The Tax Cuts and Jobs Act TCJA made several amendments to Section 168 k including changes to which property qualifies for bonus depreciation and

Download Tax Credit Under Section 168

More picture related to Tax Credit Under Section 168

Apportionment Of Input Tax Credit ITC Under GST Section 17 1 2

https://incometaxmanagement.com/Pages/Tax-Ready-Reckoner/GST-India/Images/Apportionment of Input Tax Credit in case of Goods and Services Used-Section 17-1.gif

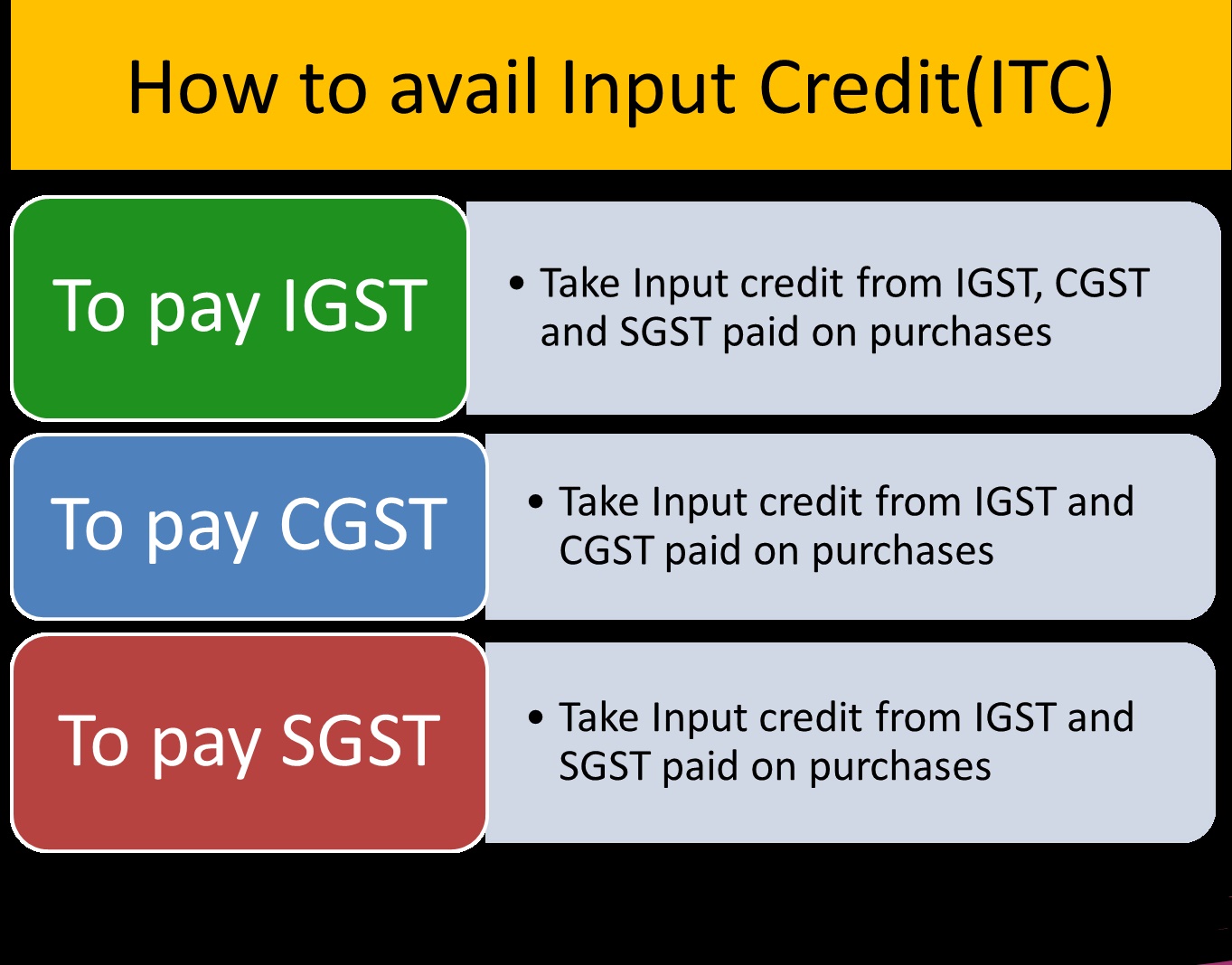

A COMPLETE GUIDE TO INPUT TAX CREDIT ITC UNDER GST TAXCONCEPT

https://taxconcept.net/wp-content/uploads/2019/09/Input-Tax-Credit-under-GST.jpg

How To Remove A Company Director Section 168 Of The Companies Act 2006

https://www.frettens.co.uk/cms/photo/article/main_removecompanydirector.png

IR 2019 156 September 13 2019 The Treasury Department and the Internal Revenue Service today released final regulations and additional proposed regulations under What Are The Specific Changes to Bonus Depreciation 168 k Starting on January 1 st 2023 for assets placed in service during the following periods the bonus depreciation percentage will decrease in

This section provides the rules for determining the 30 percent additional first year depreciation deduction allowable under section 168 k 1 for qualified property and This document contains amendments to the Income Tax Regulations 26 CFR part 1 under sections 168 k and 1502 Section 168 k allows an additional first

Apmh Reversal Of Input Tax Credit Under Rule Of Cgst Rules Hot My XXX

https://carajput.com/blog/wp-content/uploads/2018/09/ITC-1.jpg

GST Circular Contra To GST Act Can t Deny The Claim For ITC Refund

https://primelegal.in/wp-content/uploads/2020/09/gst-1.jpg

https://www.law.cornell.edu/uscode/text/26/168

Except as provided in this section the term class life means the class life if any which would be applicable with respect to any property as of January 1 1986

https://fastercapital.com/content/Deciphering-Tax...

1 Introduction to Tax Code Section 168 2 Benefits of Accelerated Depreciation 3 Eligible Assets for Section 168 Deductions 4 Calculating Depreciation

What Is The Input Tax Credit Under GST In India Busy

Apmh Reversal Of Input Tax Credit Under Rule Of Cgst Rules Hot My XXX

Executive Order Does Not Permit The IRS To Ignore Lump Sum Social

Practical FAQs On Input Tax Credit Under GST Taxmann

Tax Deduction Information Franklin IN Fletcher CDJR

Input Tax Credit Under GST 2023 Guide InstaFiling

Input Tax Credit Under GST With Examples Unlimited Guide

Input Tax Credit Meaning Conditions To Avail Documents Required

Tax Credit Under Section 168 - While Section 168 k allows a bonus depreciation deduction Section 168 e classifies property into class lives so taxpayers can decide which properties can and cannot take