Tax Credit Vs Ta Rebate Web Tax Credit Vs Rebate Definitions A tax credit is a tax allowance that the federal or state government allows certain taxpayers who meet Timing Tax credits apply to a given tax

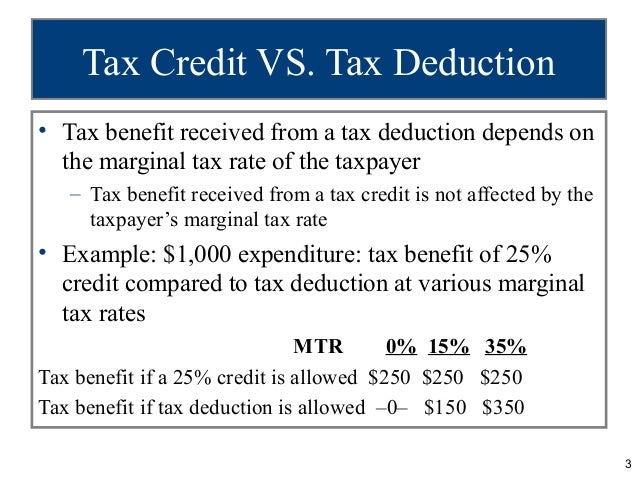

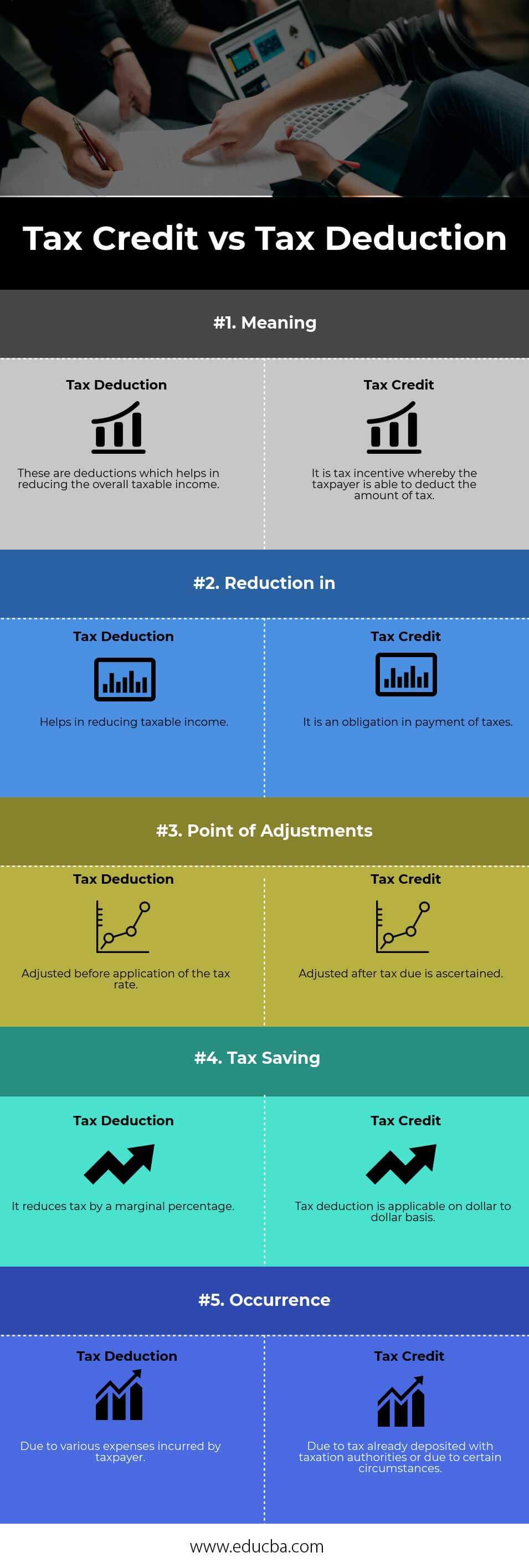

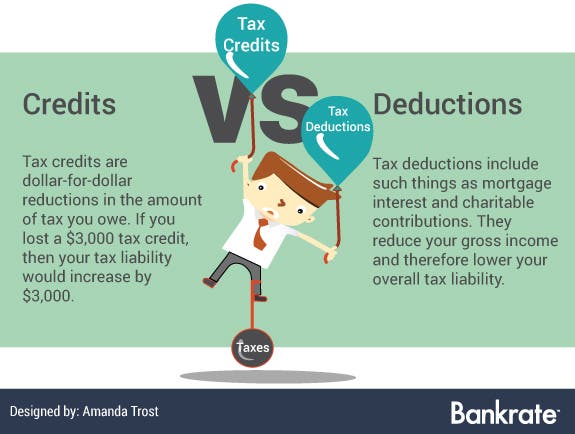

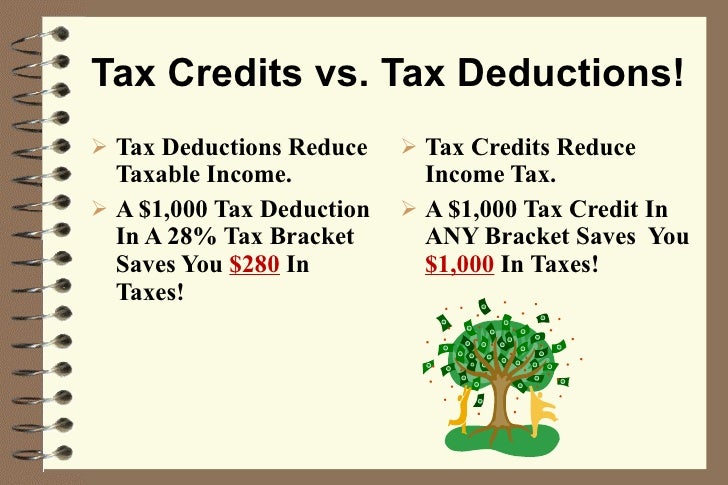

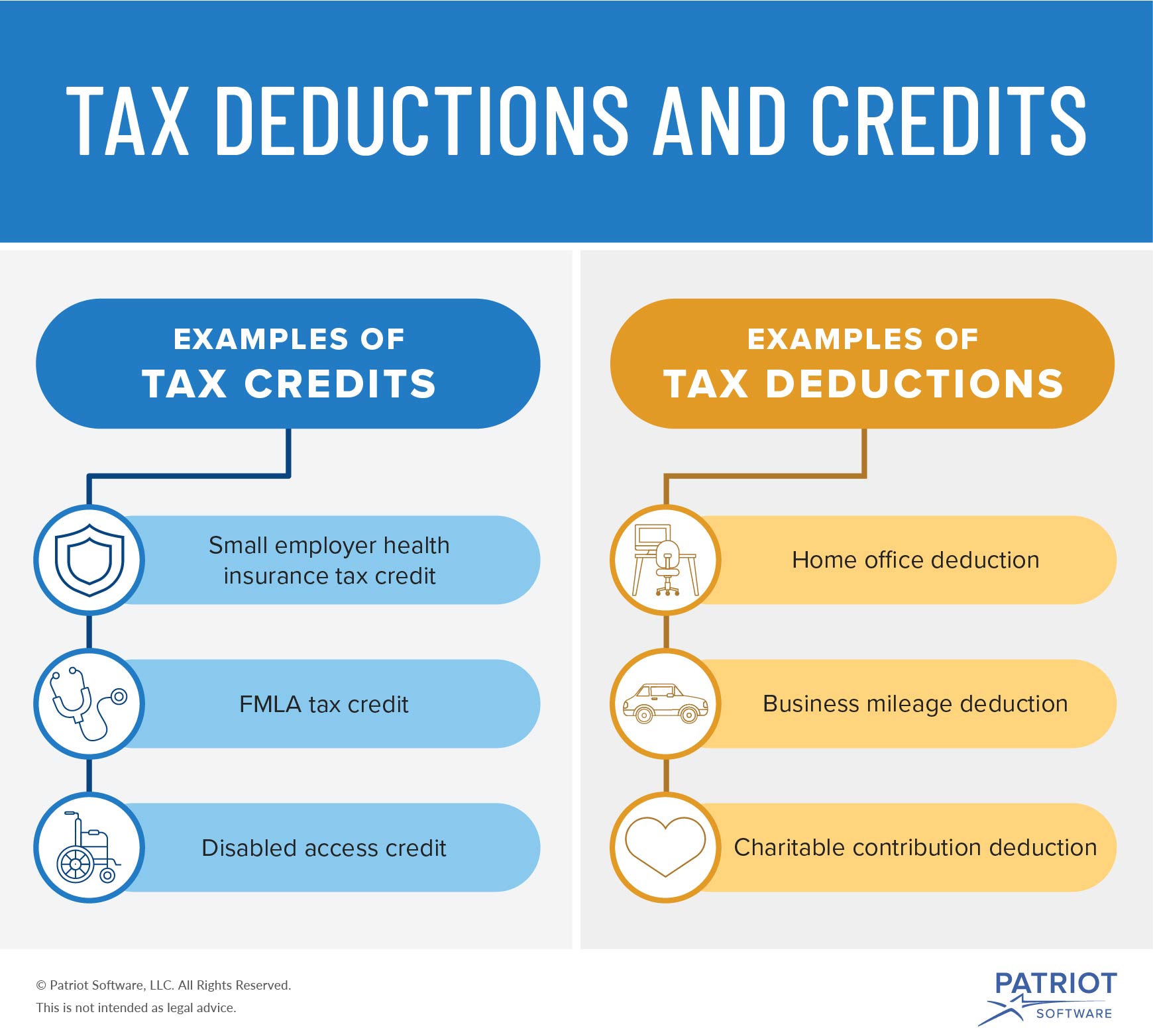

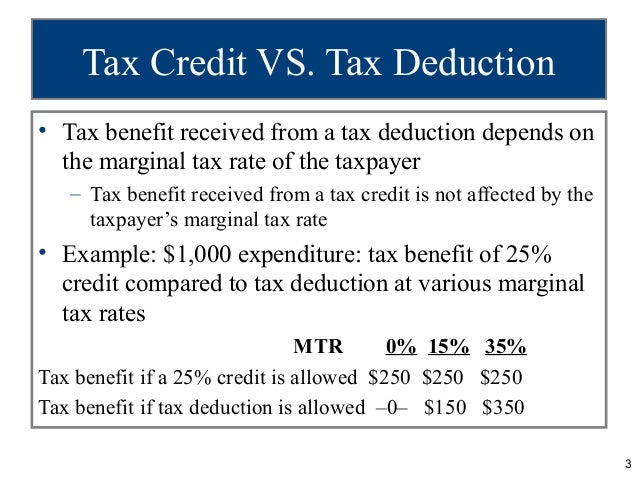

Web What is a Tax Credit The IRS says that tax credits can reduce the amount of tax you owe or increase your tax refund They are different from deductions which reduce your Web 16 nov 2017 nbsp 0183 32 Tax credits directly reduce the amount of tax you owe giving you a dollar for dollar reduction of your tax liability A tax credit

Tax Credit Vs Ta Rebate

Tax Credit Vs Ta Rebate

https://www.patriotsoftware.com/wp-content/uploads/2019/12/business-tax-credit-vs-tax-deduction-visual.jpg

Ppt Ch 13

https://image.slidesharecdn.com/pptch13-130308122028-phpapp01/95/ppt-ch-13-3-638.jpg?cb=1362745338

Tax Credit Vs Tax Deduction Top 5 Major Differences With Infographics

https://www.educba.com/academy/wp-content/uploads/2018/11/Tax-Credit-vs-Tax-Deduction.jpg

Web The difference between a tax credit and a rebate The Inflation Reduction Act calls out both tax credits and rebates What s the difference TAX CREDIT A tax credit is a dollar for dollar reduction in the amount of Web What is a tax credit Tax credits reduce the amount of tax you owe Taxes are calculated first then credits are applied to the taxes you have to pay Some credits called

Web 8 mai 2022 nbsp 0183 32 Tips Tricks amp Trends Tips Tricks amp Trends EV Rebate vs Tax Credit What s the Difference Between EV Incentives Credits and rebates and discounts oh my Web 1 f 233 vr 2023 nbsp 0183 32 Date 01 02 2023 Read 4 mins Learn the difference between an income tax rebate and tax exemption and compare it with a tax deduction Check how pensions and gratuity help in taxation Tax

Download Tax Credit Vs Ta Rebate

More picture related to Tax Credit Vs Ta Rebate

Tax Credit Vs Tax Deduction

https://www.communitytax.com/wp-content/uploads/2019/04/tax-credit-vs-tax-deductions.png

Used Capital Loss Carryover Will Taxes Go Up 3 000

https://media.brstatic.com/2017/07/27113248/taxes_Tax-credits-vs-tax-deductions.jpg

College Financial Planning Information

https://image.slidesharecdn.com/revisedcollegefundingworkshoppresentationpowerpoint20092010-12480345836-phpapp01/95/college-financial-planning-information-41-728.jpg?cb=1248017449

Web 1 d 233 c 2022 nbsp 0183 32 OVERVIEW Tax rebates encourage taxpayers to make certain types of purchases or to stimulate a flagging economy quickly by getting cash into consumers hands TABLE OF CONTENTS Getting Web As of 2023 preowned plug in electric and fuel cell EVs qualify for a credit of up to 30 of their purchase price maxing out at 4 000 The used EV tax credit can only be claimed

Web 5 mars 2009 nbsp 0183 32 Generally speaking tax credits only offset tax balances due meaning if you have low income and owe nothing in tax you get no benefit from a credit Whereas tax Web 12 f 233 vr 2023 nbsp 0183 32 Tax credits are more favorable than tax deductions because they reduce the tax due not just the amount of taxable income There are three basic types of tax

Tip Of The Week Classic Wiegand Financial Group

https://www.wiegandfinancial.com/wp-content/uploads/2022/03/deduction-vs-credit.jpg

What Is The Difference Between A Tax Credit And Tax Deduction

https://static.twentyoverten.com/5d5413591d304774fba39eb3/WZASn6oAJLl/Tax-Credits-vs-Deductions.jpg

https://www.sapling.com/7884940/tax-credit-vs-rebate

Web Tax Credit Vs Rebate Definitions A tax credit is a tax allowance that the federal or state government allows certain taxpayers who meet Timing Tax credits apply to a given tax

https://www.bpihomeowner.org/blog/understanding-difference-between...

Web What is a Tax Credit The IRS says that tax credits can reduce the amount of tax you owe or increase your tax refund They are different from deductions which reduce your

Revised Tax Rebate Under Sec 87A After Budget 2019 BasuNivesh

Tip Of The Week Classic Wiegand Financial Group

Difference Between Exemption And Deduction Difference Between

Difference Between Income Tax Slabs 2019 20 And 2020 21 Gservants

How Do I Claim The Recovery Rebate Credit On My Ta

Income Tax Deductions Income Tax Deductions Vs Credits

Income Tax Deductions Income Tax Deductions Vs Credits

Rebating Meaning In Insurance What Is Insurance Rebating The

Who Gets Tax Credits Leia Aqui Who Gets Federal Tax Credits

Tax Credit Vs Ta Rebate - Web 1 f 233 vr 2023 nbsp 0183 32 Date 01 02 2023 Read 4 mins Learn the difference between an income tax rebate and tax exemption and compare it with a tax deduction Check how pensions and gratuity help in taxation Tax